@ArmitageJim @premnsikka 1/ The Times’s @AlihussainST opens the lid again on the secretive networks that operate both inside + outside of @TheFCA’s pitifully small “porous” (A.R.’s) regulatory perimeter unfettered + without fear in ‘What happened to the £160m we put in ...

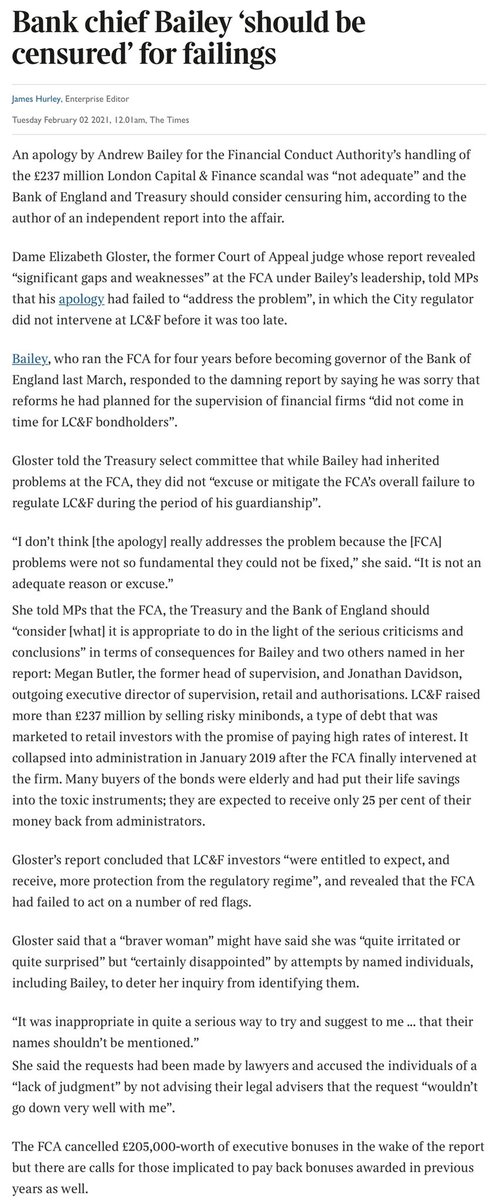

2/ “secure” investments?. Bonds promising high returns were used to fund bizarre schemes around the world’. What isn’t in the piece (but still queued up for the “curious case” treatment) is that the #LCF crew played host to Bradley Lincoln’s activities, #LCF bondholder ...

