OK, almost 2.5 years ago, I tweeted out a thread comparing $TSLA to $GM as investments based on their financial position and my evaluation of their prospects.

You can probably guess where I landed 🙃, but here's that old thread if you want to read it:

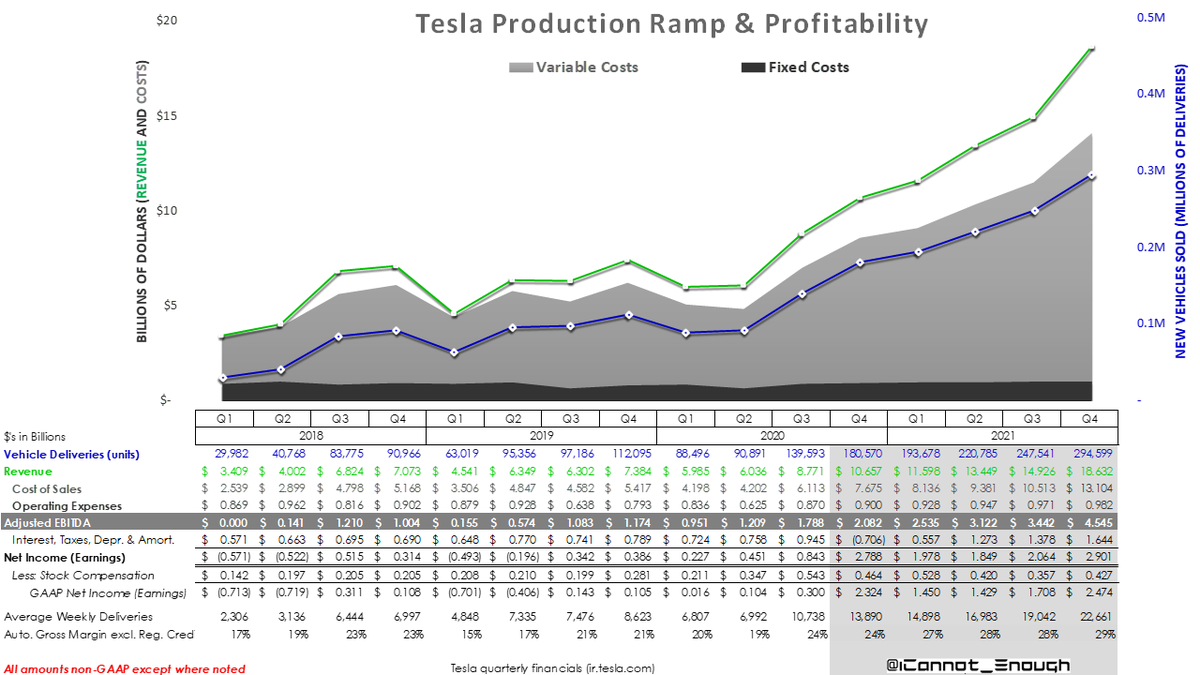

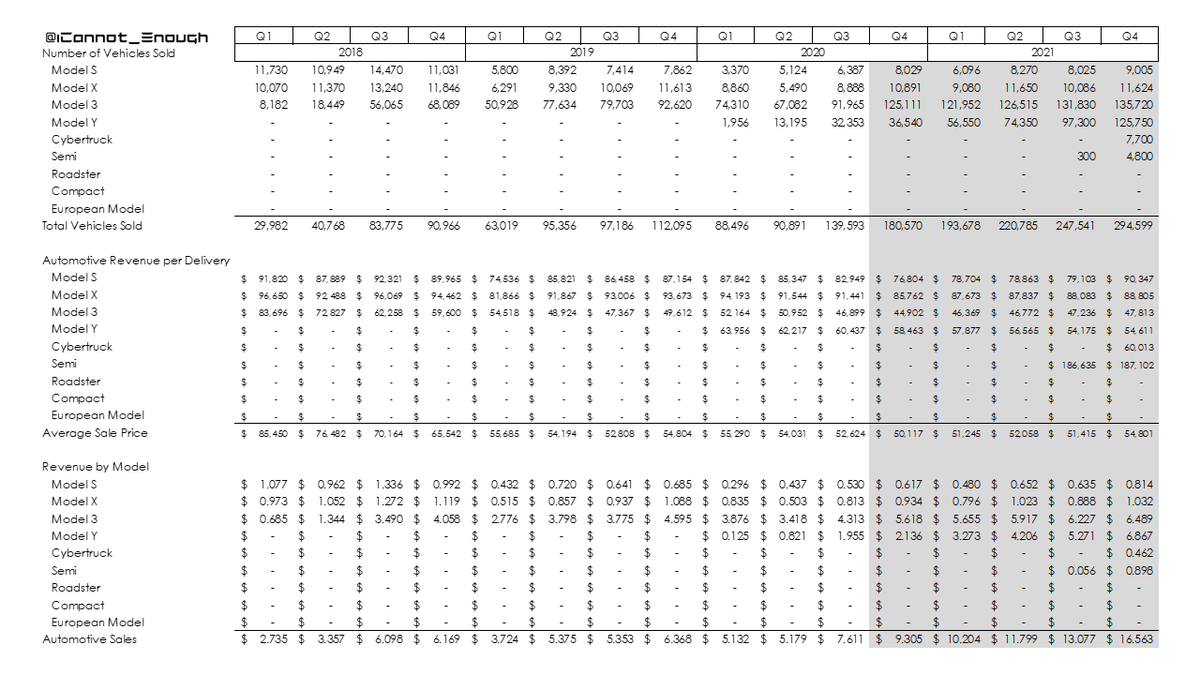

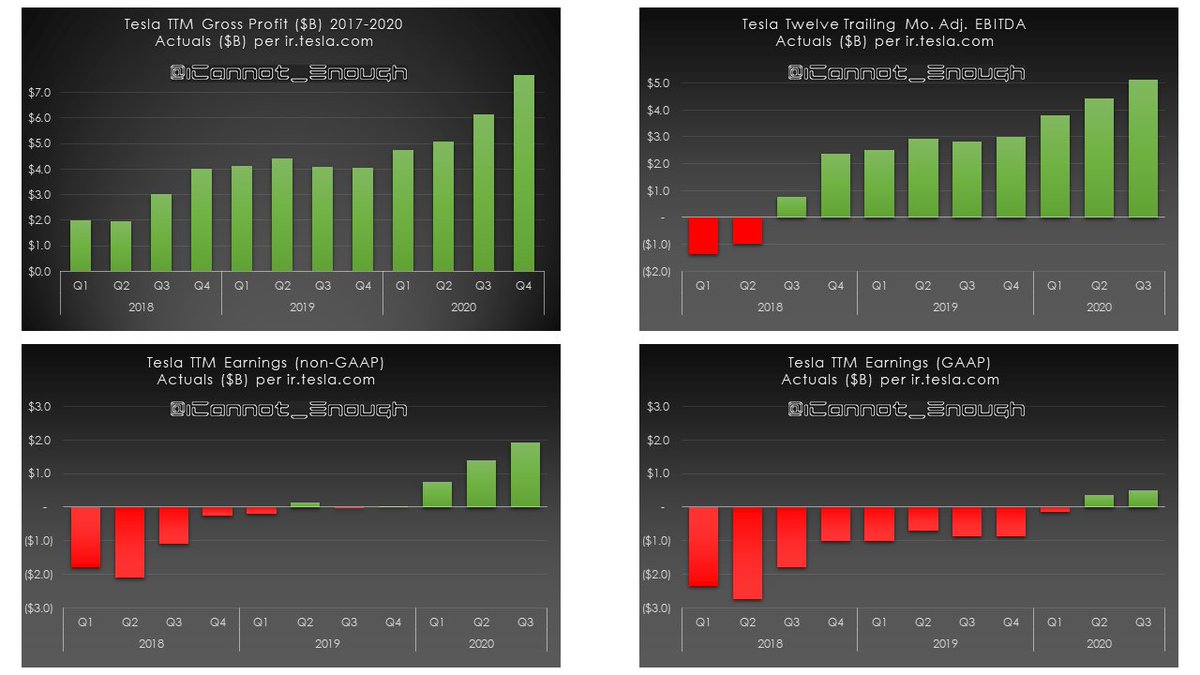

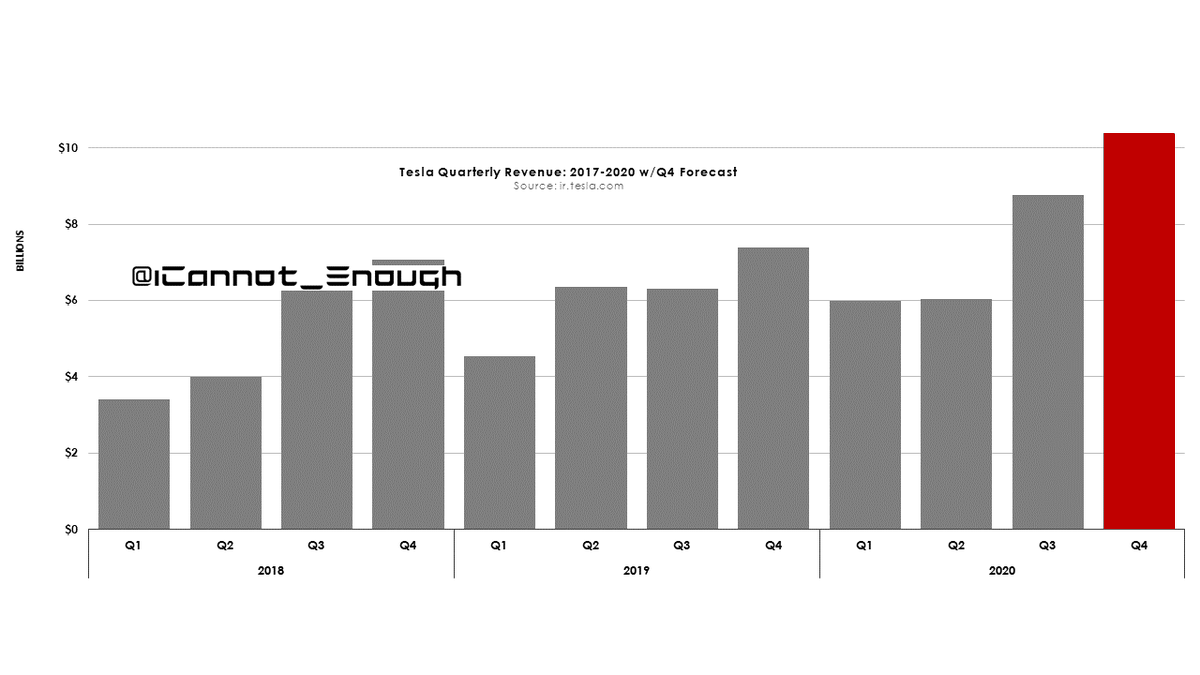

(updated charts to follow)

You can probably guess where I landed 🙃, but here's that old thread if you want to read it:

(updated charts to follow)

https://twitter.com/ICannot_Enough/status/1055849335232102400

Since then, a few things have changed.

Somebody suggested that it would be more fair to use Long Term Debt than Total Debt for GM, so I made that change (shown here, updated through 2018 Actuals):

Somebody suggested that it would be more fair to use Long Term Debt than Total Debt for GM, so I made that change (shown here, updated through 2018 Actuals):

But a few years have happened since the end of 2018, so why not update the chart?

Are you ready?

You are *not* ready. 😂🤣

Without changing the original chart's scale, here it is updated through 2020:

Are you ready?

You are *not* ready. 😂🤣

Without changing the original chart's scale, here it is updated through 2020:

