Here it is !

A thread on Central Bank Digital Currencies (CBDC) because I think it’s both extremely important and poorly understood.

Simple questions I want to answer are

i)What’s the point?

ii)How do they work?

iii)Is there a risk for banks?

Sorry, it's a bit long.

A thread on Central Bank Digital Currencies (CBDC) because I think it’s both extremely important and poorly understood.

Simple questions I want to answer are

i)What’s the point?

ii)How do they work?

iii)Is there a risk for banks?

Sorry, it's a bit long.

https://twitter.com/jeuasommenulle/status/1362726346108108801

First, the reasons for CBDC.

You can have a look at the mega thread I started a few weeks ago with @BCoeure stepping in. But it’s hard to digest, so let me summarize the rationale for CBDC (and my views).

I’ll mention official and non-official reasons.

You can have a look at the mega thread I started a few weeks ago with @BCoeure stepping in. But it’s hard to digest, so let me summarize the rationale for CBDC (and my views).

I’ll mention official and non-official reasons.

Reason#1: costs.

Real cash (banknotes & coins) is expensive. Estimates vary from 0.2% to 0.7% of GDP, depending on the methodology, country, etc

But electronic payments are also expensive – and cards payments even more. Will CBDC be cheaper? I suspect it depends on country.

Real cash (banknotes & coins) is expensive. Estimates vary from 0.2% to 0.7% of GDP, depending on the methodology, country, etc

But electronic payments are also expensive – and cards payments even more. Will CBDC be cheaper? I suspect it depends on country.

One example where the cost rationale sounds clear is the Bahamas. They were (afaik) the 1st to actually implement a CBDC and it’s presumably cheaper than managing cash on the 700 islands of the Bahamas. But that's really a very specific situation.

Reason#2: financial inclusion. This one is tricky because no one is excluded from “real cash”, so what’s the rationale?

It’s a bit convoluted: demand for “real cash” is going down and there’s a risk some people struggle to use electronic payments, so they would be “excluded”.

It’s a bit convoluted: demand for “real cash” is going down and there’s a risk some people struggle to use electronic payments, so they would be “excluded”.

Hence the need for CBDC.

This argument is bit weak imho: if they’re happy with cash, why not just let them use cash?

And why would they be more able to use CBDC than other forms of electronic money?

This argument is bit weak imho: if they’re happy with cash, why not just let them use cash?

And why would they be more able to use CBDC than other forms of electronic money?

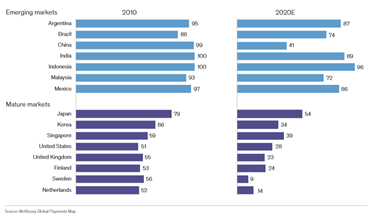

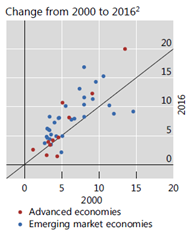

Another intriguing fact is that physical cash usage is indeed going down (see below, from McKinsey) but cash “demand” is not (see below, from BIS)

There could many reasons for that but it weakens the "people don't use cash" argument.

There could many reasons for that but it weakens the "people don't use cash" argument.

Reason#3: to avoid relying on private/foreign networks. This can be for resilience reason (e.g. Visa went down in 2018) or for “national security” reasons. Clearly, 1 driver for Chinese CBDC is to bypass (one day, maybe!) the SWIFT system and international protocols.

I understand part of this argument, especially for China, but there is no guarantee of better resilience from a central bank led network (see TARGET2 incident last Oct) and the monetary sovereignty question is inextricably linked to the reserve currency status.

More importantly, having a competitor to the US-driven international payment system does not necessarily mean having CBDC, those are two very different things, imo.

Reason#4: financial control. This argument is straightforward:

if all financial transactions are recorded, it makes it (theoretically) easier to fight money laundering, tax fraud and the shadow economy.

if all financial transactions are recorded, it makes it (theoretically) easier to fight money laundering, tax fraud and the shadow economy.

But obviously, this coin (!) has two sides: it’s likely to increase the demand for physical cash and non-governmental digital currencies (DC), which is the opposite of Reason 5’s!

So, it would only really work with a ban of physical cash and DC.

So, it would only really work with a ban of physical cash and DC.

It’s also worth pointing out that all electronic payments are already traceable – as long as you can force banks to disclose it. And the existence of electronic payments hasn’t reduced ML!

As banks would still be involved in CBDC (see below), nothing much would change there, expect if different KYC/AML rules are applied for CBDC.

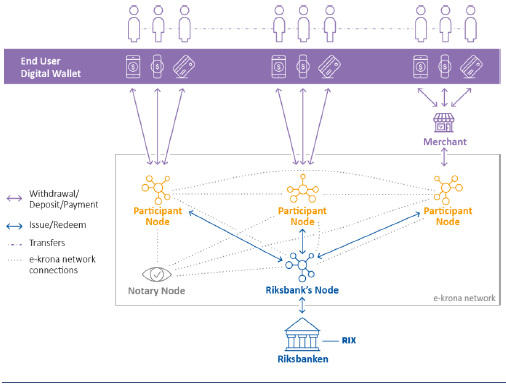

Looking at the three existing CBDC, we can see that various approaches are possible on KYC/AML. In Sweden, afaik everything is left with the banks which are distributing the e-krona they receive from the Riksbank, in exchange for reserves (1-for-1).

In China, we have the exact opposite: all CBDC transactions are recorded on a ledger at the CB, with the whole history (issuance, trades, redemption.) It is also a 2-tier system (banks and payment companies distribute) but, interestingly, the payments are hidden from the banks!

The Bahamas has an hybrid approach: a 2-tier system again (with six licensed distributors) but with varying KYC requirements depending on the size (not unlike rules that prohibit cash payments above a threshold).

The bottom line of this is that, except if you actually ban cash/DC, I don’t see CBDC as a game changer for KYC/AML, even in the Chinese format.

In any case, this is a crucial aspect and 41% of respondents to an ECB survey on CBDC said privacy was their biggest concern.

In any case, this is a crucial aspect and 41% of respondents to an ECB survey on CBDC said privacy was their biggest concern.

Reason#5. We hear this reason A LOT: there will be a first mover advantage to CBDC and CB are threatened by the competition of Libra/Diem. Honestly, I struggle a lot with this argument.

First, if there’s no other reason to do it, why being concerned about first mover? No point in being the first to do something stupid.

But competition from Libra (now Diem) –or other stable coins- is a trickier subject. Let’s not go into the debate of whether stable coins are indeed stable & for the sake of reasoning, let’s assume they are really backed by genuine CB money/reserves.

Weidmann expressed the worry in 2020: “there is a second argument in favour of CBDC: preserving financial sovereignty. In view of Facebook’s stablecoin initiative ».

Honestly, I’m not buying this.

Honestly, I’m not buying this.

1st, SWIFT is a private company too (in Belgium!), so what? It doesn’t seem to bother anyone. 2nd if the worry is that Libra will become a new currency, well I have two pieces of news for you: since it’s “stable coin”, almost by definition it’s not a new currency.

Very much like an IOU is not a currency. In the extreme scenarios where CB are worried that it would become a currency, well there’s a thing called Lex Monetae, and governments would be able to ban it easily, if needed.

Importantly, CBDC are certainly not going to reduce competition from Bitcoin, because Bitcoin isn’t used as a cheap payment system. It’s used for dark money transfers and as a speculation for people who believe CB are debasing fiat money.

If anything, CBDC will increase the demand for Bitcoin, that is obvious to me.

Reason#6: a CBDC would allow to create smart contracts in CBDC and facilitate some financial transactions and make them automatic (reducing costs and timing). Ok, maybe it’s easier to make those smart contracts happen using a CBDC then using normal electronic € or $. Maybe.

But that sounds a convoluted argument for such a complex endeavor.

Reason#7: CBDC would improve fiscal policy (related to Reason#6.) The initial Chinese CBDC attribution was designed as a lottery and the winners were only able to spend the money in a designated list of shops. .

The general idea is that, unlike usual physical cash or electronic cash, CBDC can be set up in a way that is not fungible

This is an interesting idea although I am not sure that i) micro-targeting of fiscal policy is a good idea or politically acceptable (gvt “vouchers” are considered a bit humiliating in many Western democracies) and ii) it should be the job of the CB to manage fiscal policy.

However, imho the idea of “non fungible cash” is more interesting. There are many legal consequences of this – and as a former structured finance banker, let me tell you that it gives me many ideas.

It could be used to eliminate comingling risk, improve collateralization, remove the need for fiduciaries, etc.

This being said, I don’t think CBDC change anything in the debate about generic helicopter money.

This being said, I don’t think CBDC change anything in the debate about generic helicopter money.

Reason#8: CBDC could “improve” (deteriorate some would say) the effectiveness of monetary policy. This has been emphatically denied by central bankers, but I’m not sure they’re entirely honest. The rationale is simple: physical cash creates an effective lower bound on rates.

So, to implement monetary policy at, say, -1%, physical cash has to be eliminated. I’m not entirely buying this. It would require banning physical cash, which is another story both politically and legally as I suspect, e.g. in Europe the Treaty does not allow it – not sure though

2nd, other forms of electronic money still exist and will still exist. So why would CBDC change the way this electronic money is remunerated? If CBDC pays -1% and your bank account pays 0%, why use CBDC? And if you force banks to adjust to -1%, then why CBDC?

Overall, I’d say CBDC would marginally improve monetary transmission, but I don’t see any significant effect. The hurdle is simply that banks don’t charge most household deposits, & this isn’t likely to change anytime soon because politicians don’t want it to change.

Reason#9 goes like this: your CBDC are “protected”, your bank deposits are not if the bank goes bust. Honestly, give me a break here. If you’re creating CBDC because you fear the whole banking system will collapse, you’d better spend your time fixing it!

In Europe and the US, deposit guarantee schemes and resolution rules mean that actual losses for depositors are super tiny – and households don’t care about this issue. The vast majority doesn’t have 100k at the bank anyway, so they’re already safe!

To recap the rationale for CBDC, I’d say there are some reasons for them – nothing compelling in my view, but a few nice snippets.

Next big question: how do CBDC work. What are they exactly?

Next big question: how do CBDC work. What are they exactly?

I want to make a key point here: there’s almost no relationship whatsoever between CBDC and crypto currencies. Apart from the fact that Bitcoin's initial goal was to reduce payment costs (not even remotely what it’s used for now), the two are totally different things.

Bitcoin/Blockchain are decentralized, CBDC are centralized. Bitcoin is the currency created to remunerate people proving CPU to make the blockchain work, there’s no such thing in CBDC: the CB and the banks make the system work.

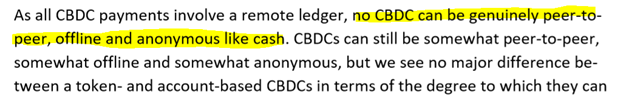

In fact, there isn’t even a proper blockchain in CBDC, there’s no “crypto” involved – I mean there’s just a standard IT security system, so you could argue it's “crypto”, but nothing like the hashing algorithm. It’s just a centralized database and there are many ways to design it

So what is CBDC? It’s actually very straightforward. Economically, it’s a deposit at the central bank, belonging to an individual or a business. That’s it. End of story. All the technology is then designed to record the transfer of that deposit to someone else.

Because CB don’t want to manage customers, KYC, for 100s of M of accounts, banks and payments servicers are introduced in the system to act as intermediaries. They provide the customer apps and channel the usual electronic cash to the CB which delivers a CBDC in return.

That’s it: CBDC are transferable central banks deposits. Not very complicated, but also a genuine innovation because deposits are generally not transferable (see above on cash fungibility.) What it’s not, is a cryptocurrency or an alternative to physical cash.

As the Riksbank said very aptly (thank @LorcanRK)

Once you know that, the key questions are the interest rates paid on the deposits, possible size limits, etc. very much the same questions banks deal with when they handle deposit accounts or the CB deals with when setting policy rates.

Last question – and maybe the one which leads to the most surreal takes – is this: what’s the impact for bank?

I’m hearing Armageddon stories like: CBDC will channel all the cash to the CB, there will be a liquidity crunch for banks and the system will collapse.

I’m hearing Armageddon stories like: CBDC will channel all the cash to the CB, there will be a liquidity crunch for banks and the system will collapse.

Errr. No

First, you have to remember that CBDC will be out there in competition with other forms of electronic cash. If the rate at you banks is better than at the CB, you’ll stay at your bank. Effective monetary policy is in contradiction with CBDC capturing all electronic money!

Even if you make the wild assumption that a substantial share of deposits will go at the CBDC (e.g. because the paid rate is high – VERY unlikely), what will the CB do with all that cash? Well, same as it always does, lend it to banks 😊.

So net net, the main difference is that bank will exchange uncollateralized deposits with collateralized ECB funding. This isn’t neutral, of course, and raises the question of changes to the CB collateral policy. But the CB will obviously adjust policy to make the system stable.

The story is a bit different in a crisis because clients could fear a bank failure and run for CBDC. Indeed, it’s easier to run for a CBDC than to queue in the line to withdraw 5k£ in cash. This is something which is already on supervisors’ mind: the fear of “stealth bank runs

Indeed, anyone with another bank account can use his online app to transfer money from a bank – a digital run. CBDC makes this worse because you don’t need another bank account – and in times of crisis you might also believe the 2nd account is also at risk.

Clearly, this will be an important aspect to consider – not for the design of CBDC but for the role of CB as lenders of last resort in a CBDC world.

In a non-crisis world, what’s the impact for banks? It’s mixed. Liquidity ratios would deteriorate (households deposits have nice features for LCR calculations because they are assumed to be sticky, an assumption which might have to change!)

But in a negative rate world, deposits are loss making for banks. So they are happy to lose them, if there wasn’t any LCR constraints! So, in practice, the consequences would probably be the following: banks would adjust their deposit rates to get to their target LCR.

This could add a few bps to banks’ funding costs – maybe compensated by the fees they would get for intermediating the system. Honestly, I would be more worried by the loss in revenues from payments (cards etc) than by lost deposits.

To summarize, in my view, CBDC would slightly increase systemic risk, but this can be managed by CB, and would had tiny impacts on banks’ P&L.

• • •

Missing some Tweet in this thread? You can try to

force a refresh