When you break down the lives of extremely successful people, you find that their success didn't come from an earth shattering break-through.

Rather, it came from obsessing about a simple idea, fanatically.

Time for a thread about one such idea. 👇👇👇

Rather, it came from obsessing about a simple idea, fanatically.

Time for a thread about one such idea. 👇👇👇

1/ During world war II, a eleven year old kid checks out a book from the nearest library. The book's title was "1000 ways to make 1000 dollars".

After he reads that book, he makes a statement that by the time he was 35 years old, he'd be a millionaire.

After he reads that book, he makes a statement that by the time he was 35 years old, he'd be a millionaire.

2/ By the age of 35, his net worth was roughly 7-8 million dollars. The library was Omaha public library. That kid was Warren Buffett.

How he got there is an interesting story.

As soon as he reads that book, he decides he should have 1000 dollars before he finishes school.

How he got there is an interesting story.

As soon as he reads that book, he decides he should have 1000 dollars before he finishes school.

3/ While looking for business ideas, he goes to his friend Dan's house one day.

He watches Dan fix an old pinball machine (that he bought for $15) in two hours.

Warren asks him if he can fix more.

Dan says yes.

He watches Dan fix an old pinball machine (that he bought for $15) in two hours.

Warren asks him if he can fix more.

Dan says yes.

4/ Warren and Dan set up a company (of course no incorporation and all that legal jazz).

They call the firm "Wilson Coin Operated Company".

They go to local barbers and pitch the barbers an ingenious business plan.

They call the firm "Wilson Coin Operated Company".

They go to local barbers and pitch the barbers an ingenious business plan.

5/ The Plan:

The barber has to let the company install a fixed up pinball machine in a corner of the barber shop.

Every week, whatever money gets collected in the pinball machine, they'd share it 50-50.

Out of the 50% share, Warren and Dan shared 50-50.

The barber has to let the company install a fixed up pinball machine in a corner of the barber shop.

Every week, whatever money gets collected in the pinball machine, they'd share it 50-50.

Out of the 50% share, Warren and Dan shared 50-50.

6/ They invest $15-20 in fixing up a machine, and in the very first week Warren finds at least $5 in the machines.

They make $2.5 from that machine per week.

That's $10 a month ; $120 a year.

They installed ~25 such machines across Omaha in barber shops.

They make $2.5 from that machine per week.

That's $10 a month ; $120 a year.

They installed ~25 such machines across Omaha in barber shops.

7/ They also come across a damaged $200 Rolls Royce that Dan fixes up with an extra $200 investment.

Then, they start renting out the Rolls Royce for weddings during weekends, at $100 per weekend.

The ROC was through the roof.

Then, they start renting out the Rolls Royce for weddings during weekends, at $100 per weekend.

The ROC was through the roof.

8/ Running few many businesses this way, Warren ends up saving over $9000 when he finishes high school.

This was way past his $1000 goal.

At age 17, he wanted a framework to compound this capital and get to $1m by age 35.

Let's take a slight detour to 1626 Manhattan now.

This was way past his $1000 goal.

At age 17, he wanted a framework to compound this capital and get to $1m by age 35.

Let's take a slight detour to 1626 Manhattan now.

