$NNOX -- thought I'd put together a refresher on:

- what the company is trying to accomplish

- how it's planning to progress

- where it is today

- all it has left to prove

Shout out to @TerraPharma for editing!

A thread! 🙂👇

- what the company is trying to accomplish

- how it's planning to progress

- where it is today

- all it has left to prove

Shout out to @TerraPharma for editing!

A thread! 🙂👇

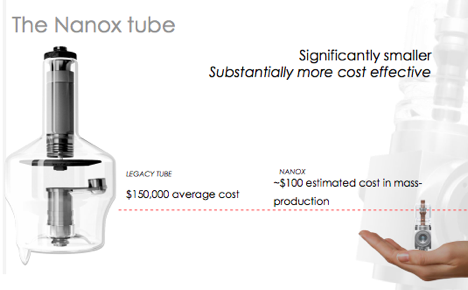

Value prop (1/4) -- X-ray tube

- costs $100 @ scale vs. $150K for legacy

- its cold cathode tech greatly reduces heat damage & extends lifetime

- 70-90% smaller vs. legacy tube -- reduces weight & enables multi-source units for 3D imaging (broader applications vs. legacy X-ray)

- costs $100 @ scale vs. $150K for legacy

- its cold cathode tech greatly reduces heat damage & extends lifetime

- 70-90% smaller vs. legacy tube -- reduces weight & enables multi-source units for 3D imaging (broader applications vs. legacy X-ray)

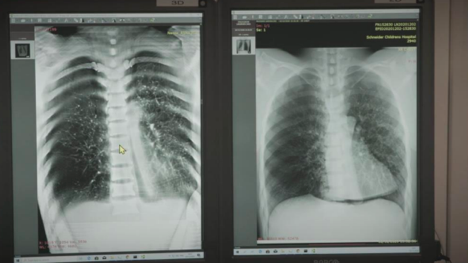

$NNOX value prop (2/4) -- better imaging

Multiple X-ray sources (up to 11) allows for

- more angles

- more tests

Digital approach enables

- clearer imaging

- less unnecessary radiation exposure -- comparatively limited Ma & KvP

(ARC image on the left)

Multiple X-ray sources (up to 11) allows for

- more angles

- more tests

Digital approach enables

- clearer imaging

- less unnecessary radiation exposure -- comparatively limited Ma & KvP

(ARC image on the left)

Quick note on buzzwords:

- Ma = brightness

- KvP = speed of electron emission

- both are positively correlated w/radiation exposure

- specifically: KvP of 40 & Ma of 1.5 for $NNOX vs. typical levels of 50-60 & 3-5 respectively

- Ma = brightness

- KvP = speed of electron emission

- both are positively correlated w/radiation exposure

- specifically: KvP of 40 & Ma of 1.5 for $NNOX vs. typical levels of 50-60 & 3-5 respectively

$NNOX value prop (3/4) -- broader access

All in cost of $15k/unit enables pay/scan model.

Units distributed for free.

W/radiology not affordable to 2/3 of 🌎 this is big.

$NNOX's software/AI partners enable assistance w/diagnosis, remote care, organizing patient history etc.

All in cost of $15k/unit enables pay/scan model.

Units distributed for free.

W/radiology not affordable to 2/3 of 🌎 this is big.

$NNOX's software/AI partners enable assistance w/diagnosis, remote care, organizing patient history etc.

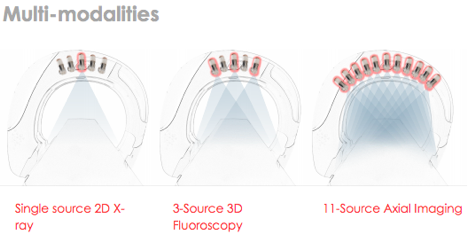

Value prop (4/4) -- optionality

Source uses per $NNOX

- X-ray

- Fluoroscopy

- Angiography

- Mammography

- Veterinary

- Security

- Manufacturing (Quality control per SK)

& (pending multi-source clearance) uses in

- CT

- Some MRI test mimicking

Need single source clearance 1st!

Source uses per $NNOX

- X-ray

- Fluoroscopy

- Angiography

- Mammography

- Veterinary

- Security

- Manufacturing (Quality control per SK)

& (pending multi-source clearance) uses in

- CT

- Some MRI test mimicking

Need single source clearance 1st!

How does it work? (1/2)

X-ray source powered by silicon semiconductor (chip)

- full name: digital microelectromechanical system chip cold-cathode -- MEMs chip

- 100M Molybdenum nano-cones capable of digital & precise electron emission

- more control, rapid switching, less waste

X-ray source powered by silicon semiconductor (chip)

- full name: digital microelectromechanical system chip cold-cathode -- MEMs chip

- 100M Molybdenum nano-cones capable of digital & precise electron emission

- more control, rapid switching, less waste

How does it work? (2/2)

The $NNOX source replaces thermionic filament need in traditional tubes used to emit electrons.

What the heck does this mean?

