Trader X -

Net-worth - 5 Cr

Trading capital - 25 lakh

Trader Y -

Net-worth - 30 lakh

Trading capital - 25 lakh

Trader X take risk of 2% per trade and he makes about 30-40 % Return on trading capital per month,

Net-worth - 5 Cr

Trading capital - 25 lakh

Trader Y -

Net-worth - 30 lakh

Trading capital - 25 lakh

Trader X take risk of 2% per trade and he makes about 30-40 % Return on trading capital per month,

Whereas Trader Y only risk 0.25% per trade and he makes about 3-4 % on Trading capital per month.

Trader Y saw how much trader X is making with the same amount of capital that he has.

Trader Y saw how much trader X is making with the same amount of capital that he has.

He is frustrated with his mediocre results as compared to Trader X, though he don’t know the fact that Trader X Is only trading with 5 % of his total net worth.

Trader X has much more risk taking ability in Rupee terms as compared to the Trader Y because he has higher net-worth.

Trader X has much more risk taking ability in Rupee terms as compared to the Trader Y because he has higher net-worth.

Trader X will not have much impact when he goes into deep Drawdowns , 40-50% where as if the Trader Y goes below 15% DD , it will have deep psychological impact on him.

Even if the Trader X makes 100% return on his trading capital , turns 25 lakh into 50 lakhs ,

Even if the Trader X makes 100% return on his trading capital , turns 25 lakh into 50 lakhs ,

it will be only 5% gain on his total net-worth.

Where as Trader Y who is using almost 80% of his total capital on his net-worth as Trading capital, so even if he makes 5% on his trading capital , it will have significant impact on his Net-worth.

Where as Trader Y who is using almost 80% of his total capital on his net-worth as Trading capital, so even if he makes 5% on his trading capital , it will have significant impact on his Net-worth.

Learning-

1. Don’t compare your trading results with anyone, because you don’t know there total capital, there source of income , Risk taking levels, Mindset

2. Anything is possible in markets, True, but it’s also a fact that The more % you make the more risk you have to take,

1. Don’t compare your trading results with anyone, because you don’t know there total capital, there source of income , Risk taking levels, Mindset

2. Anything is possible in markets, True, but it’s also a fact that The more % you make the more risk you have to take,

Sometimes you just don’t see that risk, but its there.

If someone making 10-20% in a day, then you accept it or not they are also taking the similar risk, Leverage is a good tool,but like Driving a car at 200 might not take you to the hospital this time, but eventually it will.

If someone making 10-20% in a day, then you accept it or not they are also taking the similar risk, Leverage is a good tool,but like Driving a car at 200 might not take you to the hospital this time, but eventually it will.

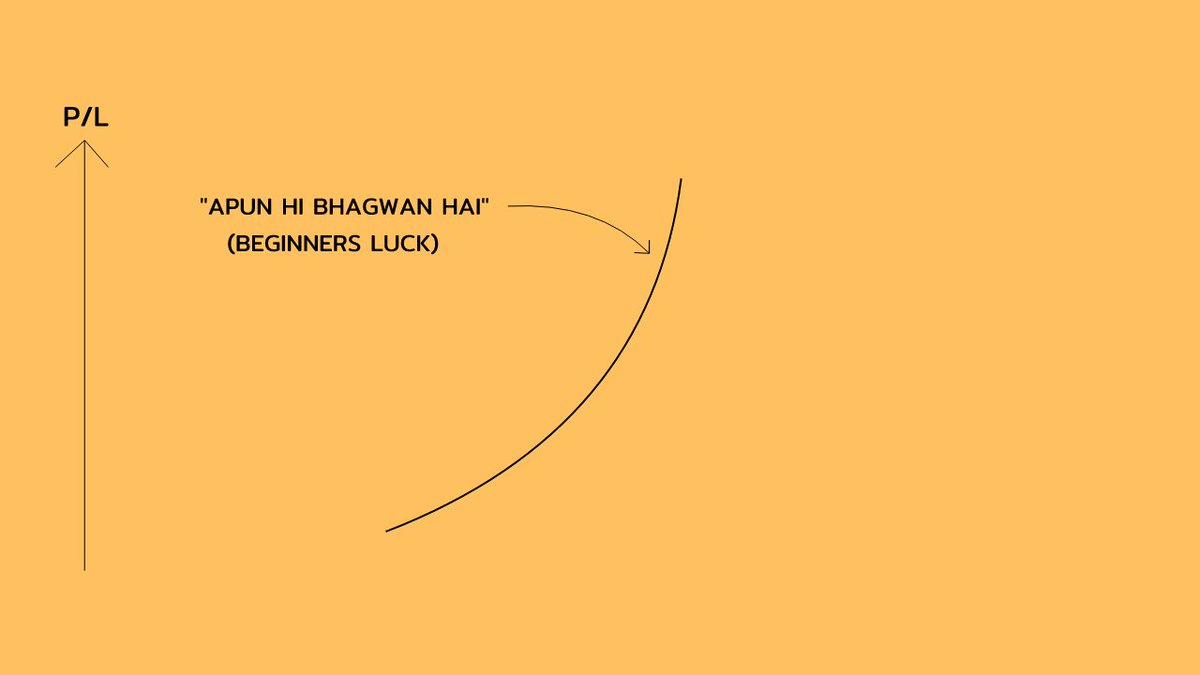

3. Market is a Money making machine, not in a single day, not In a single trade but only over a long period of time.

As @anandableanand say " There are old traders and there are bold traders, but there are no old and bold traders".

Cheers,

Trader knight

As @anandableanand say " There are old traders and there are bold traders, but there are no old and bold traders".

Cheers,

Trader knight

• • •

Missing some Tweet in this thread? You can try to

force a refresh