1/25: It’s been 6-months since I posted a thread about the trend of early stage companies raising of 2-3 back-to-back rounds with minimal progress in-between. I asked some amazing VCs whether or not anything has changed since. They think it’s gotten worse. Their thoughts:

2/25: We still have the conversation with Founders every few weeks if not more often: “How much can you learn how quickly for how much money?” This is even true for first equity rounds which are the bigger problem for us right now. (@iamjakestream)

3/25: The why: Many large VCs are incented to put money to work because in they’re playing an AUM game and need to show their LPs they have access to all the “hot companies”. (@iamjakestream)

4/25: We have the Sisyphean task of convincing Founders that a $5MM seed check out of a $1B+ Fund isn't necessarily going to improve their chances of getting to product-market fit. It buys runway but doesn't always increase optionality --- it can actually hurt. (@iamjakestream)

5/25: Hectocorns! (100x 🦄) Valuations are outpacing our lexicon for exceptional business. We're realizing companies can reach heights nobody imagined possible a year ago. If you want to understand "crazy" seed round pricing, start from there and work backwards. (@Mark_Goldberg_)

6/25: 6 months later = More of everything. Outcomes being lager than anyone thought possible 5 years ago (@DoorDash at $70B+, @Airbnb at $120B+, @onepeloton at $40B+) is driving a pace we’ve never seen before. (@chadbyers)

7/25: Pros: More big ideas are being given a chance at success. Startups as the innovation engine is chugging along. (@chadbyers)

8/25: Cons: Talent is more spread out than ever (opportunity cost is high for talented folks to not go start a company). Startups over capitalized w/poor financial stewardship. Scaling before product market fit. (@chadbyers)

9/25: Net: The power law business of #VC is going to get more so. Lots of $ will be wasted chasing ideas that are too early to scale, but a few will be larger than anyone dreams and the process will repeat itself. (@chadbyers)

10/25: This trend continues to occur beyond just the early stages! Folks who missed out on a previous round are coming in a week later (Literally: The $ aren’t in the bank yet) by offering a term sheet at a higher price. (@bonatsos)

11/25: Pre-seed rounds = $1.5-2MM. Seed rounds = $3-5MM. Series A = $5-$100MM (that’s not a typo)!!!!! Founders are getting a lot more ambitious/aggressive. Why not given the hot market? Capital is cheap. Grow at all costs seems to be the mantra again! (@bonatsos)

12/25: VCs seem to have given up being price sensitive and disciplined. It doesn’t work if you want to become a volume player. Some crossover funds have come in and they do everything that they can in today’s hot market. (@bonatsos)

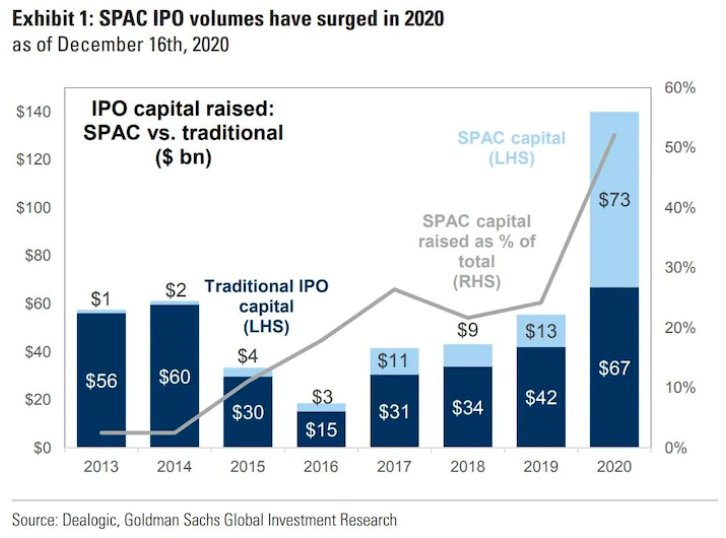

13/25: The most important trend right now are SPACtacular valuations reminiscent of the dot-com bubble. SPACs may turn out to be the long-awaited replacement to the small-cap IPO or may turn out to be the financial film-flam that pops this bubble (@duncandavi)

14/25: In the past 6 months we have noticed a profound bifurcation in valuations. The elite few get huge valuation multiples and the rest get middling multiples. The difference? The elite are seen as part of the long-term future tech stack of major companies. (@duncandavi)

15/25: One trend to watch is the Financialization of SaaS - The adding of payment rails to a SaaS business. Several of our companies have turned on transactions and seen a marked increase in revenue, delighted customers and valuation. (@duncandavi)

