Business Overview

- Agriculture sector grew by 3% in india all due to good khareef season.

- Vaccination drive might prevent 2nd wave

- Govt expenditure on rural economy was commendable

- Good monsoon has resulted in higher reservoir levels

- Agriculture sector grew by 3% in india all due to good khareef season.

- Vaccination drive might prevent 2nd wave

- Govt expenditure on rural economy was commendable

- Good monsoon has resulted in higher reservoir levels

- Overall Paddy is up by 3%.

- The govt has announced additional expenditure if 65k crores in subsidies.

- Fertilizer industry: Sales volumes were down on YoY basis

- Consumption at the farm level was down by 5%

- The govt has announced additional expenditure if 65k crores in subsidies.

- Fertilizer industry: Sales volumes were down on YoY basis

- Consumption at the farm level was down by 5%

- Major raw material prices continue to be firm.

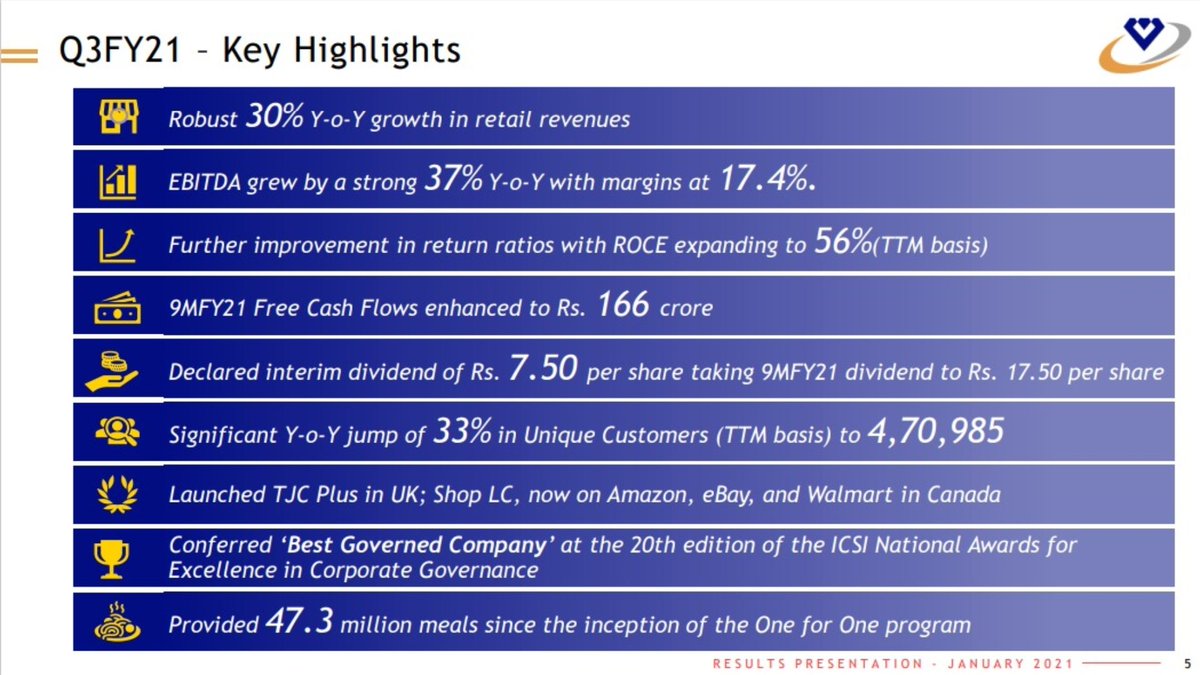

