ELI50 Macro & crypto. Formerly @DCGco @messaricrypto, TradFi 15 years, managed $7bn equities fund and founded a meditation studio.

How to get URL link on X (Twitter) App

There are ~30 *major* China property companies. Guangzhou R&F has the most leverage. Actually, of the China government's 3 "red lines", G R&F is the worst off.

There are ~30 *major* China property companies. Guangzhou R&F has the most leverage. Actually, of the China government's 3 "red lines", G R&F is the worst off.

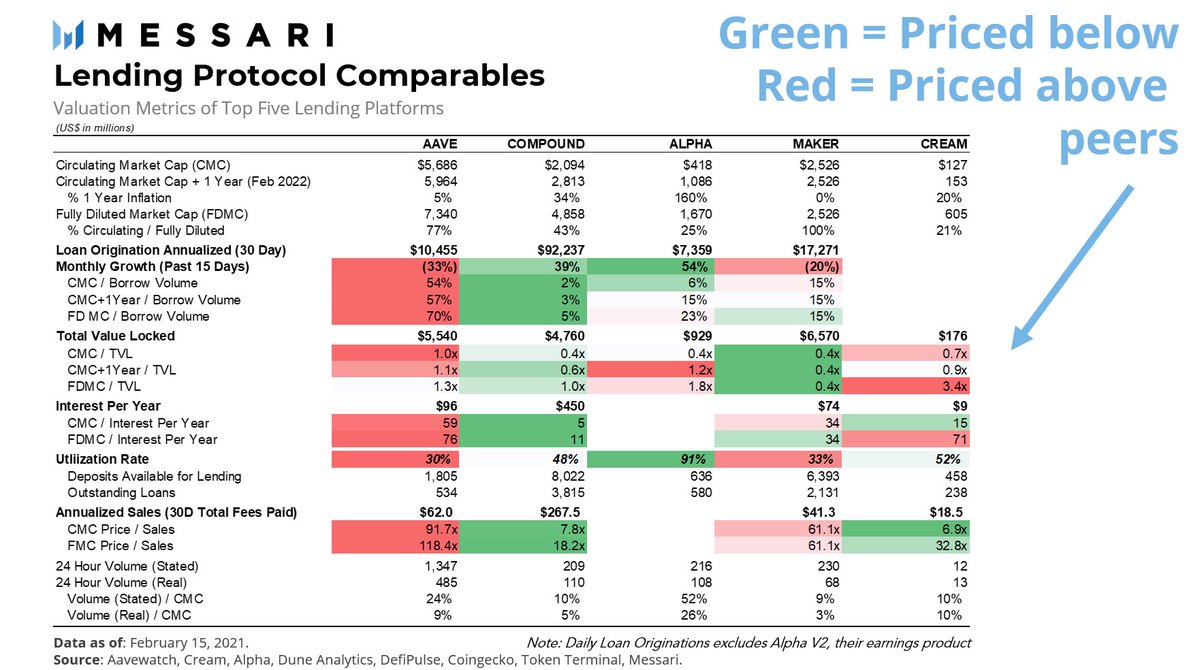

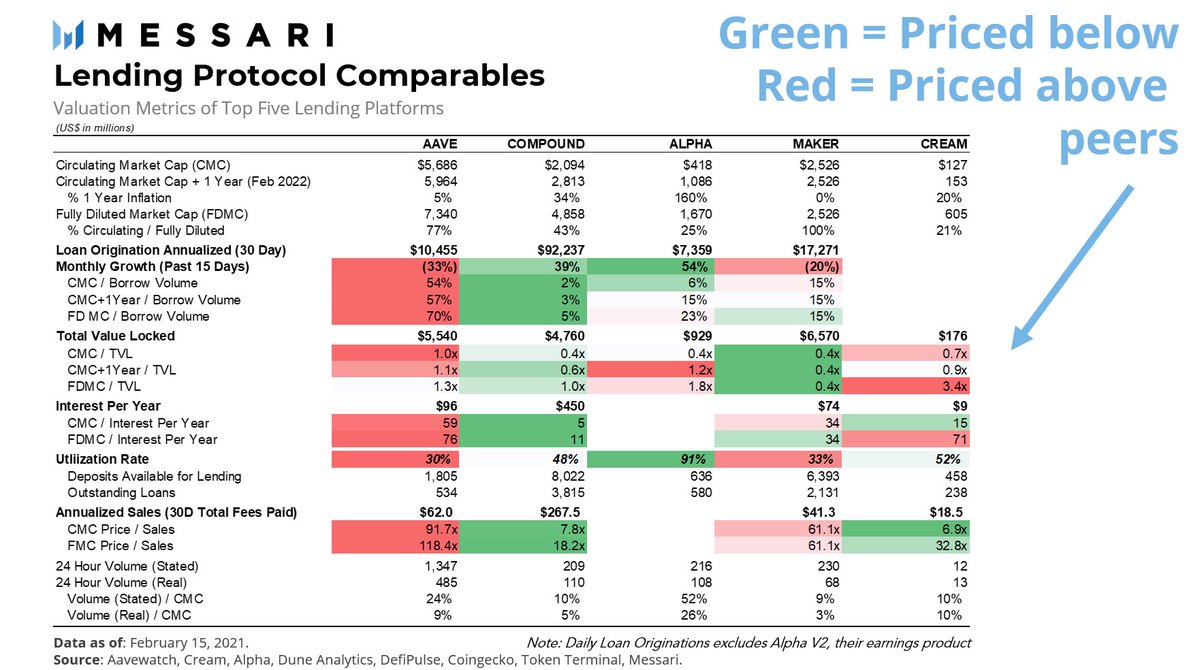

First, why is TVL useless as a price signal?

First, why is TVL useless as a price signal?

1. What is MEV? It's the additional profit a miner can get by re-ordering, including or excluding transactions from the blocks they are in charge of producing.

1. What is MEV? It's the additional profit a miner can get by re-ordering, including or excluding transactions from the blocks they are in charge of producing.