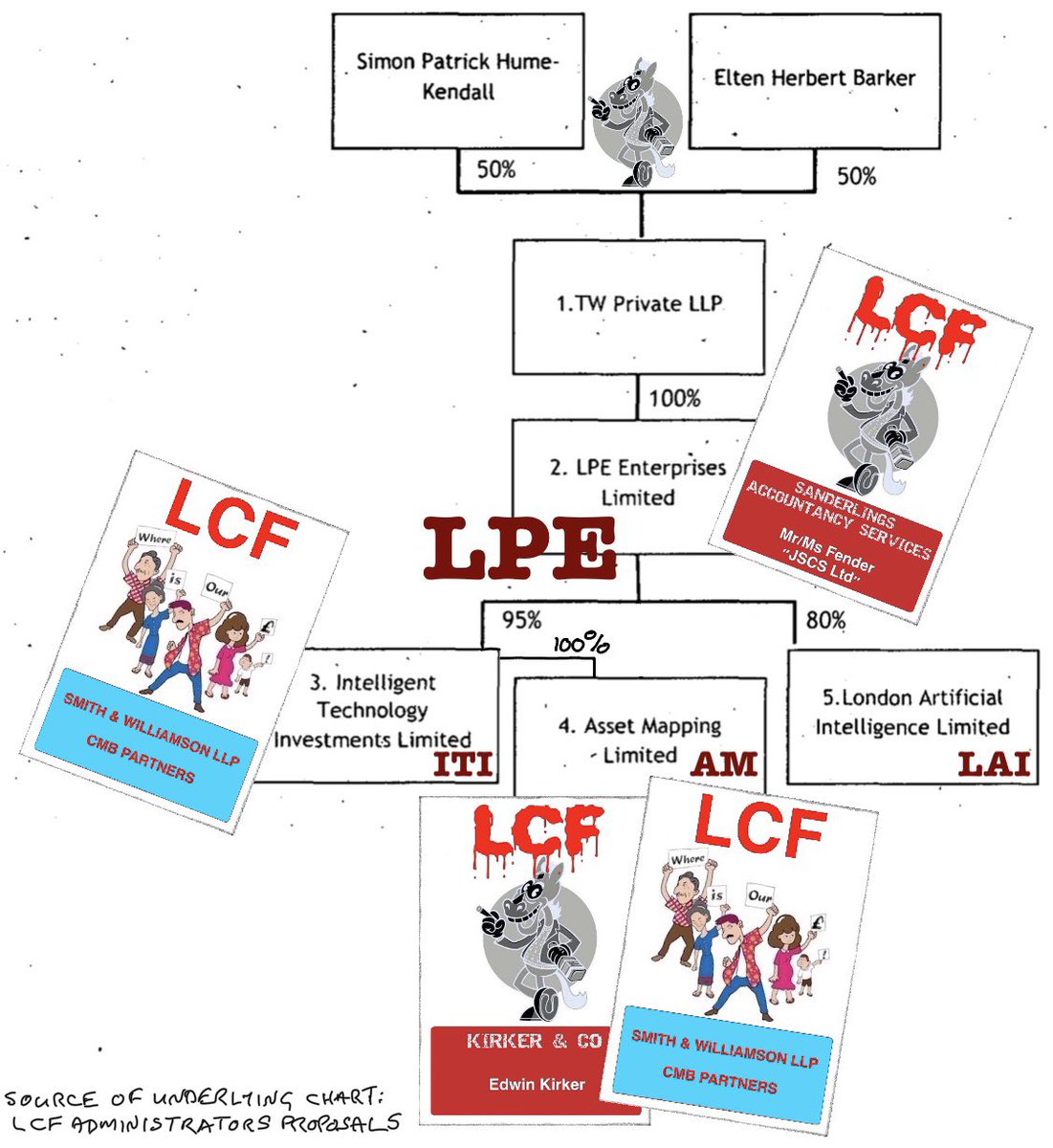

3/ victims will also recognise Mr Zhang alongside the doyen of Sussex & Kent Tory MP’s, former MP’s + former council leaders #LCF crew-mate Simon Hume-Kendall, talking turkey over the LCF crews notorious Lakeview multi recycled/rebranded “scheme”. The #LCF scandal ...

4/ was a mecca for the secretive networks that have operated unfettered + without fear in UK financial services while the FCA(FSA) slept at the wheel - the Cherish Chums

https://twitter.com/ianbeckett/status/1288857934315872256, the Knifton Clan’s Paul “Carbon Credit” Seakens & favourite ICAEW auditors ...

5/ #ClarksonHyde (a former partner of which was #LCF end game player Whyke), the #AssetLife Minibond Crew

https://twitter.com/ianbeckett/status/1236792845606031360(guess who their auditor was - LoL), the notorious #SterlingMortimer + their Cape Verde capers (+ yet another respin of Lakeview with the LCF crew) ..

6/

https://twitter.com/ianbeckett/status/1229205757238874119, Hypa Asset management [Project Kudos] crew (a hybrid of the Cherish Chums + from the shadows Intelligent Partership’s Marc Hounsell

