1/ INSIDE THE EVENT HORIZON with @MimesisCapital

THREAD #9

mimesiscapital.medium.com/1m-btc-is-earl…

THREAD #9

mimesiscapital.medium.com/1m-btc-is-earl…

2/ $1M BTC will only be the beginning.

The invention of absolute scarcity has created a massive blackhole right in the middle of the global financial system. Its gravity is so strong and so powerful that measuring Bitcoin’s “market cap” will soon not be logical or useful.

The invention of absolute scarcity has created a massive blackhole right in the middle of the global financial system. Its gravity is so strong and so powerful that measuring Bitcoin’s “market cap” will soon not be logical or useful.

3/ First, Let’s compare two vastly different monetary technologies.

One is government fiat currency (USD) and the other is Bitcoin.

One is government fiat currency (USD) and the other is Bitcoin.

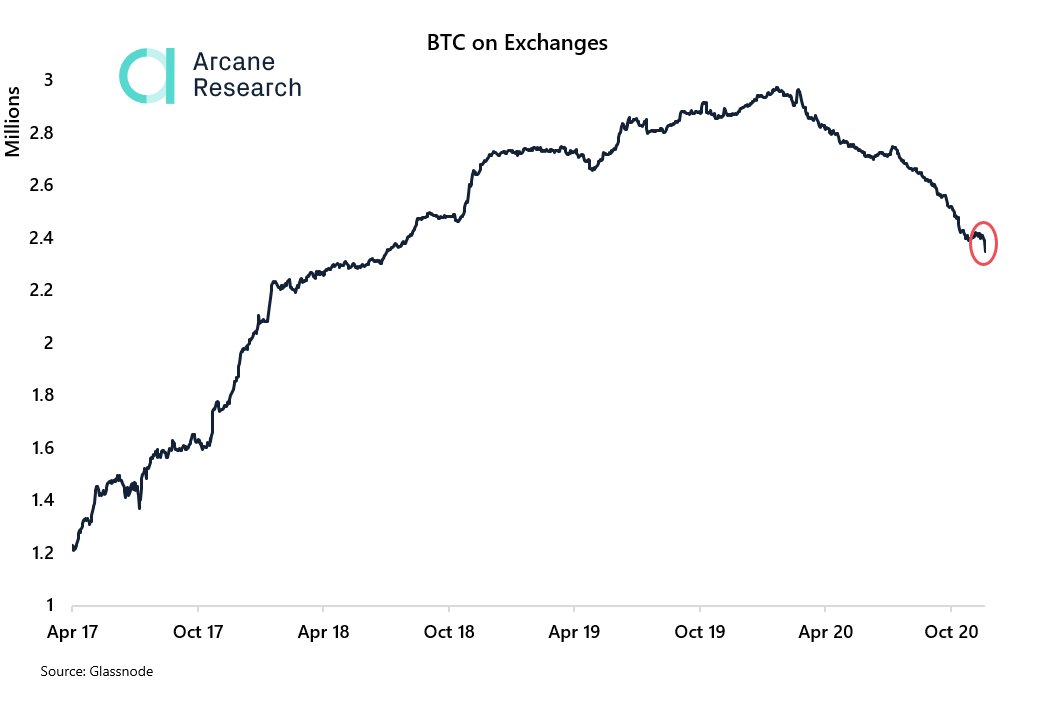

4/ One has an exponentially growing future supply, and the other has an exponentially shrinking future supply. One is unpredictable and controlled by central bankers and politicians, and the other is predictable and controlled algorithmically by code.

5/ This new monetary technology called Bitcoin is actually infinitely better than all forms of previous monetary goods. This idea of perfect scarcity is greatly underestimated.

6/ Holding Bitcoin will be like storing wealth in a low cost index fund or a diversified portfolio (like a 401k). Except it will be magnitudes more valuable because Bitcoin offers the same NgU (“Number Go Up”) technology, but with no counterparty risk and no dilution risk.

