GoDaddy was founded in 1997 (!) and is not only still with us, but is at $4B in ARR still growing 12% YoY

Is it a SaaS company? Maybe. It's largest growth segment is Business Apps. It sells $700m of them.

5 Interesting Learnings: ⬇️⬇️⬇️⬇️⬇️

Is it a SaaS company? Maybe. It's largest growth segment is Business Apps. It sells $700m of them.

5 Interesting Learnings: ⬇️⬇️⬇️⬇️⬇️

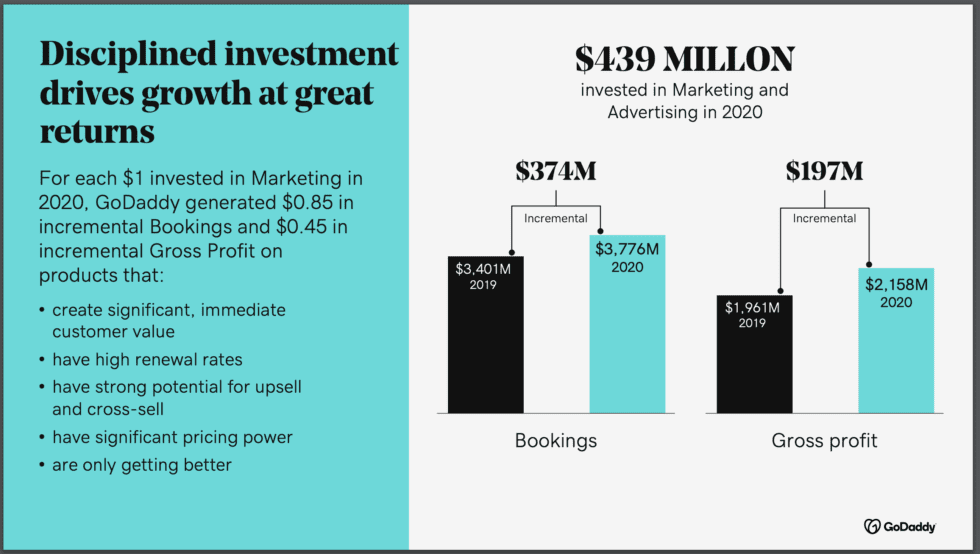

#1. >Huge investment in marketing<

GoDaddy is a marketing engine, investing $439,000,000 (!) in marketing/ads in 2020. A bit of a challenge to the notion of the power of brand at scale.

GoDaddy is a marketing engine, investing $439,000,000 (!) in marketing/ads in 2020. A bit of a challenge to the notion of the power of brand at scale.

They did acquire 1.4 million new customers for this $439m, or basically what they brought in in new bookings.

They don’t go profitable on new customers until Year 2, spending $1 to acquire $0.85 in annual bookings.

Churn is a bit murky, but obviously is the key lever here.

They don’t go profitable on new customers until Year 2, spending $1 to acquire $0.85 in annual bookings.

Churn is a bit murky, but obviously is the key lever here.

