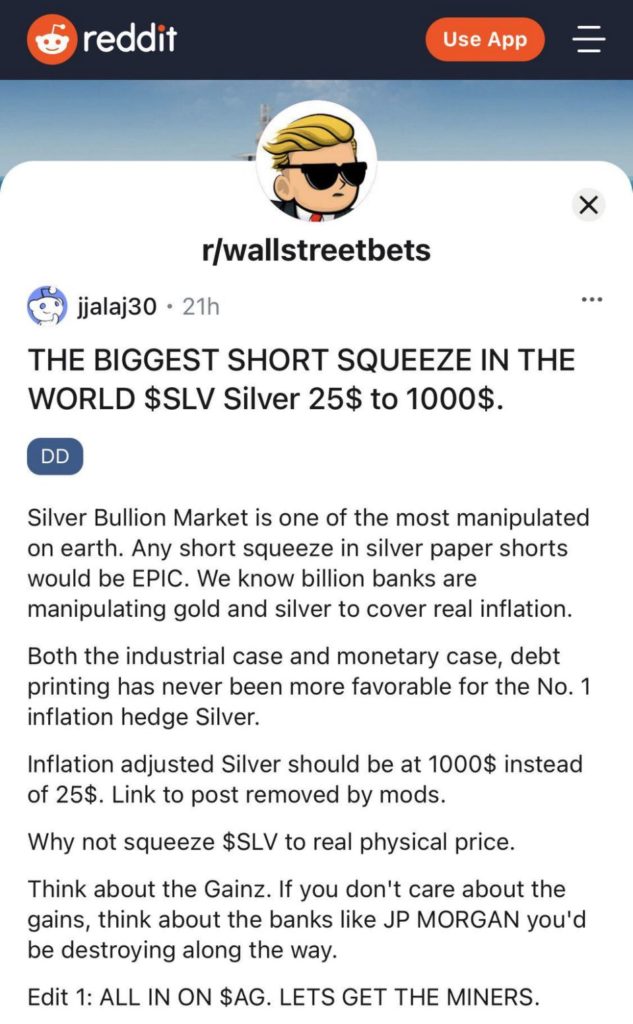

Buoyed by their success in assailing Wall Street hedge funds, the legion of retail investors who are part of the Wall Street Bets movement #WSB have turned their attention to the silver market.

Silver futures are already up 9%. How is this going to end?

Time for a thread 👇

Silver futures are already up 9%. How is this going to end?