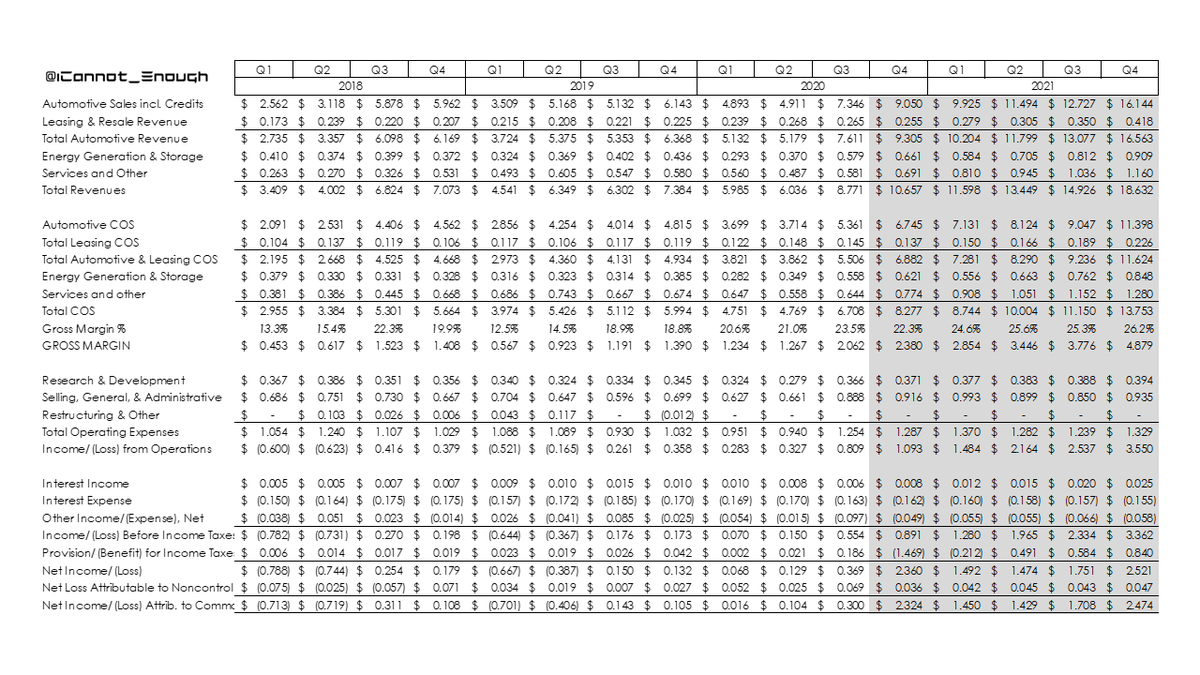

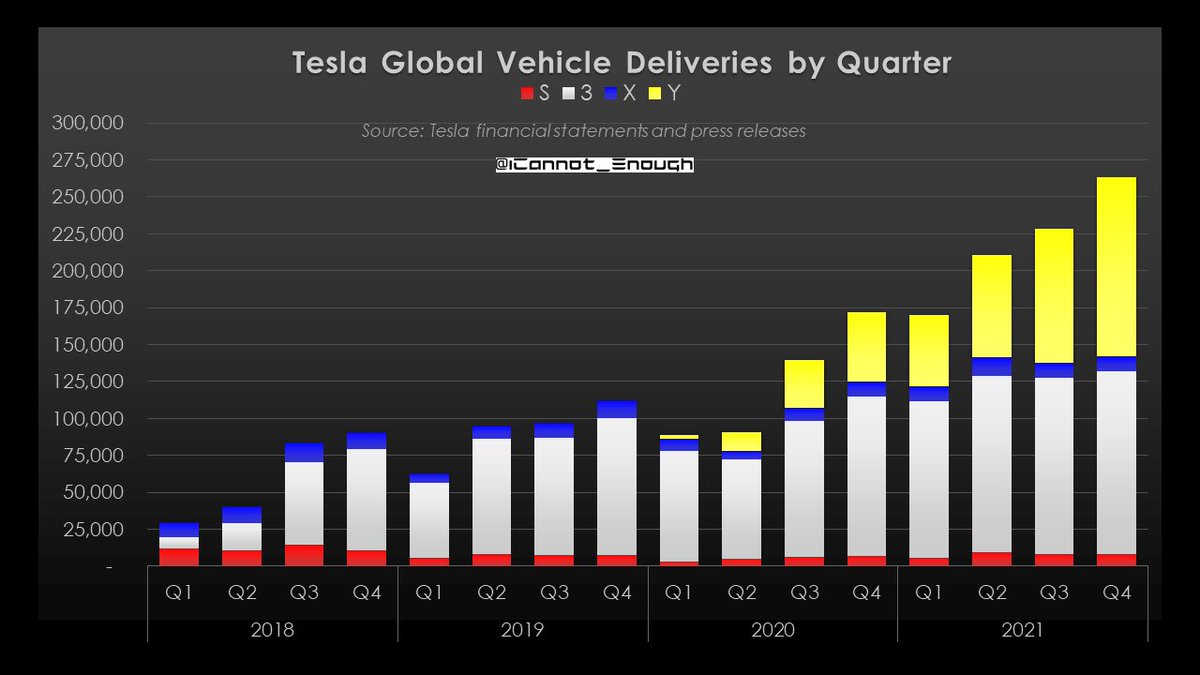

To reward the reader, here are a few more $TSLA vs. $GM charts.

This one shows the Total Revenue trend vs. Long Term Debt as a % of that revenue.

Both metrics have never been worse for GM than what they reported today (since they last went bankrupt). 😬

This one shows the Total Revenue trend vs. Long Term Debt as a % of that revenue.

Both metrics have never been worse for GM than what they reported today (since they last went bankrupt). 😬

This chart sets debt vs. market cap (how much its owners think each co. is worth).

GM's stock price has been rising (somehow), even as its sales shrink, yr after yr.

Tesla could pay off its Long Term Debt for 1% dilution

GM's owners think the whole co. isn't worth what it owes

GM's stock price has been rising (somehow), even as its sales shrink, yr after yr.

Tesla could pay off its Long Term Debt for 1% dilution

GM's owners think the whole co. isn't worth what it owes

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh