1/🧵

As unprecedented liquidity injections take place globally, talks of inflation are picking up.

In this thread, we'll take a look at why #INFLATION matters, especially if your investment thesis starts with “FED has my back whatever happens”

Best served with a cup of tea 🫖

As unprecedented liquidity injections take place globally, talks of inflation are picking up.

In this thread, we'll take a look at why #INFLATION matters, especially if your investment thesis starts with “FED has my back whatever happens”

Best served with a cup of tea 🫖

2/🧵

Since the Financial Crisis, trillions have been injected into the economy to boost activity and growth.

Broader set of financial assets held principally by households (aka M2 Money Stock):

+ $12,000 BUSD since 2008

+ of which $4,000 BUSD from 2020

fred.stlouisfed.org/series/M2

Since the Financial Crisis, trillions have been injected into the economy to boost activity and growth.

Broader set of financial assets held principally by households (aka M2 Money Stock):

+ $12,000 BUSD since 2008

+ of which $4,000 BUSD from 2020

fred.stlouisfed.org/series/M2

3/🧵

During the last 10 years or so, these liquidity injections have NOT caused rampant inflation as velocity of money has collapsed.

But few things changed with covid; a lot of funds have been given directly to individuals in form of stimulus checks.

fred.stlouisfed.org/series/M2V

During the last 10 years or so, these liquidity injections have NOT caused rampant inflation as velocity of money has collapsed.

But few things changed with covid; a lot of funds have been given directly to individuals in form of stimulus checks.

fred.stlouisfed.org/series/M2V

4/🧵

Stimulus checks, among other factors, have increased the amount of money people have for consumption.

More precisely, funds readily accessible for spending (aka M1 Money Stock):

+ $5,000 BUSD since 2008

+ of which $3,000 BUSD from 2020

fred.stlouisfed.org/series/M1

Stimulus checks, among other factors, have increased the amount of money people have for consumption.

More precisely, funds readily accessible for spending (aka M1 Money Stock):

+ $5,000 BUSD since 2008

+ of which $3,000 BUSD from 2020

fred.stlouisfed.org/series/M1

5/🧵

Money flowing directly to consumers’ hands waiting to buy things increases the demand for various products.

Increased demand leads to widespread price increases, in other words inflation.

Money flowing directly to consumers’ hands waiting to buy things increases the demand for various products.

Increased demand leads to widespread price increases, in other words inflation.

https://twitter.com/yliownyc/status/1362946687006879744?s=20

6/🧵

Due to these changing dynamics, 5-year inflation expectations (2.4%) have recently risen to their highest level since 2012.

But why should investors care?

fred.stlouisfed.org/series/T5YIE

Due to these changing dynamics, 5-year inflation expectations (2.4%) have recently risen to their highest level since 2012.

But why should investors care?

fred.stlouisfed.org/series/T5YIE

7/🧵

FED has the power to set the so-called “Fed Funds rate”, the rate (FED) member banks charge each other for overnight (i.e. very short-term) loans.

These rates present proxy for short-term yields, as visible in this picture with both FED funds rate and 3-month Treasuries.

FED has the power to set the so-called “Fed Funds rate”, the rate (FED) member banks charge each other for overnight (i.e. very short-term) loans.

These rates present proxy for short-term yields, as visible in this picture with both FED funds rate and 3-month Treasuries.

8/🧵

How FED controls long-term (LT) yields?

It could use a tool not in use since WWII: yield curve control, or YCC.

FED would publicly assign a LT yield target and hope market to set there. If not, FED would buy LT bonds for yields to reach the target.

But there’s a problem.

How FED controls long-term (LT) yields?

It could use a tool not in use since WWII: yield curve control, or YCC.

FED would publicly assign a LT yield target and hope market to set there. If not, FED would buy LT bonds for yields to reach the target.

But there’s a problem.

9/🧵

By buying a lot of bonds, FED would exchange bonds for cash, thus creating even more dollars to the system.

This would only boost inflation since increasing money supply was the problem in the first place.