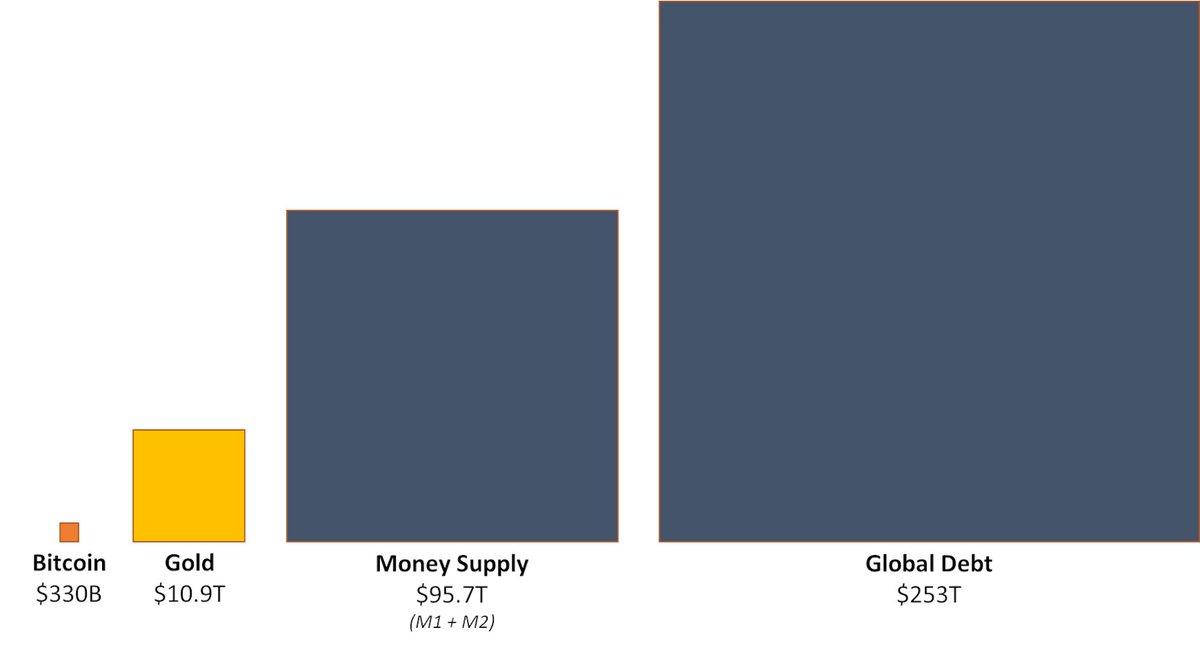

7/ Bitcoin will replace traditional stores of value. The following price targets indicate when the market cap of Bitcoin becomes equivalent to each traditional store of value asset.

8/ Some analysts have long term price targets of $5M-$10M per BTC as Bitcoin sucks up wealth stored in gold, fiat money, and fiat bonds.

This could potentially be drastically underestimating the future purchasing power of Bitcoin. Bitcoin will hold all global store of value.

This could potentially be drastically underestimating the future purchasing power of Bitcoin. Bitcoin will hold all global store of value.

9/ Real (not nominal) Price Targets

Gold = $0.5M BTC

Gold + M2 = $5M BTC

Gold + M2 + Global Debt = $17.1M BTC

Gold + M2 + Global Debt + 50% of Stocks + 50% of RE = $32.6M BTC

(Above) * High Propensity to Hold BTC? * Risk Free Nature of BTC? = $100M+ BTC

Gold = $0.5M BTC

Gold + M2 = $5M BTC

Gold + M2 + Global Debt = $17.1M BTC

Gold + M2 + Global Debt + 50% of Stocks + 50% of RE = $32.6M BTC

(Above) * High Propensity to Hold BTC? * Risk Free Nature of BTC? = $100M+ BTC

10/ Today’s store of values are likely dramatically undervalued, because there are many risks with holding all sorts of assets (stocks, bonds, real estate, etc.) and no single asset matches Bitcoin’s perfect scarcity.

11/ Bitcoin’s perfectly fixed supply helps incentivize individuals to lower their time preference and save for the future. Meaning the technology itself encourages more saving and more forward thinking which results in an even higher propensity to hold Bitcoin.

12/ Bitcoin has no counterparty risk and no dilution risk. This new technology won’t just suck in value from the old world. It will usher in a new renaissance allowing humans to store and channel monetary energy in ways and sizes never thought possible.

13/ New technologies like electricity, automobiles, computers, and the internet reshaped the world. They created abundance for society as a whole. In fact, these technologies created so much abundance and growth that the amount of wealth they created did not exist beforehand.

14/ Reinventing money itself to a degree of perfect scarcity will ignite a creation of wealth to unimaginable levels. We likely cannot fathom the amount of wealth capable of being stored on the Bitcoin blockchain.

15/ This newfound wealth will align individuals and society itself to focus on a more long term sustainable future for many generations to come.

Bitcoin’s scarcity will lead to global abundance.

Bitcoin’s scarcity will lead to global abundance.

• • •

Missing some Tweet in this thread? You can try to

force a refresh