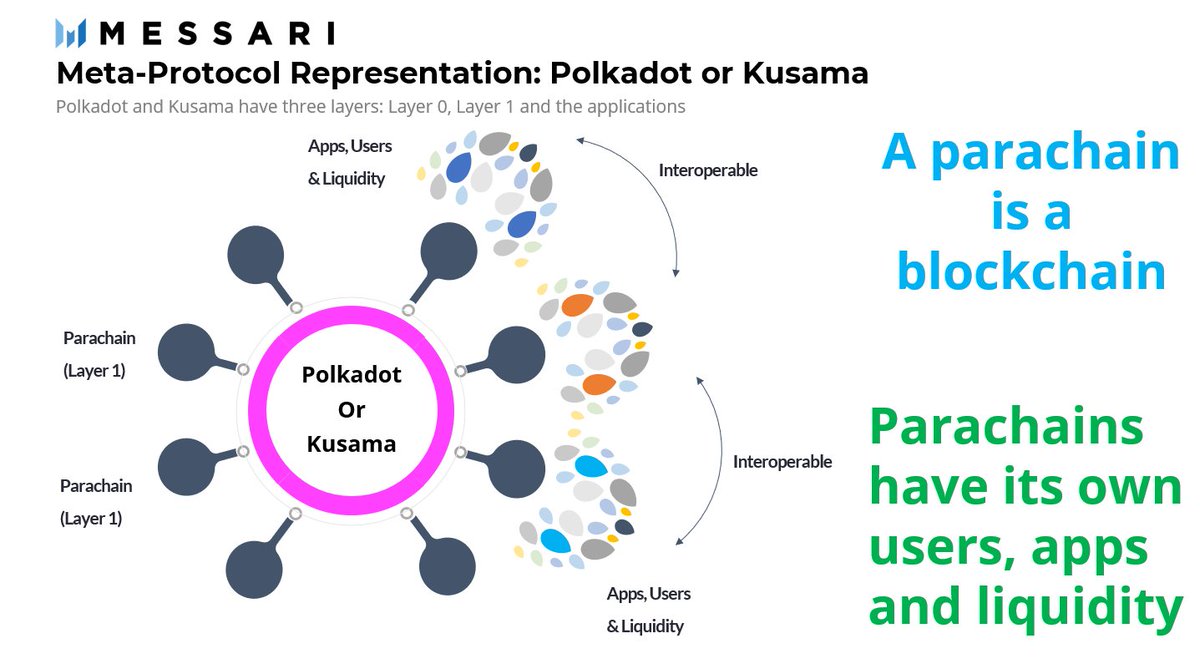

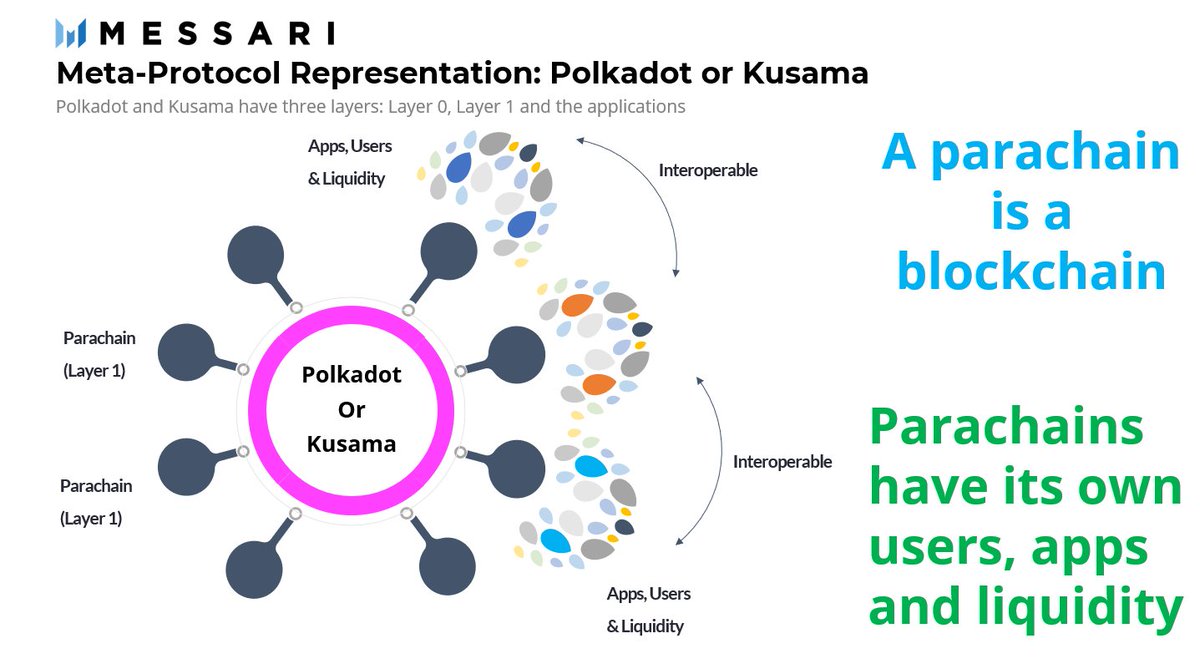

2) "Ending": There are 5 consecutive one-week auctions, 1 per week. If the project doesn't win in 43 days, then the $KSM is return to the community automatically. There will be a pause to stablized the network or even start @Polkadot's auctions

2) "Ending": There are 5 consecutive one-week auctions, 1 per week. If the project doesn't win in 43 days, then the $KSM is return to the community automatically. There will be a pause to stablized the network or even start @Polkadot's auctions

