Interesting proposal to tax capital gains on accrual rather than realization. But isn't it a bit more complicated than "unrealized capital gains are the dominant form of income of the rich and should therefore be taxed"?

A short thread:

A short thread:

https://twitter.com/gabriel_zucman/status/1351909740670902275

Basic econ theory says: 1. source of capital gains matters, 2. whether you buy/sell matters.

Example: if only reason stock price increases is falling interest rates & investors just live off dividends/never sell, unrealized cap gains are just "paper gains" so why tax them?

1/

Example: if only reason stock price increases is falling interest rates & investors just live off dividends/never sell, unrealized cap gains are just "paper gains" so why tax them?

1/

That the source of capital gains should matter for how they are taxed is an old argument.

Here are two short papers I found, one from 1940 and one from 1979.

First, Paish (1940) jstor.org/stable/2550234

2/

Here are two short papers I found, one from 1940 and one from 1979.

First, Paish (1940) jstor.org/stable/2550234

2/

Second, Whalley (1979) -- definitely check out his super clear graphical analysis using a two-period model jstor.org/stable/41863202

3/

3/

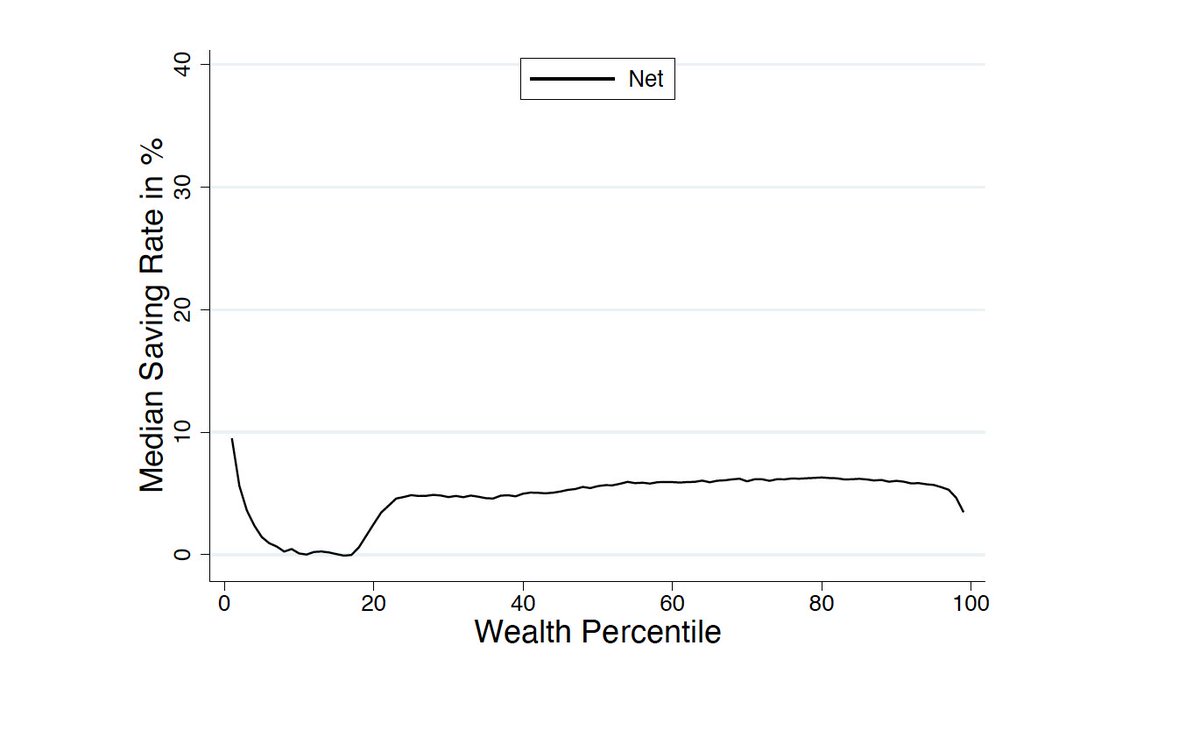

I've previously written about this in related context: If a large fraction of the increase in wealth inequality is due to changing asset prices, should we care?

Bottom line: it depends. Again on 1. source of cap gains, 2. whether investors buy/sell.

4/

Bottom line: it depends. Again on 1. source of cap gains, 2. whether investors buy/sell.

4/

https://twitter.com/ben_moll/status/1277900052439216130

In summary: before changing cap gains tax policy in such ways, shouldn't we perhaps first develop a better understanding of the role of asset price changes in wealth accumulation and their welfare implications?

(To be clear: step-up of basis on death should def be abolished)

5/

(To be clear: step-up of basis on death should def be abolished)

5/

More generally, I think the wealth inequality and public finance literatures could benefit from taking asset price changes into consideration more carefully -- from putting the "finance" in "public finance" so to speak!

6/6

6/6

• • •

Missing some Tweet in this thread? You can try to

force a refresh