The Charity Tax Group and @CFGtweets have submitted Budget representations to @hmtreasury calling for an improved tax system for #charities in the aftermath of Brexit and COVID #charitytax 1/ charitytaxgroup.org.uk/news-post/2021…

Existing charity tax reliefs should be protected & tax compliance and administration simplified. Protecting existing business rates & VAT reliefs is crucial as is future-proofing tax systems and legislation #charitytax #budget2021 2/

COVID-related support measures, such as the #JobRetentionScheme, #ExpandedRetailDiscount & temporary #5percentVAT rate on hospitality, hotel & holiday accommodation and admissions have helped many charities * should continue where possible while lockdown restrictions continue 3/

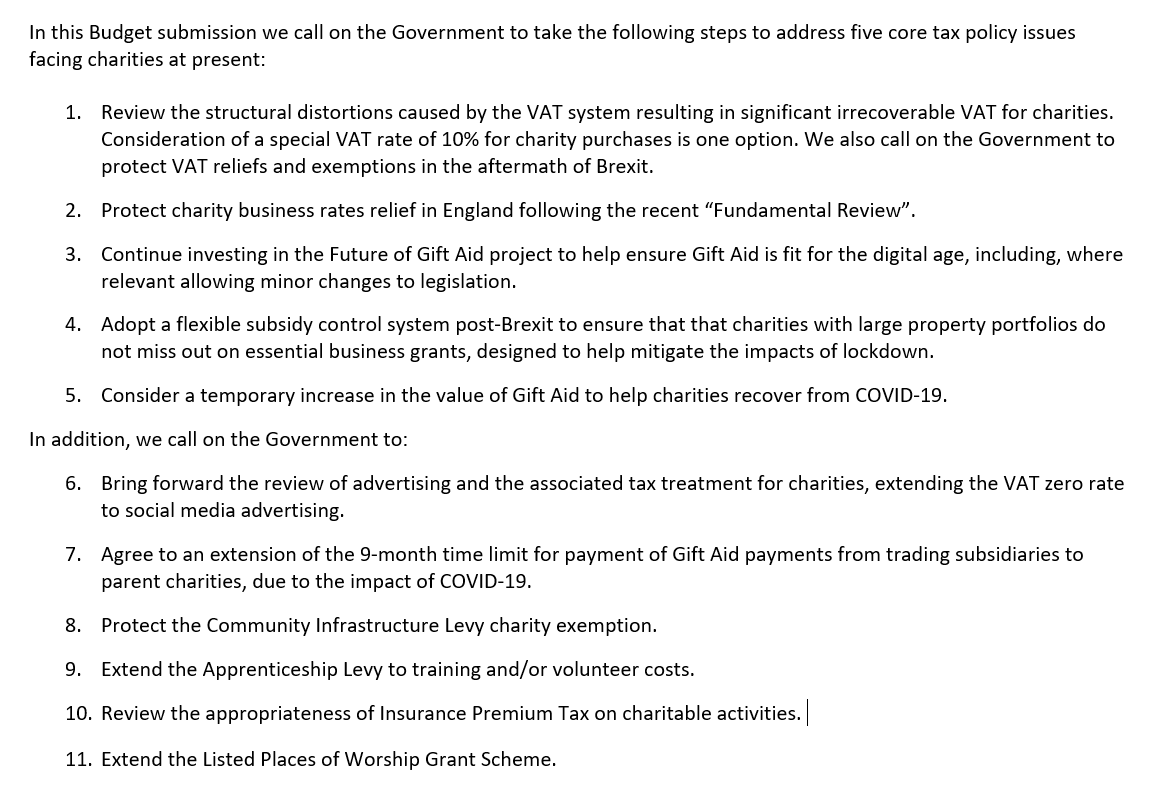

We call on Government to review the structural distortions caused by the VAT system resulting in significant #irrecoverableVAT for #charities. We also call on the Government to protect VAT reliefs and exemptions in the aftermath of Brexit #charityvat /4 charitytaxgroup.org.uk/press-release/…

We call on the Government to protect #charity #businessrates relief in England (worth almost £2bn) following the recent “Fundamental Review”. Compliance measures are important but should be targeted and proportionate #budget2021 /5 charitytaxgroup.org.uk/consultation/f…

Government should continue investing in the Future of #GiftAid project to help ensure Gift Aid is fit for the digital age, including, where relevant allowing minor changes to legislation. Automation can increase Gift Aid claims and reduce errors /6 swiftaid.co.uk/foga/

