1/ Memes only get you so far. Tokens eventually meet gravity and trade on valuations.

So how do you value DeFi Lending tokens?

$AAVE, $COMP, $ALPHA, $MKR, $CREAM

Thread👇🏻👇🏻

messari.io/article/a-clos…

So how do you value DeFi Lending tokens?

$AAVE, $COMP, $ALPHA, $MKR, $CREAM

Thread👇🏻👇🏻

messari.io/article/a-clos…

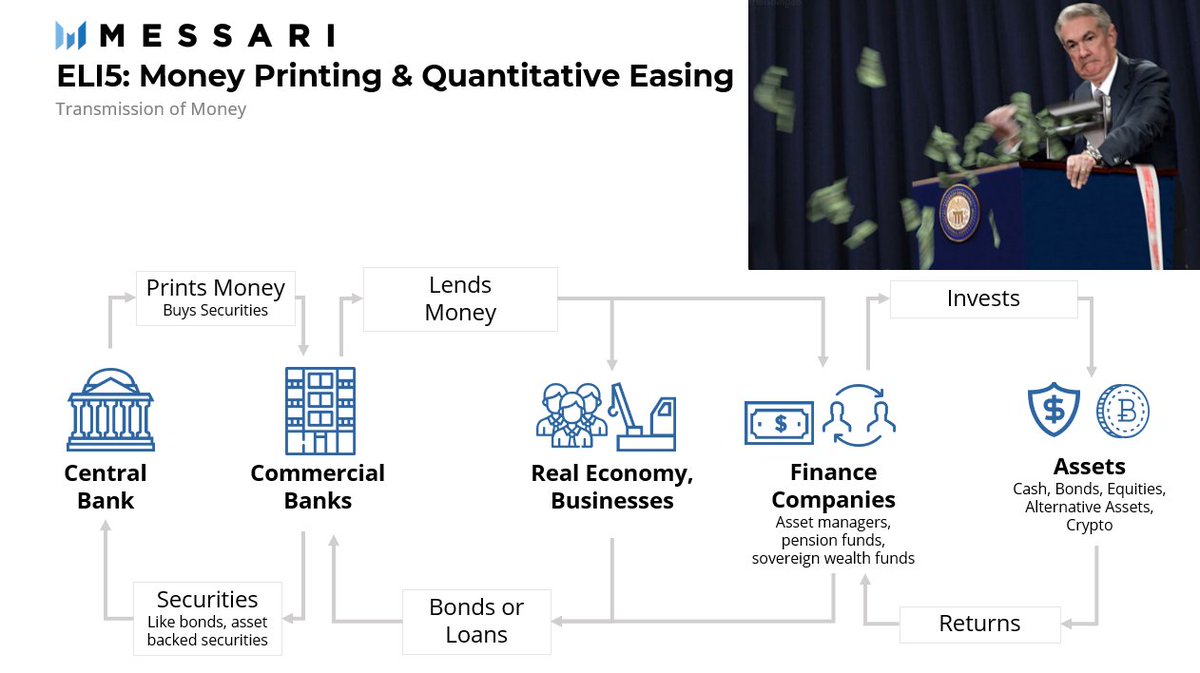

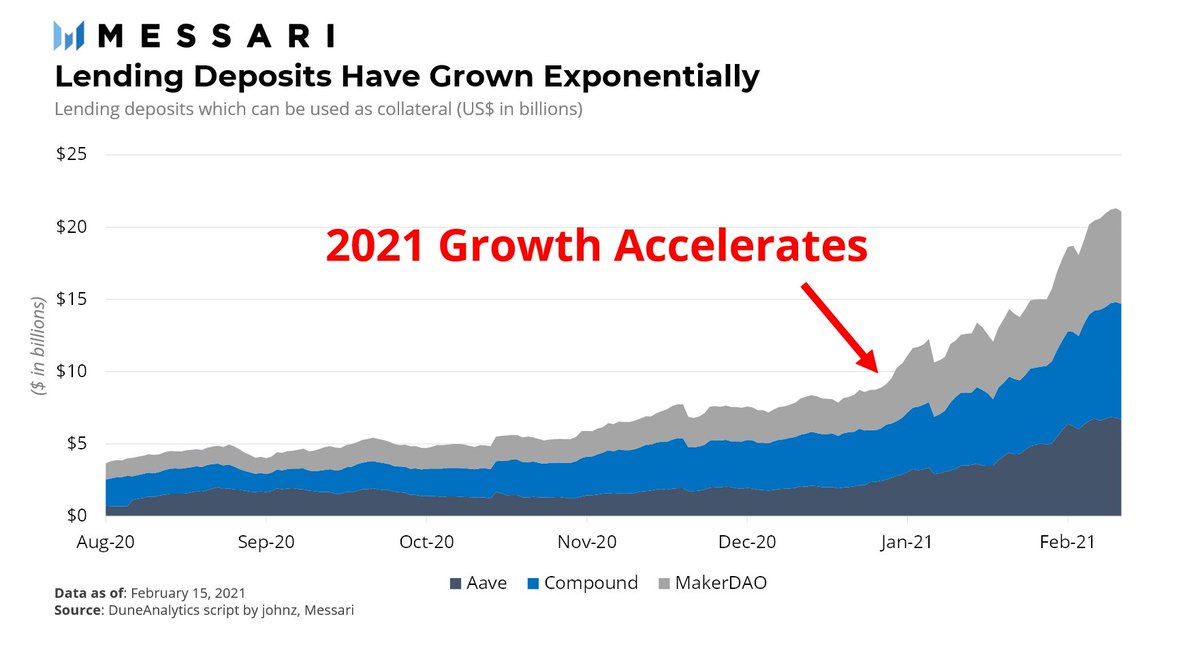

2/ Why is this important? Lending Deposits are at $20 billion, generating $660 million interest annually.

Protocols extract value by both attracting capital and putting it to use. Major pricing dislocations happen.

Protocols extract value by both attracting capital and putting it to use. Major pricing dislocations happen.

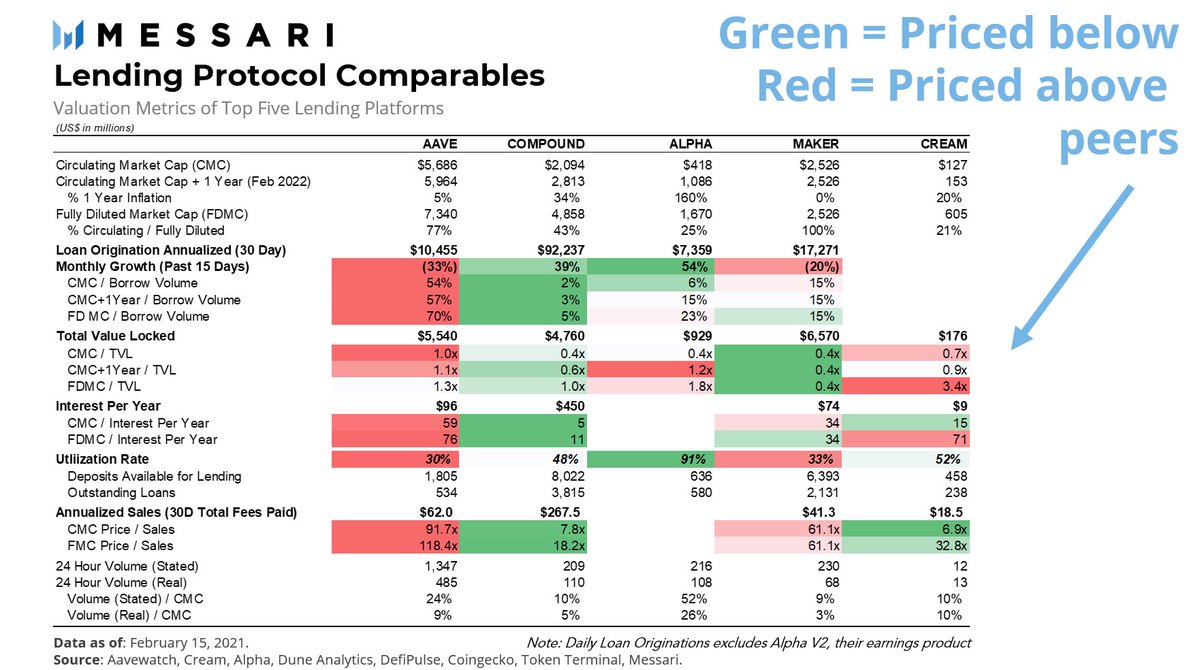

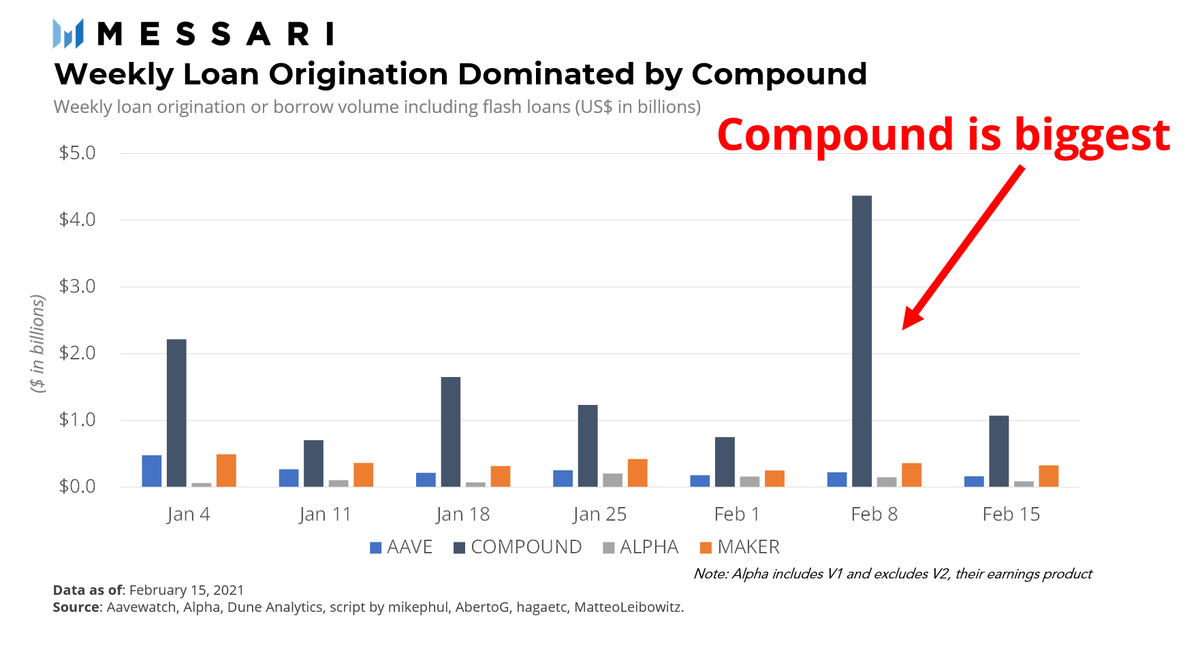

3/ Loan Origination --> Fees are typically extracted based on borrow volume. @AlphaFinanceLab has originated $1 billion in its first 3 months.

Price / Borrow Volume is a key metric. In the report, we also showcase Borrow Vol growth

Price / Borrow Volume is a key metric. In the report, we also showcase Borrow Vol growth

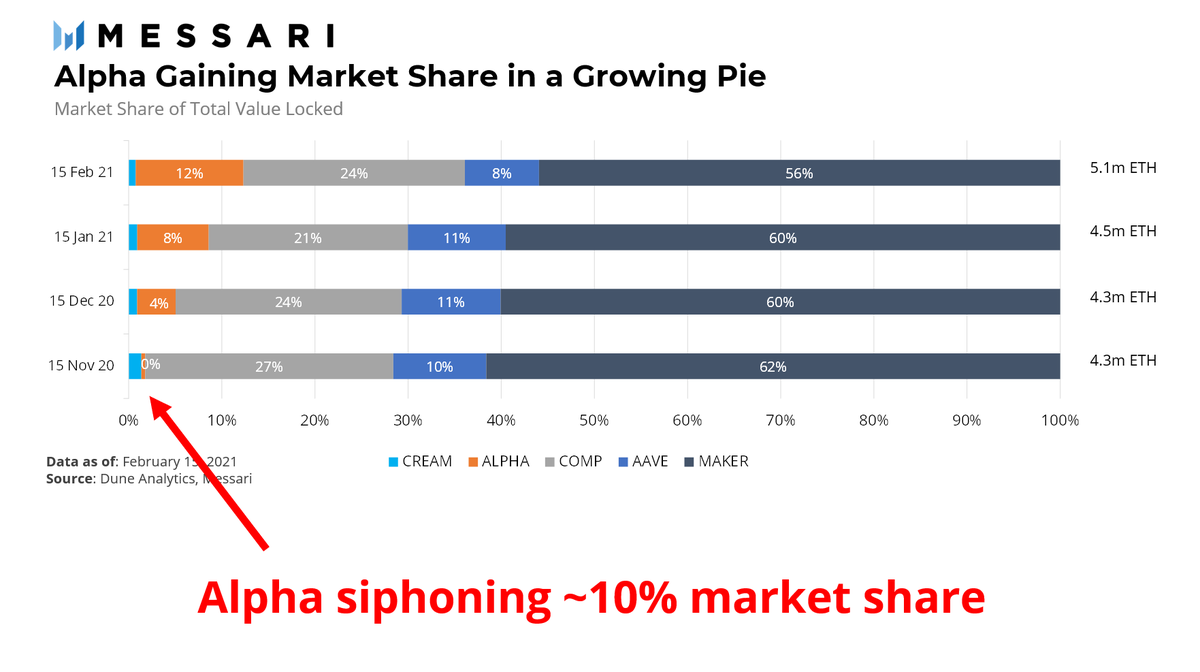

4/ Total Value Locked (TVL) correlates to a protocol's ability to attract capital.

Price / TVL can be volatile -- TVL retention is also important to consider

Price / TVL can be volatile -- TVL retention is also important to consider

5/ Interest per year is calculated by multiplying the current borrow rate by the total outstanding debt. It shows the interest accruing in that protocol.

$COMP doesn't receive any of that interest while $MKR receives all.

Deep dive --> messari.io/article/a-clos…

$COMP doesn't receive any of that interest while $MKR receives all.

Deep dive --> messari.io/article/a-clos…

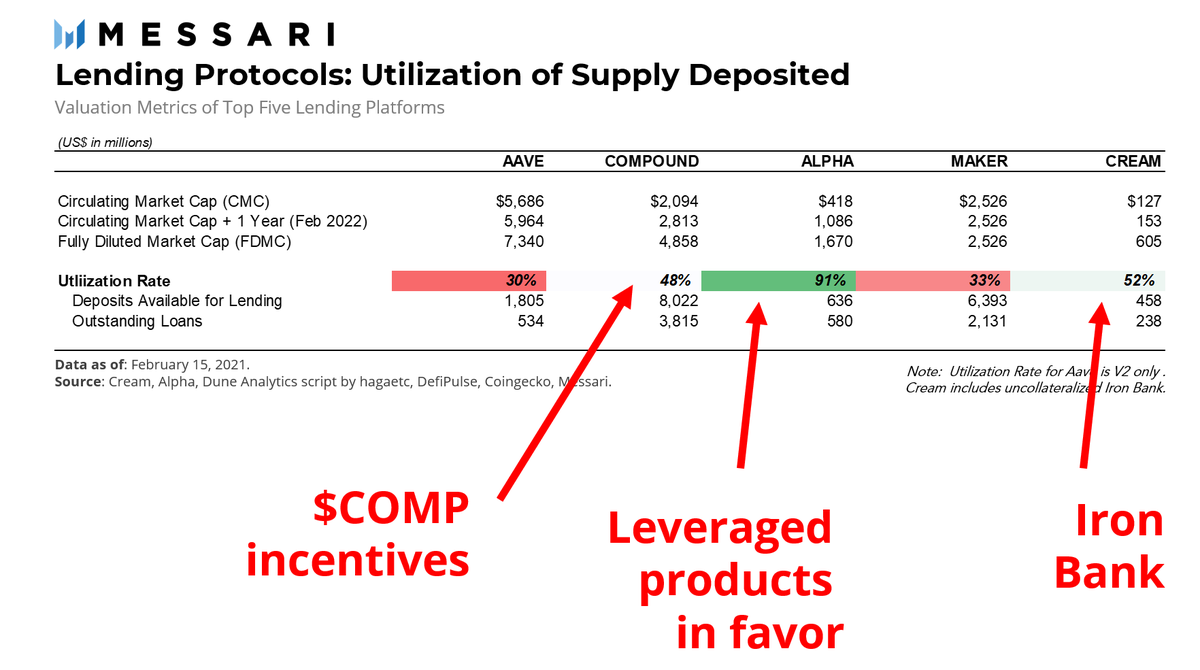

6/ Utilization Ratio: Many protocols are able to attract supply through incentives but utilization is an indication that the deposits supplied are being put to use and able to sustain the yields to suppliers.

$COMP, $CREAM, $ALPHA rank high

$COMP, $CREAM, $ALPHA rank high

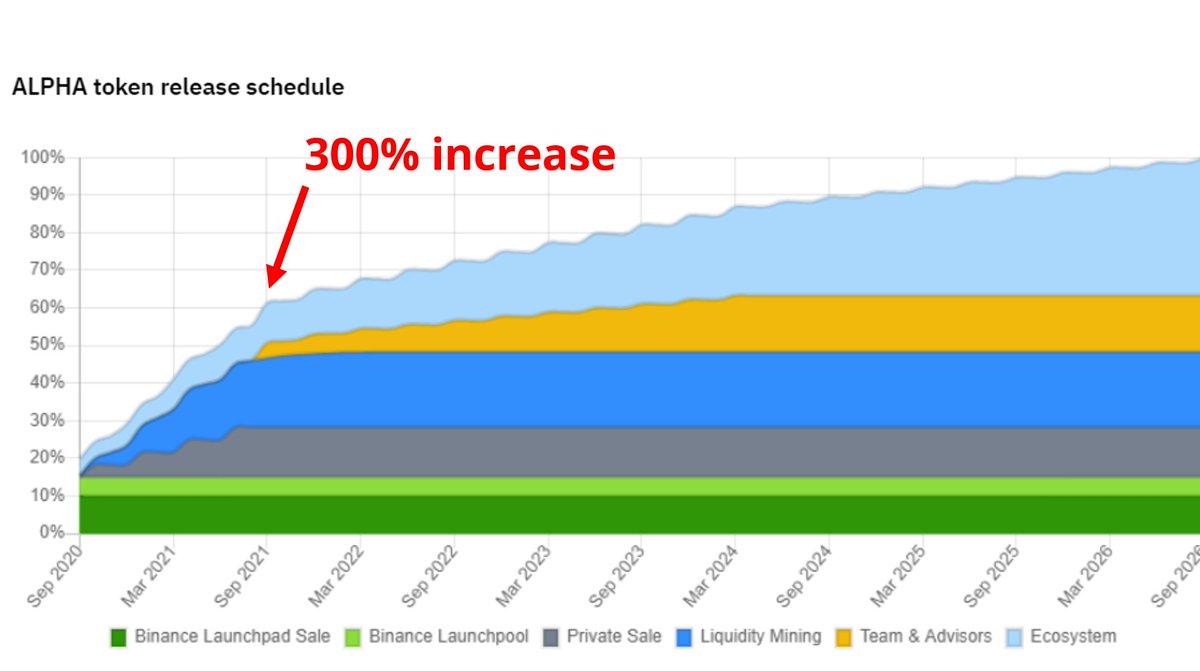

7/ Annualized Sales and Inflation are the final 2 metrics. Sales refer to the total fees paid. And Inflation is the supply schedule in 1 year and in 50 years.

$ALPHA has the highest inflation. It's inflation also jumped nearly 10% in the past week, possibly due to the exploit

$ALPHA has the highest inflation. It's inflation also jumped nearly 10% in the past week, possibly due to the exploit

8/ Paying attention to valuation metrics will be more important as DeFi matures.

Projects that are able to utilize existing funds and originate more loans, in addition to capturing value should trade at higher multiples.

Deep dive -->messari.io/article/a-clos…

Projects that are able to utilize existing funds and originate more loans, in addition to capturing value should trade at higher multiples.

Deep dive -->messari.io/article/a-clos…

• • •

Missing some Tweet in this thread? You can try to

force a refresh