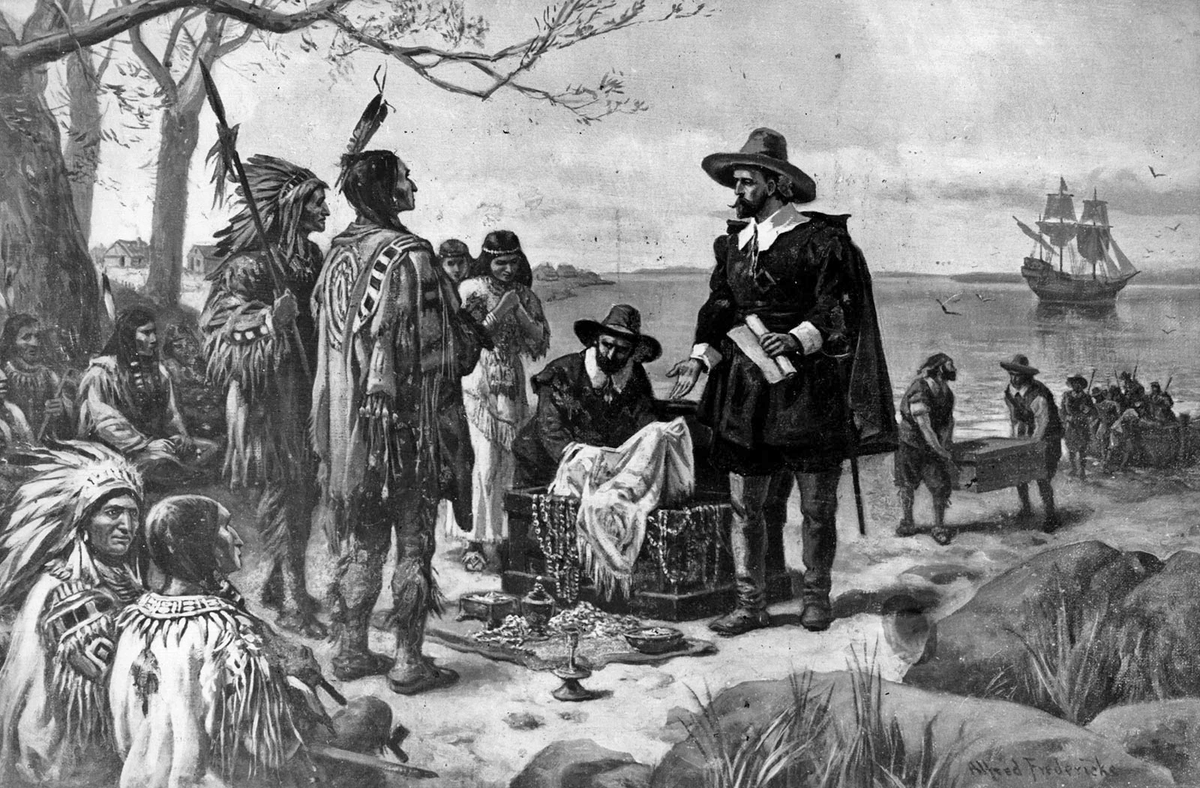

9/ In 1626, the Native Indians tasked their chief with the responsibility of selling all their Manhattan land for the best possible price.

They ended up selling Manhattan for $24.

Looking at Manhattan now, you'd think it is worth way more than that.

They ended up selling Manhattan for $24.

Looking at Manhattan now, you'd think it is worth way more than that.

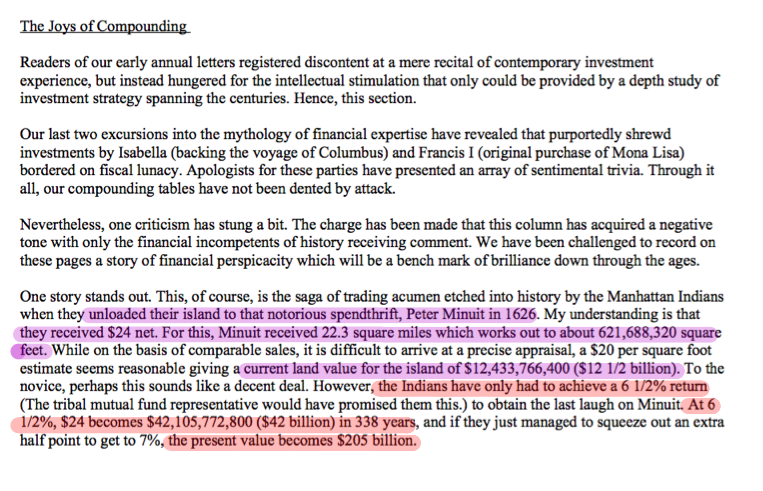

10/ The most fascinating thing about this deal is that, even adjusted for inflation, $24 doesn't seem close to what Manhattan would be worth today.

What would have happened had the Native Indians given that $24 to their investment officer, and he compounded it at 7% p.a?

What would have happened had the Native Indians given that $24 to their investment officer, and he compounded it at 7% p.a?

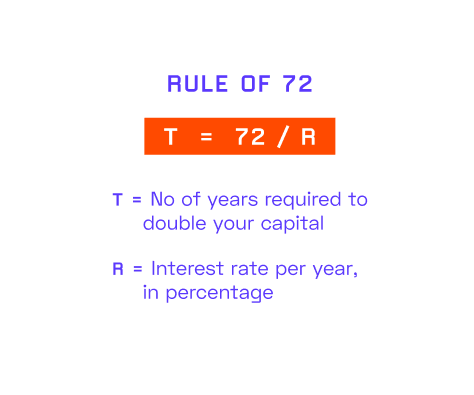

11/ This is where *The Rule of 72* comes into the picture.

According to the rule of 72,

Compounding at about ~7% per annum,

you can double your money every 10 years.

According to the rule of 72,

Compounding at about ~7% per annum,

you can double your money every 10 years.

12/ So, by 1636, the Indians would have had $48.

1646 - $96

1656 - $192

1666 - $284

and so on, doubling every 10 years.

By 2020, they would be having over $20 Trillion, had they compounded at 7% per annum.

This is an astonishing figure.

1646 - $96

1656 - $192

1666 - $284

and so on, doubling every 10 years.

By 2020, they would be having over $20 Trillion, had they compounded at 7% per annum.

This is an astonishing figure.

13/ Warren Buffett remarks about this story in his 1965 annual letter.