Government must adopt a flexible #subsidycontrol system post-Brexit to ensure that that charities with large property portfolios do not miss out on essential #businessgrants (worth £millions), designed to help mitigate the impacts of lockdown /7 charitytaxgroup.org.uk/news-post/2021…

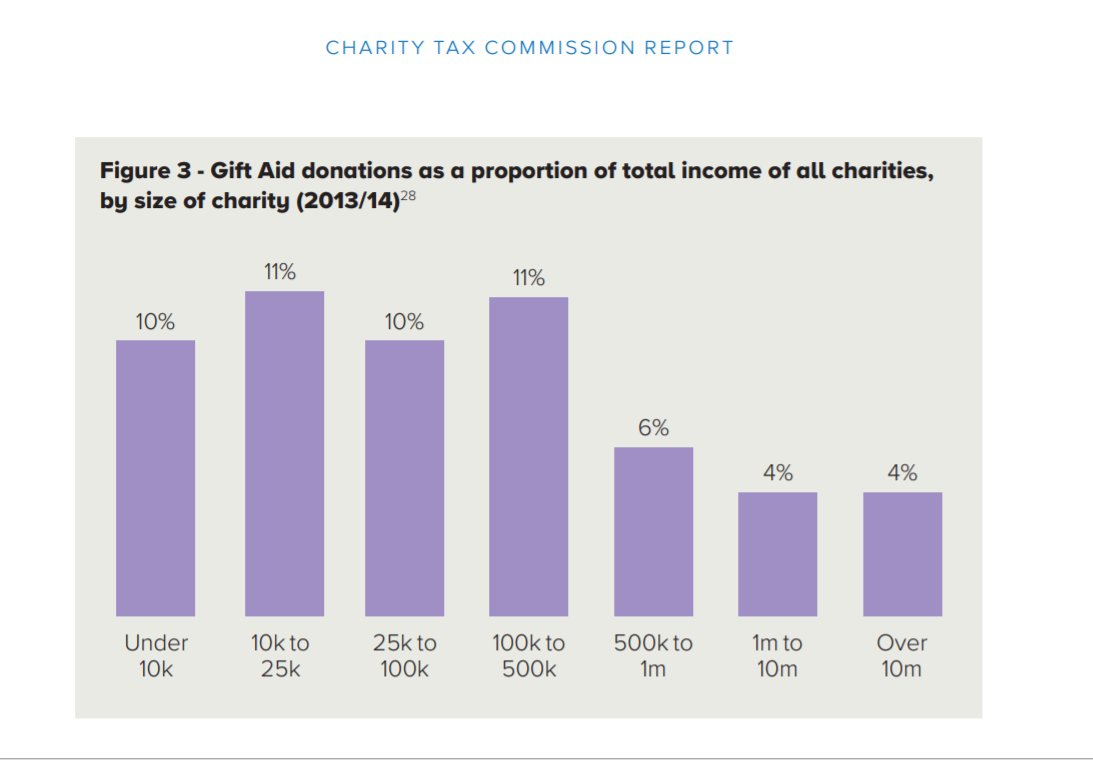

To support #charities recover from COVID-19 and the shutting of charity shops and fundraising events, the Government should consider a temporary increase in the value of #GiftAid, incentivising giving in the process 8/ cafonline.org/about-us/caf-c…

Aside from these core policy asks we also call on Government to bring forward the review of #advertising and the associated tax treatment for #charities, extending the VAT zero rate to #socialmedia advertising #charityvat 9/ charitytaxgroup.org.uk/press-release/…

To recognise the unprecedented impact of #COVID19 charities have also asked for an extension of the 9 month time limit for payment of Gift Aid payments from trading subsidiaries to parent charities /10

In addition, we reinforce our response to the Government's #PlanningfortheFuture consultation in calling for the charity exemption to the #CommunityInfrastructureLevy to be retained if the Tariff is replaced /11 charitytaxgroup.org.uk/news-post/2020…

To avoid the #ApprenticeshipLevy simply becoming another tax that many charities cannot make full use of, we have also called on the Government to extend the Levy to training and/or volunteer costs /12

In a similar vein we also call on the Government to review the appropriateness of #InsurancePremiumTax on charitable activities and to commit to no further increases /13

Lastly the submission calls on the Government to extend the funding for the #ListedPlacesofWorshipGrantScheme in advance of considering the reinstatement of a suitable charity listed buildings tax relief now that EU VAT rules are no longer an obstacle to this #charityvat /14

If these issues are of interest to your charity, please register for CTG's regular newsletter to receive #charitytax updates and event invitations 15/ charitytaxgroup.org.uk/join-us/

• • •

Missing some Tweet in this thread? You can try to

force a refresh