Tata Consumer concall was today at 6:30 PM

Tata Products continuous to remain at strong growth and expects to launch new product soon.

Here are the Key takeaways from the earning call 🧵👇

Tata Products continuous to remain at strong growth and expects to launch new product soon.

Here are the Key takeaways from the earning call 🧵👇

Strengthening core business-

• Advertsised in IPL and KBC, branding Tata Gold.

• Launched product poha

Innovation

• Lacunhed Kambucha and and continue growing brand in Tea and Coffee.

• Laucnh Tata Gold Coffee in America.

New engines of growth presented in image

• Advertsised in IPL and KBC, branding Tata Gold.

• Launched product poha

Innovation

• Lacunhed Kambucha and and continue growing brand in Tea and Coffee.

• Laucnh Tata Gold Coffee in America.

New engines of growth presented in image

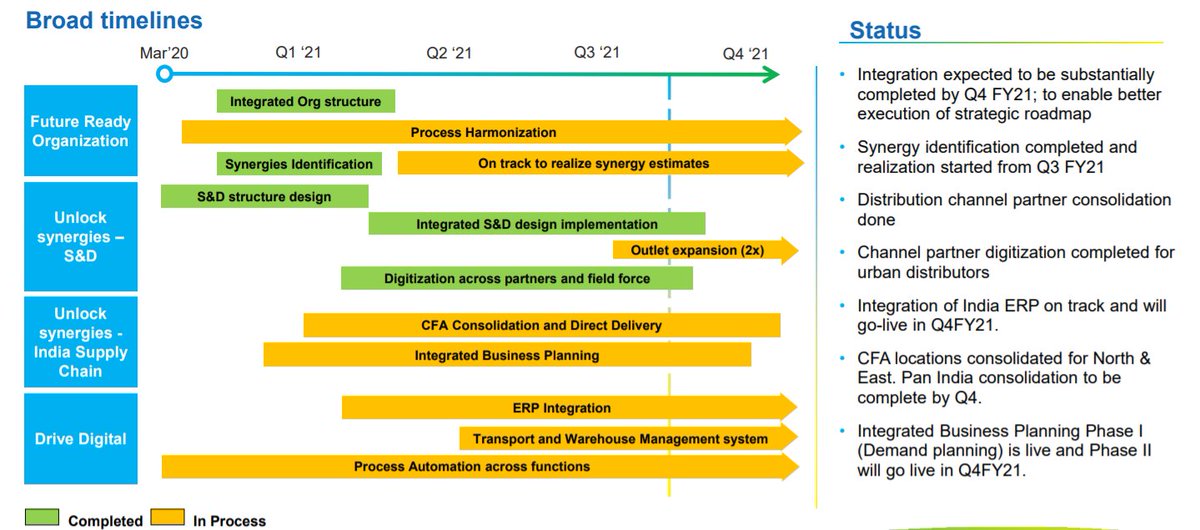

Strengthening Synergies:

• Common distributors in India for better supply chain.

• Running toward wholesale model to retail model.

• Company has increased the outlet expansion, and have worked on improving the transport and warehousing management system

• Common distributors in India for better supply chain.

• Running toward wholesale model to retail model.

• Company has increased the outlet expansion, and have worked on improving the transport and warehousing management system