Good article on the topic by @Noahpinion:

bloomberg.com/opinion/articl…

By buying a lot of bonds, FED would exchange bonds for cash, thus creating even more dollars to the system.

This would only boost inflation since increasing money supply was the problem in the first place.

Good article on the topic by @Noahpinion:

bloomberg.com/opinion/articl…

10/🧵

In other words, FED could lose control.

If inflation would exceed, say 4%, investors would lose money by owning bonds yielding less than that – hence they would sell their bonds.

When bonds are sold, price goes down and yield goes up - just like with stocks and dividends

In other words, FED could lose control.

If inflation would exceed, say 4%, investors would lose money by owning bonds yielding less than that – hence they would sell their bonds.

When bonds are sold, price goes down and yield goes up - just like with stocks and dividends

11/🧵

To clarify, think a company (Uncle Sam) paying a stable dividend (bond yield).

Starting point:

Company price $100

Dividend $5

Yield 5%

Price down:

Company price $50 (-50%)

Dividend $5

Yield 10% (+100%)

Price up:

Company price $200 (+100%)

Dividend $5

Yield 2.5% (-50%)

To clarify, think a company (Uncle Sam) paying a stable dividend (bond yield).

Starting point:

Company price $100

Dividend $5

Yield 5%

Price down:

Company price $50 (-50%)

Dividend $5

Yield 10% (+100%)

Price up:

Company price $200 (+100%)

Dividend $5

Yield 2.5% (-50%)

12/🧵

Rationally, yields would eventually set to a level that would exceed inflation, thus giving investors de-facto reason to own bonds.

In other words, there would be real return in owning bonds (not just nominal).

fred.stlouisfed.org/series/DGS30

Rationally, yields would eventually set to a level that would exceed inflation, thus giving investors de-facto reason to own bonds.

In other words, there would be real return in owning bonds (not just nominal).

fred.stlouisfed.org/series/DGS30

13/🧵

In 1977 with inflation 6-7%, Warren Buffett elaborated:

- "stocks, like bonds, do poorly in an inflationary environment"

- “the central problem in the stock market is that the return on capital hasn’t risen with inflation" (stuck at 12 percent)

hollandadvisors.co.uk/cms/resources/…

In 1977 with inflation 6-7%, Warren Buffett elaborated:

- "stocks, like bonds, do poorly in an inflationary environment"

- “the central problem in the stock market is that the return on capital hasn’t risen with inflation" (stuck at 12 percent)

hollandadvisors.co.uk/cms/resources/…

14/🧵

Excellent companies with pricing power can, however, raise their prices along with inflation – and above.

In 1972-1984 when inflation averaged nearly 8%, See's Candies was able to increase prices at a faster rate than inflation, benefitting the shareholders (i.e. Buffett)

Excellent companies with pricing power can, however, raise their prices along with inflation – and above.

In 1972-1984 when inflation averaged nearly 8%, See's Candies was able to increase prices at a faster rate than inflation, benefitting the shareholders (i.e. Buffett)

