Holy grail- A strategy Which can make money all the time.

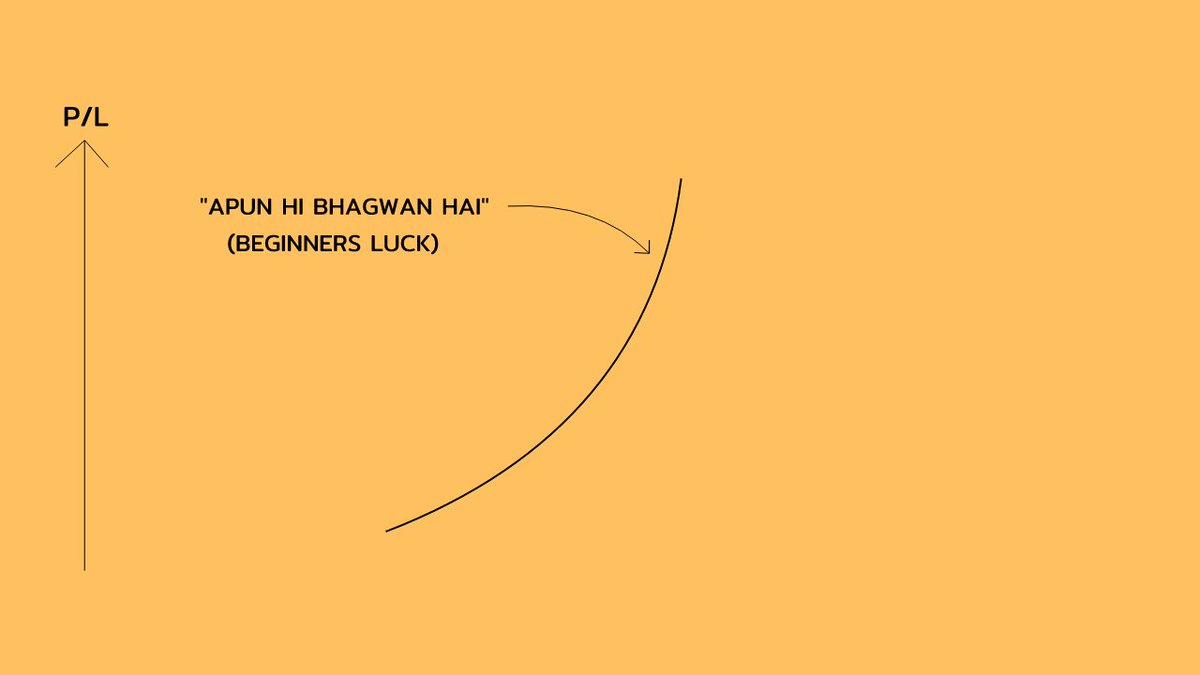

After going through two phases of a traders journey, the initial success phase, and Only why do i get loss phase, Traders enter the third phase -

THE SEARCH FOR THE HOLY GRAIL PHASE.

After going through two phases of a traders journey, the initial success phase, and Only why do i get loss phase, Traders enter the third phase -

THE SEARCH FOR THE HOLY GRAIL PHASE.

This phase has no limits, It can end in 1 month and it may not end till lifetime.

What exactly is this phase?

When a trader covers all the basics, they know how to lower their losses, they know the power of risk management.

What exactly is this phase?

When a trader covers all the basics, they know how to lower their losses, they know the power of risk management.

And few of them may even develop their edges and systems over time.

But after some time, they feel that they are doing something wrong and there is more to trading than what they know.

But after some time, they feel that they are doing something wrong and there is more to trading than what they know.

THEN COMES THE HOLY GRAIL PART-

Few of them start to Read more books about trading,finding articles about “How to win 100% of the time” and listening to Youtube videos of few big traders who make big in trading.

Few of them start to Read more books about trading,finding articles about “How to win 100% of the time” and listening to Youtube videos of few big traders who make big in trading.

Few of them start to tweak the settings of the indicators they use, if they were using supertrend 10,2 , now they feel Supertrend 10,2.3 will be better because it worked better in the last trade.

They try to change the time frame from 15min, to 1hr and from 1hr to daily, from daily to weekly, but they can't see much difference in their trading results.

And now they are in this vicious cycle of Learning something,

And now they are in this vicious cycle of Learning something,

applying some of it then jumping to the next thing and then again the same jumping over and over again.

SO, HOW TO GET OUT OF THIS VICIOUS CYCLE-

First- we have to know the few big reasons why we are trying to find the Holy grail.

SO, HOW TO GET OUT OF THIS VICIOUS CYCLE-

First- we have to know the few big reasons why we are trying to find the Holy grail.

1. We somehow feel that winning more number of trades is directly proportional to the number of profits we make.

- But in reality it doesn't matter that much , what matters is how much are your Profits in comparison to losses.

