Let's have a discussion: I have genuine questions & concerns about Bitcoin & cryptos as a store of value.

First off, I've believed in owning Bitcoin as a diversifier since it was a few hundred dollars per coin - 1/100th of today's price:

$BTC $ETH $DOGE

First off, I've believed in owning Bitcoin as a diversifier since it was a few hundred dollars per coin - 1/100th of today's price:

https://twitter.com/TheBubbleBubble/status/703605979527712769

$BTC $ETH $DOGE

Next, I've always believed in owning gold & silver.

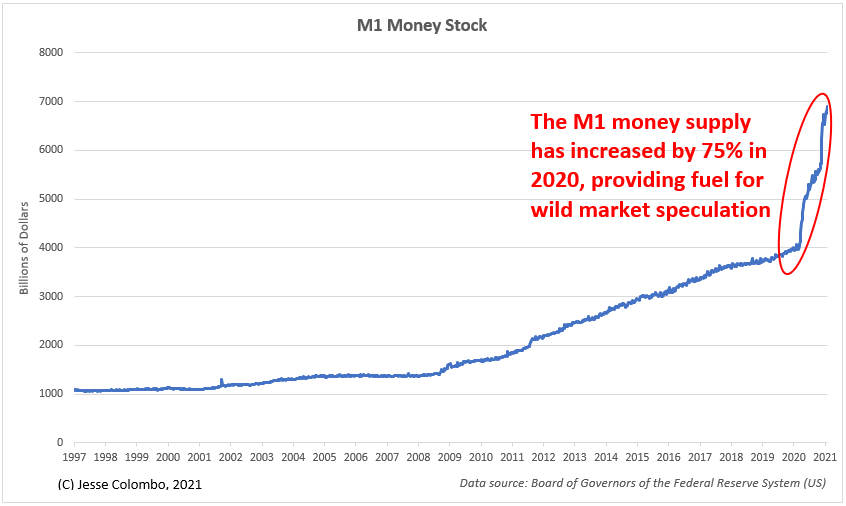

I believe Bitcoin is a good addition to a portfolio of hard assets/alternative assets given my concerns in today's monetary environment.

There's no reason for them to be mutually exclusive ->

I believe Bitcoin is a good addition to a portfolio of hard assets/alternative assets given my concerns in today's monetary environment.

There's no reason for them to be mutually exclusive ->

https://twitter.com/TheBubbleBubble/status/1131971143139811331?s=20

Now, here's my major, nagging doubt and concern about Bitcoin & other cryptos, which explains why I've never been a fanatic of them, like so many people are today:

An important feature of good money & a store of value is scarcity.

Cryptocurrencies simply don't have that.

An important feature of good money & a store of value is scarcity.

Cryptocurrencies simply don't have that.

Yes, I'm aware that there is a limit to the number of Bitcoins that can ultimately exist, which is great...if Bitcoin is the only cryptocurrency in existence.

But we need to be realistic: an unlimited number of cryptocurrencies can be created and the process has already started.

But we need to be realistic: an unlimited number of cryptocurrencies can be created and the process has already started.

There is no competitive moat for cryptocurrencies.

No matter how much demand there is for cryptos, more than enough supply will come online (because it's digital - it costs nothing to create!).

An unlimited supply of cryptocurrencies can come online. That's not scarcity, folks.

No matter how much demand there is for cryptos, more than enough supply will come online (because it's digital - it costs nothing to create!).

An unlimited supply of cryptocurrencies can come online. That's not scarcity, folks.

There's an old economics adage -

"the only cure for high prices is high prices."

So, now that Bitcoin/crypto prices have soared, and unlimited number of new cryptos can come onto the market, which will absorb demand, which should (ultimately) lead to lower prices.

"the only cure for high prices is high prices."

So, now that Bitcoin/crypto prices have soared, and unlimited number of new cryptos can come onto the market, which will absorb demand, which should (ultimately) lead to lower prices.

What's so special about Bitcoin that 1,000 or ONE BILLION other cryptos can't match?

Yes, I understand the first-mover advantage from a branding, marketing, and psychological standpoint.

But there's really no moat to prevent unlimited competition from eating its lunch.

Yes, I understand the first-mover advantage from a branding, marketing, and psychological standpoint.

But there's really no moat to prevent unlimited competition from eating its lunch.

Gold and silver have been successful stores of value for over 5,000 years because of their scarcity.

Medieval alchemists tried to reproduce precious metals to no avail.

But, with crypto, there's no need for alchemists: crypto is as scarce as silicon dioxide (i.e., sand).

Medieval alchemists tried to reproduce precious metals to no avail.

But, with crypto, there's no need for alchemists: crypto is as scarce as silicon dioxide (i.e., sand).

I honestly believe that crypto fanatics are deluding themselves and they're completely blind to this fatal flaw (lack of scarcity) that I just discussed.

So, yes, I still believe in having (some) Bitcoin as a diversifier, but I'm not a fanatic.

But let me hear your thoughts!

So, yes, I still believe in having (some) Bitcoin as a diversifier, but I'm not a fanatic.

But let me hear your thoughts!

Btw, @PeterSchiff makes some excellent points about the serious downsides and risks of cryptocurrencies.

Don't write his ideas off. No, I'm not a Boomer; I'm a millennial.

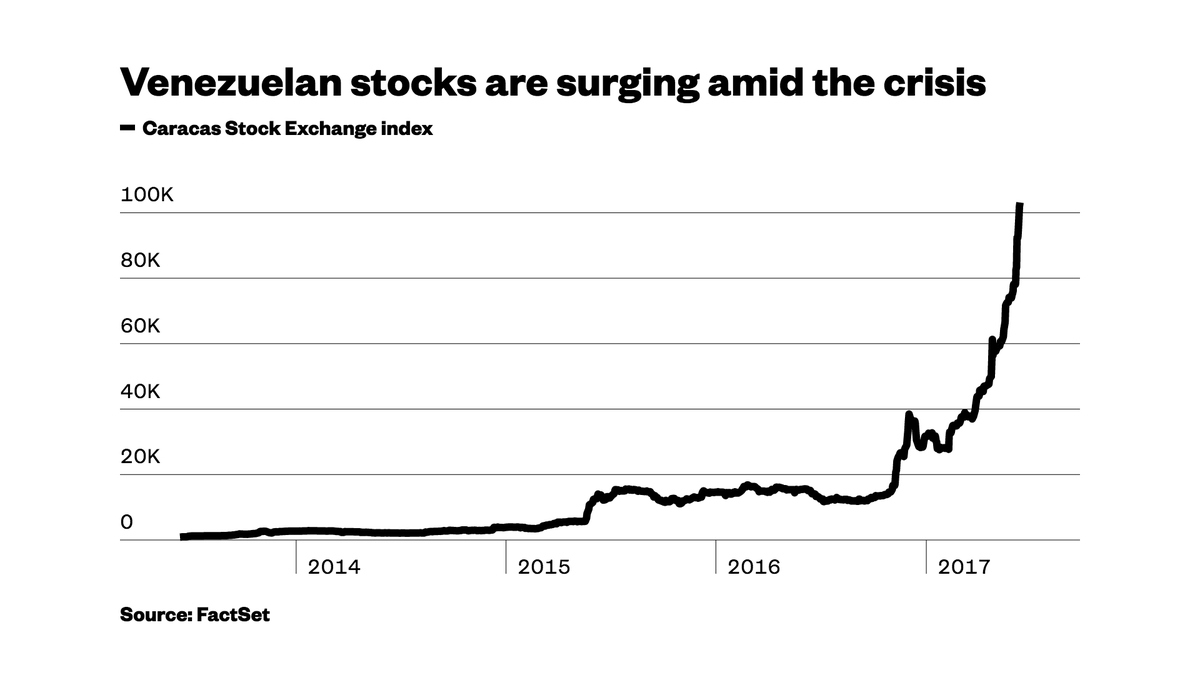

Just because crypto is soaring doesn't make it a sound investment, currency, or store of value.

Don't write his ideas off. No, I'm not a Boomer; I'm a millennial.

Just because crypto is soaring doesn't make it a sound investment, currency, or store of value.

• • •

Missing some Tweet in this thread? You can try to

force a refresh