15/🧵

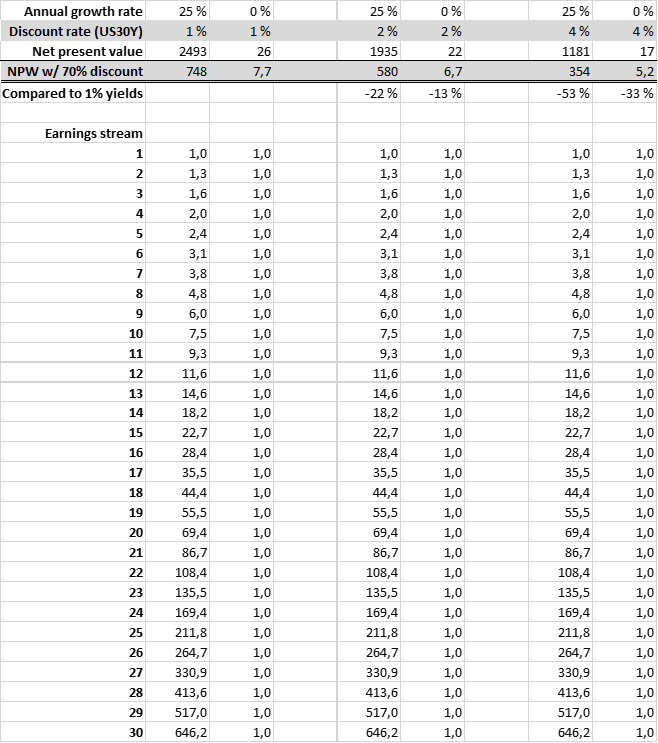

But the biggest problem with inflation comes from discounted cash flow (DCF) models using ultra-low discount rates to ultra-high growth companies.

We already concluded that inflation will raise bond yields – let’s see its impact on DCF.

But the biggest problem with inflation comes from discounted cash flow (DCF) models using ultra-low discount rates to ultra-high growth companies.

We already concluded that inflation will raise bond yields – let’s see its impact on DCF.

16/🧵

Let’s assume you use 30Y Treasuries as a discount rate for cash flows with a 70% safety margin. Most likely you don’t - but you could.

We then compare the net present value of earnings streams from two companies: one stagnant with 0% growth and one with high 25% growth.

Let’s assume you use 30Y Treasuries as a discount rate for cash flows with a 70% safety margin. Most likely you don’t - but you could.

We then compare the net present value of earnings streams from two companies: one stagnant with 0% growth and one with high 25% growth.

17/🧵

As we have learnt by now, higher inflation would lead to higher interest rates.

This, in turn, would punish growth stocks relatively more than more stagnant performers, as we can see in our simplified example.

As we have learnt by now, higher inflation would lead to higher interest rates.

This, in turn, would punish growth stocks relatively more than more stagnant performers, as we can see in our simplified example.

18/🧵

E.g., interest rates going from 1% to 2%, growers would decline nearly double (-22%) that of stalwarts (-13%).

As many things in the market, growth stocks have likely gotten ahead of themselves even further, resulting in even worse relative performance than indicated here

E.g., interest rates going from 1% to 2%, growers would decline nearly double (-22%) that of stalwarts (-13%).

As many things in the market, growth stocks have likely gotten ahead of themselves even further, resulting in even worse relative performance than indicated here

19/🧵

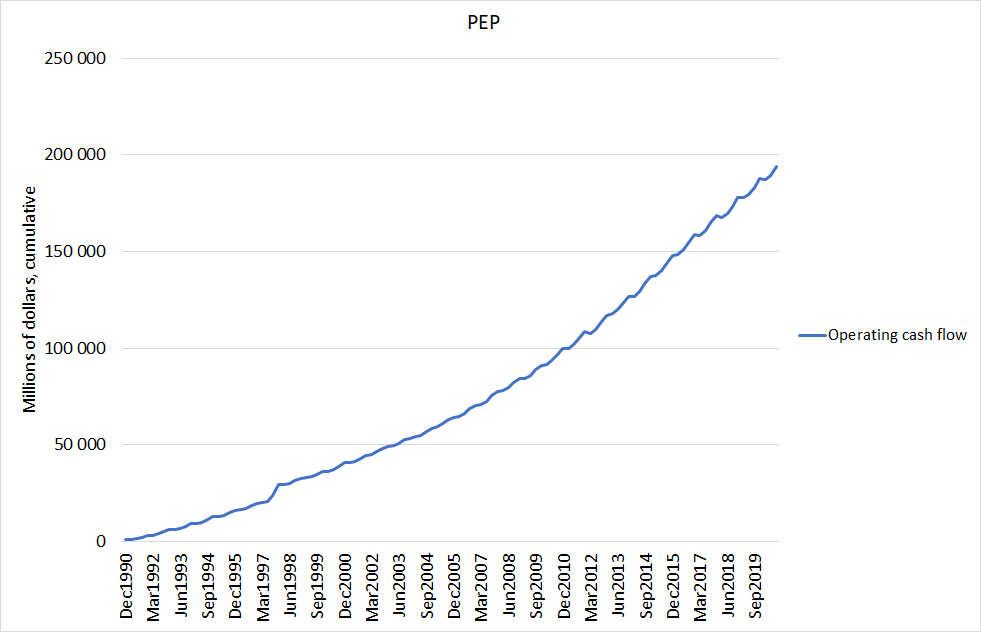

These results demonstrate one of many reasons why growth stocks have been outperforming - with the help of interest rates - more stagnant ones, as illustrated in this graph.