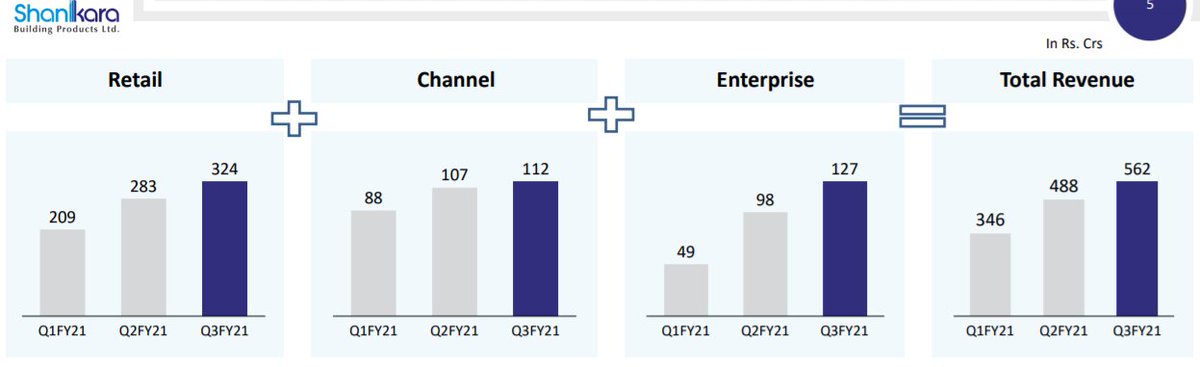

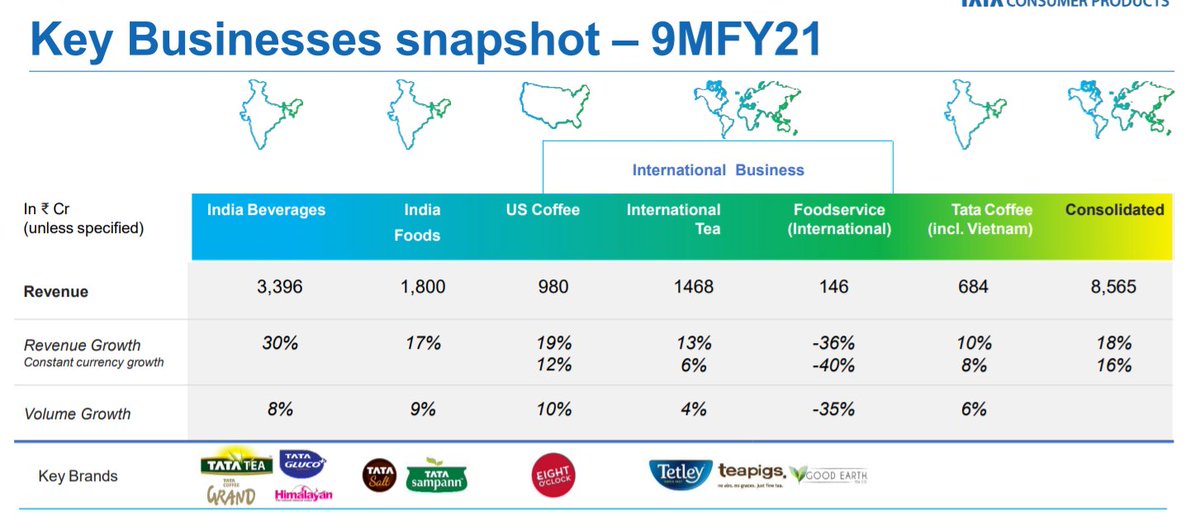

Segmental Revenue

• Value Added sales of Salt is up by 110%.

• Q3 Growth of tata Coffe has growth of 32%.

• NourishCo (100% Subsidiary) has seen growth of 109 YoY in this quarter.

• Value Added sales of Salt is up by 110%.

• Q3 Growth of tata Coffe has growth of 32%.

• NourishCo (100% Subsidiary) has seen growth of 109 YoY in this quarter.

