📝📝 2020 @MacroOps Portfolio Review 📝📝

Here's our portfolio metrics:

- Return: +66.40%

- Max Peak-2-Trough DD: -14.13%

Overall grade: B-

While the returns look good, we could've done better.

Here's a thread discussing our many errors in 2020! 👇

macro-ops.com/macro-ops-2020…

Here's our portfolio metrics:

- Return: +66.40%

- Max Peak-2-Trough DD: -14.13%

Overall grade: B-

While the returns look good, we could've done better.

Here's a thread discussing our many errors in 2020! 👇

macro-ops.com/macro-ops-2020…

1/ Our Three Biggest Errors

Recurring revenue is great. Recurring mistakes, not so great. Here were our biggest mistakes:

1) Too slow to act on a high conviction thesis

2) Overly constrictive trade management

3) Not sizing up (within limits) on higher conviction opportunities

Recurring revenue is great. Recurring mistakes, not so great. Here were our biggest mistakes:

1) Too slow to act on a high conviction thesis

2) Overly constrictive trade management

3) Not sizing up (within limits) on higher conviction opportunities

2/ Error 1: Slow To Act on High Convictions

We come across a fantastic setup that has a Trifecta of tailwinds (sentiment, fundamental, technical) behind it.

We pitch it, write it up for the group.

And then don’t take the first entry and watch as our thesis plays out to the T

We come across a fantastic setup that has a Trifecta of tailwinds (sentiment, fundamental, technical) behind it.

We pitch it, write it up for the group.

And then don’t take the first entry and watch as our thesis plays out to the T

3/ Error 2: Overly-Constrictive Trade Management

- Risk-point in way too tight, at a price level that does not invalidate the trade

- Take profits before the technicals/fundamentals invalidate the thesis

- Don’t give the trade the time it needs to play out and exit prematurely

- Risk-point in way too tight, at a price level that does not invalidate the trade

- Take profits before the technicals/fundamentals invalidate the thesis

- Don’t give the trade the time it needs to play out and exit prematurely

4/ Error 3: Not Sizing Up Higher Conviction Bets

The process error of not fully exploiting fat pitches.

It’s always going to be the case that you have too much size on in your losers and not enough on in your winners.

That’s just the reality of this (very tough) game.

The process error of not fully exploiting fat pitches.

It’s always going to be the case that you have too much size on in your losers and not enough on in your winners.

That’s just the reality of this (very tough) game.

5/ Two Examples of Our Errors In Action

The two biggest misses of the year centered around POSITION SIZING in relation to our convictions. The two names were:

- Ammo, Inc. $POWW

- Roku, Inc. $ROKU

Let's see how ...

The two biggest misses of the year centered around POSITION SIZING in relation to our convictions. The two names were:

- Ammo, Inc. $POWW

- Roku, Inc. $ROKU

Let's see how ...

6/ Mistake 1: Ammo, Inc. $POWW

POWW started as a ~3% notional position.

This was a CLEAR MISTAKE (not because of price appreciation, though).

We were buying around $2/share when we THOUGHT the stock was worth $10-$12/share.

That should've been an 8-10% position at cost!

POWW started as a ~3% notional position.

This was a CLEAR MISTAKE (not because of price appreciation, though).

We were buying around $2/share when we THOUGHT the stock was worth $10-$12/share.

That should've been an 8-10% position at cost!

7/ Mistake 2: Roku, Inc. $ROKU

ROKU was another high-conviction bet based on our research report released on 09/30 w/ killer chart.

Unfortunately, we made it a ~2% position at cost.

We added in Nov but that only gave us a 4% position in what should’ve been an 8-10% position.

ROKU was another high-conviction bet based on our research report released on 09/30 w/ killer chart.

Unfortunately, we made it a ~2% position at cost.

We added in Nov but that only gave us a 4% position in what should’ve been an 8-10% position.

8/ What We Did Right: Risk Management (RM)

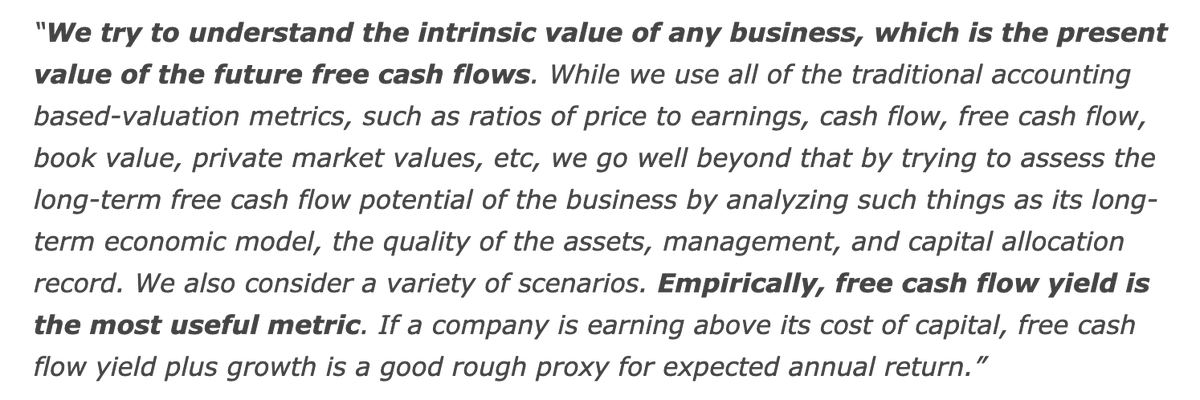

RM comes in two flavors:

1) Intrinsic value: buy at massive discount to worth

2) Active mngmt: Stop-losses at critical technical price levels indicating momentum reversal

In this case, 1 + 1 = 3 (combined creates massive advantage)

RM comes in two flavors:

1) Intrinsic value: buy at massive discount to worth

2) Active mngmt: Stop-losses at critical technical price levels indicating momentum reversal

In this case, 1 + 1 = 3 (combined creates massive advantage)

9/ Where We Go From Here

It's always Day 1 at @MacroOps.

Our goal is to create the greatest group of die-hard investors/traders on the interwebs.

If you're interested in what we do, check us out at macro-ops.com/collective

We'll leave you with our simple mission statement.

It's always Day 1 at @MacroOps.

Our goal is to create the greatest group of die-hard investors/traders on the interwebs.

If you're interested in what we do, check us out at macro-ops.com/collective

We'll leave you with our simple mission statement.

• • •

Missing some Tweet in this thread? You can try to

force a refresh