Like humans , stocks too have different nature and if you are trading every stock the same way then this thread may be for you.

A thread on Nature of stocks and how it can help you to improve your trading results.

A thread on Nature of stocks and how it can help you to improve your trading results.

First start with what is the nature of stocks ?

I broadly categorize stocks in two categories-

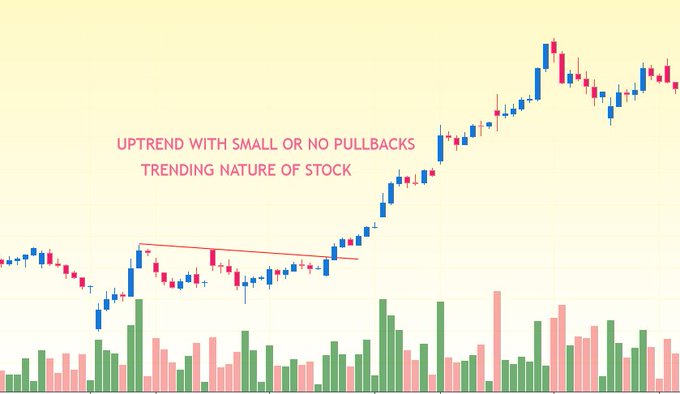

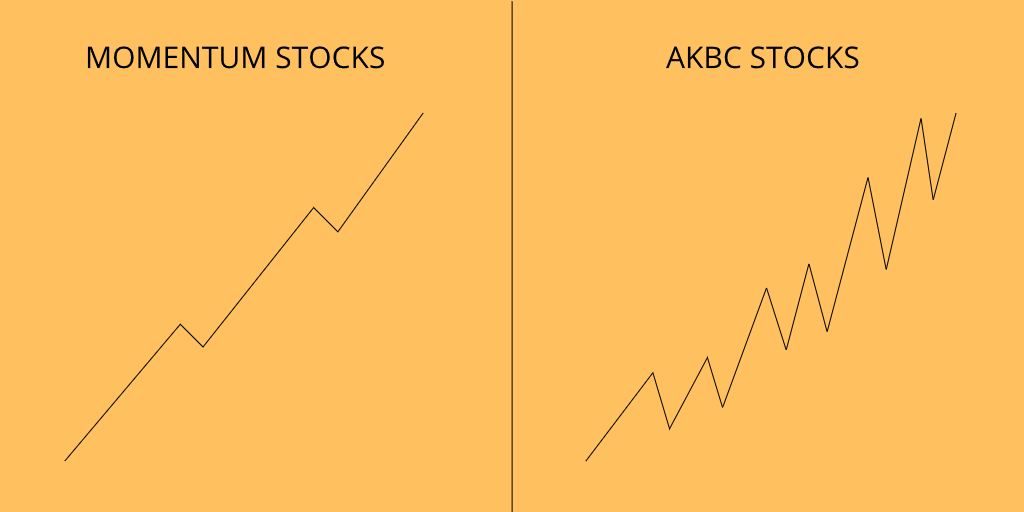

1. The momentum stocks-

These are the stocks where most of the moves are swift in nature, or we can say that the pullbacks in a trend are smaller.

I broadly categorize stocks in two categories-

1. The momentum stocks-

These are the stocks where most of the moves are swift in nature, or we can say that the pullbacks in a trend are smaller.

