1. Clarity- When the mind is free from fear and ego

The first step to successful trading is to be clear about everything you do.

BUT, the reality is that most traders don't even know what they are doing.

And because of this-

The first step to successful trading is to be clear about everything you do.

BUT, the reality is that most traders don't even know what they are doing.

And because of this-

They don't have any goals.

They don't have any Trading plan

They don't know what is suitable for them

And the list goes, on and on.

If you are among the people as described above, don't worry, There is nothing wrong with you, almost 90% of Traders are like that.

They don't have any Trading plan

They don't know what is suitable for them

And the list goes, on and on.

If you are among the people as described above, don't worry, There is nothing wrong with you, almost 90% of Traders are like that.

So, what do you have to do to get CLARITY in your Trading-

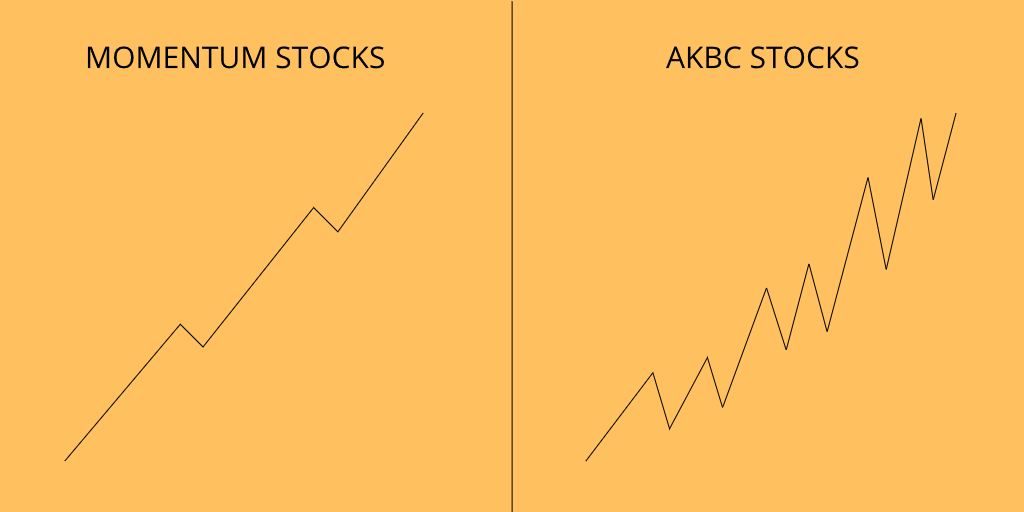

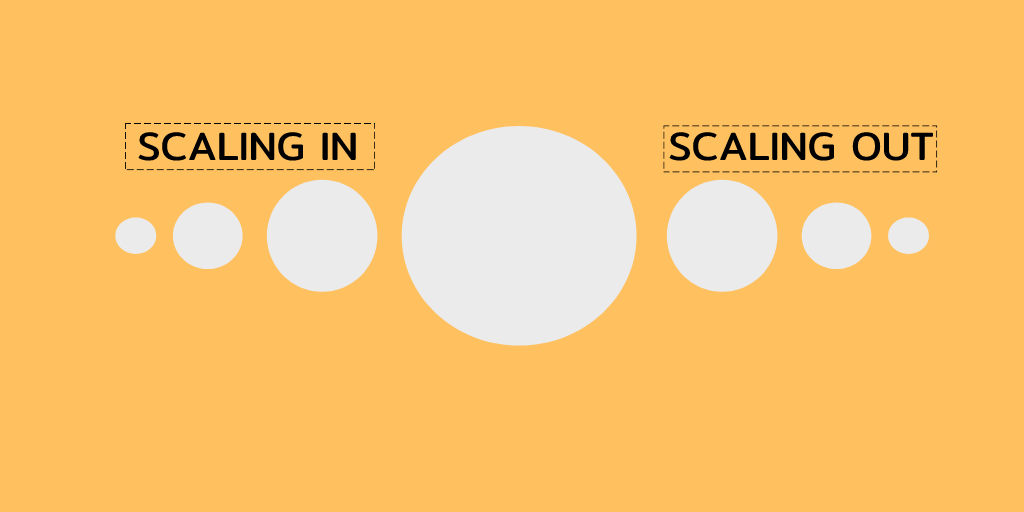

Find one style that is suitable to your personality and double down on it.

Why?