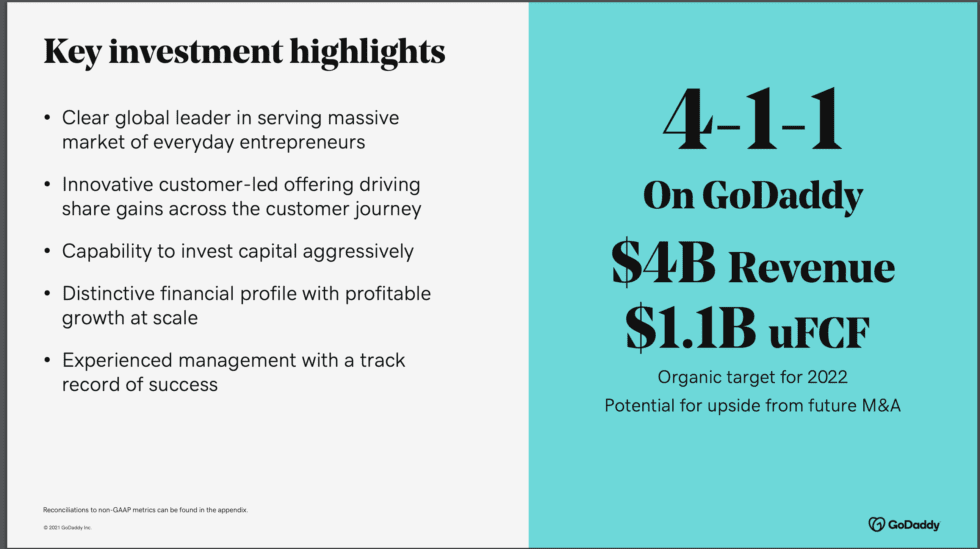

#2. SaaS is profitable at scale.

GoDaddy generates $1.1B in free-cash flow from its $4B in revenue -- even after paying $440m in marketing costs each year.

Not too shabby!

GoDaddy generates $1.1B in free-cash flow from its $4B in revenue -- even after paying $440m in marketing costs each year.

Not too shabby!

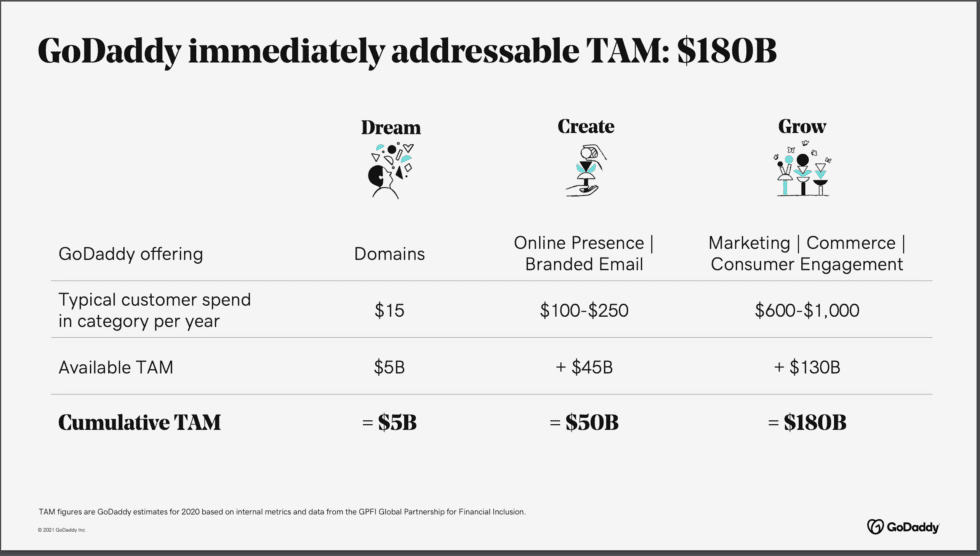

#3. Once again, you often need more than 1 product to grow past $1B in ARR.

GoDaddy is a bit like Salesforce, where its original and classic product is no longer its largest, and is also its slowest growing (and most mature) segment:

GoDaddy is a bit like Salesforce, where its original and classic product is no longer its largest, and is also its slowest growing (and most mature) segment:

#4. Added 1.4 Million More Customers in 2020.

A vivid reminder (along with Hubspot's blow-out quarter) that SMB growth in Cloud and SaaS is still going strong!

There’s no seeming ceiling to the number of SMBs that can now buy SaaS and Cloud products.

A vivid reminder (along with Hubspot's blow-out quarter) that SMB growth in Cloud and SaaS is still going strong!

There’s no seeming ceiling to the number of SMBs that can now buy SaaS and Cloud products.

#5. Freemium is back!

GoDaddy added freemium versions of its website and marketing tools and saw “millions of sign-ups with strong conversion rates”.

Like Atlassian and Hubspot, we see that adding freemium later can work. It doesn’t have to be there on Day 1.

GoDaddy added freemium versions of its website and marketing tools and saw “millions of sign-ups with strong conversion rates”.

Like Atlassian and Hubspot, we see that adding freemium later can work. It doesn’t have to be there on Day 1.

• • •

Missing some Tweet in this thread? You can try to

force a refresh