@ApolloTriCoat

#Q3marketupdates #Q3investorpresentations

Apollo tricoat - 3 steps ahead

Q3fy21/20 in crs

Rev 503/229

PAT 38/18

EPS 12.46/5.93

9m fy21/20

Rev 1006/434

PAT 70/31

EPS 23.24/10.35

Full on ahead not only 3 steps

#Q3marketupdates #Q3investorpresentations

Apollo tricoat - 3 steps ahead

Q3fy21/20 in crs

Rev 503/229

PAT 38/18

EPS 12.46/5.93

9m fy21/20

Rev 1006/434

PAT 70/31

EPS 23.24/10.35

Full on ahead not only 3 steps

50 % mkt share in structural steel tubes 9mfy21,sales vol CAGR 27% fy11-20

Most products with 1500+ SKUs (shapes & sizes)

Highest scale with 10 plants - 2.5 mn ton capacity

Largest sales network 800+ distributors

Lowest cost producer

Premium pricing to peers

50000+ retailers

Most products with 1500+ SKUs (shapes & sizes)

Highest scale with 10 plants - 2.5 mn ton capacity

Largest sales network 800+ distributors

Lowest cost producer

Premium pricing to peers

50000+ retailers

Existing product portfolio

Door solution - Chaukhat (Indias 1st closed steel door frame ) ,monthly sales reached 4000 ton ,2 lakh/month chaukhats ,UP,HP,Rajsthn,Punjab

Home beautification - Elegant ,Signature, Plank

Door solution - Chaukhat (Indias 1st closed steel door frame ) ,monthly sales reached 4000 ton ,2 lakh/month chaukhats ,UP,HP,Rajsthn,Punjab

Home beautification - Elegant ,Signature, Plank

Designer tubes

Signature

Elegant

Upgrade to conventional tubes,aesthetically superior,corrosion & rust resistant due to galvanized layer

Planks

New age steel tube product to completely replace wood with steel

Signature

Elegant

Upgrade to conventional tubes,aesthetically superior,corrosion & rust resistant due to galvanized layer

Planks

New age steel tube product to completely replace wood with steel

Gross block 9820/ton

Asset turnover - 5.6x

Sales realization - Rs 55000/ton

Ebidta margin - 12%

Ebit margin - 11%(6000/ton)

Working capital days - 0

Total capital employed - 9820/ton

Asset turnover - 5.6x

Sales realization - Rs 55000/ton

Ebidta margin - 12%

Ebit margin - 11%(6000/ton)

Working capital days - 0

Total capital employed - 9820/ton

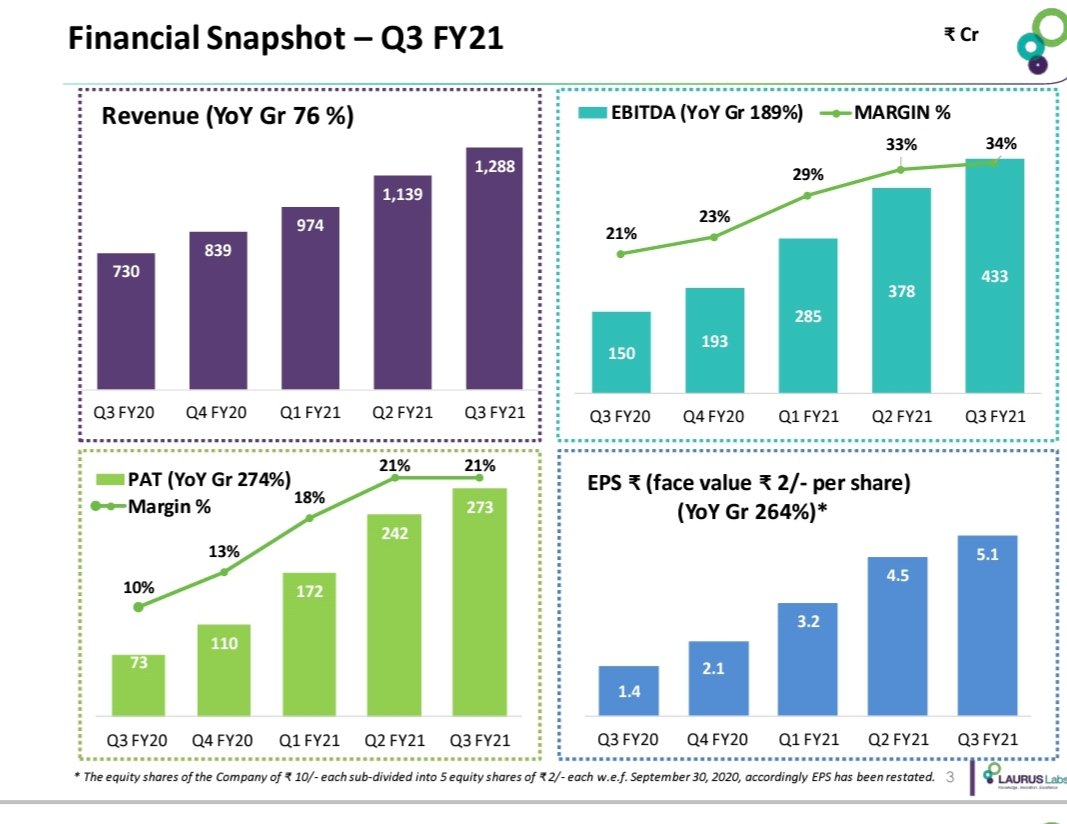

Q3 fy21 at a glance

Vol 72604 ton ,up 54% yoy

Net profit 379 mn ,110% up yoy

D/E 0.2

Ebidta 572 mn ,up 101% yoy

Net WC days -4 from -2 in 2020

1123 mn 9m operating cash flow

ROCE 40.3%, fy20 was 20

Capacity 350000 ton

Vol 72604 ton ,up 54% yoy

Net profit 379 mn ,110% up yoy

D/E 0.2

Ebidta 572 mn ,up 101% yoy

Net WC days -4 from -2 in 2020

1123 mn 9m operating cash flow

ROCE 40.3%, fy20 was 20

Capacity 350000 ton

• • •

Missing some Tweet in this thread? You can try to

force a refresh