Find one style that is suitable to your personality and double down on it.

Why?

In this world where we have plethora of information just one click away, most people are distracted and see a Glowy thing every time they go over the social media.

They Find something new every now and then, jumping from one strategy to another, searching for Holy grail.

They Find something new every now and then, jumping from one strategy to another, searching for Holy grail.

The truth is there is in this not so perfect world, there is no Holy grail, Until you do not accept it from the heart, mind you can not go ahead.

So, FIND ONE THING, AND WORK ON THAT TILL IT STARTS WORKING FOR YOU.

So, FIND ONE THING, AND WORK ON THAT TILL IT STARTS WORKING FOR YOU.

Select one style , either scalping, Algo trading, Short term trading, Long term investing, whatever you like just select one.

And Trust me, in your way, there will be times where other trading systems will look Fascinating to you, but my friend those who do not fall in that trap

And Trust me, in your way, there will be times where other trading systems will look Fascinating to you, but my friend those who do not fall in that trap

of a “monkey mind” will win the game and the one who keeps jumping will lose.

When you know you have only one style, you will become a master of that style with time.

And this has worked for me till now, when i did the above i found all my answers.

When you know you have only one style, you will become a master of that style with time.

And this has worked for me till now, when i did the above i found all my answers.

I made a trading plan after I knew that I wanted to become a short term trader.

I found all rules, Experiences, Just because I selected to do only 1 thing at a time and master it.

I found all rules, Experiences, Just because I selected to do only 1 thing at a time and master it.

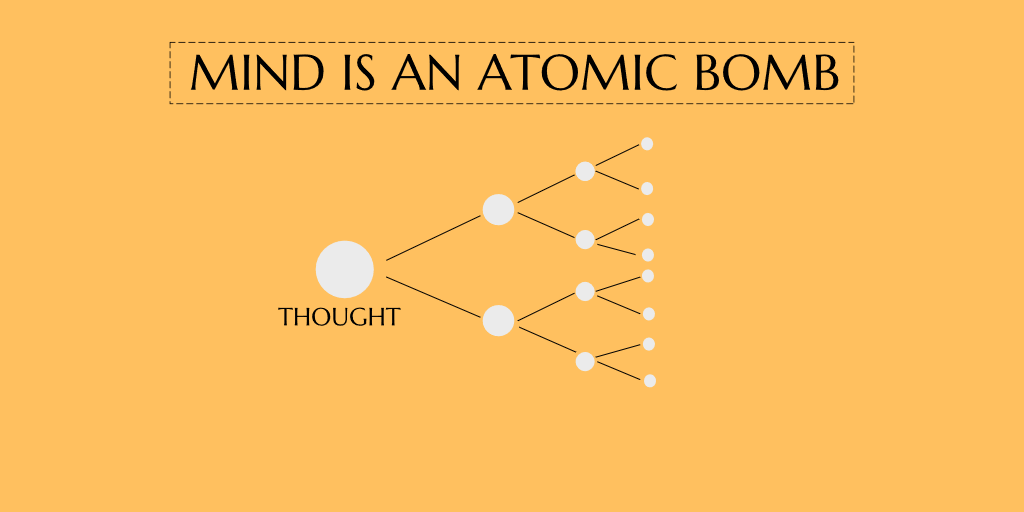

2. “Mind is an atomic bomb”-

One thought can lead to another thought and the new one can lead to another one.

One thought can lead to another thought and the new one can lead to another one.