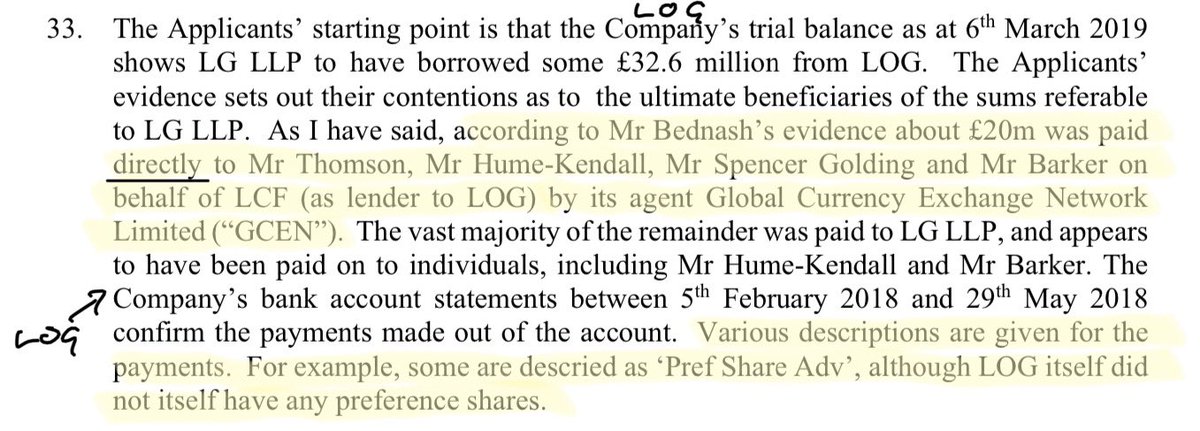

https://twitter.com/ianbeckett/status/1229173980008996869), #GCEN (who made their bones in timeshare ops & allegedly with the Cherish chums ...

7/ oh I hear LCF bondholders say “but what of the infamous Osage ‘scheme’ & #Quincecare ... what about LCF?”

https://twitter.com/ianbeckett/status/1238474974689665026) + the list goes on + on ... Maybe we’ll get round one day to the curious case of the #LCF crews Magic Circle lawyer ...

8/ (cough infamous ‘Loutish Lord’ case cough) who allegedly couldn’t keep his pants up - we’ll have to see how he’s behaved since. Dolphin Capital(GPG) victims will note their mention in Ali Hussain’s piece (The FCA’s SIPPshittery) particularly in + around the FCA’s ...

