This is your daily pension announcement. Lots of you have heard back from your MLA with the the statement below👇. This one is from @JasonCoppingAB, but they are all the same. You need to go back at your MLAs HARD because this is some Stalin level disinformation. #AbLeg #abpoli

In no particular order I will run through the errors:

1. "the Alberta Government ...holds the liability of the ATRF plan.."

Absolutely, unequivocaly false. Read the Teachers' Pension Plan Act. Any liabilities are paid off 49% by the GOA/51% by the teachers. #AbLeg #abpoli

1. "the Alberta Government ...holds the liability of the ATRF plan.."

Absolutely, unequivocaly false. Read the Teachers' Pension Plan Act. Any liabilities are paid off 49% by the GOA/51% by the teachers. #AbLeg #abpoli

This is a risk shared plan, teachers pick up 51% of the financial risk. This is a benefit to the taxpayers. Not all plans in Canada are risk shared but ATRF sure as hell is.

(even the Fraser Institute admits this) #AbLeg #handsoffmypension

(even the Fraser Institute admits this) #AbLeg #handsoffmypension

If @JasonCoppingAB would read the latest ATRF Annual Report he would see that we (teachers 51%/49% GOA) are currently paying off a deficiency that is equal to 3.28% of pay. #AbLeg #handsoffmypension

2. Next false statement: he says that section 3.8(c), giving AIMCo the right to refuse instructions from ATRF, is "a standard provision" in these types of agreements. Nope.

Just nope. #AbLeg #handsoffmypension This is a backdoor overreach into the ATRF's affairs.

Just nope. #AbLeg #handsoffmypension This is a backdoor overreach into the ATRF's affairs.

Evidence: SFPP, MEPP, and PSPP have used AIMCO for 10 years. None of them had this provision. All of them have refused to sign an IMA with this provision.

ATRF is not a lone dissenting plan. AIMCO has failed to reach agreement with 4 plans, 3 of which are clients. #AbLeg #abpoli

ATRF is not a lone dissenting plan. AIMCO has failed to reach agreement with 4 plans, 3 of which are clients. #AbLeg #abpoli

3. Next whopper lie "this change does not affect your contribution levels...". True for today. If AIMCO does not perform well contribution rates will go up as early as next year. #AbLeg #abpoli #handsoffmypension

The benefit is defined in law but the contributions sure are not.

The benefit is defined in law but the contributions sure are not.

4. Lie: "AIMCO generally performs better over the long term." Nope. Part of the problem here @JasonCoppingAB is the GOA should have done a detailed study (like in ON) into risk adjusted investment return. I don't like shit talking return....but you are making me do it.👇

There is a pic of the MEPP (invested by AIMCO) long term (8 year) return at -0.55% of value add. IT SHOULD BE AT LEAST +0.85%.

Here 👇 is the news release where (read the whole thing), where AIMCO 10 year return is 8.2%.

newswire.ca/news-releases/…

Here 👇 is the news release where (read the whole thing), where AIMCO 10 year return is 8.2%.

newswire.ca/news-releases/…

ATRF 10-year return 9.2%. Just released Available here👇.

Because of differences in asset mix and end dates this is the wrong kind of comparison to make. #AbLeg @JasonCoppingAB should have done their homework. #handsoffmypension

atrf.com/Publications/2…

Because of differences in asset mix and end dates this is the wrong kind of comparison to make. #AbLeg @JasonCoppingAB should have done their homework. #handsoffmypension

atrf.com/Publications/2…

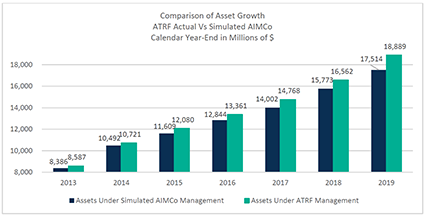

One organization only has done an accurate risk adjusted return comparison: ATRF. Over the last 7 years (long term) if ATRF had used AIMCO our fund would have been worth $1.3BILLION LESS. And that money would have had to come from increased contributions. #AbLeg #abpoli

Here is a quote from AIMCO client LAPP:

"Between AIMCo’s inception and May 31, 2020, the LAPP portfolio returned an annualized 6.18% versus a LAPP policy benchmark return of 6.76%."

Long term my ass. #AbLeg #handsoffmypension

"Between AIMCo’s inception and May 31, 2020, the LAPP portfolio returned an annualized 6.18% versus a LAPP policy benchmark return of 6.76%."

Long term my ass. #AbLeg #handsoffmypension

5. Mother of all mistruths: "AIMCO has a consistent record of ....effective corporate governance..." No. Just no. AIMCO has a byzantine governance structure that is not at all in line with the vaunted "Canadian pension model".

AIMCO clients that are (and this is critical) "joint" are picking up half the risk. In any normal reality, @JasonCoppingAB, those multi-billion dollar clients would be represented on AIMCO's Board and in the Director selection process. #AbLeg #handsoffmypension

Go see BCIMC for an example of cutting edge corporate governance structures. Plans need the option of using different asset managers tuned to their need. AIMCO gives cafeteria service when plan members need a full menu. #AbLeg #handsoffmypension

@jasoncopping this is classic example of a false economy. Moving investment employees from ATRF to AIMCO will not save a dollar. In fact , it will cost us $1.3 billion over the next 7 years. 51% will be borne by teachers and 49% by the GOA. #AbLeg #abpoli #AIMCOfail

@JasonCoppingAB you are now getting the GOA sued by two different organizations because of this overreach.

Pension warriors go back to your MLAs. Demand answers, particularly on who carries the liability for a JOINT plan. #AbLeg #abpoli #handsoffmypension

Pension warriors go back to your MLAs. Demand answers, particularly on who carries the liability for a JOINT plan. #AbLeg #abpoli #handsoffmypension

• • •

Missing some Tweet in this thread? You can try to

force a refresh