I hear a lot of people say that S2F is an invalid model because it doesn’t account for demand. Here’s what I’m thinking.

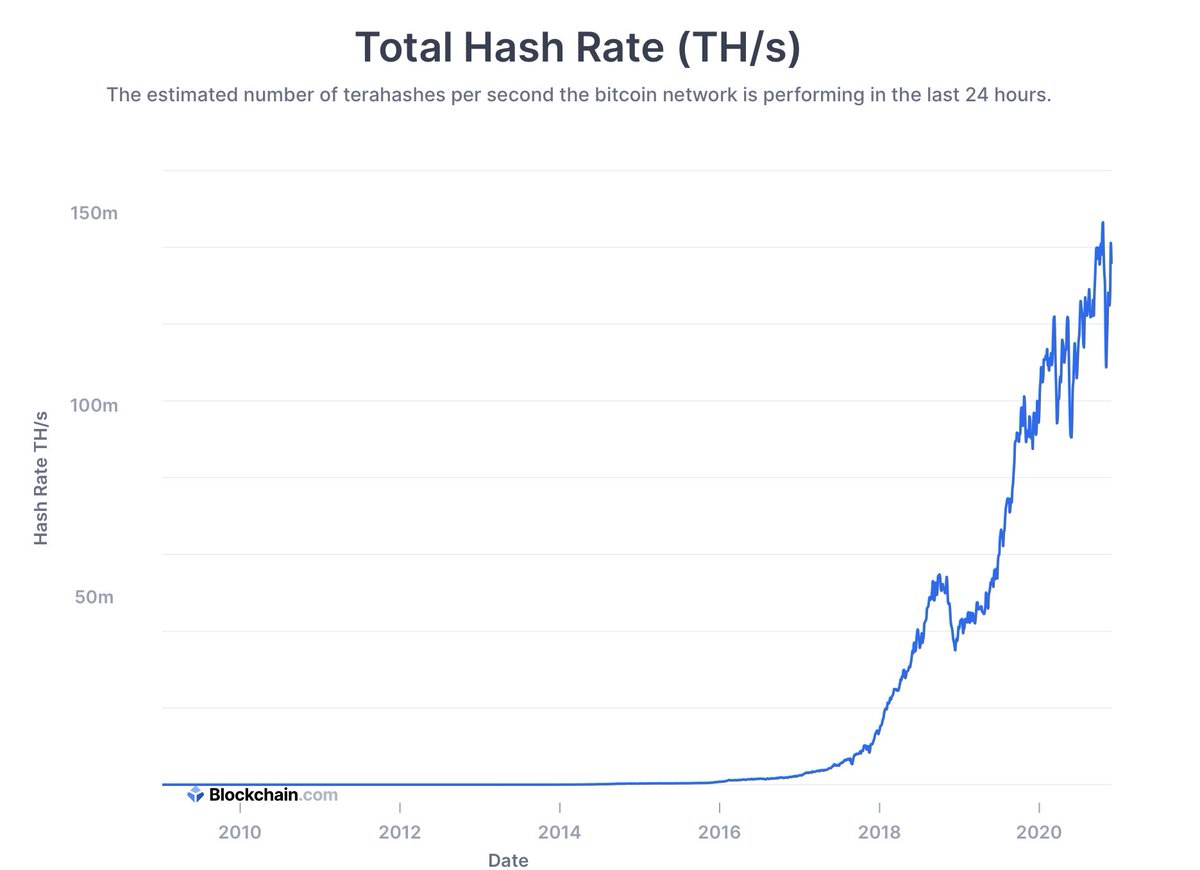

As long as hashing keeps going up over time, that means there’s a minimum threshold of demand being applied to the #Bitcoin eco-system where miners ... 1/

As long as hashing keeps going up over time, that means there’s a minimum threshold of demand being applied to the #Bitcoin eco-system where miners ... 1/

Are acting as agents (among other roles) for swapping electrical bills denominated in fiat for Bitcoin. In essence, the Labor Theory of Value (LToV) is....Valid...but only in this unique situation. This is a very unpopular opinion because most people believe Adam Smith’s ..2/

antiquated economic model for determining value is invalid in almost all modern instances (which I agree with). In this particular situation though, you’re measuring the work being performed at one of the most raw levels: energy expenses for computations conducted. 3/