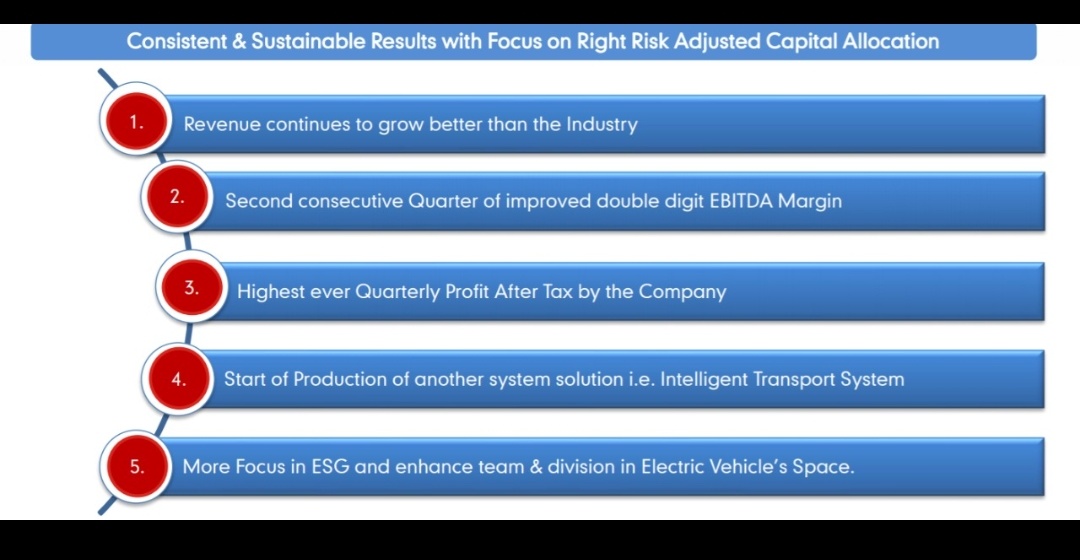

- Company gave a strong performance by continuously focusing on sales mix and better capital management

- Nutritional business had a great quarter.

- Company gave a strong performance by continuously focusing on sales mix and better capital management

- Nutritional business had a great quarter.

- Company market share was 14.3%, up by 1%

- The capacity utlization was 80%.

- Company is focusing on increasing its capital project esp in Vizag

- Sulphuric acid plant has been successfully commissioned.

- The capacity utlization was 80%.

- Company is focusing on increasing its capital project esp in Vizag

- Sulphuric acid plant has been successfully commissioned.

- The bio pesticide business registered a phenomenal growth.

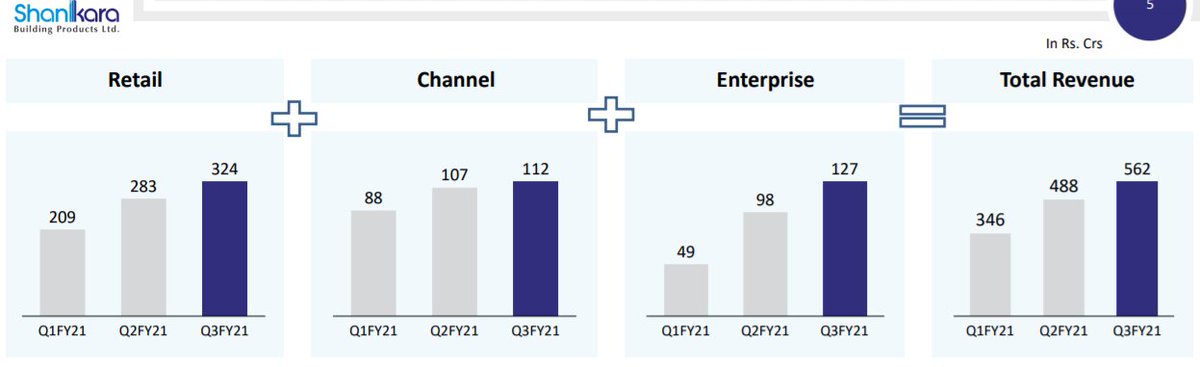

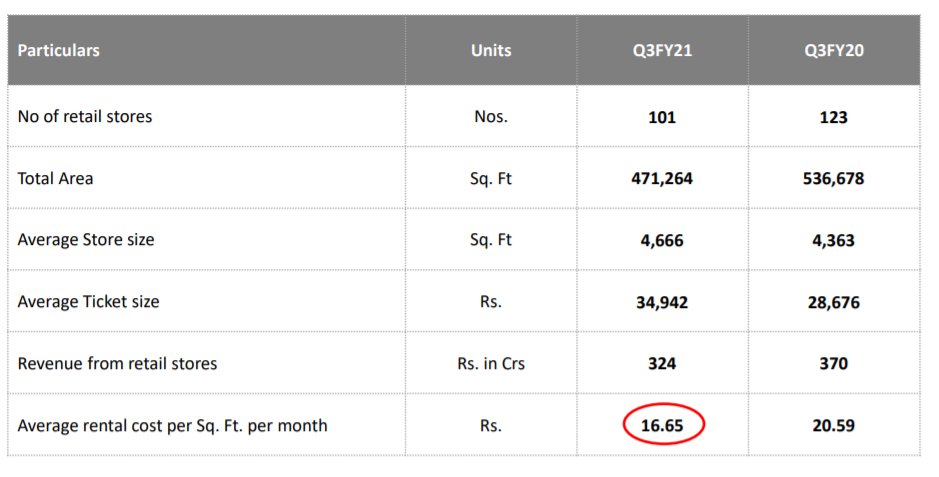

- Retail stores have been fully functioning throughout the year.