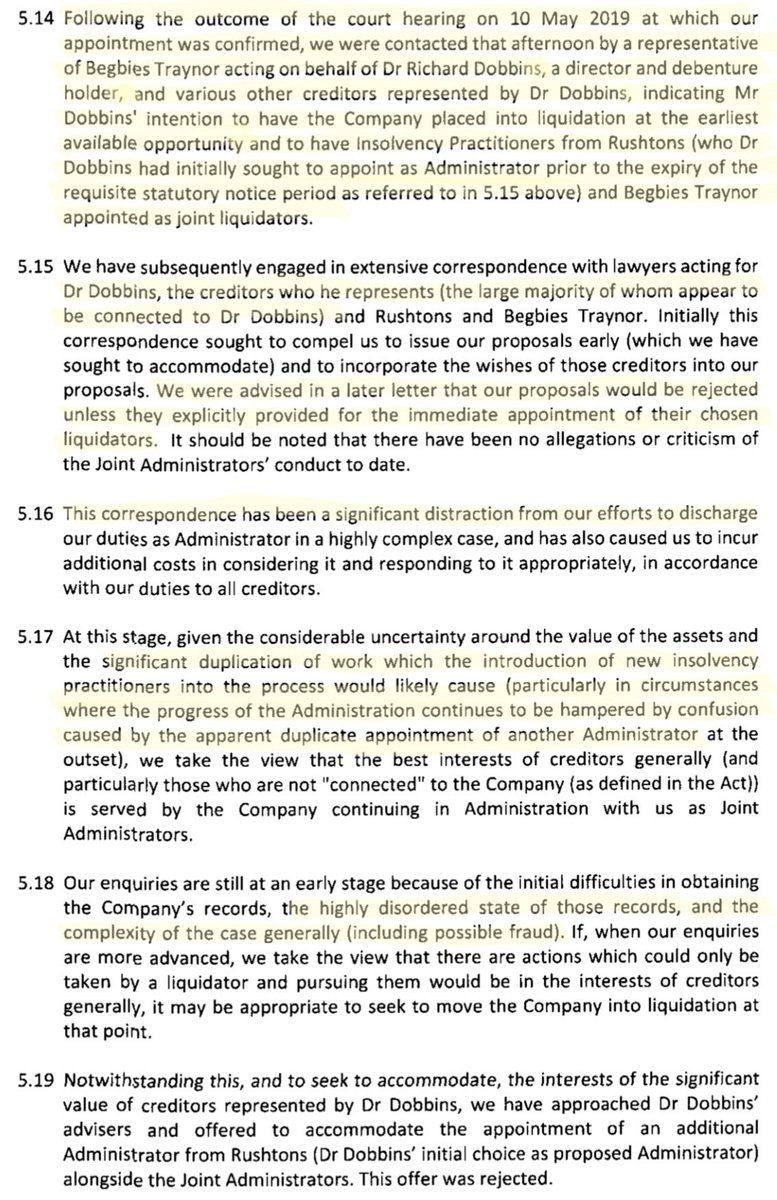

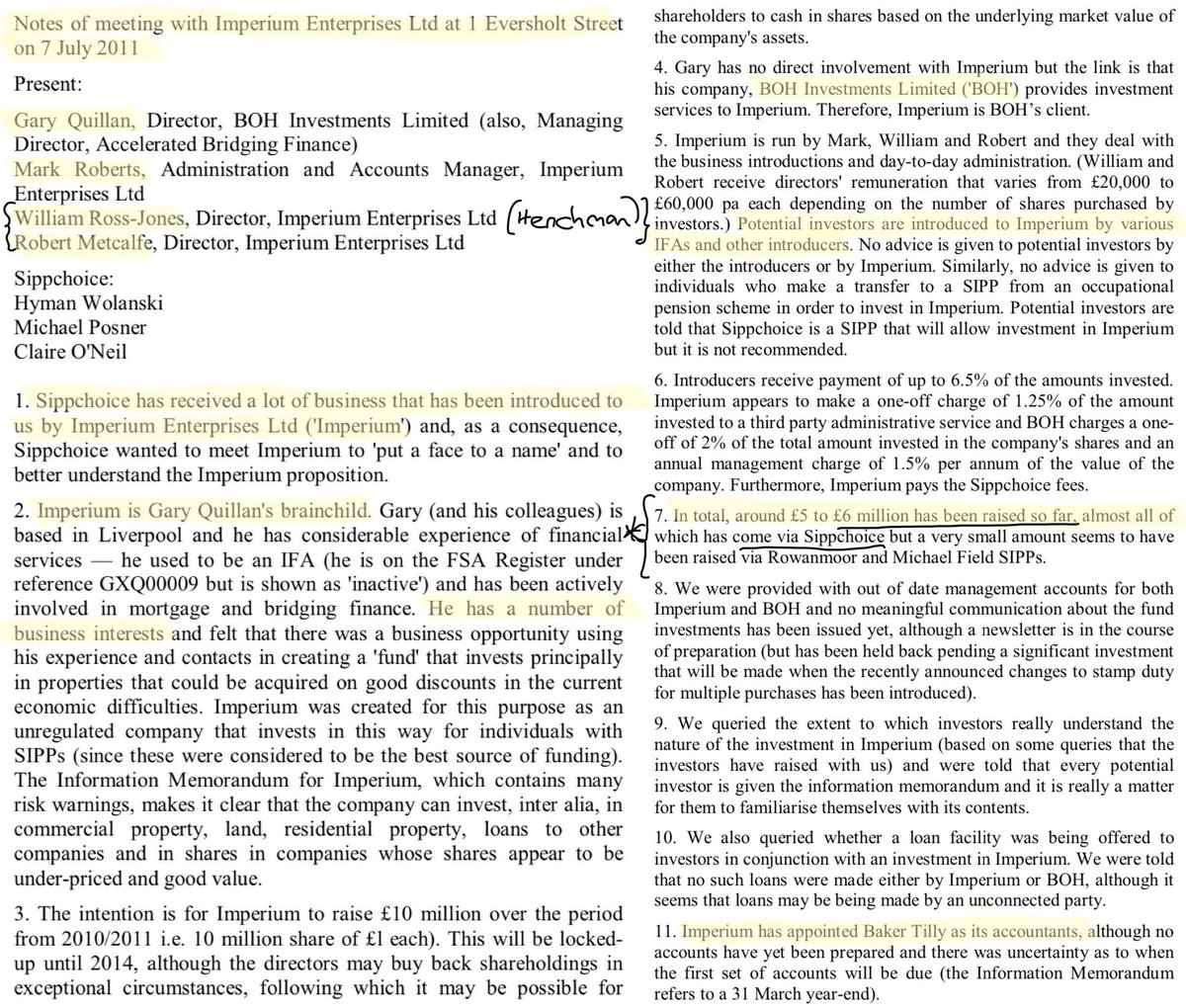

9/ notorious “Solihull SIPPshittery” - #Avacade, #Cherish, #Blackstar #LibertySIPP etc. They will also see mention when we look at the FCA’s notorious so called listed bond ops which pumped like effluent trash bonds through the FCA’s notorious DFM’s (of those not ...

