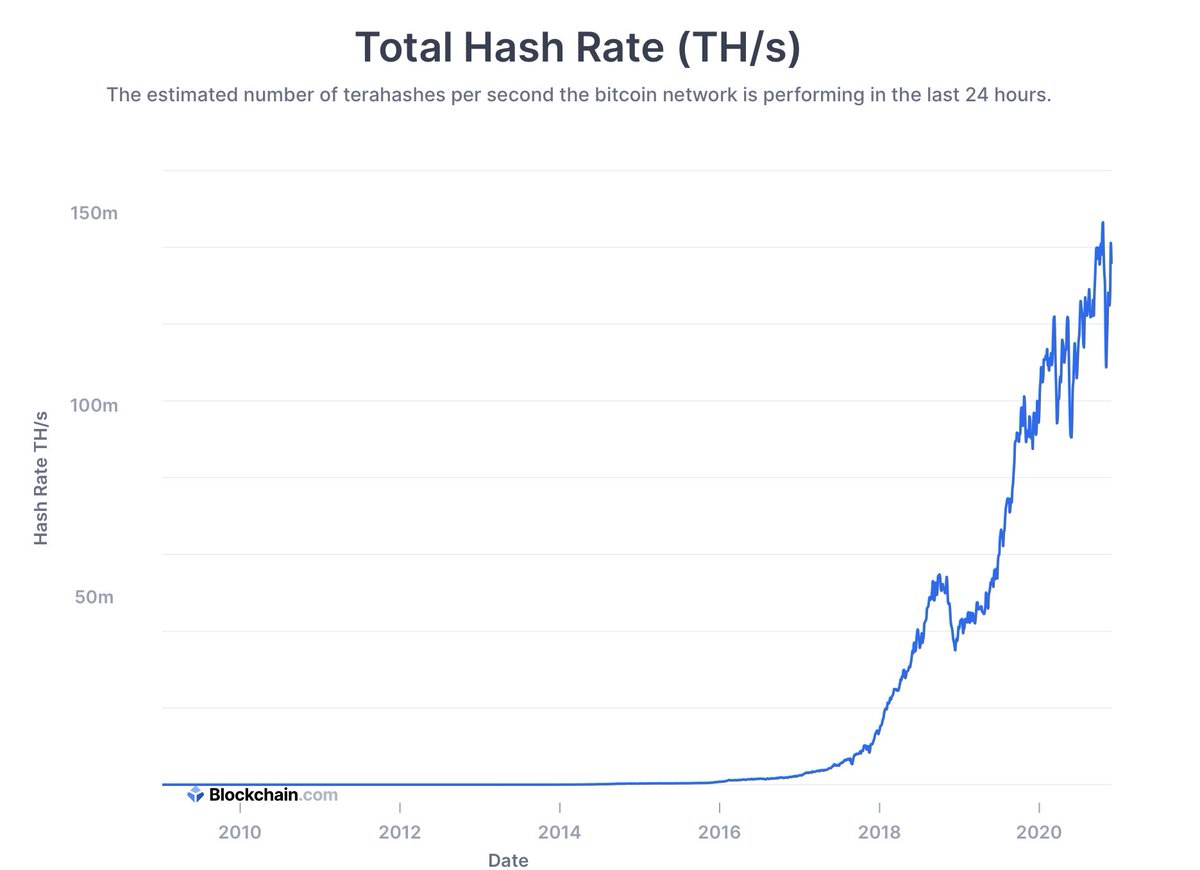

I think a lot of people are underestimating the power that a mature derivatives market is going to bring to #Bitcoin during this cycle. As the price goes higher and volatility continues to grow, it incentivizes more and more long-short funds to capture the massive ... post/1

spreads which are near risk free. These spreads are huge and nothing compared to any other asset class in the world. Here's where it gets really interesting - to implement this strategy, one has to HAVE bitcoin to sell it short. So what are they doing? Well they are... post/2

borrowing Bitcoin. But to borrow Bitcoin, the borrower needs to over-collateralize their escrow! This means they need to lock-up more Bitcoin (because their fiat colleterial is immediately turned into BTC once the loan is written). So what's this all mean? It means ... post/3

there's a perpetual loop of locking up more Bitcoin than what's being put into the market so that long-short investors can capture "risk free" returns in excess of +10% returns. Good luck turning that off. @JeffBooth @APompliano @MartyBent @pierre_rochard @michael_saylor

@maxkeiser @woonomic @100trillionUSD @tyler @cameron @RussellOkung @nic__carter @NickSzabo4 @adam3us @danheld @chamath @Melt_Dem @LynAldenContact @LukeGromen @Breedlove22 @RaoulGMI @DTAPCAP @andrewrsorkin @BeckyQuick

• • •

Missing some Tweet in this thread? You can try to

force a refresh