#sequentScientific #Q3marketupdates #Q3investorpresentations

Strong 🏋️♀️

Q3fy21/20 in cr

Rev 361/317

PAT 37.2/20

EPS 1.52/0.83

9mnth fy21/20

Rev 1014/878

PAT 87.8 /53.1

EPS 3.24/2.18

API Business up 17.2%

Formulations 15.0%

Alivira award best Company in AH India/ME/Africa

Strong 🏋️♀️

Q3fy21/20 in cr

Rev 361/317

PAT 37.2/20

EPS 1.52/0.83

9mnth fy21/20

Rev 1014/878

PAT 87.8 /53.1

EPS 3.24/2.18

API Business up 17.2%

Formulations 15.0%

Alivira award best Company in AH India/ME/Africa

Formulations

EU subdued due operational challenges of Covid

Spain & Germany impacted while Benelux & Sweden reported strong growth

Growth to accelerate with recent launches of CitramoxLA & Halofusol. Tulathromycin launch to reflect from the current quarter

EU subdued due operational challenges of Covid

Spain & Germany impacted while Benelux & Sweden reported strong growth

Growth to accelerate with recent launches of CitramoxLA & Halofusol. Tulathromycin launch to reflect from the current quarter

Brazil & Turkey grow strongly driven by mkt share gain existing portfolio & new launches

India business doubled last 9 months

Integration Zoetis portfolio completed

API Business

Highest quarterly sales 1,297Mn, growth 20%

1/3rd sales from global Top-10 AH players in 9M

India business doubled last 9 months

Integration Zoetis portfolio completed

API Business

Highest quarterly sales 1,297Mn, growth 20%

1/3rd sales from global Top-10 AH players in 9M

11 CEP & 21 US filings/approvals in total (1 CEP approval and 1 USVMF filing in Q3)

Enhanced capacities at Mahad (complete Q3) , Vizag (to be completed Q4) to drive growth in FY22

Formulations

FDFs 1000+

Mftng facilities 5

Sales to regulated mkt 65%

Mktng presence countries 80+

Enhanced capacities at Mahad (complete Q3) , Vizag (to be completed Q4) to drive growth in FY22

Formulations

FDFs 1000+

Mftng facilities 5

Sales to regulated mkt 65%

Mktng presence countries 80+

APIs

Commercial APIs 27

Mftg facilities 3

Sales to regulated mkts 75%

Asset turnover ratio 2.5x

Formulations

Products under development 35+

R&D centers 4

Injectables 38%

Filings in US next 3 yrs 10

APIs

Mols in pipeline 14+

R&D center 1

US filings 21

CEP approvals 11

Commercial APIs 27

Mftg facilities 3

Sales to regulated mkts 75%

Asset turnover ratio 2.5x

Formulations

Products under development 35+

R&D centers 4

Injectables 38%

Filings in US next 3 yrs 10

APIs

Mols in pipeline 14+

R&D center 1

US filings 21

CEP approvals 11

Overall Business Grew 15.1% CC during the quarter; strong growth across both APIs and Formulations

API Business grew 17.2%

Formulations 15.0%

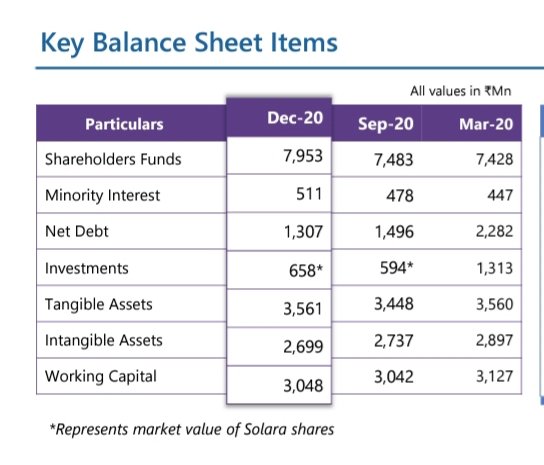

Balance sheet highlights

Cash flow generation 1.5Bn+

Net debt reduction 975Mn in 9M

API Business grew 17.2%

Formulations 15.0%

Balance sheet highlights

Cash flow generation 1.5Bn+

Net debt reduction 975Mn in 9M

Prepayment of all INR denominated term loans of ₹1,250Mn will lead to substantial interest savings going forward

Consolidation of minority interest in Turkey and Netherlands completed

Driving growth in consonance with continued focus on Working capital

Consolidation of minority interest in Turkey and Netherlands completed

Driving growth in consonance with continued focus on Working capital

Unroll

@threadreaderapp

Compile

@threader_app

#sequentScientific #pharma #cdmo #API #Nifty #animalpharma

@threadreaderapp

Compile

@threader_app

#sequentScientific #pharma #cdmo #API #Nifty #animalpharma

• • •

Missing some Tweet in this thread? You can try to

force a refresh