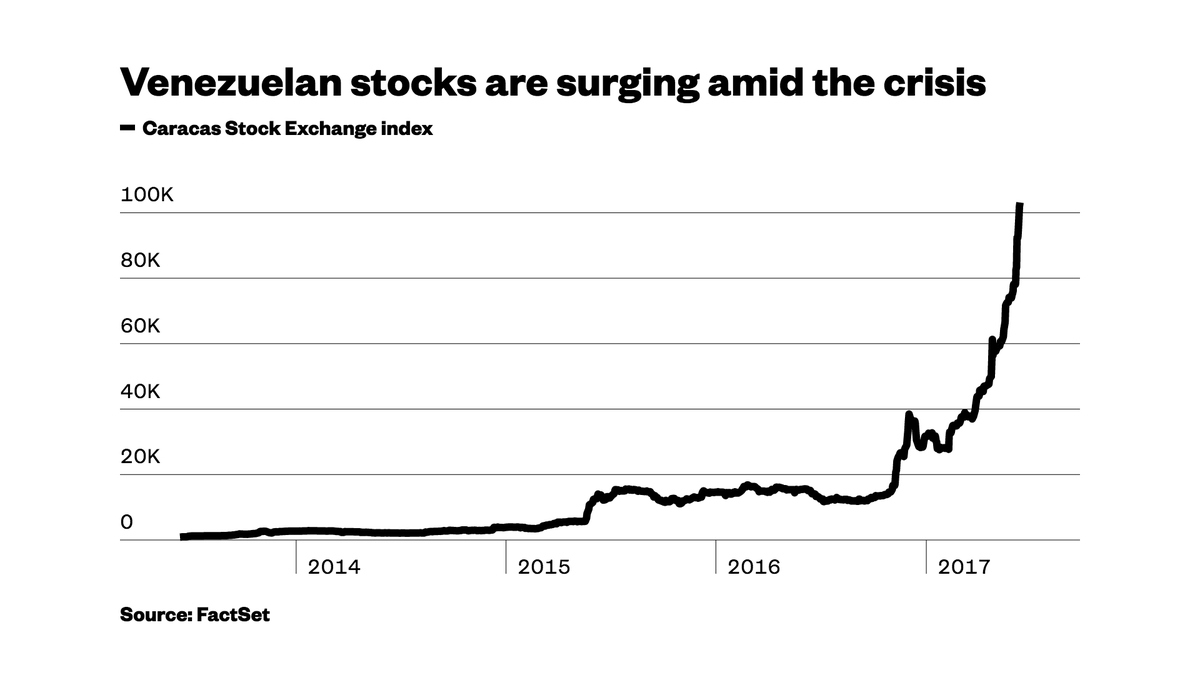

Why are the markets going ballistic? Why is Bitcoin soaring? What explains the rise of the Robinhood traders?

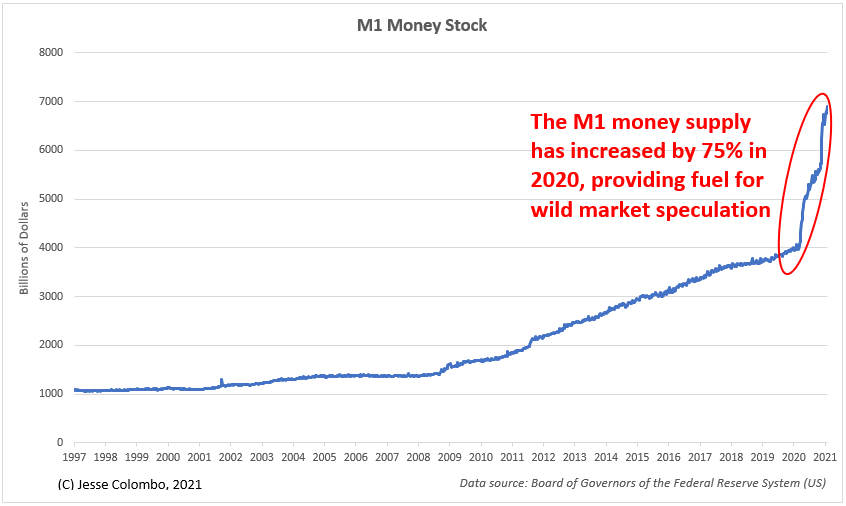

The answer is the incredible amount of new liquidity looking for a home ->

The answer is the incredible amount of new liquidity looking for a home ->

To understand the implications of rampant money printing (see chart above) and the speculative manias & false booms that it unleashes, I implore you to read this excellent free ebook, "Dying of Money: Lessons of the Great German & American Inflations":

recision.files.wordpress.com/2010/12/jens-p…

recision.files.wordpress.com/2010/12/jens-p…

Please pay attention to Germany's hyperinflation, esp. in the early stages. Read about the stock trading mania, the false economic boom that resulted from all of the newly printed money, and how it all ended in tears.

We're making the same mistake today!

We're making the same mistake today!

https://twitter.com/TheBubbleBubble/status/1358933570711130115

One of my favorite economics quotes of all time comes from Murray Rothbard -

"Inflation, therefore, lowers the general standard of living in the very course of creating a tinsel atmosphere of 'prosperity.'"

That is what we are experiencing today! It's all a mirage.

"Inflation, therefore, lowers the general standard of living in the very course of creating a tinsel atmosphere of 'prosperity.'"

That is what we are experiencing today! It's all a mirage.

Here's how Rothbard's "tinsel atmosphere of prosperity" applies now ->

The real economy is in the dumps, tens of millions are unemployed & in poverty, yet a market mania has gripped the country!

Tales abound of fortunes being made from speculation in Tesla, Bitcoin, etc.

The real economy is in the dumps, tens of millions are unemployed & in poverty, yet a market mania has gripped the country!

Tales abound of fortunes being made from speculation in Tesla, Bitcoin, etc.

To all you new and young traders (and everyone, really):

You need to study history!

My advice is to reduce the time spent on Reddit & social media and spend more time reading classic old books about economics, investing, stock market history, etc.

You need to study history!

My advice is to reduce the time spent on Reddit & social media and spend more time reading classic old books about economics, investing, stock market history, etc.

I'm particularly fascinated by Germany's hyperinflation of the 1920s because I literally would have never been born if it wasn't for that horrible episode.

My grandfather was born in Germany in 1921 and his family emigrated to the U.S. shortly after:

My grandfather was born in Germany in 1921 and his family emigrated to the U.S. shortly after:

https://twitter.com/TheBubbleBubble/status/632013126058295296?s=20

His family emigrated from Germany because times were extremely hard:

the money became worthless, people were starving, there were communist uprisings & fighting in the streets, and hundreds of politicians were assassinated at that time!

the money became worthless, people were starving, there were communist uprisings & fighting in the streets, and hundreds of politicians were assassinated at that time!

https://twitter.com/TheBubbleBubble/status/632013126058295296?s=20

Eventually, those tough economic times led to the rise of Adolf Hitler.

So, the point here is that economic crises & hyperinflations lead to the rise of extremist political leaders.

THAT is why my goal is to warn about them! It's not about trading! Do you understand now?

So, the point here is that economic crises & hyperinflations lead to the rise of extremist political leaders.

THAT is why my goal is to warn about them! It's not about trading! Do you understand now?

• • •

Missing some Tweet in this thread? You can try to

force a refresh