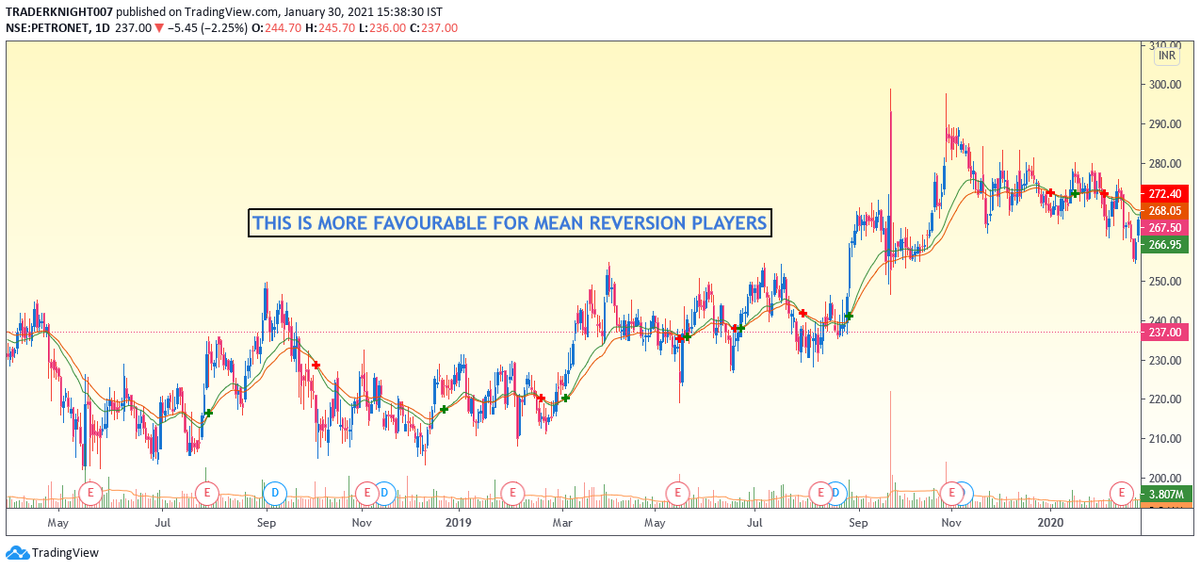

2. The AKBC stocks-

These are the stocks where most of the trending moves comes with deep pullbacks.

These are the stocks where most of the trending moves comes with deep pullbacks.

So the purpose of categorizing these stocks, is that we Trade those stocks/instruments which are more suited to our style.

Say if you are a mean reversion player and you are trading in the momentum stocks category then you are more bound to lose over large number of trades.

Say if you are a mean reversion player and you are trading in the momentum stocks category then you are more bound to lose over large number of trades.

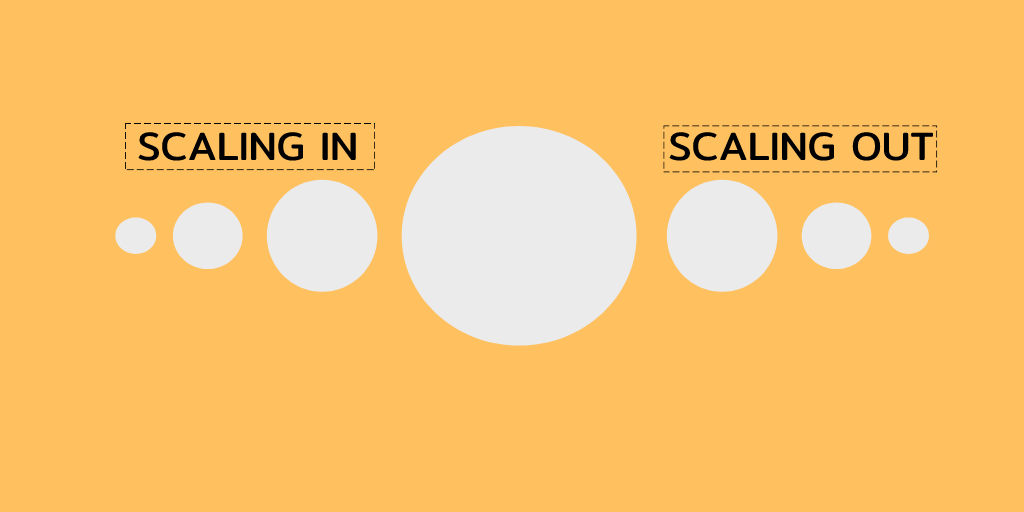

But if you do the same in the AKBC stocks then you will have more winners then losers.

Likewise If you trade with Tight stop losses in AKBC stocks then your stops will hit more often even when you get the direction right.

Likewise If you trade with Tight stop losses in AKBC stocks then your stops will hit more often even when you get the direction right.

So you got the point, that we have to trade those stocks which suits to our strategy.

// when you meet an unknown person for the first time you will not be able to know there nature , there habits fully, you will know these things over time.

// when you meet an unknown person for the first time you will not be able to know there nature , there habits fully, you will know these things over time.

Likewise, there are few qualities of stocks which you will only see if you observe closely.

For example-

1. The Metals pack, and specifically Tata steel is a stocks which has a tendency to go from top gainer to top loser intraday and vice versa.

For example-

1. The Metals pack, and specifically Tata steel is a stocks which has a tendency to go from top gainer to top loser intraday and vice versa.

2. Few stocks Perform when the market falls or when fear in markets.

3. Trend following works better in commodities then Stocks.

These are few examples and you will find many more when you track your stocks closely under different market conditions.

3. Trend following works better in commodities then Stocks.

These are few examples and you will find many more when you track your stocks closely under different market conditions.

I got confidence in this idea of knowing nature of stocks from @Trendmyfriends though our trading style is different.

These are only my views and not necessarily be yours.

Cheers

Trader knight

These are only my views and not necessarily be yours.

Cheers

Trader knight

• • •

Missing some Tweet in this thread? You can try to

force a refresh