Why many Tesla investors are frustrated over Tesla's Bitcoin experiment.

@elonmusk describing money as "avoiding the inconvenience of barter" is a rare case of him misunderstanding the first principles of something utterly important: the history & role of money.

A thread.

1/

@elonmusk describing money as "avoiding the inconvenience of barter" is a rare case of him misunderstanding the first principles of something utterly important: the history & role of money.

A thread.

1/

https://twitter.com/elonmusk/status/1363007438455074825

2/

I realize that I'll lose followers over this - but this had to be said.

It is a commonly told story to economics students all over the world: money and coinage was created to replace unwieldy barter. Instead of exchanging goods, people exchanged valuable gold coins.

I realize that I'll lose followers over this - but this had to be said.

It is a commonly told story to economics students all over the world: money and coinage was created to replace unwieldy barter. Instead of exchanging goods, people exchanged valuable gold coins.

3/

This is a convenient story that, just like the story Tesla cars being inconvenient & "dirty", is utterly false.

There's literally 𝒛𝒆𝒓𝒐 evidence in the rich archaeological record of humanity suggesting high functioning barter economies who simplified barter with coinage.

This is a convenient story that, just like the story Tesla cars being inconvenient & "dirty", is utterly false.

There's literally 𝒛𝒆𝒓𝒐 evidence in the rich archaeological record of humanity suggesting high functioning barter economies who simplified barter with coinage.

4/

There's 𝒛𝒆𝒓𝒐 evidence of human societies having complex barter economies and transitioning to coins/money to replace barter.

Instead, what is present even in the earliest records of human societies with complex production of goods is the idea of 𝒘𝒓𝒊𝒕𝒕𝒆𝒏 𝒅𝒆𝒃𝒕.

There's 𝒛𝒆𝒓𝒐 evidence of human societies having complex barter economies and transitioning to coins/money to replace barter.

Instead, what is present even in the earliest records of human societies with complex production of goods is the idea of 𝒘𝒓𝒊𝒕𝒕𝒆𝒏 𝒅𝒆𝒃𝒕.

5/

The oldest archeological evidence suspected to be "written debt" are 40,000 years old "bone tally sticks" where each scratch mark denotes "debt owed".

An ancient, written "I Owe You" - an IOU.

"Written debt" is probably an order of magnitude older than the first coins.

The oldest archeological evidence suspected to be "written debt" are 40,000 years old "bone tally sticks" where each scratch mark denotes "debt owed".

An ancient, written "I Owe You" - an IOU.

"Written debt" is probably an order of magnitude older than the first coins.

6/

Medieval "split tally sticks" were early forms of "cryptographic hash of debt", auditable, centralized debt impossible to counterfeit: a stick was uniquely marked and split in length in two, one half stayed with the Payor, the other with the Payee.

en.wikipedia.org/wiki/Tally_sti…

Medieval "split tally sticks" were early forms of "cryptographic hash of debt", auditable, centralized debt impossible to counterfeit: a stick was uniquely marked and split in length in two, one half stayed with the Payor, the other with the Payee.

en.wikipedia.org/wiki/Tally_sti…

7/

Here's historic documentation of tally sticks used by the British Monarchy as IOU: one Tally kept centrally at the Exchequer, another given to the payee.

The uneven surface of the wooden tallies were their "unique hashes" and "tally matching" was used to trade & settle debt.

Here's historic documentation of tally sticks used by the British Monarchy as IOU: one Tally kept centrally at the Exchequer, another given to the payee.

The uneven surface of the wooden tallies were their "unique hashes" and "tally matching" was used to trade & settle debt.

8/

The "semi-cryptographic hash" of wooden split tallies was used to create new debt & purchase power (money) through the power of taxation of the king - without the use of any extra unique coinage tied to some rare physical resource such as gold.

Which brings us to Bitcoin.

