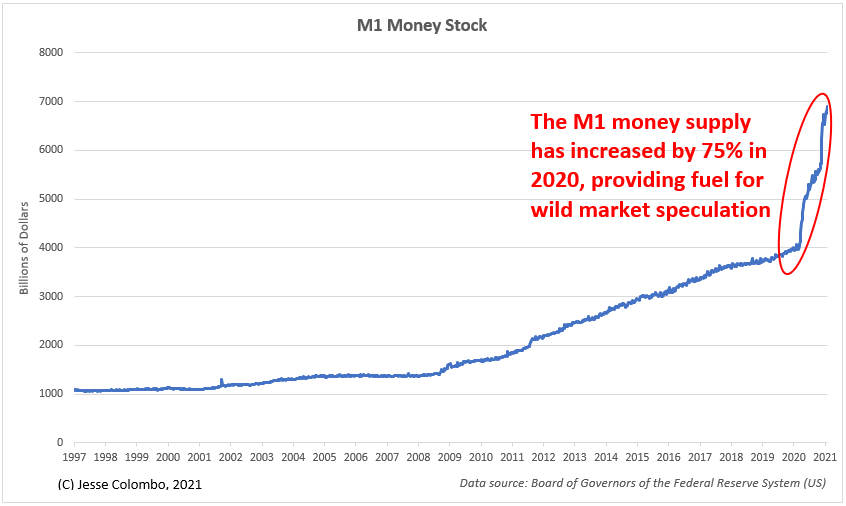

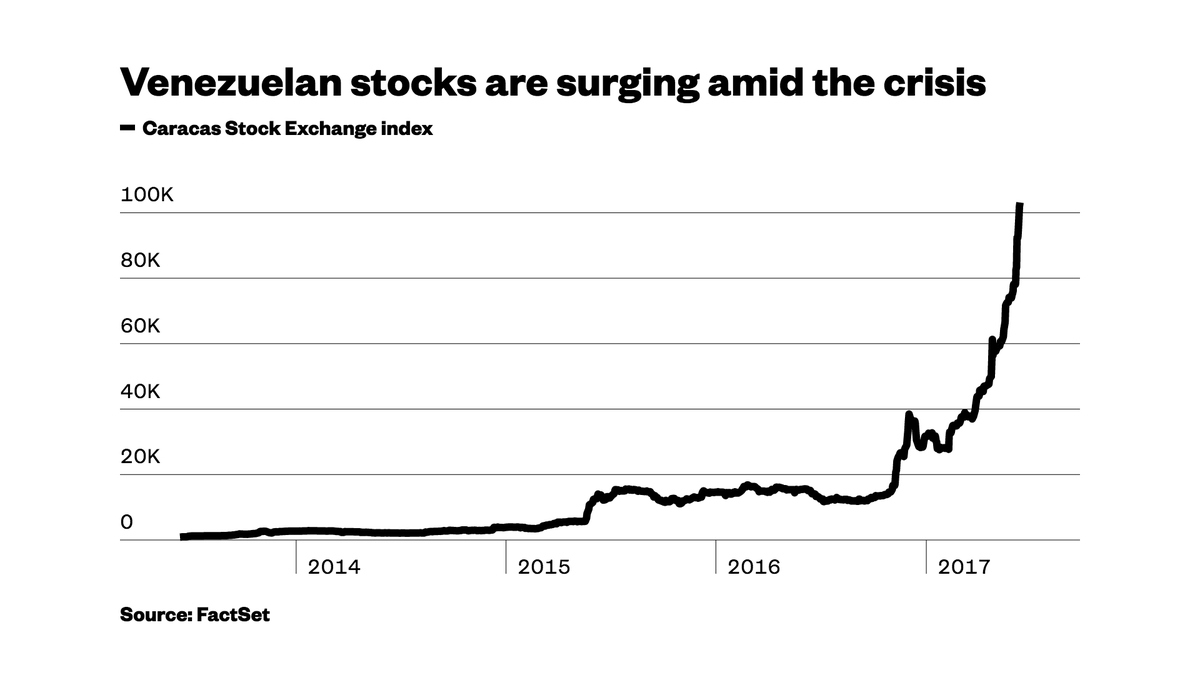

Is This The Biggest Financial Bubble Ever? Hell, Yes, It Is: dollarcollapse.com/biggest-financ… @dollarcollapse $SPY $QQQ

Fund Manager Mark Yusko: US stocks are in a bubble - "Look at the parabolic moves by a number of companies like Tesla": cnn.com/2021/02/08/inv… @MarkYusko @MattEganCNN $TSLA $QQQ

• • •

Missing some Tweet in this thread? You can try to

force a refresh