Network Effects 101

The concept of network effects is a powerful mental model through which to evaluate businesses, startups, money, human societies, and nature.

But what are “network effects” and how do they work?

Here's Network Effects 101!

The concept of network effects is a powerful mental model through which to evaluate businesses, startups, money, human societies, and nature.

But what are “network effects” and how do they work?

Here's Network Effects 101!

First, a few definitions.

A network effect is a phenomenon by which each incremental user of a product or service adds value to the existing user base.

The product or service becomes more valuable to the users as more people use it.

It is a positive feedback loop.

A network effect is a phenomenon by which each incremental user of a product or service adds value to the existing user base.

The product or service becomes more valuable to the users as more people use it.

It is a positive feedback loop.

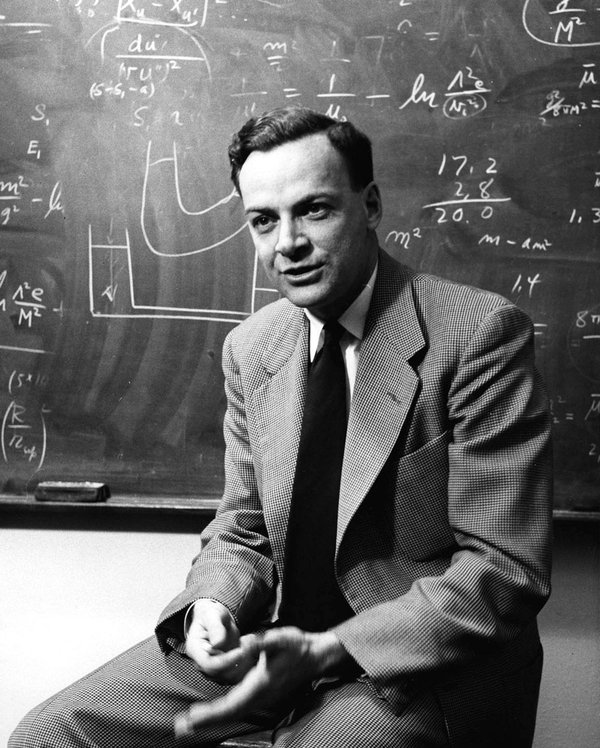

The idea originated with Theodore Vail, the president of American Telephone and Telegraph (AT&T).

In the company's 1908 annual report, Vail wrote, "[The telephone's] value depends on the connection with the other telephones — and increases with the number of connections."

In the company's 1908 annual report, Vail wrote, "[The telephone's] value depends on the connection with the other telephones — and increases with the number of connections."

While the term "network effects" had not been created, it was clearly at the heart of Vail's comment.

The value of a telephone relies on its connection with other telephones in the network.

For an existing user, this value increases with every telephone added to the network.

The value of a telephone relies on its connection with other telephones in the network.

For an existing user, this value increases with every telephone added to the network.

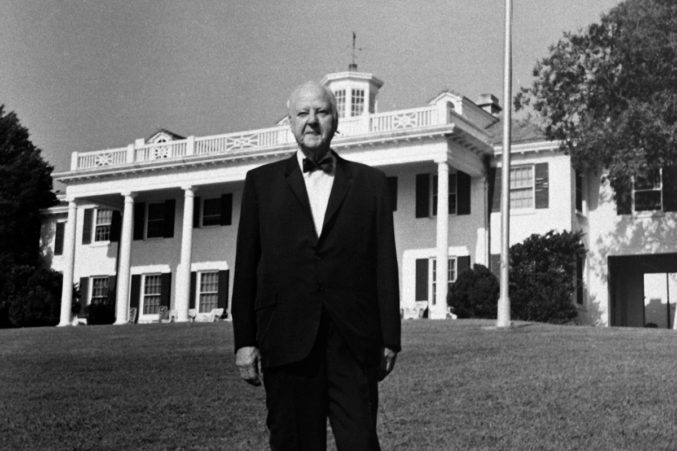

The concept of network effects wasn't popularized in its current form until the late 1900s, when Metcalfe's Law entered the lexicon.

Robert Metcalfe was the inventor of the Ethernet, though it was technologist George Gilder who coined the term Metcalfe's Law in 1993.

Robert Metcalfe was the inventor of the Ethernet, though it was technologist George Gilder who coined the term Metcalfe's Law in 1993.

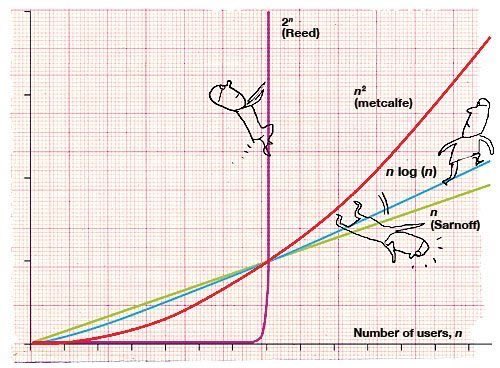

Metcalfe's Law stated that a network's inherent value is effectively equal to the square of the number of users in the network.

