The new @USCBO report confirms that we have substantial fiscal space, in fact more than we've generally had in the past. This is even true if the American Rescue Plan passes in full.

Critical to this is low interest rates mean low debt service.

Critical to this is low interest rates mean low debt service.

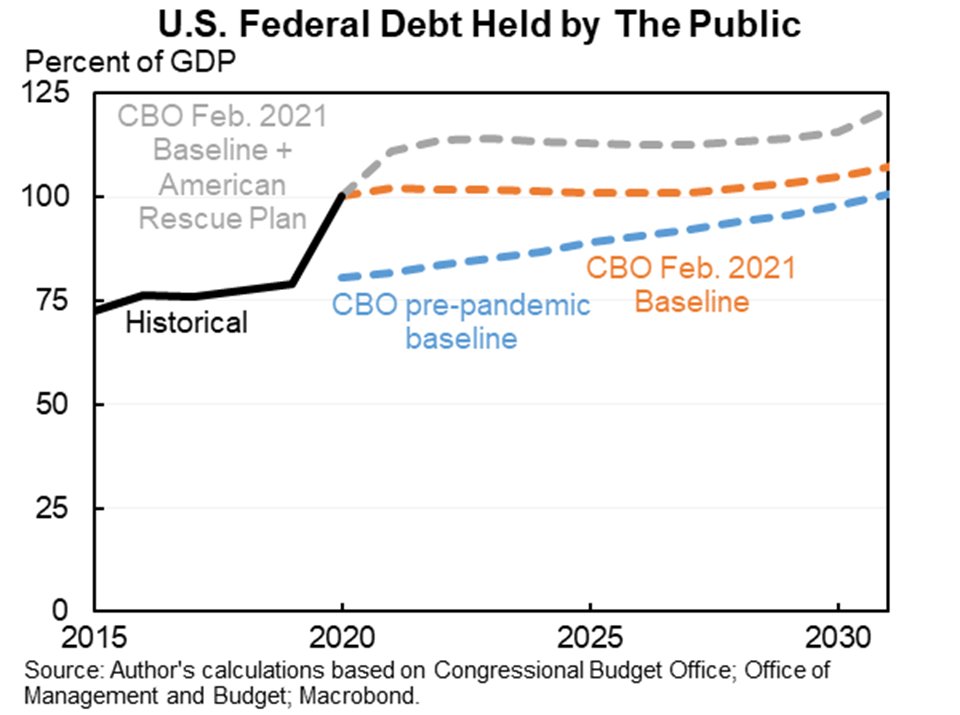

CBO projects higher debt/GDP than it did pre-pandemic. But even this projection is not "spiraling" within the budget window but a relatively gradual increase.

More importantly, debt/GDP is a bad metric to look at as I've explained before.

More importantly, debt/GDP is a bad metric to look at as I've explained before.

https://twitter.com/jasonfurman/status/1329817571332337684?s=20

CBO has lowered its interest rate forecast more than it raised its debt forecast. So real debt service as a share of GDP is lower than what we expected pre-crisis. This is even true with the American Rescue Plan (and assuming it raises interest rates).

Looked at over a longer period of time real debt service is expected to remain low relative to the economy for at least the next decade. @LHSummers and I suggested a 2% target for this metric, by the end of the decade we are closer to 0.5% even with the American Rescue Plan.

From a purely fiscal perspective, this means that we can afford the additional debt associated with the American Rescue Plan plus substantial additional debt thereafter for Build Back Better.

(There is a separate debate about the best time path and composition of that debt.)

(There is a separate debate about the best time path and composition of that debt.)

• • •

Missing some Tweet in this thread? You can try to

force a refresh