Thread.🧵

Understanding startups (or scaling startups), metrics & valuations

or

how not to be misled by analog metrics when you run digital scalable ventures.

Understanding startups (or scaling startups), metrics & valuations

or

how not to be misled by analog metrics when you run digital scalable ventures.

1st a key clarification: there are many kinds of startups - at one extreme, think of a SaaS venture aimed at getting 1m+ developers to swipe their cards, aiming to be a $1b rev biz in 5+ yrs; at other a local restaurant or a pet salon with no rev goals. In middle varying combos.

VCs invest exclusively in the 1st kind of startups - businesses that grow big very fast (or scale) - typically tech or tech-led (incl software, hardware, biotech) ventures. Tech allows you to serve or acquire next customer at low to zero cost. This is an important criterion.

Businesses that scale (technical definition - rev grows without cost increasing linearly) become very valuable & generate disproportionate return. Hence, a VC fund can invest in 20-25 such scalable startups, & 1 hit can pay for the remaining failures.

VC is thus a protocol for discovering scale. Over time, led by Silicon Valley, but now increasingly by Berlin / Beijing / Guangzhou / Bangalore, a set of rules & playbooks have emerged to help a startup scale.

Not every startup can scale. Even of the ones that VCs fund, ~5% truly scale + generate any return. And even the ones VCs fund are only a minority of the startup universe, which are businesses built to grow sustainably (reinvest profits).

VCs invest exclusively in a class of startups (perhaps <10% of all startup businesses) that we can call ‘scalable startups’. Startups that can hit scale or grow big very fast. They invest in these and help it hit scale (and only 5-10% or so truly hit it).

These scalable startups are high risk ventures, & founders who start it know it. To compensate for the risk, the ecosystem celebrates the fail fast culture, & attaches no stigma to failure. Zero stigma.

In the VC + scalable startup ecosystem, failure is a feature, not a bug. It is a natural consequence of a search of scale.

Scalable startups self-select themselves into the VC + fundraising treadmill. Founders of these are well-aware of the risks, & know what they are into.

Scalable startups self-select themselves into the VC + fundraising treadmill. Founders of these are well-aware of the risks, & know what they are into.

Which is why I find tweets like the below hard to understand.

Founders of sustainable startups focused on cash flow are typically not funded by VCs - so how can the 'VC valuation game' (his phrase) kill these sustainable startups?

Founders of sustainable startups focused on cash flow are typically not funded by VCs - so how can the 'VC valuation game' (his phrase) kill these sustainable startups?

https://twitter.com/lalitinvestor/status/1358368893245378560

In cases when scalable startups are acquihired, VCs write off their liq prefs or keep it at 1x. Often VCs sell back shares at nominal price to founders who want to run sustainable ventures (Buffer, Gumroad etc). There is no animosity when this happens.

https://twitter.com/shl/status/1178700760818708480

Over time, 2 trends emerged

A - scaling startups & their values, playbooks have come to stand for all startups.

B - mainstreaming of startups & the sexiness of startups / tech culture have meant business press coverage of startups as if they are traditional analog businesses.

A - scaling startups & their values, playbooks have come to stand for all startups.

B - mainstreaming of startups & the sexiness of startups / tech culture have meant business press coverage of startups as if they are traditional analog businesses.

Double-clicking on A.

Success of FB, Google, Flipkart + ensuing press coverage + relentless content mill by VCs + founders all mean many aspiring founders want to run their ventures by the valley playbook. There hasn't been enough education of the distinction.

Success of FB, Google, Flipkart + ensuing press coverage + relentless content mill by VCs + founders all mean many aspiring founders want to run their ventures by the valley playbook. There hasn't been enough education of the distinction.

Double-clicking on B.

As tech ate the world, a lot of the traditional financial handles for measuring business values and valuation have had to be rethought.

As tech ate the world, a lot of the traditional financial handles for measuring business values and valuation have had to be rethought.

Contd.,

Traditional accounting norms (Analog Accounting?!) were invented in ‘30s/40s when capital was scarce and there was capex but no IP / brand.

DCF / value investing emerged likewise in ‘30s during depression.

Traditional accounting norms (Analog Accounting?!) were invented in ‘30s/40s when capital was scarce and there was capex but no IP / brand.

DCF / value investing emerged likewise in ‘30s during depression.

VC had to reinvent new financial handles to address these lacunae — CAC, rule of 40, CM1,CM2, DAU, MAU, ARR etc - for a world where much of the startup’s value is in the future, & where future rev flows cant be predicted.

Here is the @mjmauboussin 's paper on how the rise of intangibles is leading to the rethinking of traditional accounting.

morganstanley.com/im/publication…

morganstanley.com/im/publication…

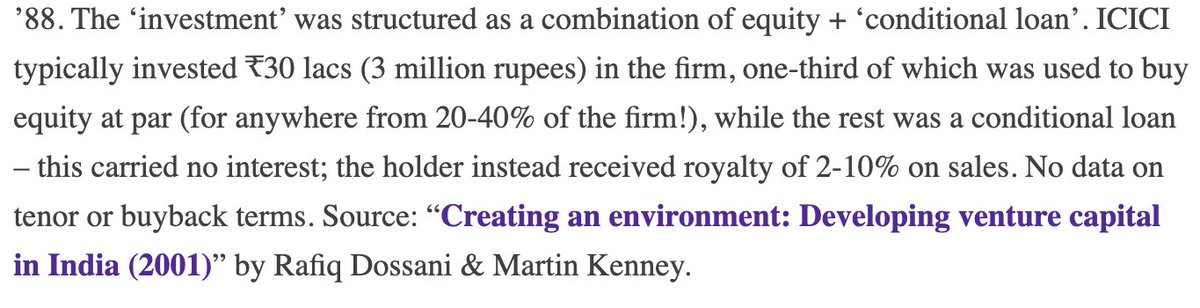

The VC investing protocol that emerged in 60s-70s SV & evolved over the years is one of the great financial inventions of the 20th cent. It is responsible for FAANG, GAFA & trillions of $ in valuation & millions of jobs. Not to mention all of what you are using to read this!

The most critical element of the protocol was the valuation engine, but one that is most misunderstood. Unlike public market valuations, VC valuations are derived.

Let us understand this better.

Let us understand this better.

If a VC provides $1m capital & takes a 20% stake then the startup is valued at $5m. This is a derivation of capital ($1m) + dilution (20%). It is not an absolute valuation (independent of the investment) or even liquid.

How do you value a biz when cash flows arent predictable?

How do you value a biz when cash flows arent predictable?

PEs when they invest work the other way around - they determine value via DCF (cash flows are stable, predictable) and then determine capital and stake.

A great tweet in this same vein by @patio11

https://twitter.com/patio11/status/1161054888505180160

Breathless startup valuation coverage by mainstream media is highly misleading. Valuation is at best just a signal. Startup valuations cannot be understood exclusive of liq prefs and waterfalls & other covenants.

Here is @madhavchanchani

economictimes.indiatimes.com/news/economy/f…

Here is @madhavchanchani

economictimes.indiatimes.com/news/economy/f…

It isn't that VC + startups work in isolation from the larger financial world. They do meet at the IPO, when the ventures have become profitable, cash flow generators.

At that point some or most of the elements of analog accounting can be used to get a grip.

At that point some or most of the elements of analog accounting can be used to get a grip.

Useful metaphors

VC money = rocketfuel, scale startups = rocketships, other businesses = cars. Nothing wrong w cars but rocketships need rocketfuel. Their mechanics are different from those of cars

OR

fertiilizers, high yield varieties of foodgrains + trees.

VC money = rocketfuel, scale startups = rocketships, other businesses = cars. Nothing wrong w cars but rocketships need rocketfuel. Their mechanics are different from those of cars

OR

fertiilizers, high yield varieties of foodgrains + trees.

