A few thoughts on the recovery plan that President-elect Biden is announcing tonight.

THREAD:

THREAD:

It is *very* large. Together with the December legislation it would be around $2.8T, which is about $300b per month for the nine months it is in effect.

For context in November GDP was about $80b below pre-crisis trend and compensation was about $20b below pre-crisis trend.

For context in November GDP was about $80b below pre-crisis trend and compensation was about $20b below pre-crisis trend.

The motivation appears to be more "bottom up" (what the health situation, households, states, etc.) need than "top down" (how big is the output gap, what is the multiplier, what is needed to fill it).

From a bottom up perspective, we're finally seeing ambitious amounts on the virus itself. Extending UI is critical, nutrition assistance and TANF, and the checks are an additional form of insurance but the targeting could be improved.

Importantly, it also has the start of a permanent reform to the social safety net, most notably a $3,000 per child allowance ($3,600 for younger children) which would dramatically reduce child poverty & also an expansion of the childless EITC. Should be extended/made permanent.

From a top down perspective, advocates of stimulus often point to multipliers like 1.5 or higher. In this case the hope has to be that the multiplier is *much* lower otherwise this would bring us way past what the economy can produce this year.

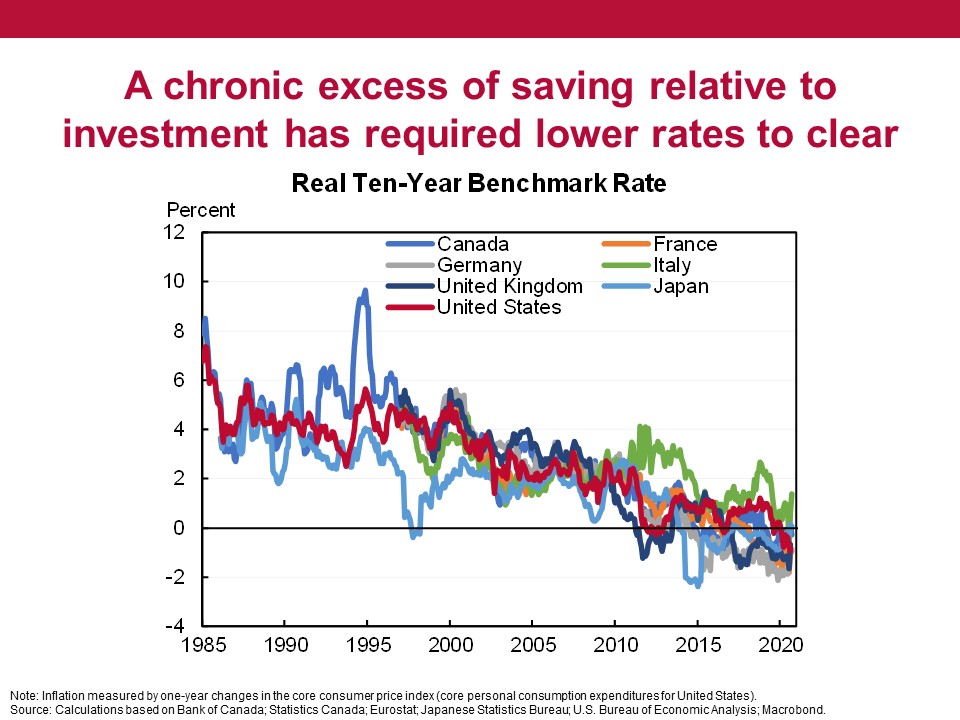

If much of the money in this bill is saved then it will put households and states in a better position to continue to spend in 2022, 2023 and beyond--easing some of the chronic demand shortages.

The biggest missing item is permanent automatic stabilizers that would last as long as needed and scale up/down as appropriate based on economic circumstances. I very much hope this gets added in the Congressional process.

The bill itself is a lot of dollars/month but still ends at the end of September. Automatic stabilizers would ensure it lasts as long as needed.

Automatic stabilizers would also scale up/down as needed based on circumstances.

Automatic stabilizers would also scale up/down as needed based on circumstances.

This package would be the largest response the United States has ever undertaken to an economic crisis, together with the December bill and the subsequent rebuilding package would be larger than CARES. It is more than anywhere else in the world.

If we control the virus could be a wild year for the economy: there is $2T in excess saving, lots of pent up demand, this would be added on top of that, and the Fed is committed to keeping rates low over the next year. Hopefully will be wild in a good way, not in a 2020 way.

• • •

Missing some Tweet in this thread? You can try to

force a refresh