Good morning! We have a new president 🇺🇸, some are sad, some are happy but the good news is that no matter who you have, they can't stick around for too long in the White House.

Markets rallied over night & so far Asian data positive w/ Korea exports (1st to report for Jan) UP!

Markets rallied over night & so far Asian data positive w/ Korea exports (1st to report for Jan) UP!

Exports rose 10.6%YoY while imports less impressive at 1.5% (domestic demand is a huge problem in South Korea, especially consumption). And it's not a base effect as the average day is good too!

Cars up +16%, oil down -46%

Shipment to China & US +19% & EU +16% but Japan -1.1% 🇰🇷

Cars up +16%, oil down -46%

Shipment to China & US +19% & EU +16% but Japan -1.1% 🇰🇷

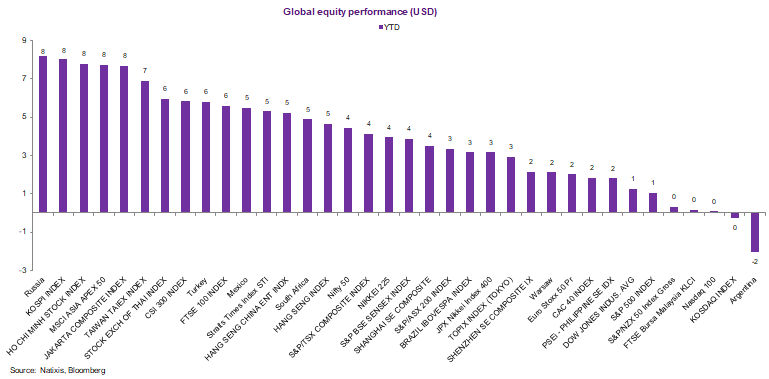

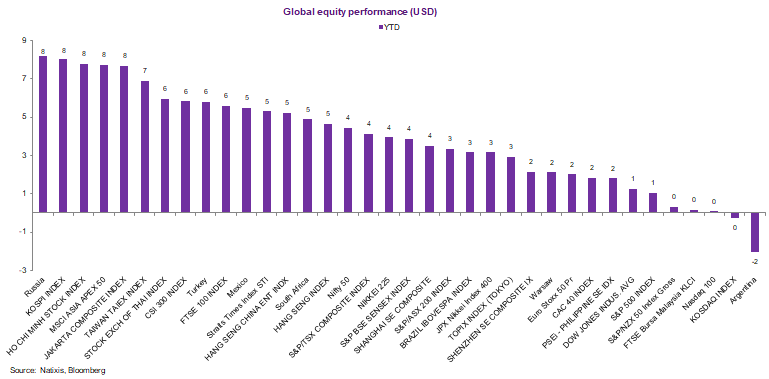

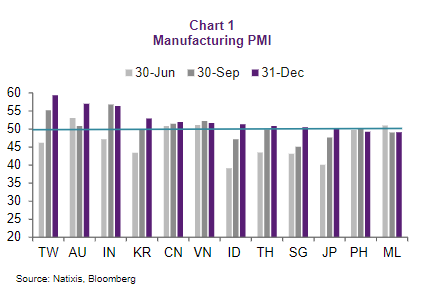

The fact that the reflation trade is priced in now but not likely to happen until H2 2021, economic data shows that demand for tech/digital related products are bolstering economies best positioned to gain.

You know who rocks Asia tech? South Korea 💥🇰🇷🤗💃🏻

You know who rocks Asia tech? South Korea 💥🇰🇷🤗💃🏻

Have you seen Taiwan export orders??? It rocked in December thanks to, well, demand from everywhere, especially China, the US etc.

Huge huge winner of Covid-19 because it got something everyone wants: CHIPS!!! 🇹🇼💥🤗

Huge huge winner of Covid-19 because it got something everyone wants: CHIPS!!! 🇹🇼💥🤗

• • •

Missing some Tweet in this thread? You can try to

force a refresh