A thread on cumulative FII inflows into India in the CY2020

Background : This was a widely shared link on social media and also tweeted by FM @nsitharaman amid a lot of discussion around the strong foreign inflows in Indian equities.

moneycontrol.com/news/business/…

Background : This was a widely shared link on social media and also tweeted by FM @nsitharaman amid a lot of discussion around the strong foreign inflows in Indian equities.

moneycontrol.com/news/business/…

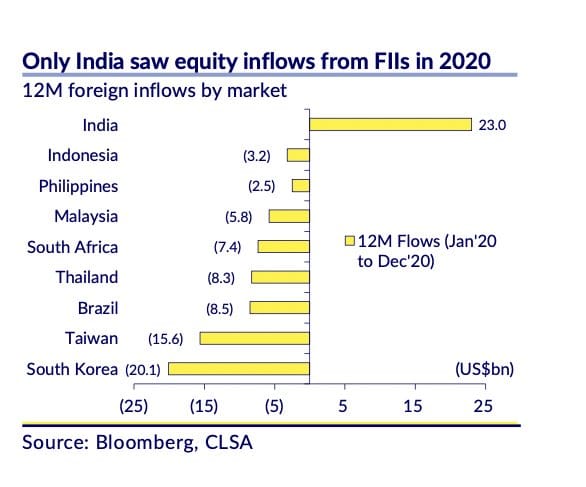

India received ~1.6 lakh crore in FII flows last calendar year when most Asian and emerging markets witnessed outflows. This is encouraging stuff one would say. However, this is not the complete story.

The total flows in Secondary markets (Debt + Equity but not including FDI deals in primary markets) are marginally positive. It means as yields collapsed, FIIs switched from Indian debt to Indian equities.

In fact, last 6 CYs (2015-2020) net flow in debt & equity is negligible.

In fact, last 6 CYs (2015-2020) net flow in debt & equity is negligible.

Now one may ask what suddenly changed in 2020. Well, Central banks kept the tap open. That's easy answer.

But still the flows became aggressive only in last two months of 2020 - Nov & Dec

But still the flows became aggressive only in last two months of 2020 - Nov & Dec

Why in last two months?

Two technical things happened:

(a) MSCI Annual review on Nov 10 brought fresh inflows. This happens every year, so was not surprising.

livemint.com/market/stock-m…

Two technical things happened:

(a) MSCI Annual review on Nov 10 brought fresh inflows. This happens every year, so was not surprising.

livemint.com/market/stock-m…

(b) MSCI also implemented change in foreign ownership limit (FOL) for Indian securities i.e merging the FDI+FII limit to sectoral limit.

PS : This was supposed to happen in June-20 but thanks to Babugiri and C19 lockdown was postponed to Nov-20

PS : This was supposed to happen in June-20 but thanks to Babugiri and C19 lockdown was postponed to Nov-20

Apart from this, licking wounds from Nov-16 US elections experience, many FIIs raised cash in two months leading up to the election date. As the event unfolded, money poured leading to the money tsunami.

In short, Nov & Dec 20 flows were exceptional due to technical adjustments & may or may not continue.

Idea that this will continue without any improvement in earnings outlook is fraught with risks. Any hint of liquidity withdrawn in any form from anywhere can prick the bubble.

Idea that this will continue without any improvement in earnings outlook is fraught with risks. Any hint of liquidity withdrawn in any form from anywhere can prick the bubble.

Thanks to @mystockedge for the charts.

• • •

Missing some Tweet in this thread? You can try to

force a refresh