Bitcoin is a virtual fortress.

(a short thread)

(a short thread)

1/ I’ve started imagining bitcoin as a virtual fortress which is secured mathematically so that even governments cannot seize it.

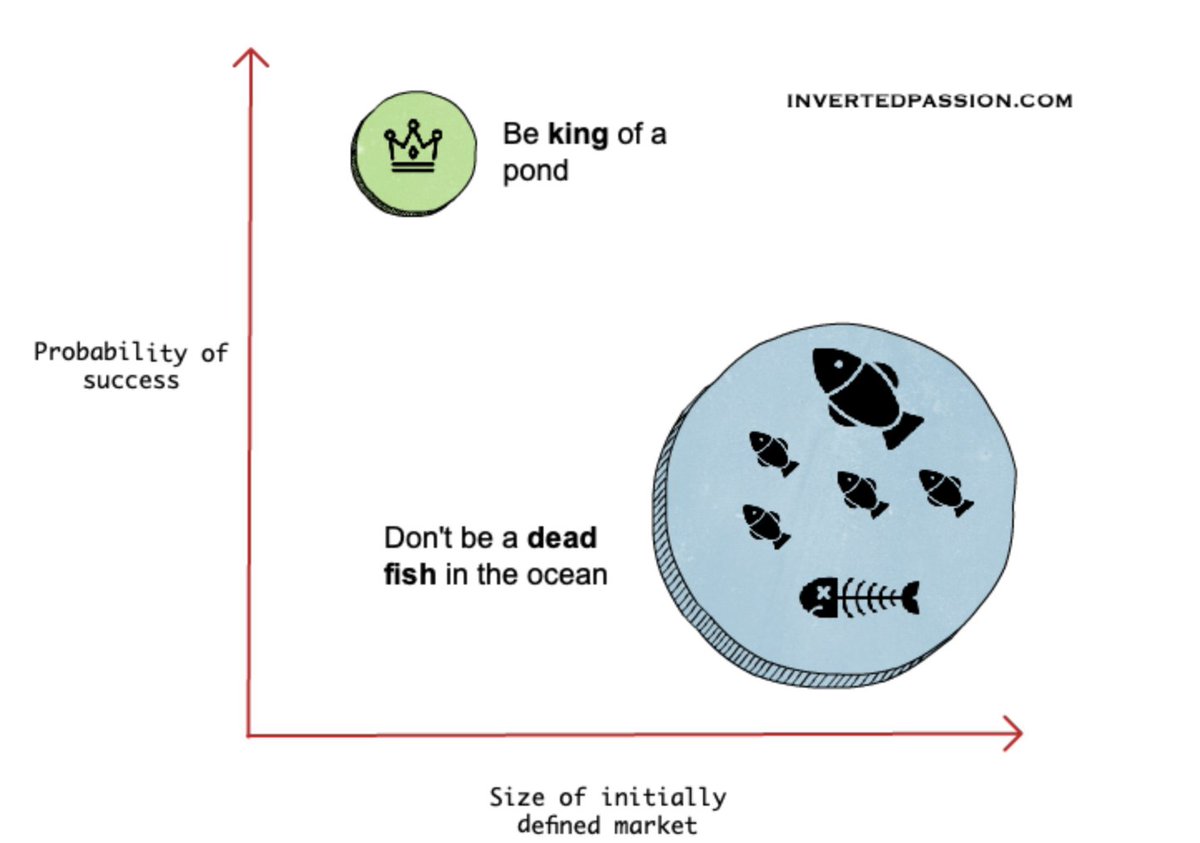

2/ There’s a price to pay to enter into this fortress but since there are limited entry tickets, if more people want to enter into it, the price keeps on going up.

3/ Keeping the fortress secure requires energy that’s supplied by miners, and that energy isn’t free.

4/ Because as the fortress becomes valuable, more and more people want to attack it and hence the cost of securing the fortress keeps going up.

We should expect bitcoin network to become more expensive (in cost and energy) to maintain.

We should expect bitcoin network to become more expensive (in cost and energy) to maintain.

5/ How the fortress is built and operates is clever, not many citizens of it understand it fully.

We humans invent religions and faith to understand complex phenomena, and that seems to be the case with fortress citizens as well.

Here are some bitcoin myths 👇

We humans invent religions and faith to understand complex phenomena, and that seems to be the case with fortress citizens as well.

Here are some bitcoin myths 👇

6/ Bitcoin is not “digital gold”.

Gold operates in the physical realm, so when I exchange it with someone else, it’s a transaction between two people.

In that sense, you own gold because you can literally hold it in your hands.

Gold operates in the physical realm, so when I exchange it with someone else, it’s a transaction between two people.

In that sense, you own gold because you can literally hold it in your hands.

7/ But you don’t own bitcoin. You license it from the network (the fortress).

So, unlike gold, when two people transact bitcoin, everyone holding bitcoin has to agree that the transaction happened.

Some call this a strength, but understanding it is important.

So, unlike gold, when two people transact bitcoin, everyone holding bitcoin has to agree that the transaction happened.

Some call this a strength, but understanding it is important.

8/ Bitcoin cannot be destroyed by government.

It’s true because no government can solve cryptographic puzzles, but govt can seize the means of production if they really want to.

It’s true because no government can solve cryptographic puzzles, but govt can seize the means of production if they really want to.

9/ You can’t eat a bitcoin and if pushed too much by the fortress citizens, the outsiders can definitely seize things that we actually want - food, cars, software.

In that sense, say govt taking over Tesla is really govt taking over at least $1.5 billion worth of bitcoins.

In that sense, say govt taking over Tesla is really govt taking over at least $1.5 billion worth of bitcoins.

10/ The primary means of control in the world has and will always be threat of physical violence.

And as Max Weber said, “Govt is legitimate monopoly on violence”.

And as Max Weber said, “Govt is legitimate monopoly on violence”.

11/ Bitcoin is one of the least privacy oriented currencies.

When you do bitcoin transactions, the entire network knows it. It’s like broadcasting your purchases to the entire world.

Of fortress citizens have identified themselves via KYC, there’s no escape for them from govt.

When you do bitcoin transactions, the entire network knows it. It’s like broadcasting your purchases to the entire world.

Of fortress citizens have identified themselves via KYC, there’s no escape for them from govt.

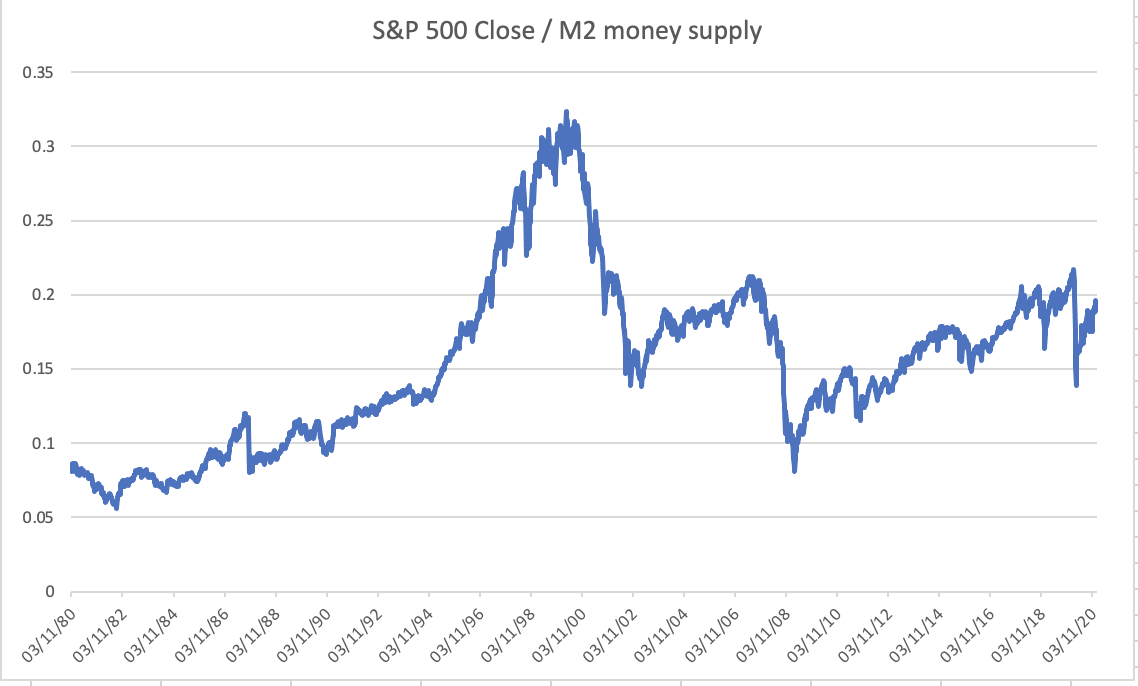

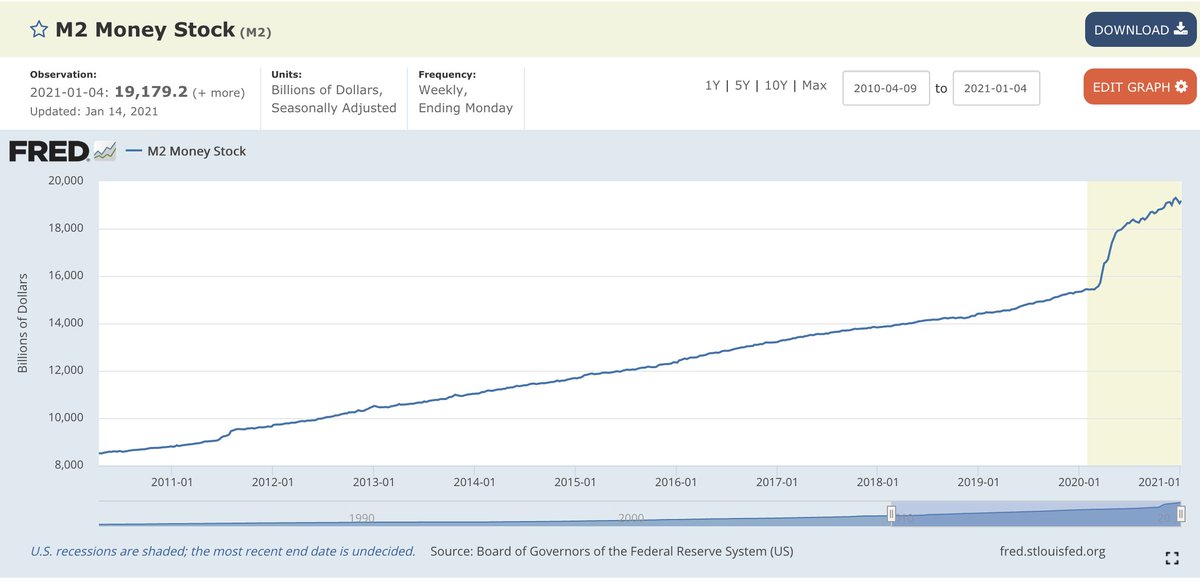

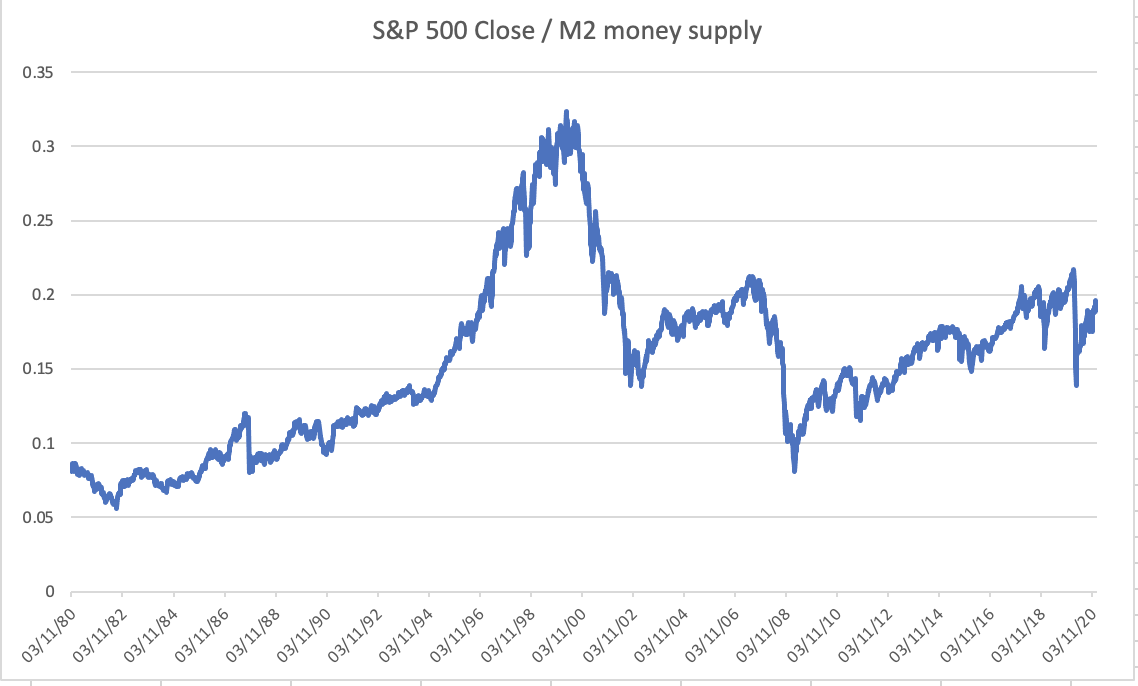

12/ The advantage that bitcoin cannot be inflated away by the govt can actually turn out to be it’s greatest weakness.

Govts use inflation to keep an economy going. In an economy crash, if govt can’t redistribute money because it’s locked in a fortress, people will get angry.

Govts use inflation to keep an economy going. In an economy crash, if govt can’t redistribute money because it’s locked in a fortress, people will get angry.

13/ Ultimately governments are nothing but people.

Yes, sometimes they’re inefficient and self-serving but modern democracies are the best thing we’ve got.

We should fight to strengthen self-rule and keep on doing experiments to govern ourselves better.

Yes, sometimes they’re inefficient and self-serving but modern democracies are the best thing we’ve got.

We should fight to strengthen self-rule and keep on doing experiments to govern ourselves better.

14/ The bitcoin virtual fortress is an interesting experiment, and generally cryptographic mechanisms for making our institutions better needs to be encouraged.

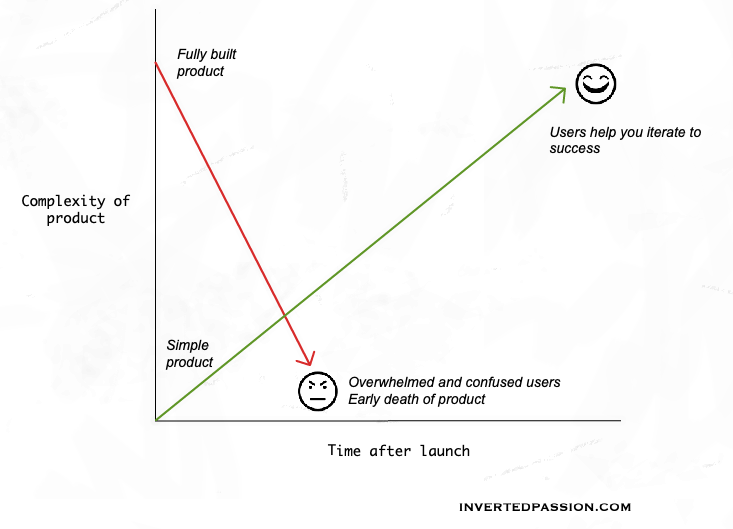

But we should know that perhaps bitcoin is not the last word.

But we should know that perhaps bitcoin is not the last word.

15/ The world is more complex than any single minded philosophy can accommodate.

So I’ll keep watching at the fortress with curious eyes from the outside :)

So I’ll keep watching at the fortress with curious eyes from the outside :)

16/ I think the likely scenario is that some or majority of politician representatives actually become citizens of the virtual fortress, and the anger of the masses then generally gets directed on the rich or powerful.

It’s already happening - farmers protest, GME saga.

It’s already happening - farmers protest, GME saga.

17/ If farmers protest in India is showing us anything, it’s that major inequality won’t be tolerated.

Our lives in physical world will get disrupted, even if our digital portfolios grow.

Our lives in physical world will get disrupted, even if our digital portfolios grow.

18/ Also even though govts (which is nothing but people) can’t destroy bitcoins, they can render it worthless by refusing (via decree) to provide any good or service in exchange of it.

They’ll only do it if they’re desperate but that’s what the virtual fortress is designed to do

They’ll only do it if they’re desperate but that’s what the virtual fortress is designed to do

• • •

Missing some Tweet in this thread? You can try to

force a refresh