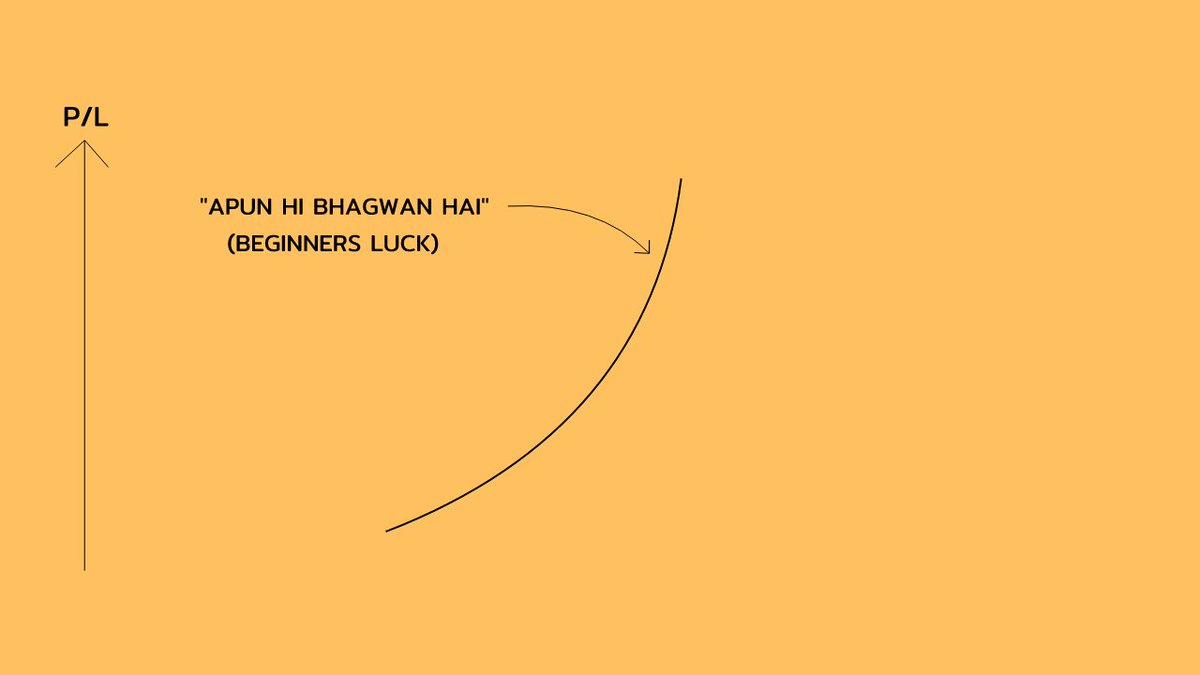

Most traders spend their time scrolling on social media, Looking at others P&L screenshots, ideas, Achievements, Trade tips, etc.

We love to know what the big traders have to say about something.

“This is Number 1 Reason most traders are unsuccessful in trading”

We love to know what the big traders have to say about something.

“This is Number 1 Reason most traders are unsuccessful in trading”

You heard it right, Most people will be better off without others advice, screenshots.

Why?

Let's look at an example-

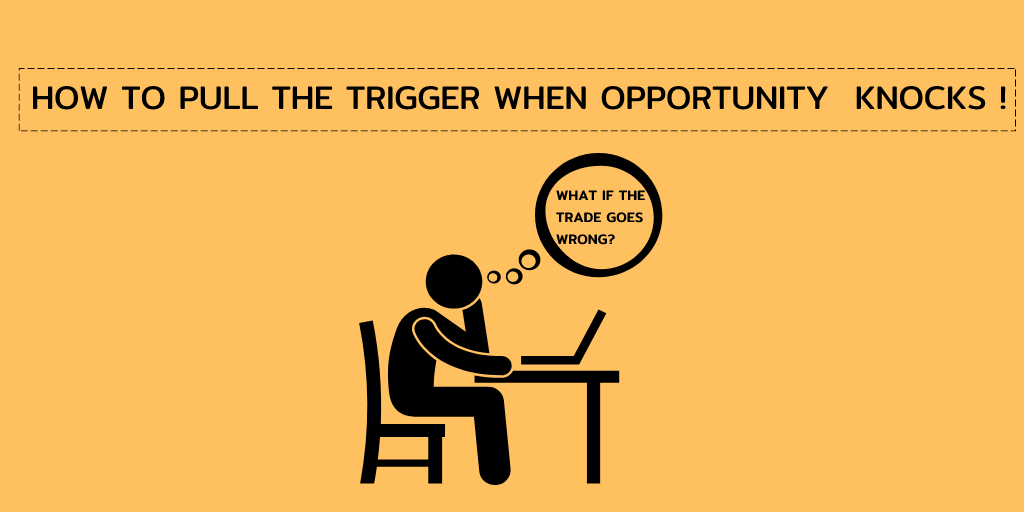

A trader named Rahul is an intraday trader and has a good plan to follow.

He gets a setup in Nifty to buy above 15000 with sl at 14950.

Why?

Let's look at an example-

A trader named Rahul is an intraday trader and has a good plan to follow.

He gets a setup in Nifty to buy above 15000 with sl at 14950.

He buys Nifty at the desired levels and sits and relax, just to check twitter.

