One of the parameters you use to understand your trading strategy performance historically before deploying it is called the RoMaD.

Return over Max Drawdown.

It's essentially (annual return % / max DD % )

Let me explain each part of this.

Return over Max Drawdown.

It's essentially (annual return % / max DD % )

Let me explain each part of this.

Average return % :

If your system started with $100,000 in 2010, and ended 2020 with $200,000, that's a 7.18% annual return over 10 years.

Maximum Drawdown % :

If portfolio falls from 150k to 120k, that's a 20% drawdown. Amongst all such drawdowns, maximum value is taken.

If your system started with $100,000 in 2010, and ended 2020 with $200,000, that's a 7.18% annual return over 10 years.

Maximum Drawdown % :

If portfolio falls from 150k to 120k, that's a 20% drawdown. Amongst all such drawdowns, maximum value is taken.

Return over Max Drawdown will then be

7.18% / 20% = 0.359

The RoMaD value is expressed as a ratio.

*This helps answer the question*:

Am I willing to accept an occasional drawdown of X% in order to generate an average return of Y%?

7.18% / 20% = 0.359

The RoMaD value is expressed as a ratio.

*This helps answer the question*:

Am I willing to accept an occasional drawdown of X% in order to generate an average return of Y%?

Generally, it's prudent to be working with a system where the average annual return is at least 2x the maxDD number.

If your maxDD is 10%, you should have average annual return of at least 20% or more.

If your maxDD is 10%, you should have average annual return of at least 20% or more.

When comparing across different systems, this is one of the parameters you could use to evaluate the system's worthiness to deploy into trading further.

That said, this ratio alone isn't sufficient - and is usually taken in tandem with other parameters to evaluate a system.

That said, this ratio alone isn't sufficient - and is usually taken in tandem with other parameters to evaluate a system.

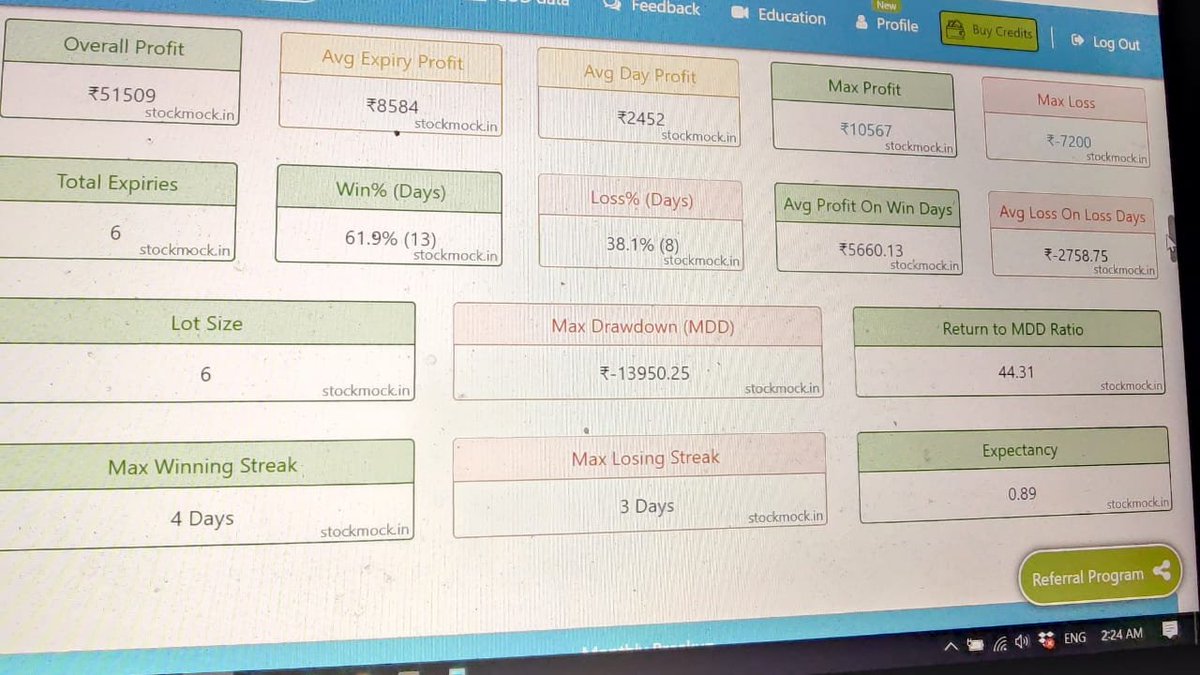

And btw, this was in response to a friend who asked what the ratio was from a backtesting site report.

I don't know how they arrived at a RoMAD ratio of 44. That sure doesn't look right.

Expectancy calculation also seems wrong.

So calculate the important parameters yourself.

I don't know how they arrived at a RoMAD ratio of 44. That sure doesn't look right.

Expectancy calculation also seems wrong.

So calculate the important parameters yourself.

• • •

Missing some Tweet in this thread? You can try to

force a refresh