No need for extreme heat & subsequent cooling so again:

- less power

- more durable

- far smaller & cheaper machine 👍

The $NNOX source replaces thermionic filament need in traditional tubes used to emit electrons.

What the heck does this mean?

No need for extreme heat & subsequent cooling so again:

- less power

- more durable

- far smaller & cheaper machine 👍

Digital X-Ray Competition (1/2)

Several other digital cold-cathode companies in the industry.

All use carbon nano tube (CNT) base for X-ray sources while Nanox uses the MEMs base we touched on.

How do these two methods compare? 👇👇

Several other digital cold-cathode companies in the industry.

All use carbon nano tube (CNT) base for X-ray sources while Nanox uses the MEMs base we touched on.

How do these two methods compare? 👇👇

Digital X-Ray Competition (2/2) -- CNT vs. MEMs

CNT is

- less stable

- prone to heat damage (less durable)

No viable, long-term commercial solution among CNT comp after “significant investment.”

$NNOX Molybdenum-cones proven more suitable for scale vs. carbon-tubes.

CNT is

- less stable

- prone to heat damage (less durable)

No viable, long-term commercial solution among CNT comp after “significant investment.”

$NNOX Molybdenum-cones proven more suitable for scale vs. carbon-tubes.

FDA clearance approach

Aims for single-source clearance 1st (proof of concept).

Then multi-source (more dynamic).

Will soon resubmit single source app.

Will resubmit multi-source app in 2021.

Hopes to deploy 1000 units Q1 2022 & 15K by 2025.

speaking of clearance...

Aims for single-source clearance 1st (proof of concept).

Then multi-source (more dynamic).

Will soon resubmit single source app.

Will resubmit multi-source app in 2021.

Hopes to deploy 1000 units Q1 2022 & 15K by 2025.

speaking of clearance...

🐘 in the room (1/2)

Last year, $NNOX received a deficiency letter on its single source app.

Last week it filed a 6k informing investors of another deficiency letter.

Issues included needing:

- more support for Arc uses

- more comparability of Arc to legacy devices

Last year, $NNOX received a deficiency letter on its single source app.

Last week it filed a 6k informing investors of another deficiency letter.

Issues included needing:

- more support for Arc uses

- more comparability of Arc to legacy devices

🐘 in the room (2/2)

No clearance severely diminishes the IP's value.

Would then be for non-medical uses only.

‼️ I used 2nd letter as a cue to take profit on 44% of my position. $NNOX is now 1.5% of my holdings.‼️

Regardless of mgmt's confidence, no guarantee it's cleared.

No clearance severely diminishes the IP's value.

Would then be for non-medical uses only.

‼️ I used 2nd letter as a cue to take profit on 44% of my position. $NNOX is now 1.5% of my holdings.‼️

Regardless of mgmt's confidence, no guarantee it's cleared.

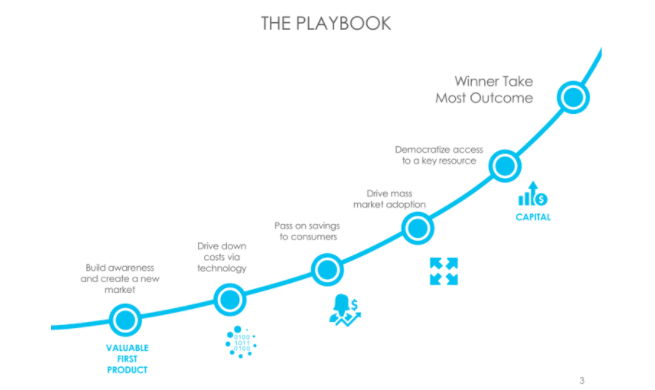

Scale approach (1/2) -- Distribution

- building 100 units for a dry run

- first to urgent care centers, private clinic chains, outpatient clinics, “retail locations” before attempting to disrupt hospital system

- building 100 units for a dry run

- first to urgent care centers, private clinic chains, outpatient clinics, “retail locations” before attempting to disrupt hospital system

Scale approach (2/2) -- Open source

- $NNOX will not be aiming to displace $GE or other radiology incumbents

- tube/source IP available to anyone for licensing fees

- philosophy: sharing is caring... & lucrative 🙂

Leadership hints at where these licensing deals could occur 👇

- $NNOX will not be aiming to displace $GE or other radiology incumbents

- tube/source IP available to anyone for licensing fees

- philosophy: sharing is caring... & lucrative 🙂

Leadership hints at where these licensing deals could occur 👇

Leadership (1/4) -- Advisory board

Morry Blumenfeld

- $GE higher-up in medical systems

Ruth Atherton

- General Counsel Gates Foundation

Michael Jackman

- Health Group COO @ $LDOS

Tom Dekle

- Client Exec @ $IBM

Morry Blumenfeld

- $GE higher-up in medical systems

Ruth Atherton

- General Counsel Gates Foundation

Michael Jackman

- Health Group COO @ $LDOS

Tom Dekle

- Client Exec @ $IBM

Leadership (2/4) -- the board:

