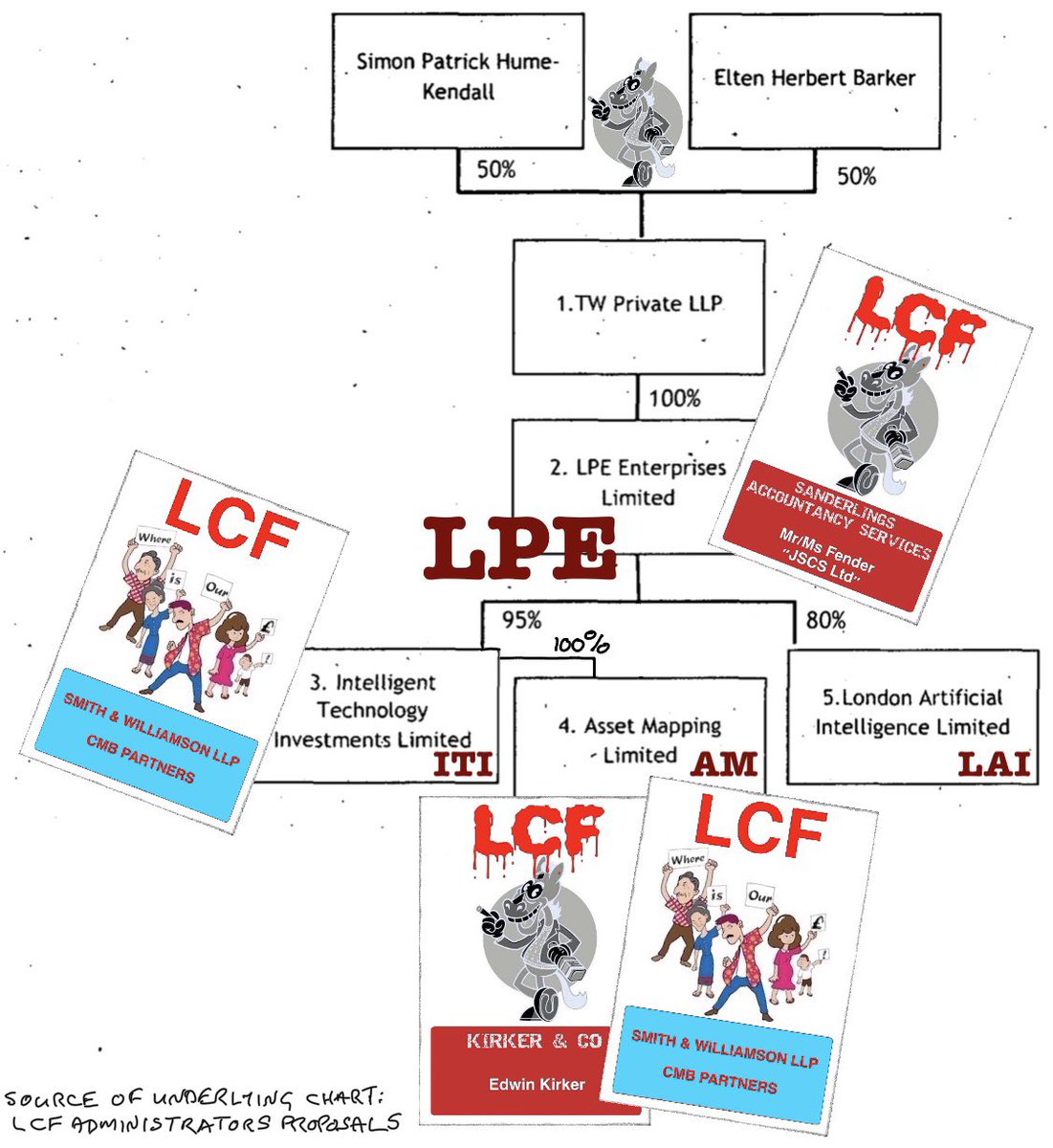

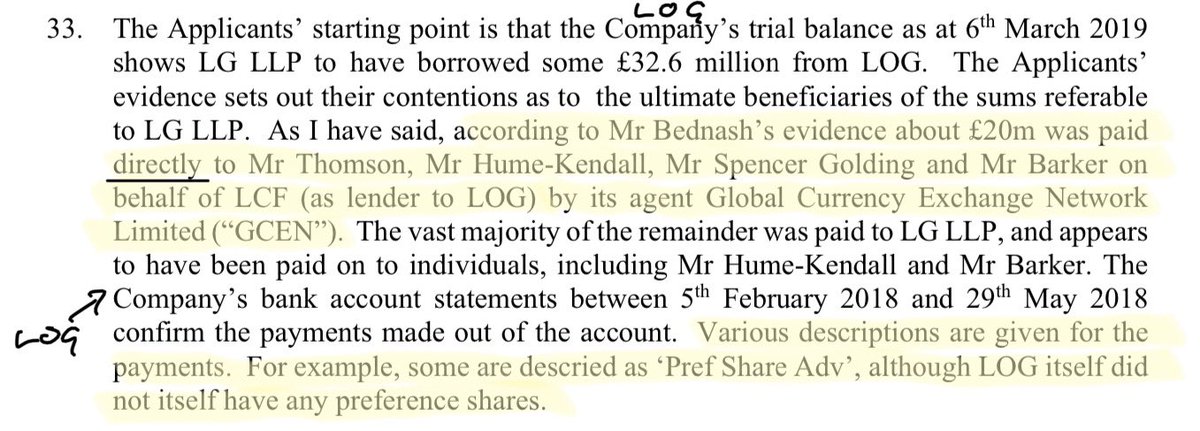

@ArmitageJim @premnsikka 1/ Leeds finance firm boss Liam Wainwright banned from being a director for adding >£12m in false entries to company records. businessleader.co.uk/lender-who-add… . “Under the hood”, the case becomes rather more interesting. The administrators proposals tell ...

2/ the all too familiar gruesome tale in the “Wild West” that is U.K. Financial Services. The debenture holders & company’s directors included rather fascinatingly the now deceased Lord (Prof.) Barrie Pettman & colleague Dr Richard Dobbins, amongst other things academics & ...