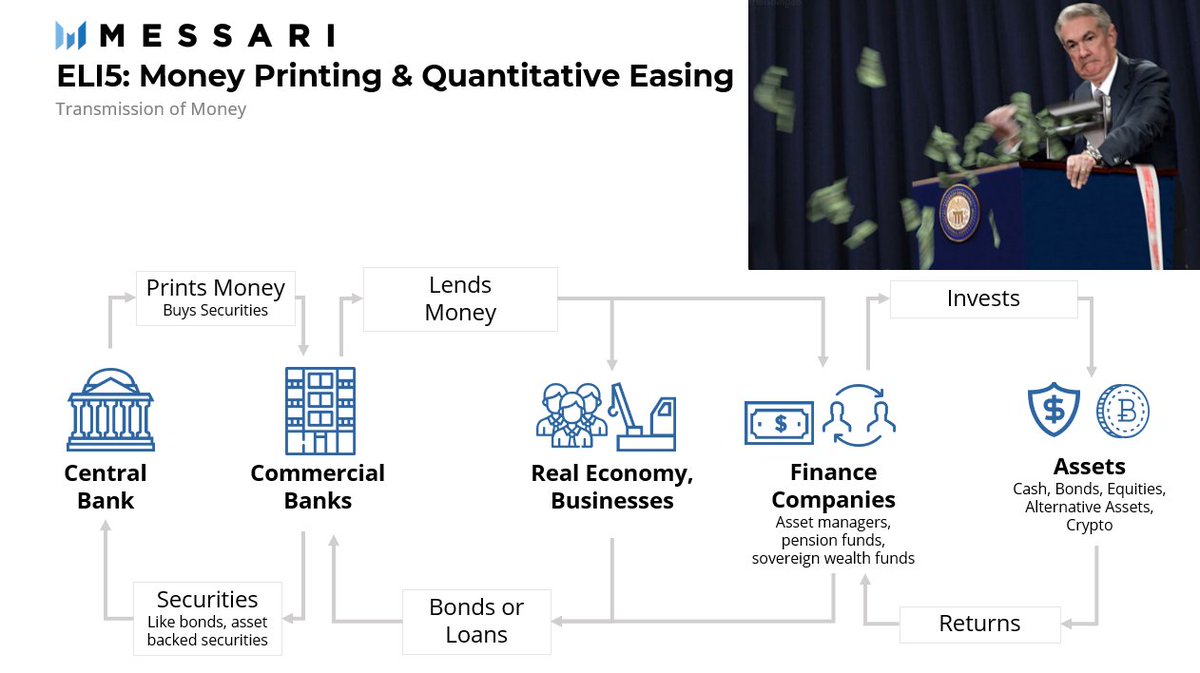

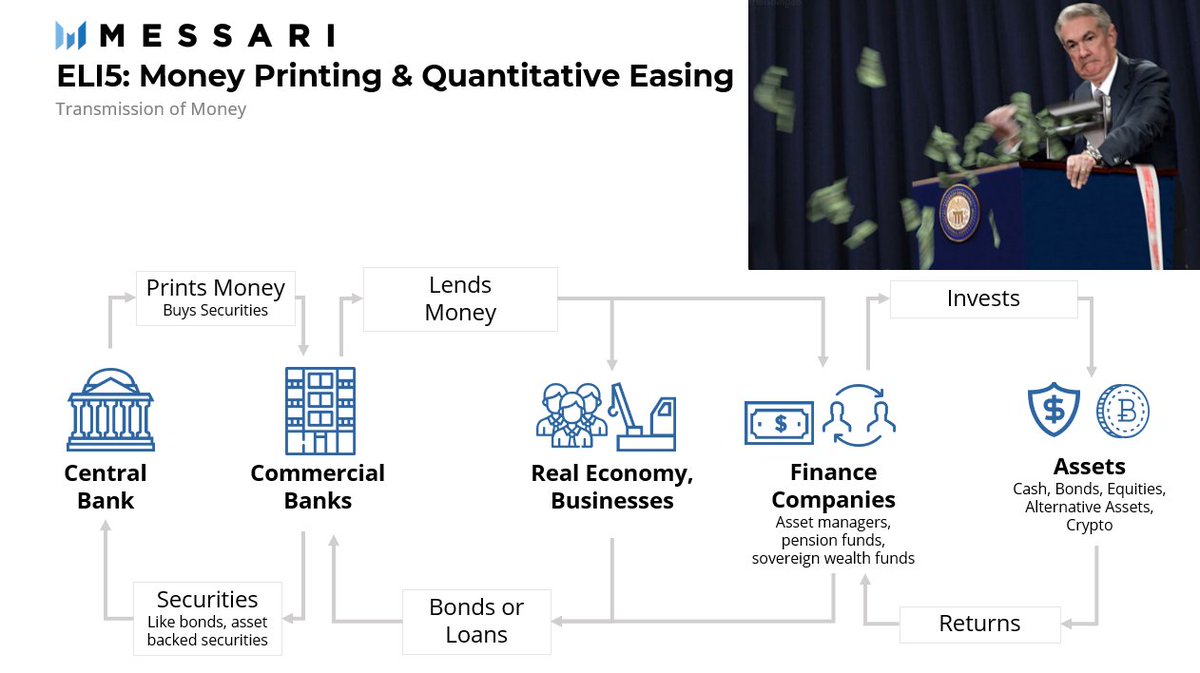

But with institutional adoption, we now need to pay attention to cross-asset flows. #Bitcoin is viewed as a risk-on, growth asset, at the extreme end of the risk spectrum.

But with institutional adoption, we now need to pay attention to cross-asset flows. #Bitcoin is viewed as a risk-on, growth asset, at the extreme end of the risk spectrum.

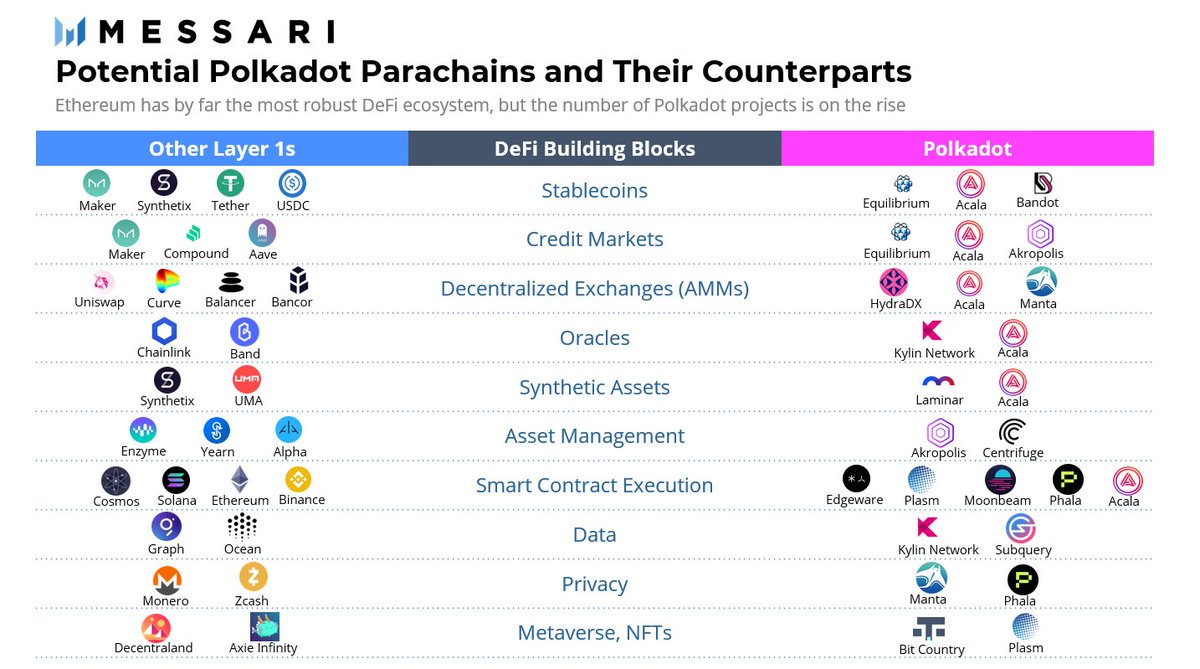

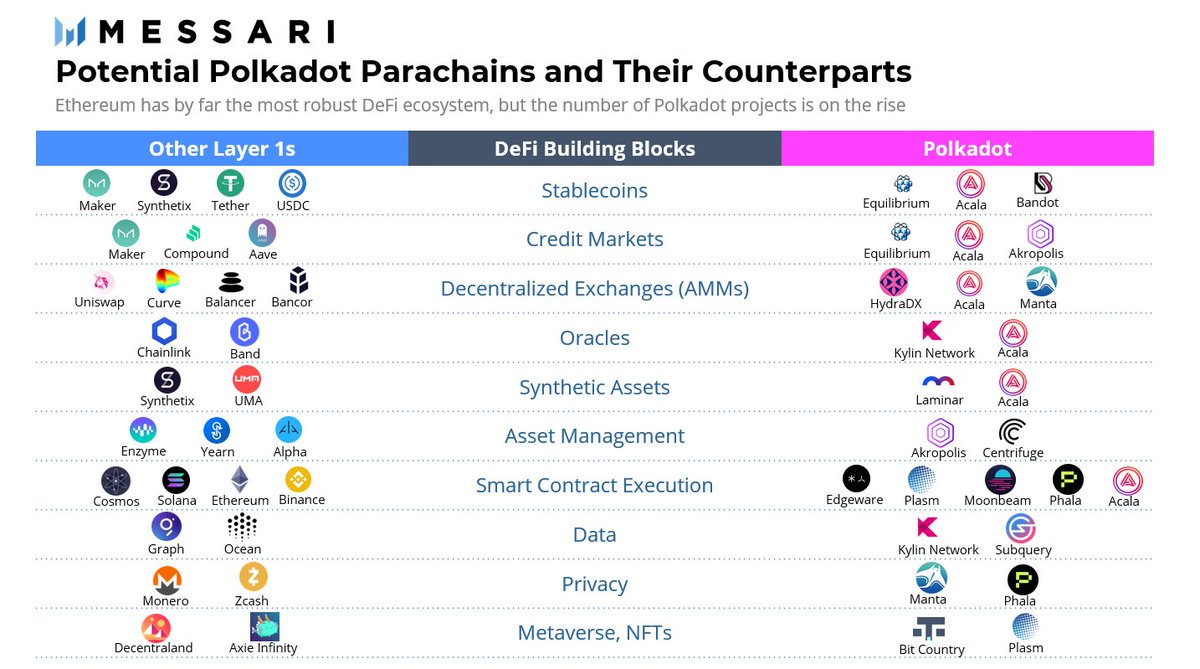

If you'd like a deeper dive into each major project, see our report --> messari.io/article/the-po…

If you'd like a deeper dive into each major project, see our report --> messari.io/article/the-po…

Why do developers want to do this?

Why do developers want to do this?

Then this (nonsense) was published —

Then this (nonsense) was published — https://twitter.com/fxhedgers/status/1383611847144730626

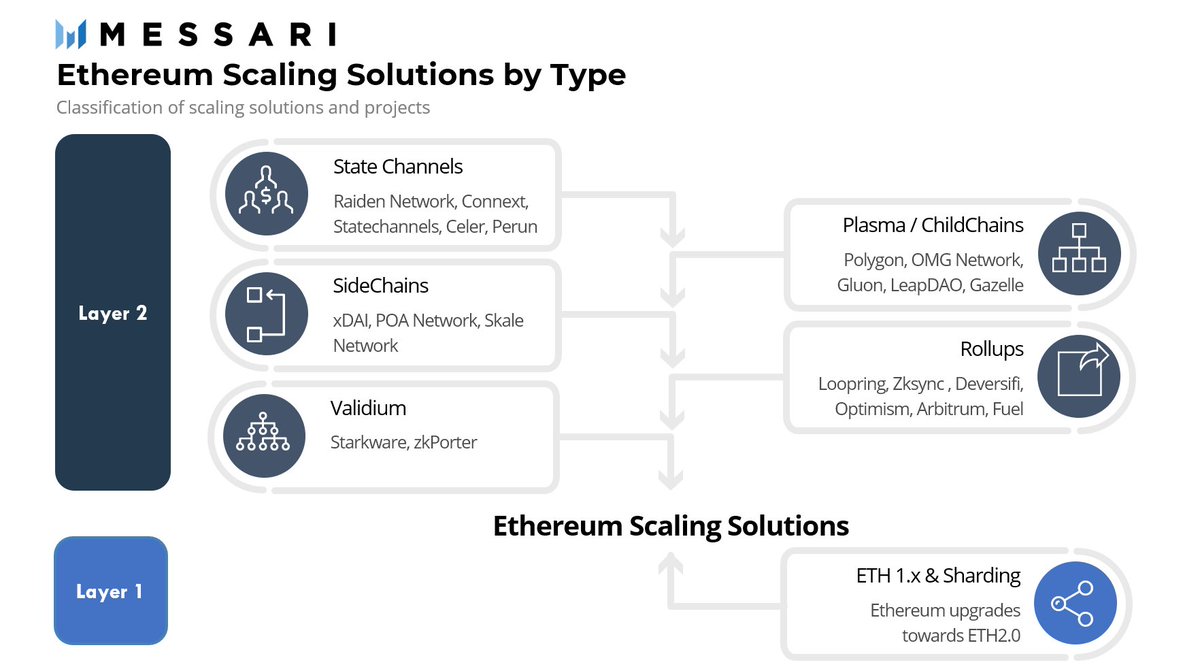

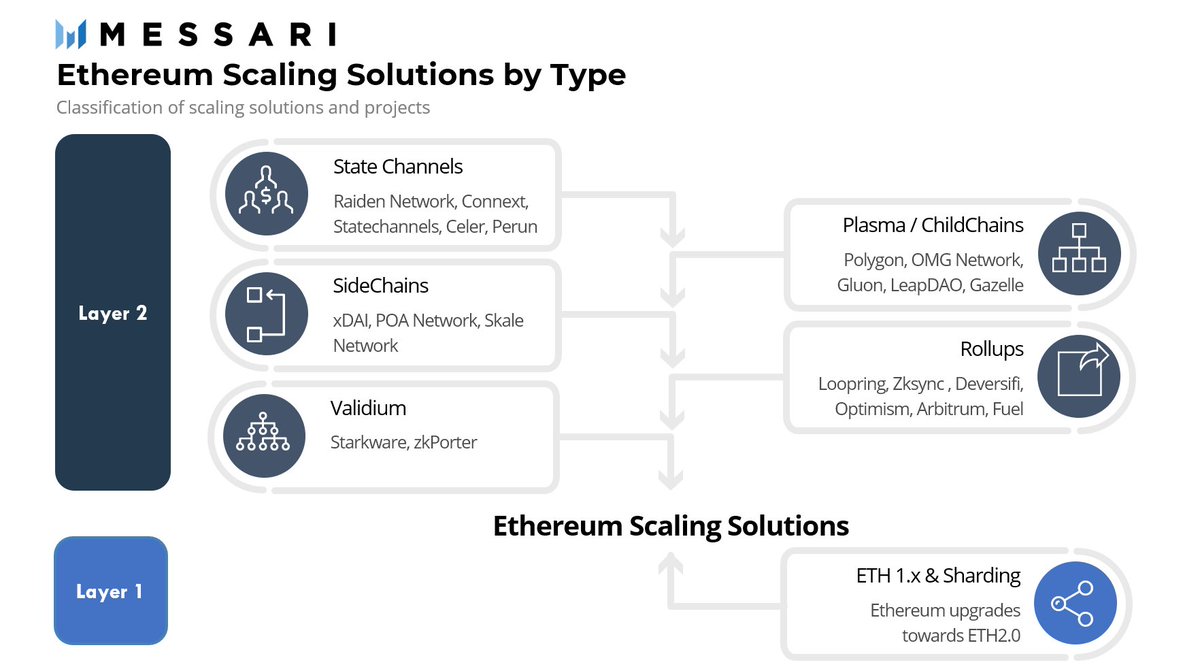

@ethereum Power users: Even if you don't know about ZK-Rollups, Sharding, or Plasma, the future of the most active blockchain depends on it.

@ethereum Power users: Even if you don't know about ZK-Rollups, Sharding, or Plasma, the future of the most active blockchain depends on it.

#BSC isn't trying to cure cancer or be the most innovative, decentralized blockchain. They're focused on low-cost yield farming with high APYs.

#BSC isn't trying to cure cancer or be the most innovative, decentralized blockchain. They're focused on low-cost yield farming with high APYs.

2/ We list all the exploits vs TVL and price below.

2/ We list all the exploits vs TVL and price below.

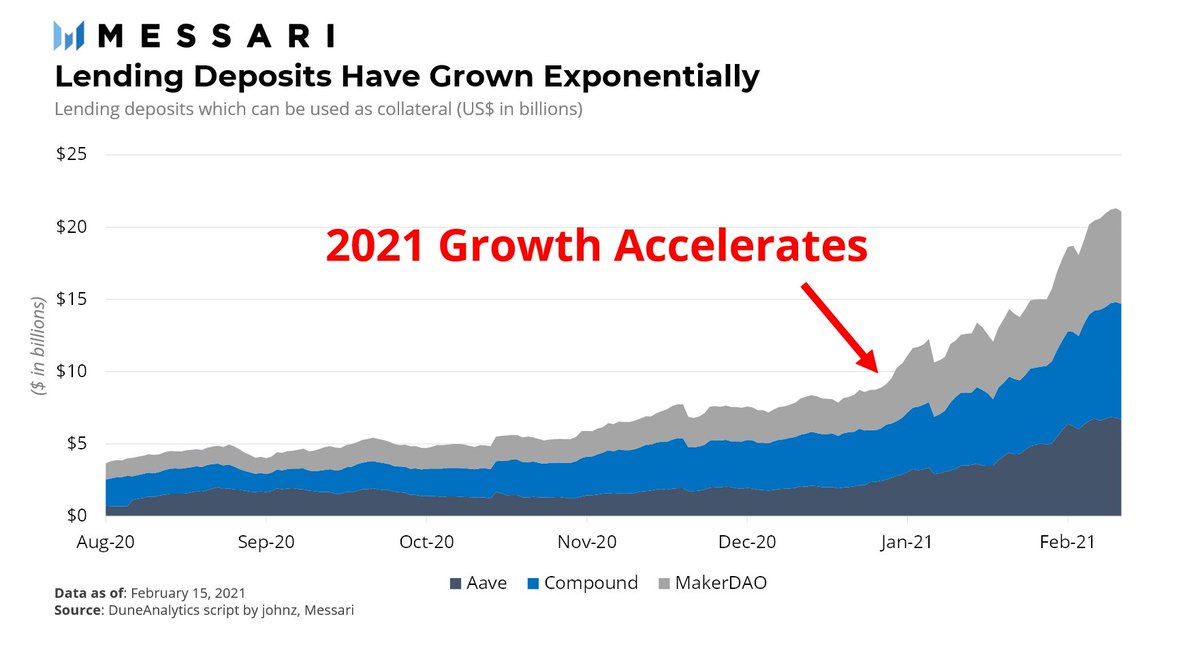

2/ Why is this important? Lending Deposits are at $20 billion, generating $660 million interest annually.

2/ Why is this important? Lending Deposits are at $20 billion, generating $660 million interest annually.

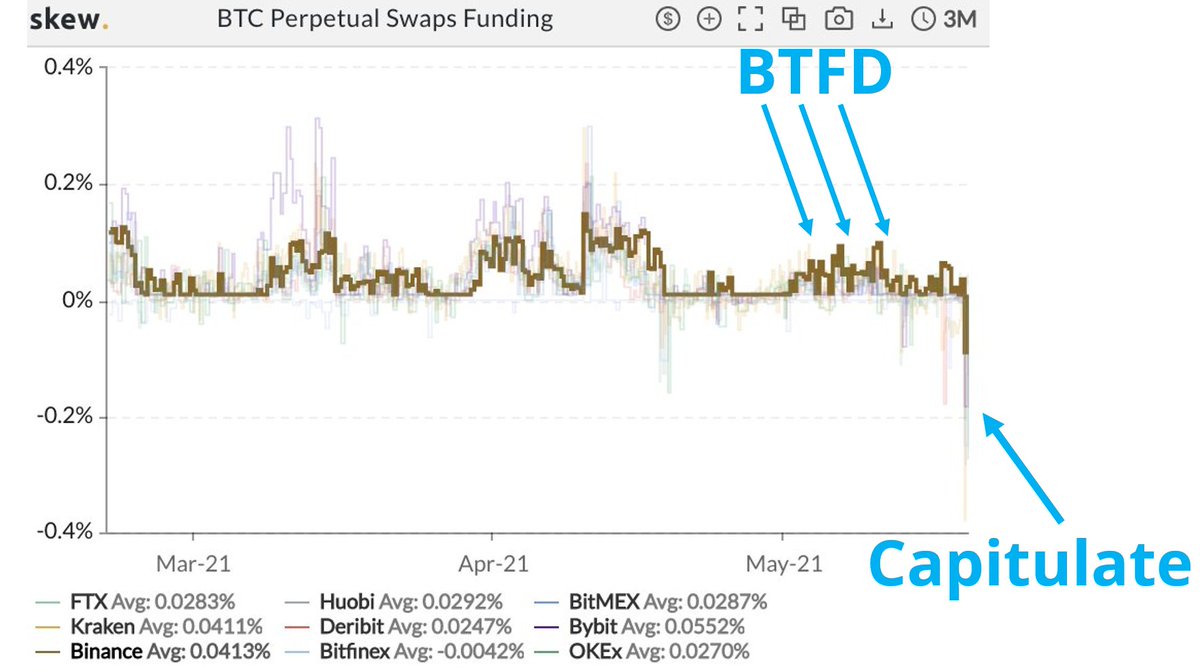

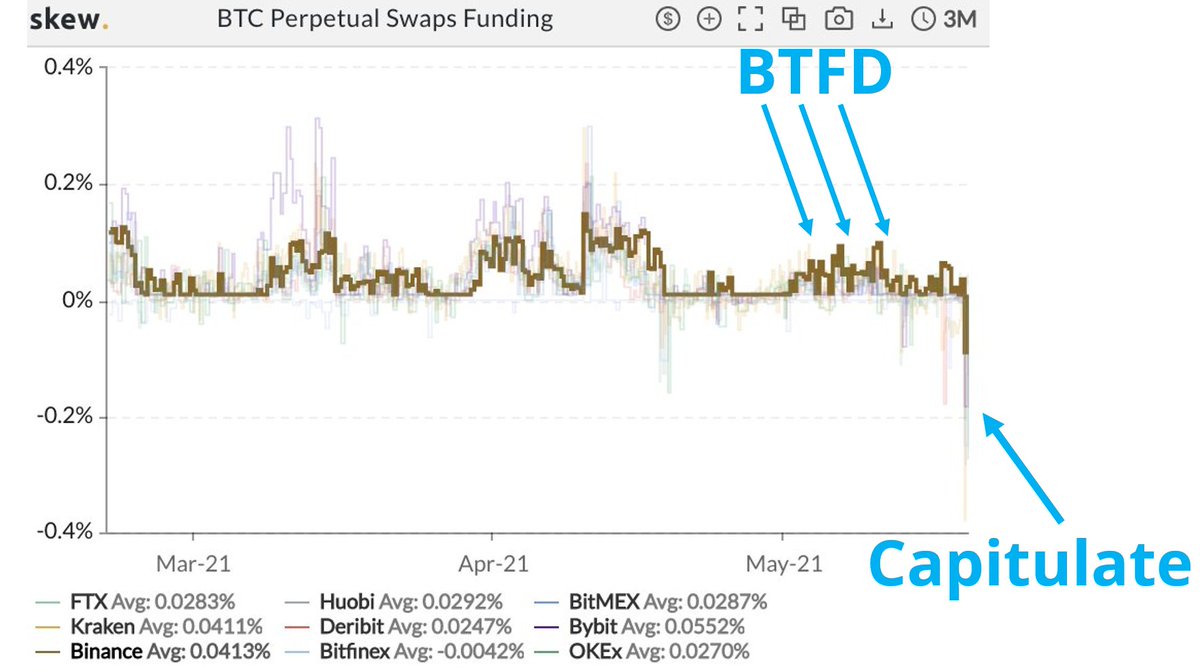

2/ There are 2 types of investors: those who want to GET rich and those who want to STAY rich.

2/ There are 2 types of investors: those who want to GET rich and those who want to STAY rich.