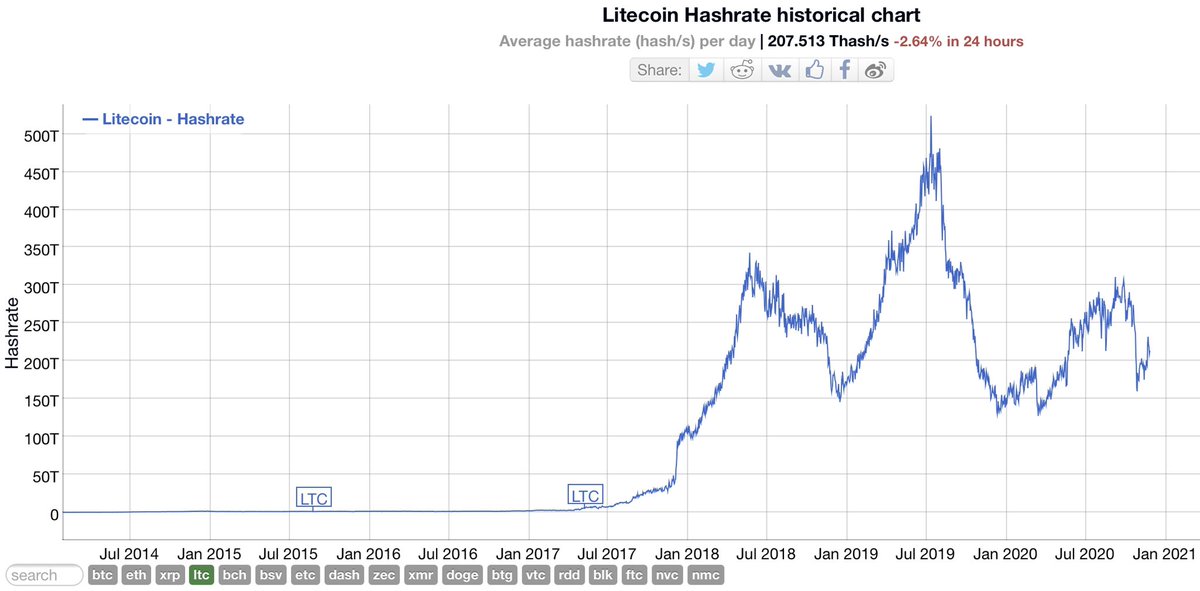

Now, if the hashing for the network wasn’t constantly becoming more competitive or increasing over time, I don’t think this S2F model would work. The reason why is the demand wouldn’t be consistently hitting a minimum threshold per two week adjustment. For instance, look... 4/

at the hashing on a very similar protocol, Litecoin. Here, the minimum demand for fiat to LTC energy swap is sporadic and unpredictable. If a S2F model was conducted on this protocol I would suspect the results would be inconclusive (which @100trillionUSD has demonstrated)... 5/

Let’s assume the demand for gold was constantly increasing for the past ten years relative to the amount being sold into the market. Additionally, let’s assume the speed at which new supply was allowed to be dropped into the market was governed at a certain pace. In this...6/

Situation, the price could still blow-out to the upside, but it might also suggest the price floor would be governed at a minimum amount which would have a correlation to the rate of flow being issued and governed. Sure, this price floor could be penetrated, but I don’t ...7/

Suspect this could last for any meaningful period of time as long as hashing continues to demonstrate a consistent growth in demand while the issuance rate continues to be governed. So if true, we should see such a display in the long-term price chart. 8/

Well, here’s the chart for Bitcoin for the past 8.5 years. For me, this chart is anything but normal. In a weird way, it looks like an algorithmically produced chart - like you’re looking at a processor governing the price within a certain range (but hey maybe it’s just me). 9/

Interestingly, in March 2020, I’d argue the price penetrated this “price floor” when viewing it over a near-decade view. Some may point to this instance and say it proves this theory wrong, but I think this is a good instance for demonstrating what I said earlier, ....10/

“Sure, this price floor could be penetrated, but I don’t think it could happen for any kind of meaningful period of time.” Final thought - I often get asked, how would you know if #Bitcoin was failing? To this point, I would suggest that if Bitcoin’s hashing was declining...11/

And you started to see variability in the demand for hashing, the #Bitcoin protocol may have a competitor taking market share. If the hashing wasn’t consistently going up over time, it might suggest, work for securing the best protocol has 12/

Moved on to more fruitful areas. And if that ever happened, I also suspect the S2F would fail to work as a model for projecting a minimum price floor of value relative to an ever expanding amount of fiat currency. Please shoot holes through this thread, I’m sure many ...13/

Might disagree or see it differently. My intent isn’t to tell, but to spark creative thinking and counter-opinions to my theory on why we are seeing such an odd economic phenomenon with #bitcoin price action and S2F.

@JeffBooth @100trillionUSD @LynAldenContact @LukeGromen

@JeffBooth @100trillionUSD @LynAldenContact @LukeGromen

• • •

Missing some Tweet in this thread? You can try to

force a refresh