- Business has improved its operational efficiencies.

- Company is focusing to fast track the upcoming projects.

- Retail stores have been fully functioning throughout the year.

- Business has improved its operational efficiencies.

- Company is focusing to fast track the upcoming projects.

Capex plans

- Company was looking for 350 to 400 crores in FY 20 but covid had reduced its plan.

- For coming next 4 quarters the coming is focusing on Rs. 450 crores including fertilizer business

- Business would increase the capacity and add multi purpose plant.

- Company was looking for 350 to 400 crores in FY 20 but covid had reduced its plan.

- For coming next 4 quarters the coming is focusing on Rs. 450 crores including fertilizer business

- Business would increase the capacity and add multi purpose plant.

- Many molecules have gone off patented such have been identified for manufacturing.

- Company would also work towards PLI scheme and would participate in it.

- For fertilizer business, the additional subsidies the past dues will be cleared.

- Company would also work towards PLI scheme and would participate in it.

- For fertilizer business, the additional subsidies the past dues will be cleared.

- Company is focusing for de-bottle necking the Kakinada plant to achieve higher efficiency.

- Company is also focusing on increasing the throughout

- Company is also focusing on increasing the throughout

Crop protection

- Company focus is towards to increase the product pipeline getting into new technical manufacturing.

- The growth would be in double digits and margins have been increasing and 17% margins can be looked for.

- Company focus is towards to increase the product pipeline getting into new technical manufacturing.

- The growth would be in double digits and margins have been increasing and 17% margins can be looked for.

- Domestic market share is quiet low as product portfolio towards insecticide

- Comapny is increasing the product portfolio

- 5 states results in 60% of demand of crop protection and the comoany is present in 3 of these.

- Comapny is increasing the product portfolio

- 5 states results in 60% of demand of crop protection and the comoany is present in 3 of these.

- Current year company seeing some growth in B2B business

- Company is focusing towards branding in this verticle

- Company is focusing towards branding in this verticle

Capital allocation

- Due to cash surplus that the company would be generating, Company has some aggressive plans and is looking for some growth opportinities

- Due to cash surplus that the company would be generating, Company has some aggressive plans and is looking for some growth opportinities

Volume growth

- Fertilizers business, there has been a good demand due to back to back good khareeb and rabi season.

- Normal monsoon is being forecasted, the only watchout is to be on Raw material prices....if they are passed on then farmers behavior has to be watched.

- Fertilizers business, there has been a good demand due to back to back good khareeb and rabi season.

- Normal monsoon is being forecasted, the only watchout is to be on Raw material prices....if they are passed on then farmers behavior has to be watched.

- Crop protection, new molecules in the pipeline would give better prodcut offering to the customers.

- Company is looking for registration of combination molecule in global b2b and b2c markets.

- Company is looking for registration of combination molecule in global b2b and b2c markets.

Subsidies

- Additional 65k crores coming in, the old dues for the industry will be wiped off.

- When farmers buys from the retailers and acknowledges, it is then the company can generate the claims to the govt.

- Additional 65k crores coming in, the old dues for the industry will be wiped off.

- When farmers buys from the retailers and acknowledges, it is then the company can generate the claims to the govt.

- Until there is DBT 2.0, the company would have tovcliam the subsidies to the government.

- Govt would come direct transfer to the farmers sooner.

- Govt would come direct transfer to the farmers sooner.

Capping of fertilizer

- Govt would be capping the amount of fertilizers purchased by farmer to protect shortage from Jan 21

- It won't affect the marginal farmer which consists of 85% of farmers.

- It would affect some of the big farmers.

- Capping would be mainly on urea.

- Govt would be capping the amount of fertilizers purchased by farmer to protect shortage from Jan 21

- It won't affect the marginal farmer which consists of 85% of farmers.

- It would affect some of the big farmers.

- Capping would be mainly on urea.

• • •

Missing some Tweet in this thread? You can try to

force a refresh