If you are a Positional trader then Keep your position sizing as such that even if the stocks open 10% down, your account should not be down more than 5-6 %.

Lets understand how to deal with risk when you are a positional trader,

Lets understand how to deal with risk when you are a positional trader,

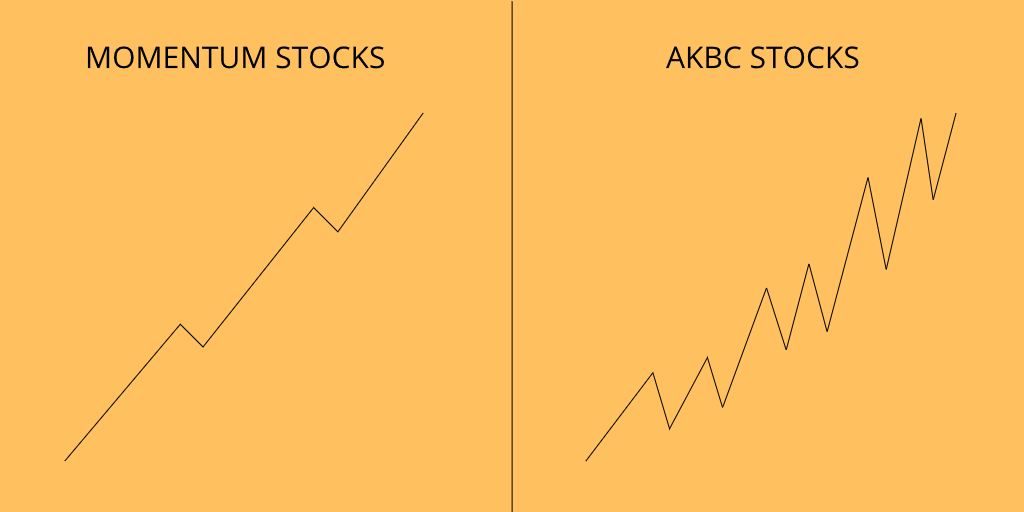

There are two types of Positional traders,

1. Those who hold stocks with 1-2 % SL for 4-5 days, though they call themselves swing traders

2. Those who hold stocks with more than 5% SL for 15 days to 1 month

Both type of traders have one thing is common, which is overnight risk

1. Those who hold stocks with 1-2 % SL for 4-5 days, though they call themselves swing traders

2. Those who hold stocks with more than 5% SL for 15 days to 1 month

Both type of traders have one thing is common, which is overnight risk

Now Most people who lose there pants overnight belong to the first category, who hold with 1-2 % SL.

lets know how and why?

You may have set your SL as say 2%, but can you control how much the market moves overnight, no, right.

lets know how and why?

You may have set your SL as say 2%, but can you control how much the market moves overnight, no, right.

What most traders are doing that they are taking risk depending on the SL , which is very small, so Most of them utilises 100% money of there account , plus they take 3-4 times leverage , in an overnight position.

Now, say the stock open 10% down, which has a very less chance of happening but a possible scenario.

Your account could be down more than 20-40% in a day, and most people would not exit the positions , most likely wiping there accounts in a single, trade.

Your account could be down more than 20-40% in a day, and most people would not exit the positions , most likely wiping there accounts in a single, trade.

So even after doing 100 trades with profits doing this way you can wipe your account in a single trade, at-least i have done that in past.

So whats the solution??

So whats the solution??

There are two ways -

The first is to take positions with big stop-losses , usually more than 5% and go for big targets, profits will be similar to to the previous more dangerous way, but the risk will be much more controllable, and your decision will be much rational.

The first is to take positions with big stop-losses , usually more than 5% and go for big targets, profits will be similar to to the previous more dangerous way, but the risk will be much more controllable, and your decision will be much rational.

Because if you are dealing with overnight risk, at-least take the reward of the risk you are taking.

This is similar to how @markminervini and @iManasArora trades, they are taking positional trades but they are much less prone to overnight wipe-out.

This is similar to how @markminervini and @iManasArora trades, they are taking positional trades but they are much less prone to overnight wipe-out.

The second way is to position yourself such that you are not taking high risk even when your SL are are 1-2% keep your position sizing very low.

If you don't want your account to be down more than 5-6% in a single trade and your account has say 1lakh.

If you don't want your account to be down more than 5-6% in a single trade and your account has say 1lakh.

You buy a stock at 1000 with 2% overnight sl, your sl level is 980.

Your risk on that trade should not be more than 1000, which is 1% of 1 lakh,

because if the stock open 10% down, you will lose around 5000, which is 5% of your account, which is still high but you will be able

Your risk on that trade should not be more than 1000, which is 1% of 1 lakh,

because if the stock open 10% down, you will lose around 5000, which is 5% of your account, which is still high but you will be able

recover from this kind of loss, but recovering from 20-30% loss of equity is not easy.

These are only my opinions and not necessarily be yours.

Thanks,

TRADER KNIGHT

These are only my opinions and not necessarily be yours.

Thanks,

TRADER KNIGHT

• • •

Missing some Tweet in this thread? You can try to

force a refresh