Onn Fenig

- formerly w/ $CSCO & Siemens in senior leadership roles

Floyd A. Katske

- former President of California Urological Association

Onn Fenig

- formerly w/ $CSCO & Siemens in senior leadership roles

Floyd A. Katske

- former President of California Urological Association

Leadership (3/4) -- Management

Ran Poliakine -- CEO & Board Chairman

- “Founder of the wireless charging industry” (Powermat)

Yoel Raab -- CTO (outgoing soon)

- Former executive w/ $INTC

Itzhak Maayan -- CFO

- Formerly in financial leadership roles w/ $CSCO & Perrigo

Ran Poliakine -- CEO & Board Chairman

- “Founder of the wireless charging industry” (Powermat)

Yoel Raab -- CTO (outgoing soon)

- Former executive w/ $INTC

Itzhak Maayan -- CFO

- Formerly in financial leadership roles w/ $CSCO & Perrigo

Leadership (4/4) -- Encouraging hires

$NNOX recently hired 3 executives to “support long term growth”

Sounds like a confident company.

Outgoing CTO Yoel Raab staying with the company in a lesser role. 👍

Bios of the 3 new hires in the link below:

nano-ximaging.gcs-web.com/news-releases/…

$NNOX recently hired 3 executives to “support long term growth”

Sounds like a confident company.

Outgoing CTO Yoel Raab staying with the company in a lesser role. 👍

Bios of the 3 new hires in the link below:

nano-ximaging.gcs-web.com/news-releases/…

3 key partners

$SKM

- 2 investments in $NNOX for $25M

- Nanox-related hires for chips/AI/Cloud

- will place 2.5K units if cleared

- partner on new Korean subsidiary/factory

$FUJIY

- invested

- mammography OEM customer

Foxconn

- invested

- main manufacturing partner

$SKM

- 2 investments in $NNOX for $25M

- Nanox-related hires for chips/AI/Cloud

- will place 2.5K units if cleared

- partner on new Korean subsidiary/factory

$FUJIY

- invested

- mammography OEM customer

Foxconn

- invested

- main manufacturing partner

Math if cleared (1/2)

$NNOX expects:

- to charge $40/scan

- to collect $14/scan in revenue after partners paid

- revenue to be in “mostly profit”

$NNOX expects:

- to charge $40/scan

- to collect $14/scan in revenue after partners paid

- revenue to be in “mostly profit”

Math if cleared (2/2)

Current contracts & collaborations =

- 10,650 units

- MIN 7 scans/day/unit based on contracts

Current deals = MIN $380M in revs

Expect closer to 20 scans/day/unit = $1.09B in revs

Global average for scans/X-ray unit/day is 60.

20 is pessimistic.

Current contracts & collaborations =

- 10,650 units

- MIN 7 scans/day/unit based on contracts

Current deals = MIN $380M in revs

Expect closer to 20 scans/day/unit = $1.09B in revs

Global average for scans/X-ray unit/day is 60.

20 is pessimistic.

More math

Assuming

- most pessimistic scan/day outcome

- most pessimistic take-away from Ran’s reiterated “mostly in profits” comments (so 50% profit)

- unit cost of $15K

We get a:

- 306 day profit payback period/unit.

- 153 day revenue payback period/unit.

Assuming

- most pessimistic scan/day outcome

- most pessimistic take-away from Ran’s reiterated “mostly in profits” comments (so 50% profit)

- unit cost of $15K

We get a:

- 306 day profit payback period/unit.

- 153 day revenue payback period/unit.

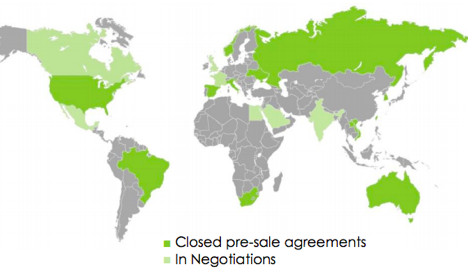

Promising future (only if cleared)

“In negotiations with”

- India

- Canada

- The UK

& many more

Also have not begun licensing deals.

“Flood of interest” in $NNOX's arc machine post RSNA according to Ran.

I am long $NNOX. 🙂

“In negotiations with”

- India

- Canada

- The UK

& many more

Also have not begun licensing deals.

“Flood of interest” in $NNOX's arc machine post RSNA according to Ran.

I am long $NNOX. 🙂

Sources:

sec.gov/Archives/edgar…

jpmorgan.metameetings.net/events/healthc…

fool.com/investing/2020…

investors.nanox.vision/static-files/5…

sec.gov/Archives/edgar…

jpmorgan.metameetings.net/events/healthc…

fool.com/investing/2020…

investors.nanox.vision/static-files/5…

Oops I tagged the wrong terrapharma in the first tweet.

@TerraPharma1 helped edit on this one!

Fantastic resource & an even more fantastic follow. 🙂

@TerraPharma1 helped edit on this one!

Fantastic resource & an even more fantastic follow. 🙂

• • •

Missing some Tweet in this thread? You can try to

force a refresh