MicroStrategy to borrow $600 million to buy more bitcoin: reuters.com/article/crypto… by @ReutersNoor $BTC $ETH $MSTR

Borrowing to buy Bitcoin...that doesn’t sound risky at all!

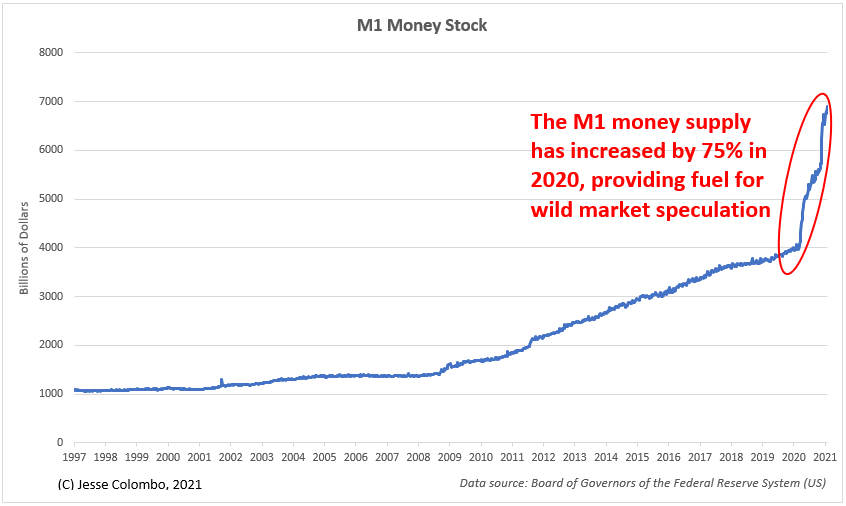

That’s where we are in the cycle...

That’s where we are in the cycle...

https://twitter.com/TheBubbleBubble/status/1361761183695446019?s=20

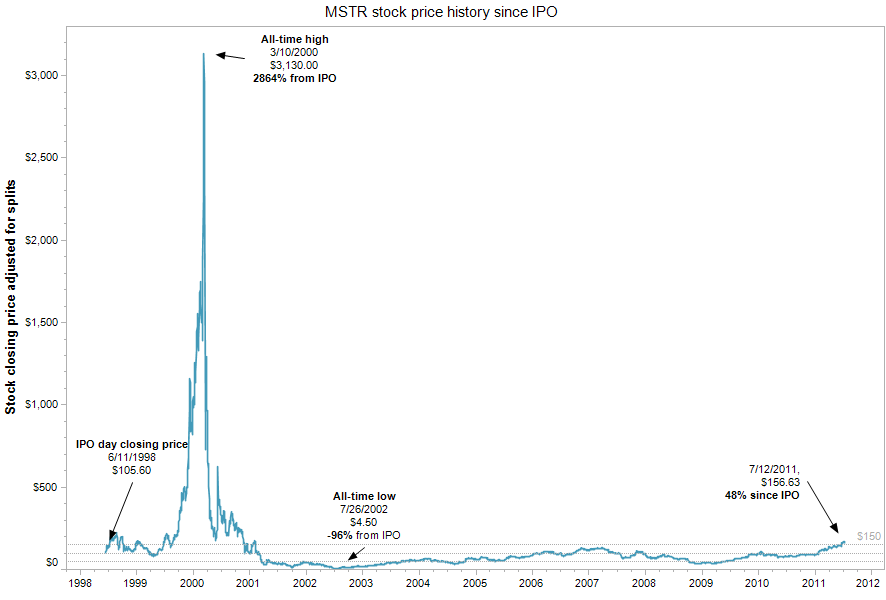

MicroStrategy is practically synonymous with “tech bubble.”

They were one of the poster children for the late-1990s Dot-com bubble (see chart below).

Is history repeating?

They were one of the poster children for the late-1990s Dot-com bubble (see chart below).

Is history repeating?

The problem is that today’s trader bros don’t remember the Dot-com bubble because they were in diapers then (if they were even born).

They think that the Dot-com bubble is ancient history and that those lessons don’t apply today. They’re sorely mistaken.

They think that the Dot-com bubble is ancient history and that those lessons don’t apply today. They’re sorely mistaken.

https://twitter.com/TheBubbleBubble/status/1361762730911260672?s=20

For today’s short-sighted, sophomoric, hubristic, avaricious, and “bubble drunk” trader bros, the Dot-com bubble may as well be a long-past historic era like WW I, WW II, etc.

They’ve little sense or knowledge of history.

As someone who appreciates history, I find it bizarre.

They’ve little sense or knowledge of history.

As someone who appreciates history, I find it bizarre.

• • •

Missing some Tweet in this thread? You can try to

force a refresh