New analysis has suggested the relationship between users and network value is not this simple, but the basics hold.

More users = more value per user.

New analysis has suggested the relationship between users and network value is not this simple, but the basics hold.

More users = more value per user.

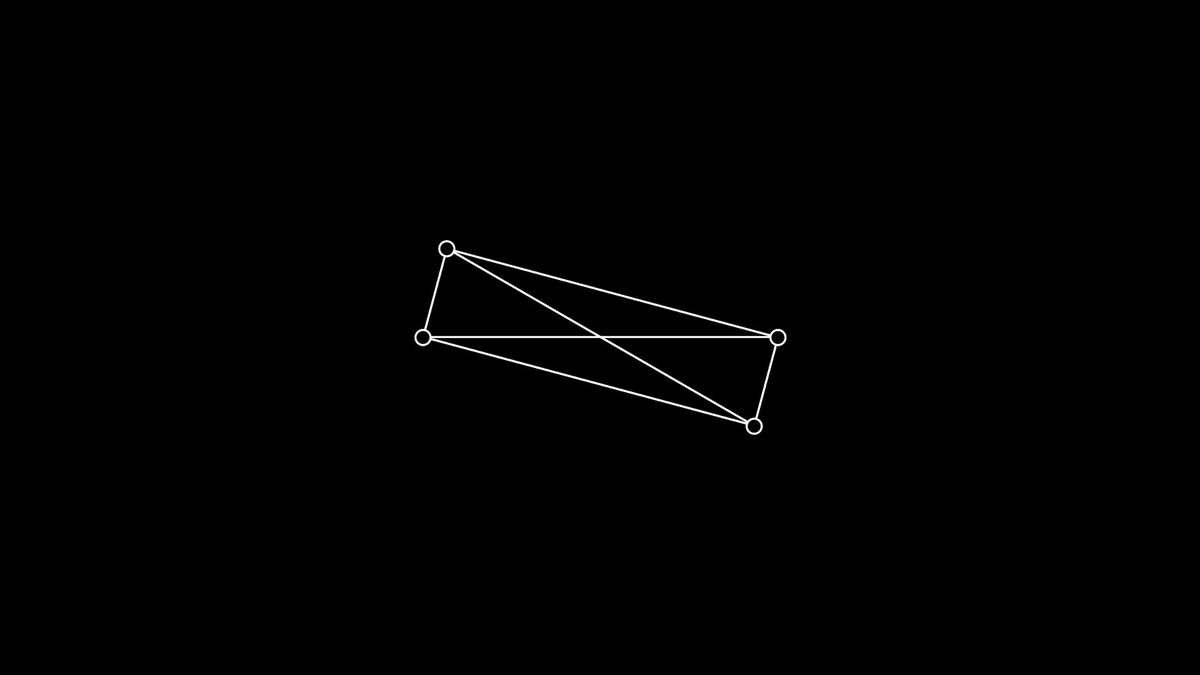

Let's illustrate with a simple example.

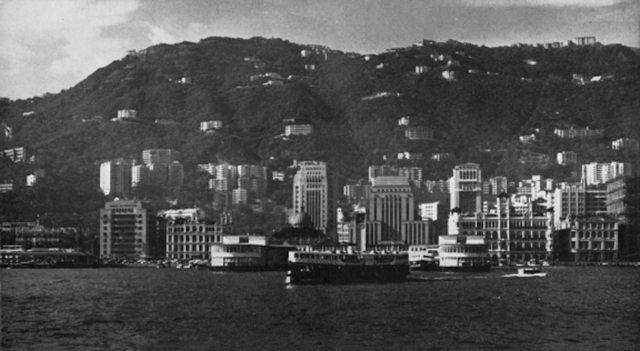

Imagine a telephone network.

If there are two telephones in the network, there is only one potential connection.

If you add a third telephone, there are three potential connections.

If you add a fourth, there are six.

And so on...

Imagine a telephone network.

If there are two telephones in the network, there is only one potential connection.

If you add a third telephone, there are three potential connections.

If you add a fourth, there are six.

And so on...

The key point here is that the 4th telephone user added more value to the network (via 3 new potential connections) than the 3rd telephone user (via 2 new potential connections).

Each incremental user adds more value to the network than the prior incremental user!

Each incremental user adds more value to the network than the prior incremental user!

While it took until the 20th century to have the concept of network effects be formally identified and named, it is a basic feature of human society and has existed for millennia.