Growth outperformance has recently reached the notorious levels of the late 1990s.

These results demonstrate one of many reasons why growth stocks have been outperforming - with the help of interest rates - more stagnant ones, as illustrated in this graph.

Growth outperformance has recently reached the notorious levels of the late 1990s.

20/🧵

As broader markets have become more reliant on the performance of high-growth companies paired with ever-increasing multiples, the negative impact of this dynamic would be highlighted in the current market environment.

As broader markets have become more reliant on the performance of high-growth companies paired with ever-increasing multiples, the negative impact of this dynamic would be highlighted in the current market environment.

https://twitter.com/hkeskiva/status/1363525891406647302?s=20

21/🧵

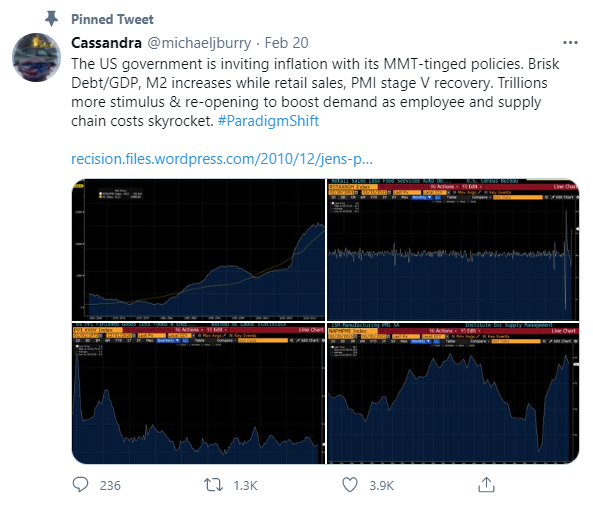

If you liked @michaeljburry for his “Big Short” in the financial crisis, or for his GameStop long, he's now out calling risks regarding inflation.

(he has a habit of removing tweets, hence caption instead of tweet link)

If you liked @michaeljburry for his “Big Short” in the financial crisis, or for his GameStop long, he's now out calling risks regarding inflation.

(he has a habit of removing tweets, hence caption instead of tweet link)

22/🧵

Simultaneously, market participants' positioning on the market may be - just may be - changing to something that it hasn't been in years and years:

value outperforming growth

Simultaneously, market participants' positioning on the market may be - just may be - changing to something that it hasn't been in years and years:

value outperforming growth

https://twitter.com/lisaabramowicz1/status/1363787234579804162?s=20

23/🧵

That's inflation’s impact on the stock market in a nutshell!

For high-quality tweets in the business domain, pls give a follow:

🇺🇸@ChrisBloomstran

🇺🇸@10kdiver

🇺🇸@tanayj

🇺🇸@QuisitiveInvest

🇫🇮@Hemingwayz

🇫🇮@Ollikopo

🇫🇮@JukkaLepikko

Thank you for your kind attention! 🙏🙂

That's inflation’s impact on the stock market in a nutshell!

For high-quality tweets in the business domain, pls give a follow:

🇺🇸@ChrisBloomstran

🇺🇸@10kdiver

🇺🇸@tanayj

🇺🇸@QuisitiveInvest

🇫🇮@Hemingwayz

🇫🇮@Ollikopo

🇫🇮@JukkaLepikko

Thank you for your kind attention! 🙏🙂

• • •

Missing some Tweet in this thread? You can try to

force a refresh