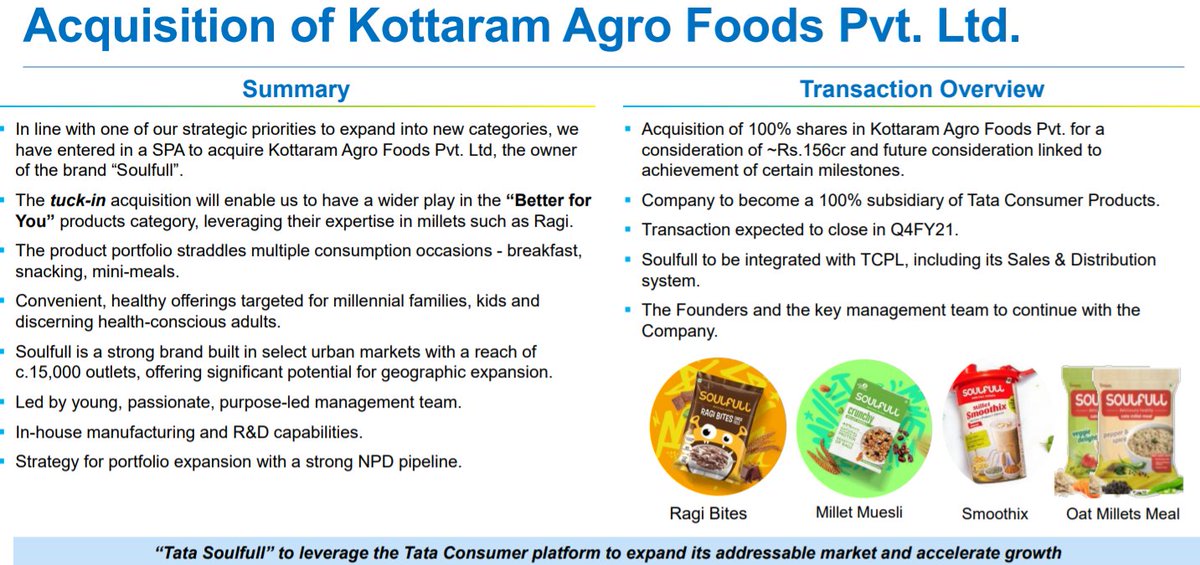

Acquisition of Soulfull

• Acquire 100% brand Soulfull from Kottaram Agro Foods Pvt Limited.

• Founder continuous to be remain with the company.

• Soulfull with supply chain of Tata Consumer will have good growth in future

• Acquire 100% brand Soulfull from Kottaram Agro Foods Pvt Limited.

• Founder continuous to be remain with the company.