The "semi-cryptographic hash" of wooden split tallies was used to create new debt & purchase power (money) through the power of taxation of the king - without the use of any extra unique coinage tied to some rare physical resource such as gold.

Which brings us to Bitcoin.

9/

Unlike the King's or a modern economy's treasury having the 'power of taxation' and issuing new money backed by government spending (~35% of the US GDP), Bitcoin has 𝒏𝒐 internal economy other than the speculative expectation of BTC price going up.

Unlike the King's or a modern economy's treasury having the 'power of taxation' and issuing new money backed by government spending (~35% of the US GDP), Bitcoin has 𝒏𝒐 internal economy other than the speculative expectation of BTC price going up.

10/

There's only four Bitcoin transactions every second - while several orders of magnitude higher economic activity in real-world payment systems.

The reason is "Proof of Work": a single Bitcoin transaction takes more energy to verify than to charge a Model 3 to 300 miles. (!)

There's only four Bitcoin transactions every second - while several orders of magnitude higher economic activity in real-world payment systems.

The reason is "Proof of Work": a single Bitcoin transaction takes more energy to verify than to charge a Model 3 to 300 miles. (!)

11/

Bitcoin PoW wastes stupendous amounts of energy - below is one of the coal power plants in China powering Bitcoin mining rigs...

This pointless waste of energy in the BTC network is the result of the design mistakes & political leanings of the early developers of Bitcoin.

Bitcoin PoW wastes stupendous amounts of energy - below is one of the coal power plants in China powering Bitcoin mining rigs...

This pointless waste of energy in the BTC network is the result of the design mistakes & political leanings of the early developers of Bitcoin.

12/

Bitcoin is not a "slightly less bullshit" version of fiat money, because real money is a collection of real IOUs and tax payments that anchor the strength of a currency.

It is the balance of taxes owed vs. government spending that give "fiat money" strength - or weakness.

Bitcoin is not a "slightly less bullshit" version of fiat money, because real money is a collection of real IOUs and tax payments that anchor the strength of a currency.

It is the balance of taxes owed vs. government spending that give "fiat money" strength - or weakness.

13/

Just like Tesla's FSD training data isn't just "bullshit" records in Tesla's storage system, the U.S. dollar isn't just "bullshit" computer records at the central bank.

There's very little "fiat" about the strength of the dollar - it's a real-world economic property.

Just like Tesla's FSD training data isn't just "bullshit" records in Tesla's storage system, the U.S. dollar isn't just "bullshit" computer records at the central bank.

There's very little "fiat" about the strength of the dollar - it's a real-world economic property.

14/

In the simplest terms the strength of the U.S. dollar represents future cash flows of the U.S. economy: the combined power of trillions of dollars worth of "I Owe You" split tally sticks.

There's no "belief" behind the value of currencies:

fred.stlouisfed.org/series/W006RC1…

In the simplest terms the strength of the U.S. dollar represents future cash flows of the U.S. economy: the combined power of trillions of dollars worth of "I Owe You" split tally sticks.

There's no "belief" behind the value of currencies:

fred.stlouisfed.org/series/W006RC1…

15/

There's no underlying gold reserves giving the dollar its strength - it's the US economy and the underlying future written obligations (debt, taxes) that makes it useful and valuable.

Just like "fiat" TSLA shares represent future Tesla cash flows - with no gold reserves.

There's no underlying gold reserves giving the dollar its strength - it's the US economy and the underlying future written obligations (debt, taxes) that makes it useful and valuable.

Just like "fiat" TSLA shares represent future Tesla cash flows - with no gold reserves.