He saw that a big trader has just posted that “ NIFTY IS GOING TO FALL LIKE A HOUSE OF CARDS ”

Rahul is in panic mode, his heart beat just got faster cause that big trader predictions never go wrong

He saw that a big trader has just posted that “ NIFTY IS GOING TO FALL LIKE A HOUSE OF CARDS ”

Rahul is in panic mode, his heart beat just got faster cause that big trader predictions never go wrong

He is worried about his position, don’t know if he can continue holding that position.

He exited nifty at market order at cost, phew i just saved my ass not going against the BIG BEAR - Rahul says.

Nifty closes about 500p up that day.

He exited nifty at market order at cost, phew i just saved my ass not going against the BIG BEAR - Rahul says.

Nifty closes about 500p up that day.

Rahul is so angry because he was right, his setup was right but because he listened to someone else advice and ruined his Profitable day.

This can further lead to more negative events, next day, but I think you may have got the point.

This can further lead to more negative events, next day, but I think you may have got the point.

Its that use social media to LEARN but not that it can change your DECISIONS.

You should be the pilot of your Plane either it reaches the destination or crashes down.

Even if you don't succeed At Least you would be happy that you took the chance.

You should be the pilot of your Plane either it reaches the destination or crashes down.

Even if you don't succeed At Least you would be happy that you took the chance.

3. Risk Management Will Save You At Every Point

As a beginner you will make a lot of mistakes, A lot of screw-ups but as my friend @KillerTrader_ used to say, don't screw up-to an extent that you can't unscrew.

How to not Screw too much as a beginner -

As a beginner you will make a lot of mistakes, A lot of screw-ups but as my friend @KillerTrader_ used to say, don't screw up-to an extent that you can't unscrew.

How to not Screw too much as a beginner -

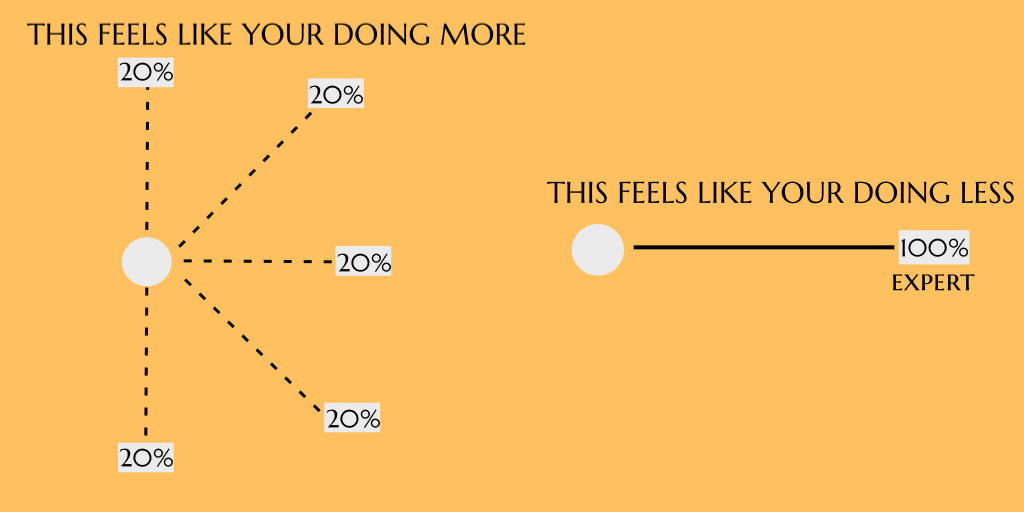

The Best possible thing is to Risk less per trade, because even otherwise you are going to make losses, best is to keep them super small.

Do all kinds of things you want to, but keep the bet small.

Do all kinds of things you want to, but keep the bet small.

What most people focus on is Money ---- which leads to -----Greed----which leads to ----- Losses---- which leads to ---

Fear----which leads to ----- You don't have courage to put the next trade.

Fear----which leads to ----- You don't have courage to put the next trade.

So get the Money part out of your mind, and for the initial years focus to Hone your skills and Risk as less as you can.

By doing this you will have “experience + Money in your pocket.”

Whereas most other traders will only have Experience.

If you get to even save what you have for the next 2 years, consider yourself Good.

Cheers,

Trader knight

Whereas most other traders will only have Experience.

If you get to even save what you have for the next 2 years, consider yourself Good.

Cheers,

Trader knight

• • •

Missing some Tweet in this thread? You can try to

force a refresh