Language, religion, and early forms of money all exhibited (and benefitted from) network effects.

Language, religion, and early forms of money all exhibited (and benefitted from) network effects.

There are two core types of network effects:

(1) Direct Network Effects

(2) Indirect (or 2-Sided) Network Effects

Let's cover the basics of each type...

(1) Direct Network Effects

(2) Indirect (or 2-Sided) Network Effects

Let's cover the basics of each type...

Direct network effects are clean and simple.

They exist when the increased usage of a product leads to increased value of the product to each user.

To reiterate: more users = more value per user.

The telephone example from above is a clear example of a direct network effect.

They exist when the increased usage of a product leads to increased value of the product to each user.

To reiterate: more users = more value per user.

The telephone example from above is a clear example of a direct network effect.

Indirect (or 2-sided) network effects are more nuanced.

In an environment with two sides - supply-side and demand-side - indirect (or 2-sided) network effects exist when new users on either side add incremental value to users on the opposite side.

An example...

In an environment with two sides - supply-side and demand-side - indirect (or 2-sided) network effects exist when new users on either side add incremental value to users on the opposite side.

An example...

The @Uber business model is a classic example of indirect network effects.

Drivers are supply-side users. Riders are demand side-users.

New drivers add value to existing riders (easier access, lower waits).

New riders add value to existing drivers (more rides, less downtime).

Drivers are supply-side users. Riders are demand side-users.

New drivers add value to existing riders (easier access, lower waits).

New riders add value to existing drivers (more rides, less downtime).

The indirect network effects of the @Uber business model created powerful growth loops.

More riders led to less driver downtime, which encouraged new drivers to join, reducing rider wait times and encouraging new riders to join.

@DavidSacks highlighted the loop with this chart.

More riders led to less driver downtime, which encouraged new drivers to join, reducing rider wait times and encouraging new riders to join.

@DavidSacks highlighted the loop with this chart.

When network effects are present (or embedded) in a business model or industry structure, the environment tends to become winner-take-all (or winner-take-most).

This often leads to a mad rush to raise and deploy capital to accelerate user growth and become the market "winner."

This often leads to a mad rush to raise and deploy capital to accelerate user growth and become the market "winner."

The concept of network effects is an extremely powerful mental model to have in your toolkit for the modern, technological age.

The most impactful emerging technologies of the coming century will be grounded in network effects.

Let's look at a few potential examples...

The most impactful emerging technologies of the coming century will be grounded in network effects.

Let's look at a few potential examples...

Bitcoin Network Effects

The more people and institutions turn to Bitcoin as a store of value, the greater the incentives of miners to secure the network and maintain its integrity.

New users benefit from the value they create via price appreciation, driving more user growth.

The more people and institutions turn to Bitcoin as a store of value, the greater the incentives of miners to secure the network and maintain its integrity.

New users benefit from the value they create via price appreciation, driving more user growth.

There have been interesting thought pieces on the network effects of Bitcoin and other cryptocurrencies.

For more, check out the following resources:

Article by @jessewldn: a16z.com/2020/04/08/cry….

Thread by @RaoulGMI:

For more, check out the following resources:

Article by @jessewldn: a16z.com/2020/04/08/cry….

Thread by @RaoulGMI:

https://twitter.com/RaoulGMI/status/1347013567799848961?s=20

The @joinClubhouse App Network Effects

The hottest new app on the block.

New users create more value for existing users by increasing the quantity and quality of discussions on the platform.

User growth attracts super users (like @ElonMusk), whose presence attracts more users.

The hottest new app on the block.

New users create more value for existing users by increasing the quantity and quality of discussions on the platform.

User growth attracts super users (like @ElonMusk), whose presence attracts more users.

Network effects are a powerful mental model through which to evaluate the world - a new tool in your toolkit.

For more learning:

Article by @ljin18 & @DCoolican: a16z.com/2018/12/13/16-…

Article by @trengriffin: a16z.com/2016/03/07/net…

Article by @NFX: nfx.com/post/network-e…

For more learning:

Article by @ljin18 & @DCoolican: a16z.com/2018/12/13/16-…

Article by @trengriffin: a16z.com/2016/03/07/net…

Article by @NFX: nfx.com/post/network-e…

Special thank you to @jackbutcher @visualizevalue for the incredible GIF visual!

If you enjoyed this follow me for more educational threads on business, money, finance, and economics. You can find all of my threads in the meta-thread below.

If you enjoyed this follow me for more educational threads on business, money, finance, and economics. You can find all of my threads in the meta-thread below.

https://twitter.com/SahilBloom/status/1284583099775324161?s=20

And if you are less Twitter inclined, sign up for my newsletter here, where you can find all of my old threads and receive all of my new threads directly to your inbox. sahilbloom.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh