Is the European Union really being unreasonable over the City of London?

Or are we seeing an inevitable consequence of a Brexit that prioritised sovereignty over financial services?

A thread…🧵💵🏦🇬🇧🇪🇺

Or are we seeing an inevitable consequence of a Brexit that prioritised sovereignty over financial services?

A thread…🧵💵🏦🇬🇧🇪🇺

Andrew Bailey’s Mansion House speech this week showed clear signs of frustration about the EU’s foot dragging in granting “equivalence” to UK regulators on financial regulation...2/bankofengland.co.uk/speech/2021/fe…

The view among UK financial lobbyists and regulators is that the EU has various financial equivalence agreements already with a host of other third countries (even the US) so why not the UK, which is currently, of course, totally aligned?...3/ ec.europa.eu/info/sites/inf…

But the view in the EU is that the UK is different from those other countries because it’s so dominant in finance - and they fear outsourcing regulation to an authority outside the bloc when that regulated activity could potentially affect EU markets/business so profoundly ...4/

Andrew Bailey thinks the EU is gearing up to demand the UK be a simple “rule taker” in return for equivalence, unable to unilaterally change UK rules, which he says would be "intolerable"....5/

But isn’t the EU just trying to poach business from the City?

To some extent yes – especially true among French.

But don’t discount the financial stability concerns, especially since UK ministers have said they intend to use Brexit to diverge on regulation...6/

To some extent yes – especially true among French.

But don’t discount the financial stability concerns, especially since UK ministers have said they intend to use Brexit to diverge on regulation...6/

In a way the UK and EU views on this are a mirror of each other – both fear the consequences of diluting total regulatory control on finance...7/

In a sense this shows that this IS a natural consequence of Brexit.

When the UK was in the EU both co-operated to determine financial regulation.

Now there’s no institutional mechanism to force co-operation, build trust, ensure enforcement etc...8/

When the UK was in the EU both co-operated to determine financial regulation.

Now there’s no institutional mechanism to force co-operation, build trust, ensure enforcement etc...8/

So labelling each other unreasonable arguably misses the point - it's not a question of mental state, but an absence of institutional architecture...9/

An important question is what happens if the EU DOES demand, as Andrew Bailey fears, the UK become an EU rule taker in return for equivalence?...10/

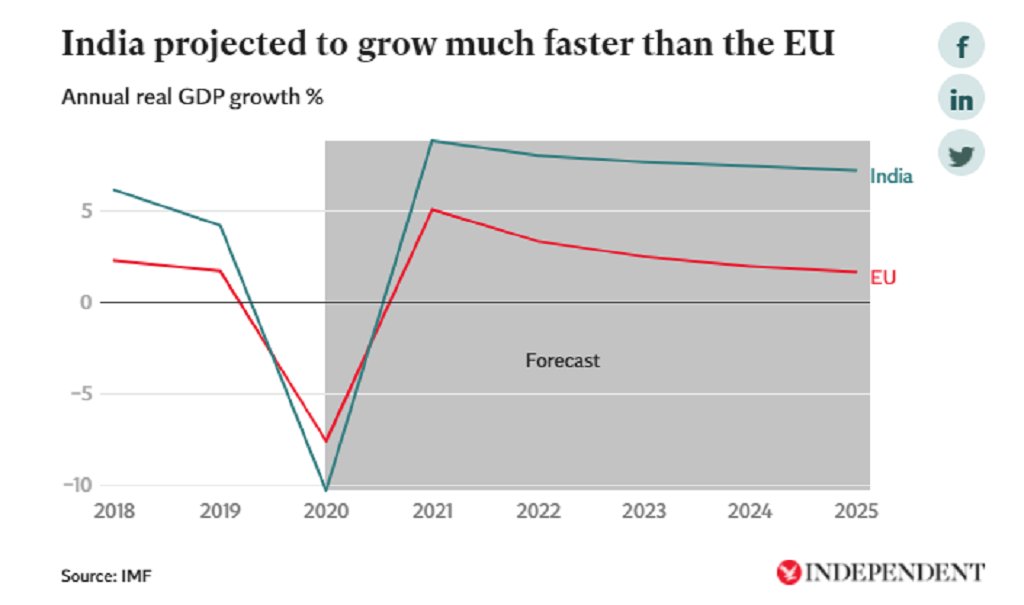

My conversations with the sector suggest that this would NOT be judged a price worth paying and that the City would, with regret, give up on the EU and focus on other overseas markets.

Given the value of UK exports to the EU market that would be painful for both parties...11/

Given the value of UK exports to the EU market that would be painful for both parties...11/

• • •

Missing some Tweet in this thread? You can try to

force a refresh