As tech has grown (eaten the world), many tech businesses have begun having huge real-world impact, thereby drawing attention, attracting coverage and media spotlight. Nothing wrong with that.

Media coverage of tech falls in 3 buckets. Let us look at these.

Media coverage of tech falls in 3 buckets. Let us look at these.

Bucket 1: Funding announcements, launches, ESOP buybacks acquisition. Founders + VCs want it, readers seem to care, & a host of traditional tech media & mainstream biz media cover this extensively, often in absence of other content.

Bucket 2: Coverage of social impact of startup actions or abuses e.g., this by @kashhill for instance

nytimes.com/2020/06/24/tec…

Startups, VCs may not necessarily want it or celebrate as raises Qs abt their systems or processes, but this is impt for society + startup ecosystem.

nytimes.com/2020/06/24/tec…

Startups, VCs may not necessarily want it or celebrate as raises Qs abt their systems or processes, but this is impt for society + startup ecosystem.

Bucket 3: Coverage of early-stage scalable startup perfornance through backward-facing accounting metrics e.g., P&L filed 1+yr back. Media is well within its rights to cover this. But, startups arent helped by these (though not harmed by this too, as VCs dont rely on these).

That said it does create a misunderstanding in the larger reader + business community.

Many of them arent aware that scalable startups have to operate by a different rule book. Rocketships cant be regulated like automotives.

Many of them arent aware that scalable startups have to operate by a different rule book. Rocketships cant be regulated like automotives.

Please note the nature of accounting.

-An oil co spends $1b in drilling an oil will but instead of expensing can capitalize it till oil gushes

-A software co spends money on building a data moat (that can be monetized later) but has to expense - incurring losses.

-An oil co spends $1b in drilling an oil will but instead of expensing can capitalize it till oil gushes

-A software co spends money on building a data moat (that can be monetized later) but has to expense - incurring losses.

Traditional accounting was not geared for scenario #2 above.

Still startups have to file for statutory reasons/

The issue is taking financial accounting data from scenario #2 to generate clickbait or even worse, hint, wink (misleading) narrative around it.

Still startups have to file for statutory reasons/

The issue is taking financial accounting data from scenario #2 to generate clickbait or even worse, hint, wink (misleading) narrative around it.

To wrap this long thread

a. VC-fundable startups (scalable startups) are a small minority of overall startups

b. unfortunately their huge success and coverage has meant a conflation of scalable startups with other (sustainable) startups

a. VC-fundable startups (scalable startups) are a small minority of overall startups

b. unfortunately their huge success and coverage has meant a conflation of scalable startups with other (sustainable) startups

c. Unlike most sustainable startups which need to reinvest profits, scalable startups r financed by VCs to run costly experiments to discover scale. These result in losses till they fail or get big. This is a feature not a bug. Founders self-select into it knowing they may fail.

d. Scalable startups have much of their value in future (Amazon listed at $440m, Google at $23b; both are ~$1.5tn market cap today); hence you cant look at backward facing metrics like 1-yr ago P&L to judge them.

e. Scalable startups need to be covered by media as much as other businesses for their social impact

f. Media has a responsibility to understand scalable ventures and communicate the true nature of their performance.

f. Media has a responsibility to understand scalable ventures and communicate the true nature of their performance.

They can chose not to do the last (#f). And startups will survive & thrive, but increasingly media will risk losing respect of their audience, who any case have access to content created by members of the startup ecosystem.

Fin. Phew!

A request: pls be civil in replies. This is my perspective; your perspective may differ, and rightly so. I am prepared to understand your perspective & feedback. Do give me the same courtesy.

A request: pls be civil in replies. This is my perspective; your perspective may differ, and rightly so. I am prepared to understand your perspective & feedback. Do give me the same courtesy.

• • •

Missing some Tweet in this thread? You can try to

force a refresh