- But in reality it doesn't matter that much , what matters is how much are your Profits in comparison to losses.

2. One of the big reasons because of which we feel we have to find a holy grail is that we see someone posting their big profits on social media.

- And because you are not making that big profits you think that you are doing something wrong.

- And because you are not making that big profits you think that you are doing something wrong.

- Let me tell you the reality, those big profits that you see of some successful traders, they also risk that big amounts also.

- If someone is making say 1 crore in a trade, they may be risking from 10-50 lakhs on that trade, maybe a 5-6 R trade.

- If someone is making say 1 crore in a trade, they may be risking from 10-50 lakhs on that trade, maybe a 5-6 R trade.

- The R:R is similar to someone making 10k, by risking 2-3k.

- But just by seeing that Figure we think they must be doing something special.

- No they are not, they are successful because they are doing the same thing over and over again.

- But just by seeing that Figure we think they must be doing something special.

- No they are not, they are successful because they are doing the same thing over and over again.

3. “THE SECRET”-

- Let me tell you the secret, drum rolls……………… that there is no secret.

- It's all in front of you, it's the same charts that we all see.

- Let me tell you the secret, drum rolls……………… that there is no secret.

- It's all in front of you, it's the same charts that we all see.

- The only difference is that you keep jumping from one thing to another whereas the successful traders stick to one thing that they have mastered , which takes us to the next point.

4. “Please tell me the strategy”-

- I get this question a lot, Please tell me one strategy which i can follow from tomorrow.

- My answer is - there is no strategy that i can tell you that you can deploy from tomorrow and start to make profit.

- I get this question a lot, Please tell me one strategy which i can follow from tomorrow.

- My answer is - there is no strategy that i can tell you that you can deploy from tomorrow and start to make profit.

- Tell me which skill or profession can make you money in one day, then why do you expect to make money from markets in one day.

- It takes years of hard work, to build your edge, for some it may take less time for some it will take more time.

- It takes years of hard work, to build your edge, for some it may take less time for some it will take more time.

- Don't hurry, it's not a 100 metres race, it's a marathon brother,

- It's not the fastest who wins here but the one who sticks around for a long time.

“No strategy makes money all the time”

- It's not the fastest who wins here but the one who sticks around for a long time.

“No strategy makes money all the time”

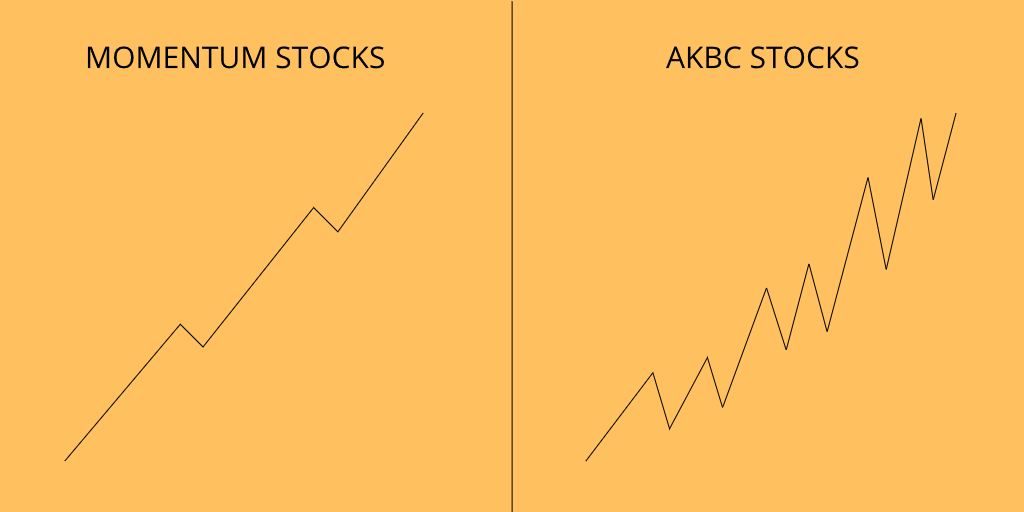

- Whatever the strategy/system is, it will go through the drawdown period,where it feels like you are in a desert where there is no water but you have to keep going in order to get to the water.

- This is the point where most traders jump the strategy, they feel its not working, they feel maybe they have to know more in order to make profits.

- They jump to the next strategy which will make money initially but then again it will also go through the draw-down period.

- They jump to the next strategy which will make money initially but then again it will also go through the draw-down period.

- So if you keep jumping strategies, you will never really get the best part which comes after the draw-down period.

These are only my views and not necessarily be yours.

At last i only want to say -” It's not about a trade, it's about the process”

Trader knight.

These are only my views and not necessarily be yours.

At last i only want to say -” It's not about a trade, it's about the process”

Trader knight.

• • •

Missing some Tweet in this thread? You can try to

force a refresh