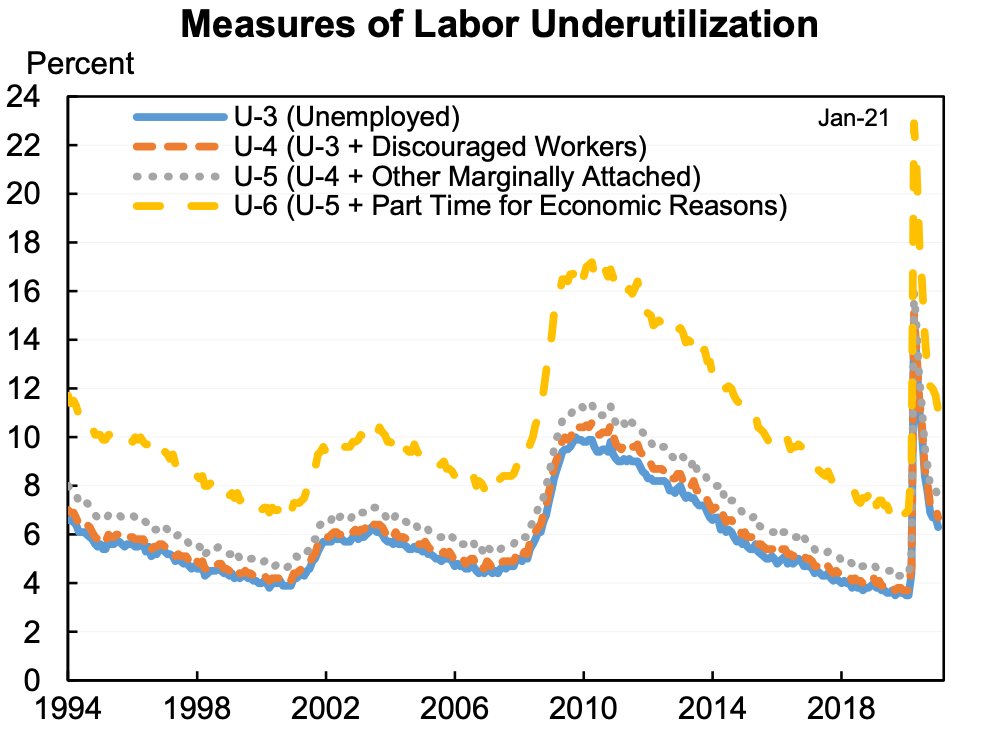

Jay Powell cited an unemployment rate of 10% adjusted for participation. Willie Powell & I have been using 8.3% as the "realistic unemployment rate". Both are correct, both are useful, I won't be offended if you use his instead of mind, but a technical note on the differences.

The labor force participation rate has fallen from 63.3% in February 2020 to 61.4% in January 2021 as 4.3m people gave up looking for work. Powell's stat is that all 4.3m had not given up but were instead classified as unemployed then the unemployment rate would be 10% now.

The participation rate always falls in recessions so the Powell stat is a great way to capture just how terrible the current labor market is.

The downside of the Powell stat is that you cannot (or at least should not) compare it to historical unemployment rates.

The downside of the Powell stat is that you cannot (or at least should not) compare it to historical unemployment rates.

For example, the official unemployment rate reached 10% in 1982 and 2009. But using the Powell adjustment unemployment rates would have been higher then because participation rate went down then too.

Willie & I ask a slightly different question--what would the unemployment rate adjusted for the unusual above normal withdrawal from the labor force. Based on the historic pattern, would have been 2.5m more people in the labor force and UR of 8.3%. piie.com/blogs/realtime…

Our concept has the advantage of being comparable to past unemployment rates like the 10% in 1982 and 2009. It is not a measure that by construction is always higher than the official rate, it is only higher now because of the surprisingly large withdrawal from the labor force.

But our concept has three disadvantages: (1) it is less vivid in capturing the current experience (people who left the labor force don't care whether they left more or less than people did in the past, they still left); (2) it is harder to calculate; and (3) I'm not Jay Powell.

cc: Jay Powell @genebsperling @hshierholz

• • •

Missing some Tweet in this thread? You can try to

force a refresh