16/

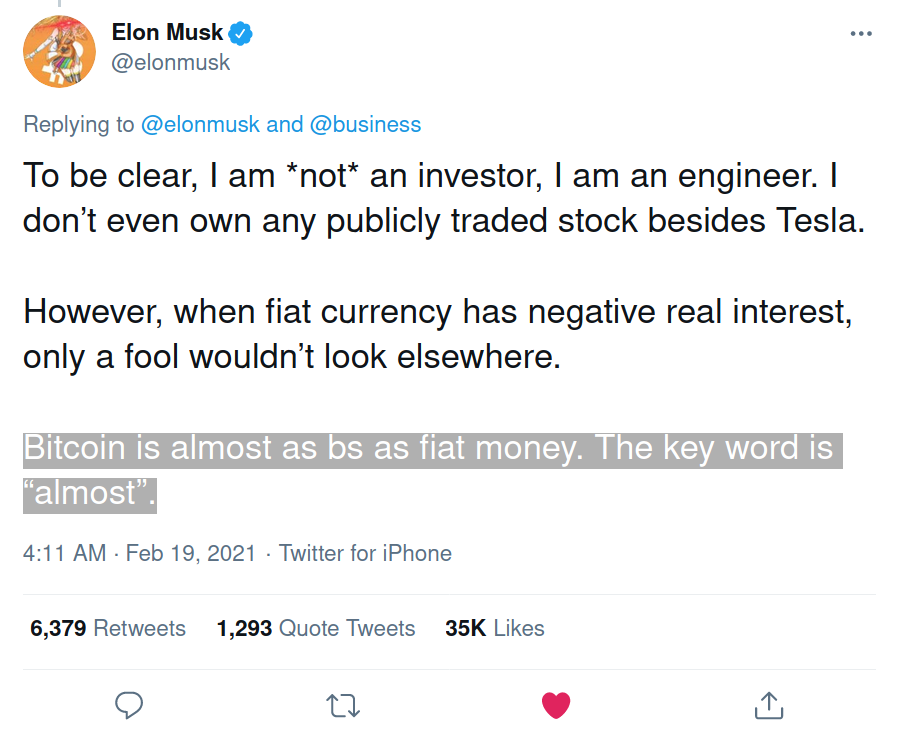

And for this reason it's borderline insulting to call fiat money "bullshit" & put it in the same sentence as a poorly designed crypto currency that is wasting a medium sized country's electricity supply just to run & is heating our planet under make-believe fantasies ...

And for this reason it's borderline insulting to call fiat money "bullshit" & put it in the same sentence as a poorly designed crypto currency that is wasting a medium sized country's electricity supply just to run & is heating our planet under make-believe fantasies ...

17/

Distributed crypto blockchains in themselves are in no way evil, they are useful tools: one of the oldest Merkle Tree crypto hash data structures, the Linux Kernel Git tree, is a prototypical audited, distributed crypto hash - and it predates Bitcoin by ~half a decade.

Distributed crypto blockchains in themselves are in no way evil, they are useful tools: one of the oldest Merkle Tree crypto hash data structures, the Linux Kernel Git tree, is a prototypical audited, distributed crypto hash - and it predates Bitcoin by ~half a decade.

18/

I support Tesla using blockchains: Tesla should create their 𝒐𝒘𝒏 cryptocurrency - backed by the name recognition of Elon Musk.

MarsCoin, TeslaCoin, XCoin or GreenCoin: the power is in the name recognition of Elon & its economic relevance.

I support Tesla using blockchains: Tesla should create their 𝒐𝒘𝒏 cryptocurrency - backed by the name recognition of Elon Musk.

MarsCoin, TeslaCoin, XCoin or GreenCoin: the power is in the name recognition of Elon & its economic relevance.

https://twitter.com/truth_tesla/status/1361263892798844928

19/

And this is why Tesla investors who understand both blockchains and monetary systems are so frustrated with Tesla's and @elonmusk's crypto experiments: Bitcoin has very few of the characteristics of real currencies and all the characteristics of speculative bubbles.

And this is why Tesla investors who understand both blockchains and monetary systems are so frustrated with Tesla's and @elonmusk's crypto experiments: Bitcoin has very few of the characteristics of real currencies and all the characteristics of speculative bubbles.

• • •

Missing some Tweet in this thread? You can try to

force a refresh