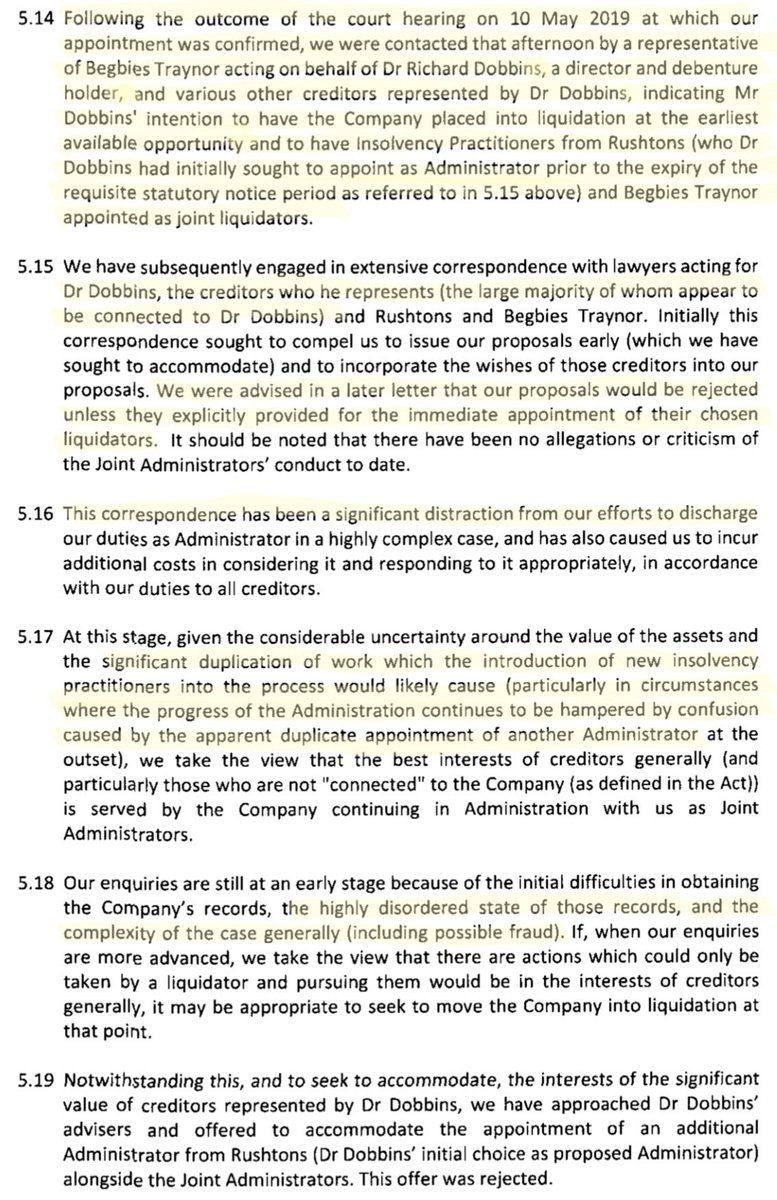

3/ prolific finance/accountancy writers/publishers en.wikipedia.org/wiki/Barrie_Pe…. The administrators proposals outline a quite astonishing “bitch fight” in the “mysterious world of corporate insolvency” between debenture holders mounted on their chosen Insolvency Practitioners.

4/4 Worthy of a case study all to itself on #CorporateGovernance, Insolvency, alleged #fraud etc ...

• • •

Missing some Tweet in this thread? You can try to

force a refresh