@chrislhayes raised a question about "overheating" from a thread I did. I want to answer him in a thread with general conceptual points & their current application.

Short version: if there is no risk of overheating we are doing too little.

Short version: if there is no risk of overheating we are doing too little.

https://twitter.com/jasonfurman/status/1359932966210732032?s=20

The chance of overheating with this package is not 0% and not 100%.

Overheating is not costless.

The right sized and designed package should balance the costs/probability of costs against the benefits/probability of benefits.

Overheating is not costless.

The right sized and designed package should balance the costs/probability of costs against the benefits/probability of benefits.

Framed differently we recognize this when we say "it is better to err on the side of too much instead of too little." That sentence acknowledges the possibility of errors in both directions.

(MMT also says the limiting principle for fiscal policy should be inflation.)

(MMT also says the limiting principle for fiscal policy should be inflation.)

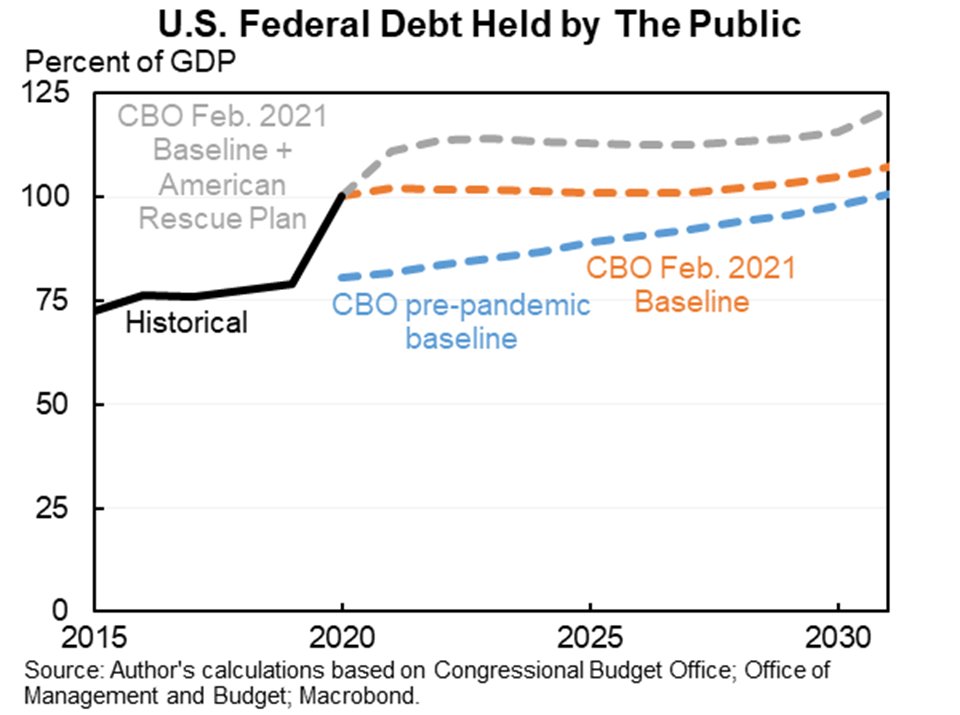

The last time we had overheating of this type was in the 1960s. But the December legislation plus this is a 14% of GDP fiscal stimulus, an amount that will be hitting at the same time as (hopefully) a huge positive supply shock from curbing the pandemic. So let's all be humble.

The costs of overheating include:

--If price inflation outweighs wage inflation real wage cuts.

--More likely real wages up but people are affected by inflation and perceive it has hurting them.

--If price inflation outweighs wage inflation real wage cuts.

--More likely real wages up but people are affected by inflation and perceive it has hurting them.

--The Fed causing a recession to get inflation down (something they have always done and could be worse with a flat Phillips curve).

--The bad scenario that we get seriously rising inflation when the unemployment rate hits, say, 5% raising questions about maximum employment.

--The bad scenario that we get seriously rising inflation when the unemployment rate hits, say, 5% raising questions about maximum employment.

(This last has gotten little attention but it worries me. I have little doubt 3.5% unemployment or lower is sustainable. I am less positive about whether we can get to 3.5% unemployment this fall just because it takes time for people to find jobs, new businesses to open.)

The above were all conceptual points. Now lets apply them to this particular package and ask about magnitudes and how to balance risks.

My best guess is that inflation will be too low over the next two years (I define this as less than 2.5%).

Given an up or down vote on the $1.9T package I would enthusiastically vote yes.

Given an up or down vote on the $1.9T package I would enthusiastically vote yes.

But I don't think the risks of overheating or zero or even trivial (and if I did I would be shouting that $1.9T was too little).