• Soulfull with supply chain of Tata Consumer will have good growth in future

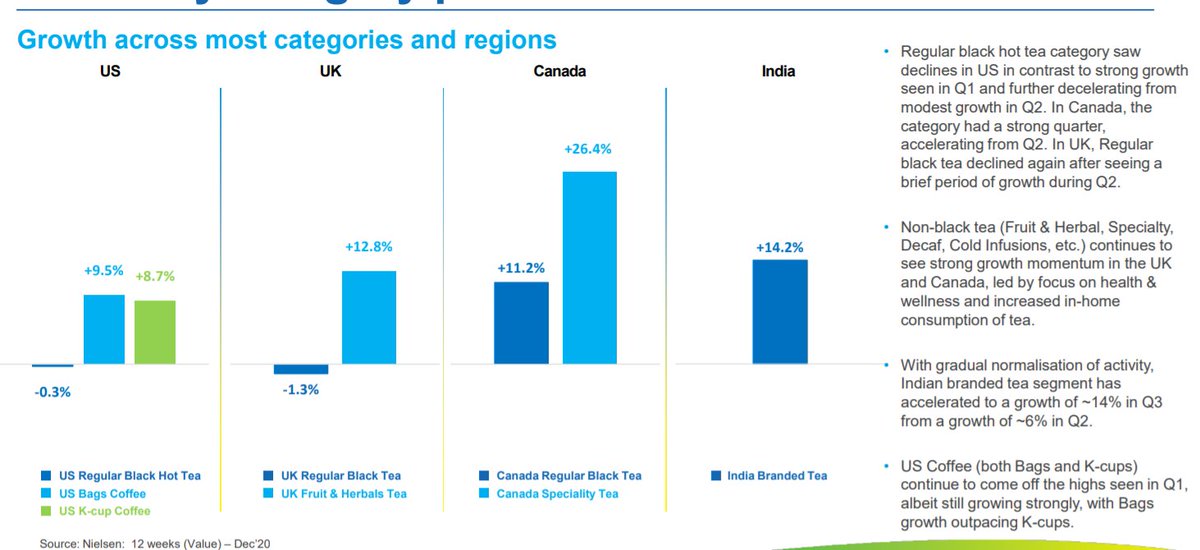

Geographical revenue share mentoined in image

• Major growth remains India only, while Canada was impacted due to 2nd wave of lockdown. Seen upsurge in this quarter.

• Tetley continuous to be branded product in Canada.

• Little bit impact of Margins in India.

• Major growth remains India only, while Canada was impacted due to 2nd wave of lockdown. Seen upsurge in this quarter.

• Tetley continuous to be branded product in Canada.

• Little bit impact of Margins in India.

Coffee

• Arabica coffee price has seen uptick.

• Continuous to be at 2 digit growth rate.

• Tea price declined bit, which highest decrease in price in South India.

• Growth

6%- plantation

1%- revenue

-3%- extraction

• Extractions business by shortage in shipping containers.

• Arabica coffee price has seen uptick.

• Continuous to be at 2 digit growth rate.

• Tea price declined bit, which highest decrease in price in South India.

• Growth

6%- plantation

1%- revenue

-3%- extraction

• Extractions business by shortage in shipping containers.

Starbucks:

• Opened 13 new stores & entered 3 new cities in Q3, bringing this year store count to 24

• Around 90% of the stores has re-opened

• Dine-in capacity still at 50%

• Increased scale, hence there was leverage of scalability.

• Negotiation of rental space worked well

• Opened 13 new stores & entered 3 new cities in Q3, bringing this year store count to 24

• Around 90% of the stores has re-opened

• Dine-in capacity still at 50%

• Increased scale, hence there was leverage of scalability.

• Negotiation of rental space worked well

Value Added Salt:

• Co. has gain increasing share in salt business, with respect to volume growth.

• There is growth in premium product, however there is growth available in lower margin product as well.

• Co. has gain increasing share in salt business, with respect to volume growth.

• There is growth in premium product, however there is growth available in lower margin product as well.

Covid Impact:

• Covid has seen growth more in home consumption product.

• Hence tea and coffee has seen good consumption growth.

• Premiumization is also improving as people are consuming premium product in home.

• Covid has seen growth more in home consumption product.

• Hence tea and coffee has seen good consumption growth.

• Premiumization is also improving as people are consuming premium product in home.

Starbucks

• This year has been very struggling for Startbucks, while the growth has been growing this quarter.

• EBIDTA was positive was in the last quarter and will continue to grow next quarter

• Plantation was impacted in Q1 and in next quarter segment was was picked up

• This year has been very struggling for Startbucks, while the growth has been growing this quarter.

• EBIDTA was positive was in the last quarter and will continue to grow next quarter

• Plantation was impacted in Q1 and in next quarter segment was was picked up

Market Share:

• Growth in market share was 94 bps.

• While mgmt expects this number to be very small with respect with to external growth.

• Company expects significant growth in coffee category.

• Growth in market share was 94 bps.

• While mgmt expects this number to be very small with respect with to external growth.

• Company expects significant growth in coffee category.

Tea business:

• Growth in tea has been seen in all the geography.

• Hindi speaking region has seen more than double digit growth.

Sampan: Simple formula of distribution. Poha portfolio is seeing 5x growth. For both spices and pulses mgmt expects launch of new product.

• Growth in tea has been seen in all the geography.

• Hindi speaking region has seen more than double digit growth.

Sampan: Simple formula of distribution. Poha portfolio is seeing 5x growth. For both spices and pulses mgmt expects launch of new product.

• • •

Missing some Tweet in this thread? You can try to

force a refresh