Today showed us that the SEC has had it wrong. The problem isn’t that some cryptos may be securities. The problem is that all securities aren’t yet cryptos.

Now is the time to draft a bill that legalizes security tokens.

Now is the time to draft a bill that legalizes security tokens.

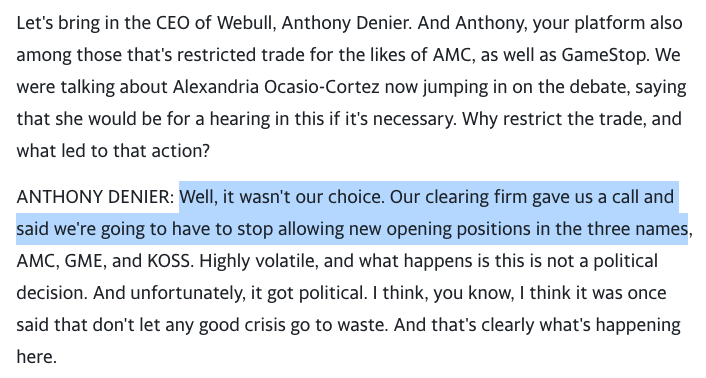

If all securities were represented on-chain:

- all users have self-custody of certificates

- brokerages can’t stop you from trading

- trading runs 24/7

- and settlement happens in minutes, not days

Basically, root cause is the antiquated financial backend. On-chain fixes this.

- all users have self-custody of certificates

- brokerages can’t stop you from trading

- trading runs 24/7

- and settlement happens in minutes, not days

Basically, root cause is the antiquated financial backend. On-chain fixes this.

The stockchain

What we just observed was a technology problem that is being cast as a human problem. It was basically a Slashdotting of the legacy financial system, an unexpected workload that it isn’t prepared to handle. Putting stocks on chain really does fix this.

What we just observed was a technology problem that is being cast as a human problem. It was basically a Slashdotting of the legacy financial system, an unexpected workload that it isn’t prepared to handle. Putting stocks on chain really does fix this.

The stockchain is how we achieve consumer protection, rule of law, equitable treatment, transparent regulation.

It’s the regulatory flippening. Like the flip from banning encryption to mandating it, allowing users to self-custody stock certificates on-chain prevents many abuses.

It’s the regulatory flippening. Like the flip from banning encryption to mandating it, allowing users to self-custody stock certificates on-chain prevents many abuses.

https://twitter.com/balajis/status/1349751517897658373

Yes. You can do it with multisig. So you’d still have on-chain custody but there are various models where a trusted designate can help you recover. Empirical q.

Also, with a stock, the company is still the centralized issuer & there could be some protocol for “scrivener errors”.

Also, with a stock, the company is still the centralized issuer & there could be some protocol for “scrivener errors”.

https://twitter.com/nileshthorve/status/1355073455813656583

The most important data structure in technology is the cap table, and this is the moment to put @AngelList, @cartainc, @clerkyinc, @captable_io, and the rest all on-chain.

https://twitter.com/balajis/status/1135263867246927872

Excellent question. It basically is like ripping out Oracle and installing Postgres, except in a huge number of companies at once. The settlement system is a shared backend that’s hard to innovate on, for technical, legal, and inertial reasons.

Never a priority, till crypto.

Never a priority, till crypto.

https://twitter.com/justindross/status/1354996580756152321

Stock portability

The right reform to protect retail from trading shutdowns is to mandate that all cap tables support send/receive functionality & self-custody for stock certificates.

Just like portability of phone numbers & medical records. Give people access to their shares!

The right reform to protect retail from trading shutdowns is to mandate that all cap tables support send/receive functionality & self-custody for stock certificates.

Just like portability of phone numbers & medical records. Give people access to their shares!

There are precedents for stock portability.

The US Congress passed bills for phone number portability (WLNP) & medical record portability (HIPAA). The former at least was very successful.

Decentralization of control back to the retail investor is the foundation of any solution.

The US Congress passed bills for phone number portability (WLNP) & medical record portability (HIPAA). The former at least was very successful.

Decentralization of control back to the retail investor is the foundation of any solution.

• • •

Missing some Tweet in this thread? You can try to

force a refresh