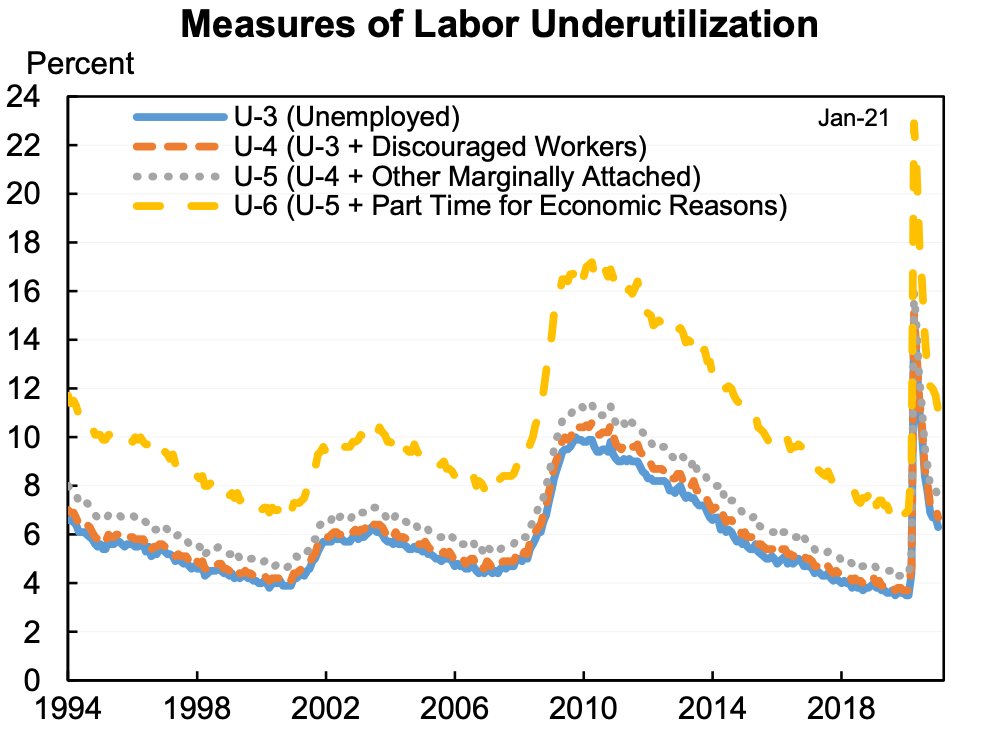

For example, what if the multiplier is >0.7 then UR would be ~2% at the end of the year?

Or if lingering supply effects affect return of employment?

For example, what if the multiplier is >0.7 then UR would be ~2% at the end of the year?

Or if lingering supply effects affect return of employment?

As I said, I think the benefits of the $1.9T outweigh the risks by a decent margin. But that doesn't mean we can't improve the reward-risk balance. Could, for example, ask how to preserve much of the benefit while reducing the risk.

Eg, most of the anti-overheating people argue people won't spend most of their checks this year so multiplier is low. That is probably true. But could provide extra insurance by doing $700 this year and $700 next year. (May be politically impossible but I'm doing economics.)

Or to flesh out the example from my thread, the @WendyEdelberg @lsheiner estimates imply Biden plan would return economy to pre-pandemic trend by Q3. That could mean UR of 3.5% by September plus much higher LFPR.

brookings.edu/blog/up-front/…

brookings.edu/blog/up-front/…

I think most supporters of the plan believe something like that would happen (and the multipliers in their paper are *much* smaller than many were using just a few months ago to advocate for stimulus).

IF we are to have UR of 3.5% give or take by Sept then won't need $400/wk.

IF we are to have UR of 3.5% give or take by Sept then won't need $400/wk.

Plus $400/week may interfere with the *massive* labor supply response we need to get to that place. The evidence from 2020 has almost no relevance for this question because it was during a pandemic when jobs were very scarce and most added jobs were recalls.

(Of course, even better would be to have UI on a trigger. I haven't given up on that but not where the energy seems to be.

I should add, if UR still high in September that might be inadequate demand but also might mean slow supply adjustment, later could mean overheating.)

I should add, if UR still high in September that might be inadequate demand but also might mean slow supply adjustment, later could mean overheating.)

So, again talking purely about the economics on a blank slate, I would rather take the $400/week down starting over the summer to something lower. Even adding that money to something else and keeping the total package the same would help.

In summary, as a general matter people can be very hostile to discussions of tradeoffs and risks (not Chris, others). I understand and sympathize with some of that hostility because many worthwhile ideas are killed in the name of tradeoff/risk management. But, ...

Most policies do actually have tradeoffs and risks. If we shut down all conversation about them we will end up with worse policies, including less effort to minimize downside risks.

Creating an ecosystem that shuts down debates/dicusses these risks risks worse outcomes.

Creating an ecosystem that shuts down debates/dicusses these risks risks worse outcomes.

Addendum: I wrote about some of these ideas in an earlier thread.

https://twitter.com/jasonfurman/status/1322196501666344960?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh