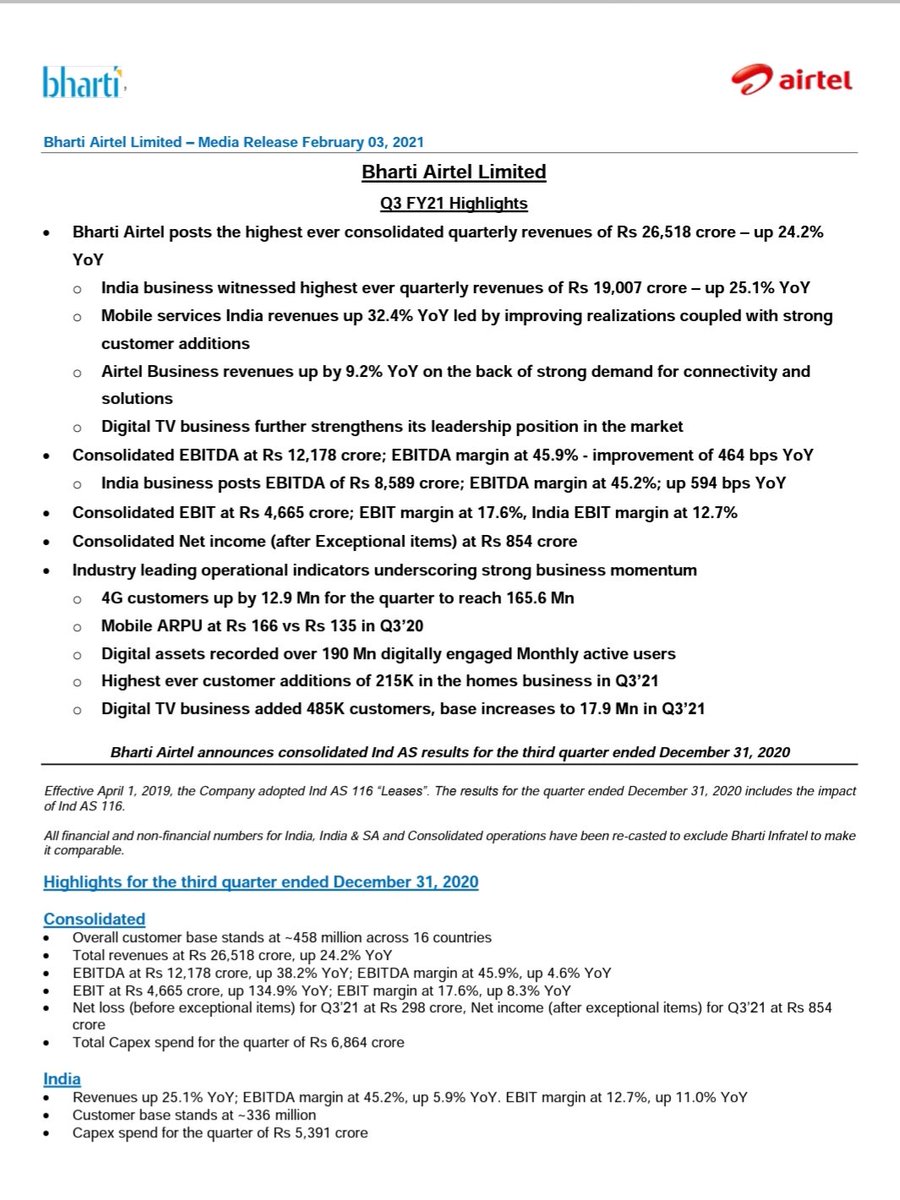

@airtelindia #Airtel #Q3marketupdates

Q3fy21 Highlights

Highest ever cons quarterly rev 26518 cr, up 24.2% yoy

India business highest ever quarterly rev 19,007 cr, up 25.1% yoy

Mobile services India rev up 32.4% yoy led by improving realizations,strong customer addn

Q3fy21 Highlights

Highest ever cons quarterly rev 26518 cr, up 24.2% yoy

India business highest ever quarterly rev 19,007 cr, up 25.1% yoy

Mobile services India rev up 32.4% yoy led by improving realizations,strong customer addn

Airtel Business rev up by 9.2% yoy back of strong demand for connectivity and solutions

Digital TV business strengthened leadership position

Cons EBITDA 12178 cr

EBITDA margin at 45.9%, up 464 bps yoy

India business EBITDA 8,589 cr EBITDA margin 45.2%; up 594 bps YoY

Digital TV business strengthened leadership position

Cons EBITDA 12178 cr

EBITDA margin at 45.9%, up 464 bps yoy

India business EBITDA 8,589 cr EBITDA margin 45.2%; up 594 bps YoY

Cons EBIT 4665 cr ,EBIT margin 17.6%

India EBIT margin 12.7%

Cons Net income (after exp items) 854 cr

Industry leading operational indicators, strong business momentum 4G customers up 12.9 mn for Q3 to 165.6 mn

Mobile ARPU 166 vs 135 Q3’20

India EBIT margin 12.7%

Cons Net income (after exp items) 854 cr

Industry leading operational indicators, strong business momentum 4G customers up 12.9 mn for Q3 to 165.6 mn

Mobile ARPU 166 vs 135 Q3’20

Digital assets recorded over 190 mn digitally engaged monthly active users

Highest ever customer additions 215K in homes business in Q3’21 Digital TV business added 485K customers, base increases to 17.9 Mn in Q3’21

Highest ever customer additions 215K in homes business in Q3’21 Digital TV business added 485K customers, base increases to 17.9 Mn in Q3’21

• • •

Missing some Tweet in this thread? You can try to

force a refresh