1/ We've all seen the massive amount of BTC being drained from exchange balances, but I've been somewhat skeptical that $GBTC could be sucking up exchange balances (not HODLers adding BTC into cold storage).

Here's a short thread of my research on this topic.

Here's a short thread of my research on this topic.

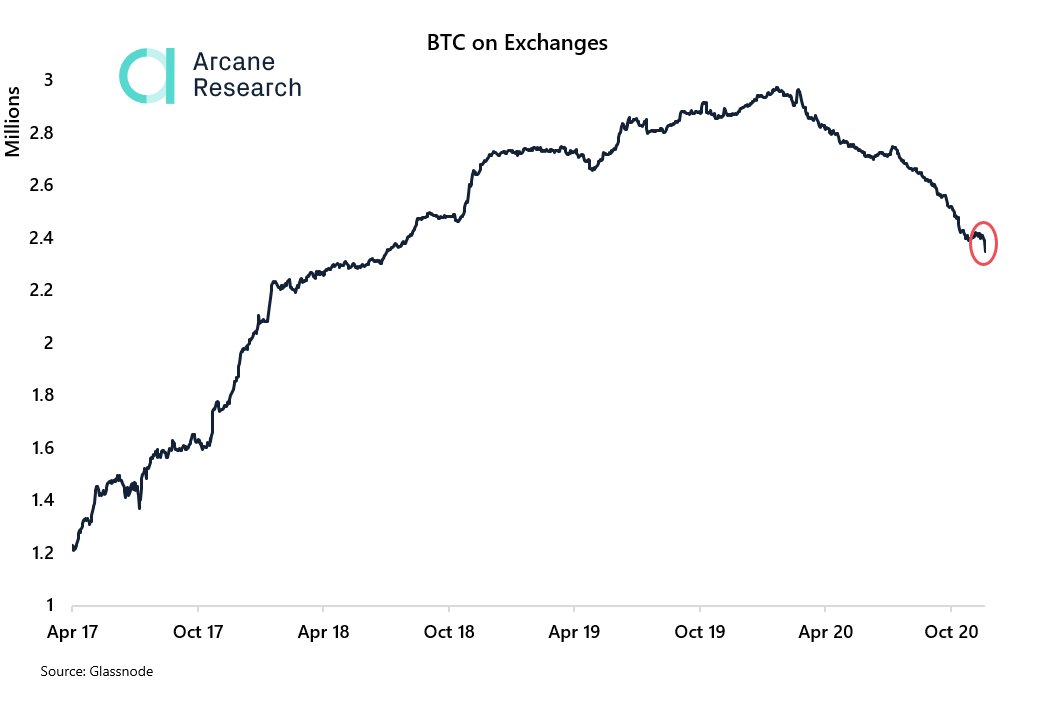

2/ The total Exchange Balance peaked roughly February 14th (around the same time the price peaked).

Price $10,300

Exchange Balance 2.95M BTC

GBTC AUM $2.97B

GBTC Holdings 288,000 BTC

Price $10,300

Exchange Balance 2.95M BTC

GBTC AUM $2.97B

GBTC Holdings 288,000 BTC

3/ Today, December 11th, the data is...

Price $18,000

Exchange Balance 2.3M BTC

GBTC AUM $10B

GBTC Holdings 553,000 BTC

Price $18,000

Exchange Balance 2.3M BTC

GBTC AUM $10B

GBTC Holdings 553,000 BTC

4/ 650,000 BTC were removed off of exchanges since Feb 14th, 2020.

GBTC added 265,000 BTC since Feb 14th, 2020.

It is possible that a large portion of those BTC were pulled off of exchanges and added to GBTC (funds arbing the premium).

GBTC added 265,000 BTC since Feb 14th, 2020.

It is possible that a large portion of those BTC were pulled off of exchanges and added to GBTC (funds arbing the premium).

5/ This research indicates that even if ALL the newly added coins to GBTC came directly from exchanges, there is still a very significant amount of coins being moved off exchanges into cold storage (minimum of 385,000 BTC).

This is still extremely bullish for #Bitcoin.

This is still extremely bullish for #Bitcoin.

6/ I would love to hear from @glassnode about whether GBTC holdings are included in "Exchange Balances" as GBTC does have Coinbase Custody Trust Company as their custodian.

7/ If Glassnode does include GBTC holdings in their Exchange Balances, then it would be scary bullish.

If they don't, then I'm still highly bullish.

If they don't, then I'm still highly bullish.

8/ Thanks to @MimesisCapital for helping provide the resources to allow me to take the time to perform this research.

9/ Update: Thanks to @n3ocortex's quick reply, we have confirmed that $GBTC holdings are NOT included in "Exchange Balances".

https://twitter.com/n3ocortex/status/1337430745984495616?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh