@FTX_Official adds new features at an unprecedented pace.

Here we value $FTT based on 1. Burn Yields, 2. Price/Sales, 3. Price/Earnings and those 3 metrics vs Growth.

Thread on $FTT 👇🏻👇🏻👇🏻

messari.io/article/valuin…

Here we value $FTT based on 1. Burn Yields, 2. Price/Sales, 3. Price/Earnings and those 3 metrics vs Growth.

Thread on $FTT 👇🏻👇🏻👇🏻

messari.io/article/valuin…

FTX created innovative new products like basket trades, leveraged tokens, prediction markets, and tokenized stock trading.

It has grown to be a major venue for futures trading:

2/

It has grown to be a major venue for futures trading:

2/

Due to the hype of the launch, and lockup schedule -- $FTT soared after launch but flatlined for ~1 year before rallying again at the end of 2020:

3/

messari.io/article/valuin…

3/

messari.io/article/valuin…

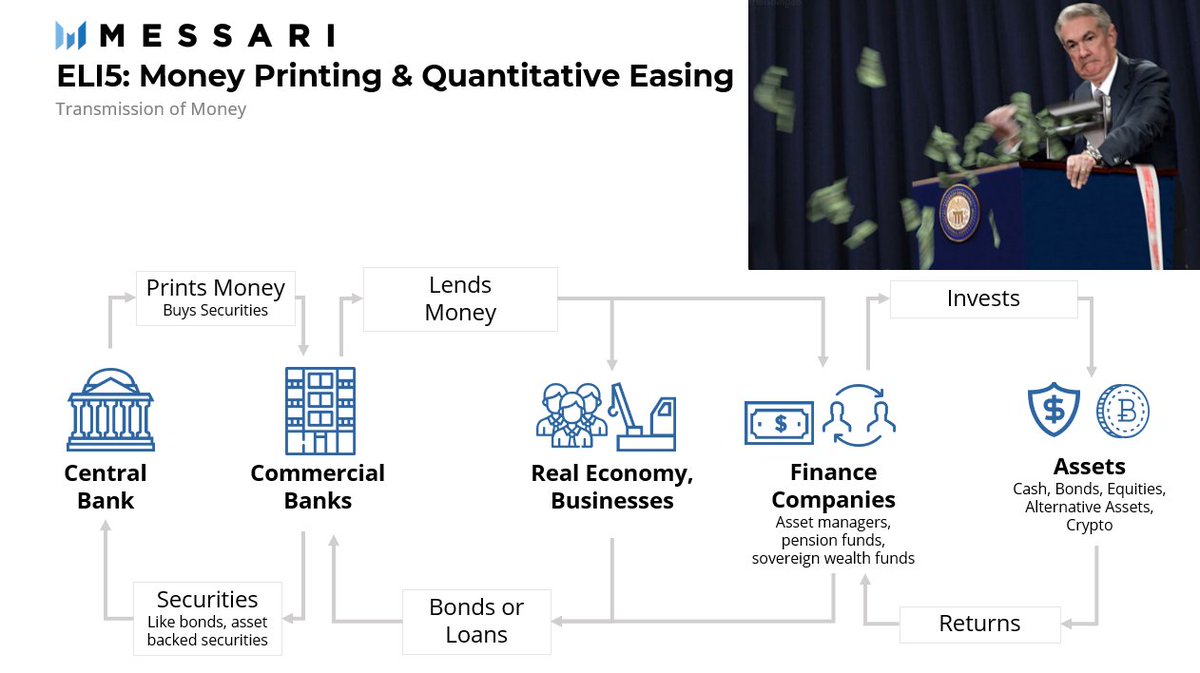

Currently, 3% of tokens have been burned. Indeed $FTT has the lowest amount of burn (in USD) compared to its peers.

Burn is based on fees generated on FTX & additions to their insurance fund

4/9

Burn is based on fees generated on FTX & additions to their insurance fund

4/9

Valuation: $FTT is priced higher than peers on ratios. Please see link for the full valuation metrics.

But I wanted to highlight their Growth-based valuation on both a circulating and fully diluted market cap basis.

5/9

But I wanted to highlight their Growth-based valuation on both a circulating and fully diluted market cap basis.

5/9

We look at FTT’s valuation based on levels where comparable tokens are trading, excluding outliers. We get the final valuation through a weighted probability calculation on each metric.

Edit the spreadsheet to your own assumption --> messari.io/article/valuin…

6/9

Edit the spreadsheet to your own assumption --> messari.io/article/valuin…

6/9

Does $FTT deserve to trade above comparables? Yes

1️⃣ Product rollout is unmatched

2️⃣ Weekly burns is more frequent than peers

3️⃣ $FTT is required for lotteries

4️⃣ Available on #Ethereum and #BSC

7/9

messari.io/article/valuin…

1️⃣ Product rollout is unmatched

2️⃣ Weekly burns is more frequent than peers

3️⃣ $FTT is required for lotteries

4️⃣ Available on #Ethereum and #BSC

7/9

messari.io/article/valuin…

What can $FTT do to generate more value?

1️⃣ Allow DeFi staking

2️⃣ Increase liquidity outside FTX (It's also listed on @binance)

8/9

messari.io/article/valuin…

1️⃣ Allow DeFi staking

2️⃣ Increase liquidity outside FTX (It's also listed on @binance)

8/9

messari.io/article/valuin…

We go through other risks and dive deeper into FTX and FTT below. You can play around with the spreadsheet to input your own assumptions.

Happy investing!

9/9

messari.io/article/valuin…

Happy investing!

9/9

messari.io/article/valuin…

• • •

Missing some Tweet in this thread? You can try to

force a refresh