Clearly a blow off top bubble here. Would not buy #Bitcoin at ≈ 2x ATH.

January 2021

1 BTC = $40,700

January 2021

1 BTC = $40,700

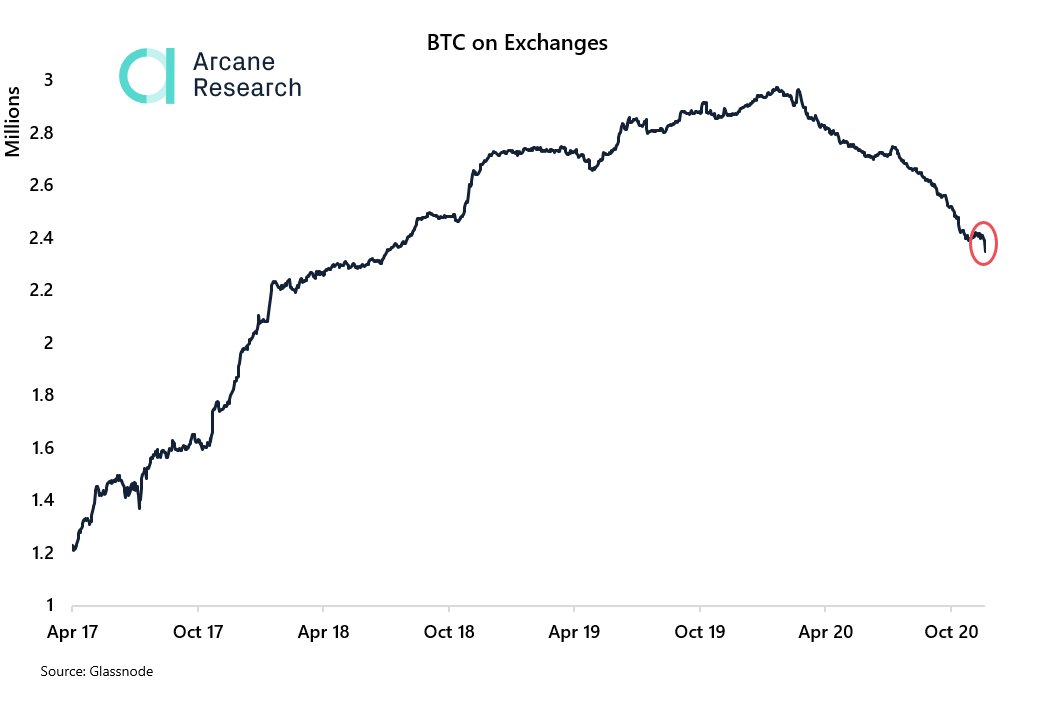

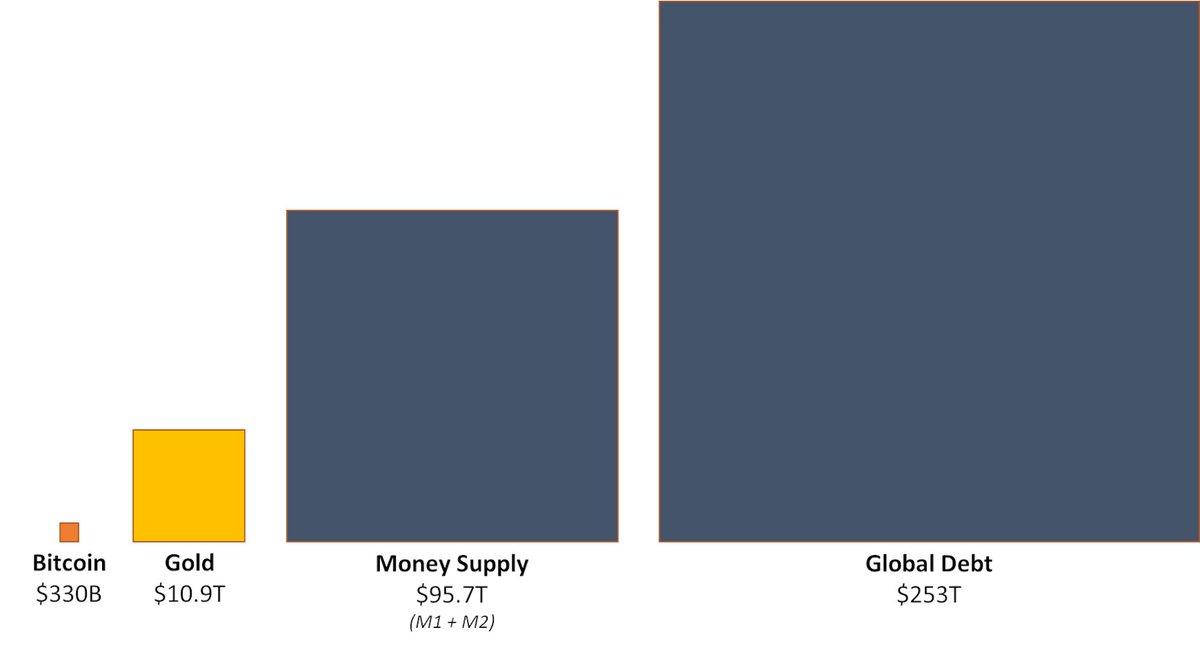

This time is clearly different.

If you own 0.00000000 BTC, wake up.

If you own 0.00000000 BTC, wake up.

• • •

Missing some Tweet in this thread? You can try to

force a refresh