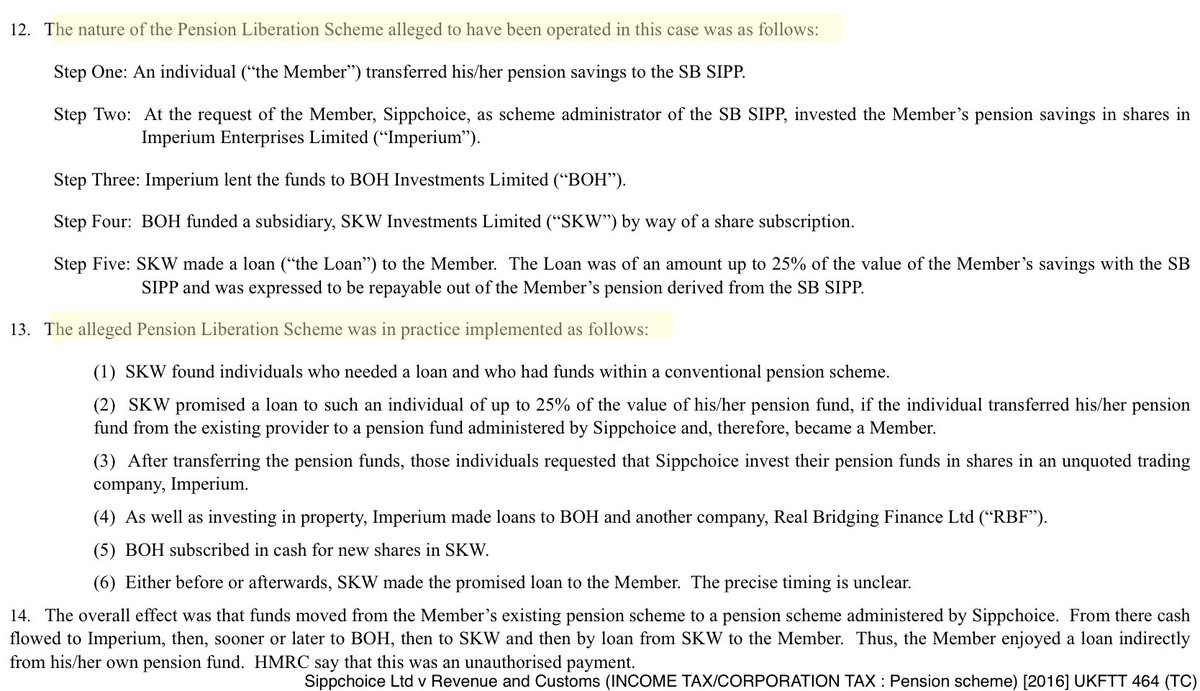

10/10 busted by the FBI, many have “quietly” exploded, the @FSCS’s Ms Rainbird swooping quietly in, pecking away at the victims) + pension liberation scams (while @TPRgovuk slept at the wheel). Some particularly explosive Pension Liberation scam exposes coming in due course.

• • •

Missing some Tweet in this thread? You can try to

force a refresh