16/25: One phenomenon driving back-to-back rounds is the emergence of indexing behavior in private markets. Some investors (including some very smart ones) are paying generous prices to get invested in multiple companies in a category. (@nshalek)

17/25: The logic of pre-raising ahead of progress is “be prepared to weather a storm” or “never have to raise again”. In practice, it’s rare to see companies w/the discipline required to have money but not spend it, especially as their peers raise competitive rounds. (@nshalek)

18/25: Founders raising rapid back-to-back rounds may inadvertently give up something valuable for their teams: The motivating effect of steady progress tied to a reliably increasing share price. (@nshalek)

19/25: I've continued to see both the large early stage round dynamic as well as the back-to-back round one in the market and attribute both paradigms to two primary reasons: Competitor Capitalization and Early Stage Fundraising pain. (Anonymous)

20/25: Entrepreneurs wary of other early stage businesses in their space continue to be hyper-focused on wanting to lock up capital & VC relationships to preempt others from having a capital advantage. This creates a "raise a wartime chest" mentality. (Anonymous)

21/25: Many serial Entrepreneurs have shown an aversion to raising painful, incremental small rounds, preferring instead to fill the gas tank and floor the accelerator. Investors are agreeable which has led to larger first rounds and/or fast back-to-back rounds. (Anonymous)

22/25: My take – The VC playbook on how to generate returns has shifted dramatically. 10 years ago the goal was to back companies that could exit at $500MM-$1B. 5 years ago the objective function changed to $1B-$10B. Now we routinely talk about companies with $10B+ potential.

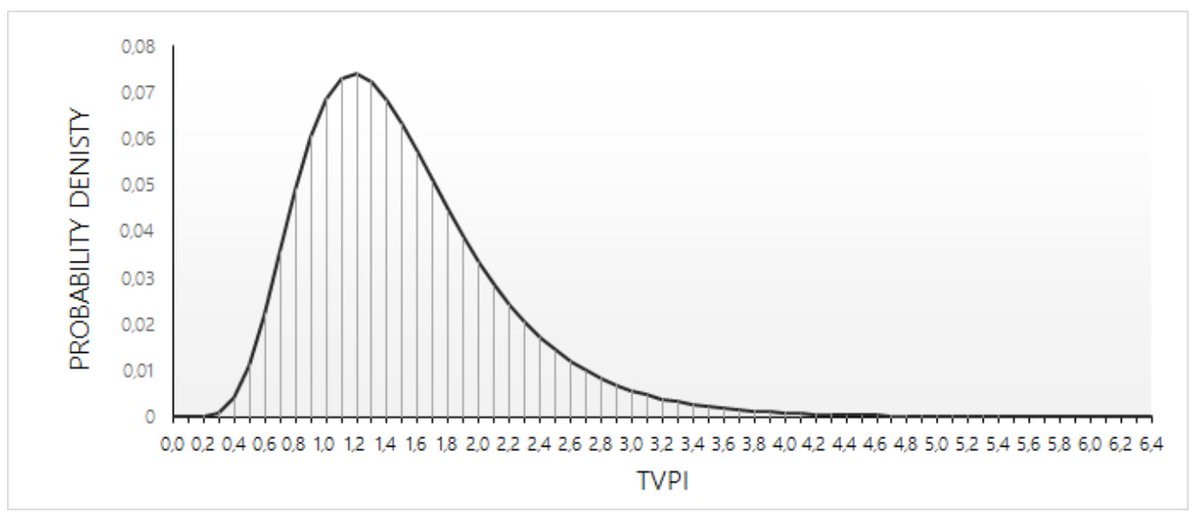

23/25: Simultaneously, yield has dropped to 0 outside of the equity markets. So instead of the VC asset class benefiting from much larger outcomes, early stage valuations have adjusted to chase the same potfolio outcomes (3X+ MOIC) based on a distribution with a MUCH longer tail.

24/25: And when “how high is up” has 1 if not 2 extra zeros on it for the winners, many smart investors are trying to plant money in as many, high-potential early stage companies as they can. Paying up/putting more money behind newly raised money is how they’re doing it.

25/25: Love to hear what other people are seeing (RT or Reply with your thoughts)! And in case you’re interested, the original thread from 6 months ago is here:

https://twitter.com/fintechjunkie/status/1299394389844865025?s=20.

• • •

Missing some Tweet in this thread? You can try to

force a refresh