While he conservatively estimated at $20 per square foot for 1965, even today, the potential of the sum paid compounded at 7% p.a doesn't come anywhere close to Manhattan's current value.

While he conservatively estimated at $20 per square foot for 1965, even today, the potential of the sum paid compounded at 7% p.a doesn't come anywhere close to Manhattan's current value.

14/ Coming back to Warren's story. He was looking for a framework to compound his $9000 with.

He wanted to get to a million before age 35.

He found Ben Graham, and adopted the value investing framework. The rest is history.

He wanted to get to a million before age 35.

He found Ben Graham, and adopted the value investing framework. The rest is history.

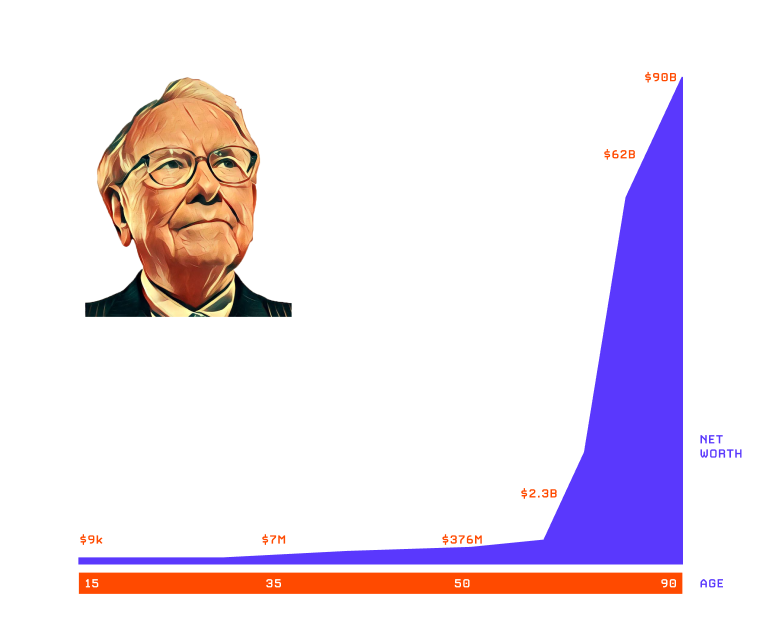

15/ Where the power of compounding really shines is in Warren's own life.

When he was 40, his net worth was less than $40 million.

When he was 50, his net worth was around $300-400 million approximately.

That's like 1/3rd of 1% of his current net worth.

When he was 40, his net worth was less than $40 million.

When he was 50, his net worth was around $300-400 million approximately.

That's like 1/3rd of 1% of his current net worth.

16/ 99.66% of Warren's wealth came after his age of 50.

That's what we see in the graphic here.

This right here, is the power of compounding at work.

That's what we see in the graphic here.

This right here, is the power of compounding at work.

17/ What does this mean for you?

You may not have 70+ years of runway ahead of you.

What should you do?

@MohnishPabrai discovered Warren Buffett at age 29, and he realised if he could compound $1M at 26% per annum, he could get to $1B by age 60.

You may not have 70+ years of runway ahead of you.

What should you do?

@MohnishPabrai discovered Warren Buffett at age 29, and he realised if he could compound $1M at 26% per annum, he could get to $1B by age 60.

18/ Likewise, use the rule of 72 to decide what your compounding goal is, what rate of compounding would help you get there, and get to work.

Going back, if you double your capital every 10 years, you can achieve 1000x in 100 years (at a rate of 7% p.a).

Going back, if you double your capital every 10 years, you can achieve 1000x in 100 years (at a rate of 7% p.a).

19/ Likewise, if you want to double your capital every 5 years, you must compound at ~14% p.a. You'll reach 1000x in 50 years.

If you compound at ~28% p.a, you'll reach 1000x in 25 years, doubling your capital every 2.5 years.

If you compound at ~28% p.a, you'll reach 1000x in 25 years, doubling your capital every 2.5 years.

20/ Now, whether 28% p.a CAGR is possible or not is another question.

Needless to say, there are always going to be opportunities.

You need a framework to capture them and maximize your CAGR as much as possible.

Needless to say, there are always going to be opportunities.

You need a framework to capture them and maximize your CAGR as much as possible.

21/ You need a systematic framework to compound your effort in any field, and to put compounding at play.

It could be business, investing, trading, sports, anything.

Once you have the framework, acquire the discipline to put the framework to its best use.

It could be business, investing, trading, sports, anything.

Once you have the framework, acquire the discipline to put the framework to its best use.

22/ So, this is a quick primer on Compounding 101 and how to put the rule of 72 to good use.

What's your compounding goal? Comment it down below.

If you would like to see more threads like this, smash the follow button on my profile.

What's your compounding goal? Comment it down below.

If you would like to see more threads like this, smash the follow button on my profile.

• • •

Missing some Tweet in this thread? You can try to

force a refresh