Time for a thread 👇

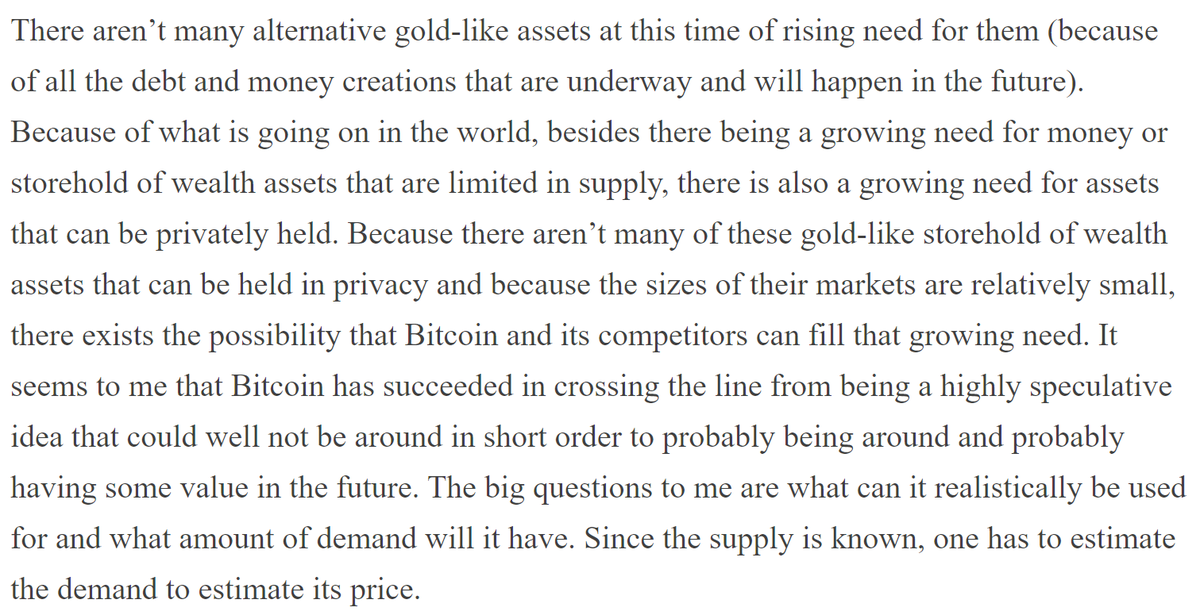

Unlike GameStop ($gme) which is worth billions, the above ground silver market is worth almost 1.5 Trillion (2018 estimate). This is not to mention the massive derivatives market on top of the silver spot market. A short squeeze will be much harder to achieve, so why bother? 👇

It is believed that the silver market is highly manipulated by Wall Street and that the market is shorted by many factors more than actual silver that exists above ground. By trying to corner silver, especially physical, #WSB hopes to explode Wall Street's machinations.

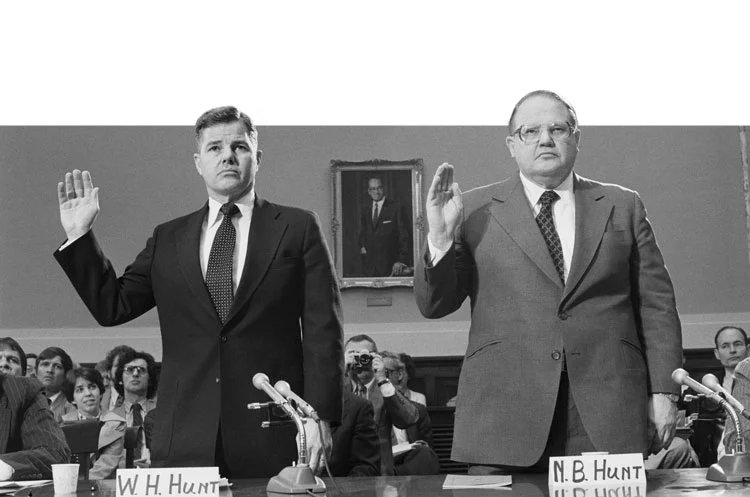

In the late 70s the Hunt brothers (Nelson, William and Lamar) began an operation to corner the silver market and their attempt is instructive to anyone trying the same thing today. Let's explore how it went 👇

Like today, the Federal Reserve pursued a policy of monetary expansion in the 70s, a decade which saw high single digit inflation, peaking at 13.5% in 1980. Ostensibly, the Hunt brothers, among America's wealthiest at the time, were cornering silver to protect their savings.

Unlike the Wall Street Bets movement today, however, the Hunt brothers did not have popular opinion on their side. in 1980, the jeweler Tiffany's took an ad in the New York Times condemning the Hunt brothers for causing regular buyers of jewelry to pay "artificially high prices"

As the Hunt brothers accumulated silver, demanding physical delivery (they sent their silver stash to Switzerland) the price of the precious metal went parabolic. To increase their position with leverage the brothers bought more silver in the futures market.

The Hunt's plan backfired; The commodities exchange COMEX decide to limit the amount of silver that could be purchased with futures on their exchange, reminiscent of the actions of various brokers preventing purchases of GameStock in recent days.

Futher, as the price rose, physical silver materialized from many sources as people melted down old cutlery, silver dimes and quarters. Cornering the market became increasingly difficult and the price of silver began to drop, culminating in "Silver Thursday" (March 27, 1980)

With their silver future contracts deeply underwater the Hunt brothers faced a margin call for $100m and a total nominal loss of $1.7billion. The commodities market immediately went into a panic. An emergency loan from a consortium of banks averted a complete collapse.

The moral of the story is that the silver market is not an easy one to manipulate even for the world's richest and even in an environment that is macroeconomically very conducive to a bull run in silver.

Retail investors attempting to corner silver today should be circumspect.

Retail investors attempting to corner silver today should be circumspect.

I will end with a note that I believe that people who are part of the Wall Street Bets movement have the right motivations (angst against the status quo financial system), but they have chosen the wrong vessel to carry their hopes.

Our one hope for real change is #Bitcoin.

Our one hope for real change is #Bitcoin.

• • •

Missing some Tweet in this thread? You can try to

force a refresh