Start your own company

Start your own community

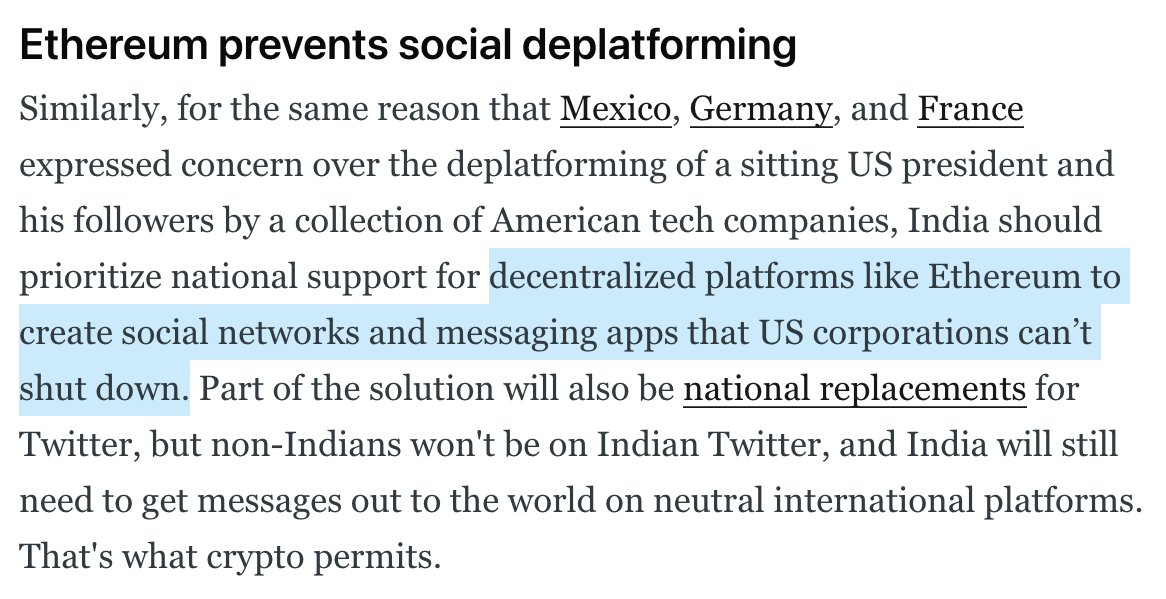

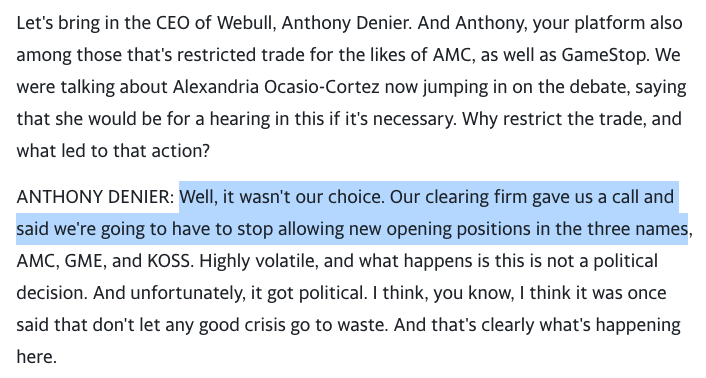

Start your own currency

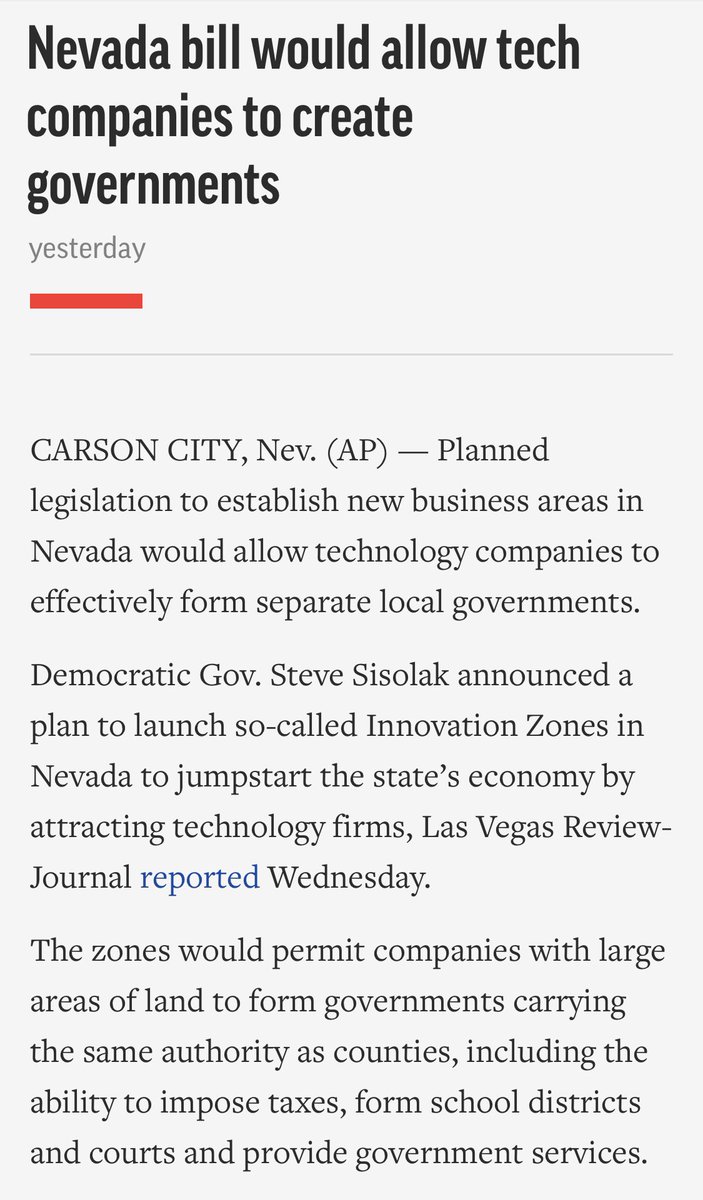

Start your own city

apnews.com/article/legisl…

Start your own community

Start your own currency

Start your own city

apnews.com/article/legisl…

San Francisco sucks. You can build something better in the sands of Nevada. And decentralize tech to the rest of the world.

I’ve been working in this area for years with folks like @patrissimo @mwiyas @MarkLutter, so DM if you’re doing a project like this and seeking funding.

I’ve been working in this area for years with folks like @patrissimo @mwiyas @MarkLutter, so DM if you’re doing a project like this and seeking funding.

Tech companies: take all the money you’d have spent on an expensive office, and use it to bootstrap a city in NV.

Lower the cost of living for employees. Build an equity stake in land. Gain write access to your physical surroundings. Legalize self driving cars & delivery drones.

Lower the cost of living for employees. Build an equity stake in land. Gain write access to your physical surroundings. Legalize self driving cars & delivery drones.

It will be faster to build your own city and recruit 800,000 people than to reform San Francisco.

• • •

Missing some Tweet in this thread? You can try to

force a refresh